India Clear Aligners Market Size, Share & Trends Analysis Report By Age (Teens, Adults), By Material Type, By Dentist Type, By Duration, By Distribution Channel, By End-use (Hospitals, Stand-alone Practices), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-082-1

- Number of Pages: 50

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

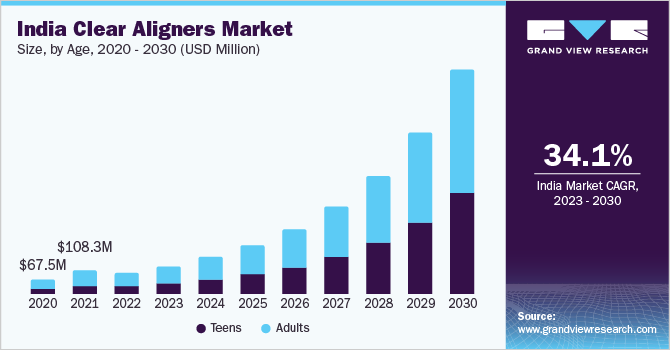

TheIndia clear aligners market sizewas valued atUSD 96.02 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 34.07% from 2023 to 2030. Clear aligners are a set of tight-fitting, custom-made mouth guards or orthodontic appliances that can straighten up crooked or misaligned teeth. Clear aligners are nearly unnoticeable, removable alternatives to braces that are created for the comfort and flexibility of patients. The market is primarily growing due to the high number of patients suffering from malocclusions and rising demand for clear aligners in the country; as per research published by the NCBI, the prevalence of malocclusions among children of age 8-15 years in India is approximately 35.40%.

In addition, technological advancements, such as computer-aided design and manufacturing, allow for the precise fabrication of aligners, resulting in better treatment outcomes. These factors also contribute to the market growth.In recent years, dental clinics and hospitals have seen an increase in the number of patients with dental issues. This is brought about by the increased understanding of the value of dental and oral health, as well as the availability of various treatment choices.

Moreover, dental education and infrastructure in the region are increasing rapidly, these factors are also expected to drive the market over the forecast period. The COVID-19 had a huge impact on the market. The government immediately issued a guideline to shut the dental clinics and hospitals. This impacted the market during the initial phase of the pandemic. However, with the ease of COVID-19 restrictions, the market scenario changed due to improved hygiene practices.

Age Insights

Based on age, the market is segmented into adults and teens. The adult segment held the largest market share of 60.82% in 2022. Malocclusion is a common dental condition that affects adult patients' quality of life. In addition to impairing dentofacial aesthetics and oral functions like chewing, swallowing, and speech, malocclusion also increases patients' susceptibility to trauma and periodontal disease. Nowadays, acceptable aesthetic appearance, including dental appearance, plays a vital role in society.

