Hip Replacement Implants Market Size, Share, & Trends Analysis Report By Product (Total Hip, Partial Femoral Head), By Application (MOM, MOP, COP), By End Use (Orthopedic Clinics), By Region, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-487-1

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry:Healthcare

Report Overview

The global hip replacement implants market size was estimated at USD 5.56 billion in 2018 and is anticipated to grow at a CAGR of 4.7% over the forecast period. Increase in demand for hip arthroplasty/replacement surgical procedures, rise in geriatric population, and high prevalence of lower extremity conditions such as Osteoarthritis (OA), osteoporosis and hip ailments are some major growth propelling factors for the market. For instance, according to a report by Osteoarthritis Research Society International, around 130 million people globally will suffer from OA by 2050.

The market is expected to witness further growth due to the presence of affordable healthcare facilities in developed countries and technological advancements in non-invasive surgeries. The advent of non-metal materials, such as polymer and ceramic, is expected to help overcome problems associated with conventional devices, such as increased metallic ions in the bloodstream of the patients and deterioration of implants over time. The newer operating techniques have shortened hospital stay post full hip replacement surgery to less than 4 days.

Moreover, the growing number of younger individuals suffering from degenerative diseases is expected to have a positive impact on the revenue over the forecast period. In addition, the growing number of robot-assisted surgeries have increased the success rate of minimally invasive surgeries, which in turn is anticipated to provide lucrative growth avenues to this market in the near future.

Favorable reimbursement policies are further boosting growth. According to the Patient Protection and Affordable Care Act (PPACA), there has been an increase in the extent of insurance coverage in orthopedic devices, providing access to a larger number of patients. Over the past several years, both public (e.g., CMS) and private payers are offering appropriate coverage for prosthetics & orthotics.

For instance, in November 2018, Johnson & Johnson initiated “India centric” reimbursement program, assuring full reimbursement for patients in case of revision surgery within 15 years from the primary hip replacement surgery. In August 2018, Conformis, Inc., a medical technology company, collaborated with JFK Medical Center in Florida to perform first 3D total hip replacement surgeries.

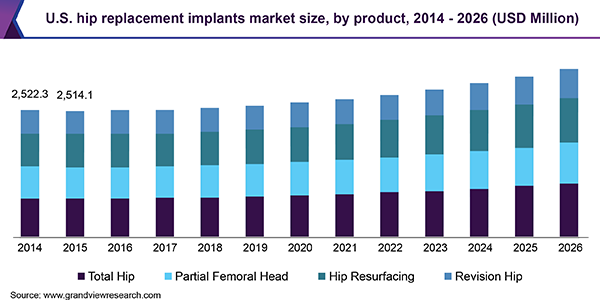

Product Insights

On the basis of products, the market is segmented into total hip implants, partial femoral head, hip resurfacing, and revision hip. Total hip implants held the largest market share as of 2018, owing to the growing demand for minimally invasive surgeries and ongoing technological advancements. Moreover, increasing prevalence of osteoarthritis is another major driver for the market. According to the National Joint Registry for England, 90% of total hip replacement was performed for osteoarthritis in the U.K. in 2016.

The industry players are continuously trying to develop new technologies and navigation systems in order to simplify surgical procedures and increase their market penetration. For instance, in August 2018, Conformis, Inc. collaborated with JFK Medical Center in Florida to perform the first-ever 3D total hip replacement surgery. Similarly, in May 2019, OrthoAlign, Inc. launched the HipAlign application that provides smart navigation technology during surgery.

Hip resurfacing surgery also held a substantial share of the hip replacement implants market. These implants assist in realigning damaged joints instead of total replacement. They are alternatives for total hip replacement. Many key players are investing on R&D in order to create new ceramic implants for better patient outcomes. For instance, there is an ongoing clinical trial on a ceramic device implant “H1,” which is expected to result in faster recovery as compared to total hip implants.

Application Insights

On the basis of application, the market is segmented into Metal-on-Polyethylene (MOP), Metal-on-Metal (MOM), Ceramic-on-Metal (COM), Ceramic-on-Polyethylene (COP), and Ceramic-on-Ceramic (COC). Metal on polyethylene held the largest revenue share as of 2018. It is the most cost-effective implant among others and its added benefits include fewer complications and lesser wear particles.

金属对金属介面人工髋关节广泛用于全髋关节replacement and revision hip replacement surgery. Postsurgery complications and inflammatory reactions may restraint the growth of this segment in the coming years. The COP market is expected to show significant growth over the forecast period, owing to its lowest wear rate and fewer complications. Some major players in this segment are CermacTec, Biomet, Stryker, Corin Group, and DePuy Synthes Orthopedics.

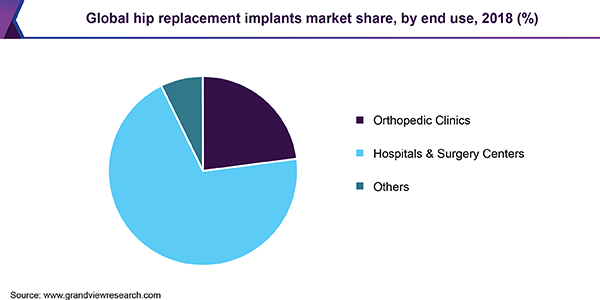

End-use Insights

Hospitals and surgery centers held the largest revenue share of the end-user segment as of 2018. The segment is driven by an increased number of hip implant surgeries within these facilities. These centers are equipped with the latest technologies and skilled healthcare professionals, which further boosts segment growth. Furthermore, collaborations between hospitals and industry players in order to create advanced surgical procedures are aiding growth.

The orthopedic clinic segment is expected to show lucrative growth over the forecast period. This growth can be attributed to the availability of skilled surgeons and the presence of well-developed infrastructure. An increase in the number of orthopedic clinics is another major factor supporting growth. On the other hand, according to the AAOS report, the number of patients requiring hip replacement surgery will outpace the number of orthopedic surgeons available in the coming years, which can be an untapped opportunity for the market.

Regional Insights

North America accounted for the largest share as of 2018, owing to favorable healthcare infrastructure and the presence of key industry players. Moreover, the growing incidence of osteoporosis & osteoarthritis and rising number of sports & road injuries are some major factors aiding the growth of the regional market. Favorable reimbursement policies for patients are anticipated to increase the number of surgeries, which in turn is expected to support growth in the near future.

Asia Pacific is expected to witness lucrative growth over the forecast period. Factors such as growing healthcare spending in emerging Asian marketplaces and growing elderly population, which have a higher risk of developing osteoarthritis, osteoporosis, & bone injuries, and rising incidence of obesity will contribute to the growth over several years. In addition, rapidly developing healthcare infrastructure due to the booming medical tourism industry is impelling market demand in the region.

The availability of resources that enable the development of advanced technology at a cheaper cost is resulting in manufacturing growth in countries such as China and India. In addition, China has released Order 650 in 2014 (former Order 276) - Regulations for Supervision and Administration of Medical Devices - to restrict foreign investment in the country, mainly to protect domestic medical devices manufacturing industry. As a result, the number of local orthopedic manufacturers is anticipated to grow in the near future.

Hip Replacement Implants Market Share Insights

The market is competitive in nature with the presence of many large and small industry players. Some of the key players are Zimmer Biomet Holdings, Inc.; Stryker Corporation; Johnson & Johnson; MicroPort Scientific Corporation; Smith & Nephew plc; DJO Global, Inc.; and MicroPort Scientific Corporation.

The aforementioned players are constantly involved in strategic initiatives such as new product launch, technological advancements, and mergers & acquisitions in order to gain a higher market share. For instance, in November 2016, Medacta International launched a new MasterLoc Hip System in order to improve its hips implants product portfolio. In October 2018, Zimmer Biomet collaborated with Apple in order to launch a mobile app pertaining to joint replacement.

Hip Replacement Implants Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 5.90 billion |

Revenue forecast in 2026 |

USD 7.88 billion |

Growth Rate |

CAGR of 4.7% from 2019 to 2026 |

Base year for estimation |

2018 |

Historical data |

2014 - 2017 |

Forecast period |

2019 - 2026 |

Quantitative units |

Revenue in USD million and CAGR from 2019 to 2026 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, end use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; China; India; Brazil; Mexico; South Africa; Saudi Arabia |

Key companies profiled |

ConMed Corporation; Aesculap Implant Systems, LLC; DJO Global, Inc.; B. Braun Melsungen AG; OMNIlife Science, Inc.; Exactech, Inc.; MicroPort Scientific Corporation; Smith & Nephew plc; Stryker Corporation; Johnson & Johnson; Zimmer Biomet |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2026. For the purpose of this study, Grand View Research has segmented the global hip replacement implants market report on the basis of product, application, end-use, and region:

Product Outlook (Revenue, USD Million, 2014 - 2026)

Total Hip

Partial Femoral Head

Hip Resurfacing

Revision Hip

Application Outlook (Revenue, USD Million, 2014 - 2026)

Metal-on-Metal

Metal-on-Polyethylene

Ceramic-on-Polyethylene

Ceramic-on-Metal

Ceramic-on-Ceramic

最终用途前景(收入,百万美元,2014 - 2026)

Orthopedic Clinics

Hospitals & Surgery Centers

Others

Regional Outlook (Revenue, USD Million, 2014 - 2026)

North America

The U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

Japan

China

India

Latin America

Brazil

Mexico

MEA

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global hip replacement implants market size was estimated at USD 5.56 billion in 2019 and is expected to reach USD 5.90 billion in 2020.

b.The global hip replacement implants market is expected to grow at a compound annual growth rate of 4.7% from 2019 to 2026 to reach USD 7.88 billion by 2026.

b.North America dominated the hip replacement implants market with a share of 50.87% in 2019. This is attributable due to increase in demand for hip arthroplasty/replacement surgical procedures, and high prevalence of lower extremity conditions such as osteoarthritis and osteoporosis.

b.Some key players operating in the hip replacement implants market include ConMed Corporation; Aesculap Implant Systems, LLC; DJO Global, Inc.; B. Braun Melsungen AG; OMNIlife Science, Inc.; Exactech, Inc.; MicroPort Scientific Corporation; Smith & Nephew plc; Stryker Corporation; Johnson & Johnson; and Zimmer Biomet.

b.Key factors that are driving the market growth include presence of affordable healthcare facilities in developed countries and technological advancements in non-invasive surgeries, growing number of younger individuals suffering from degenerative diseases, and growing number of robot-assisted surgeries have increased the success rate of minimally invasive hip replacement implant surgeries.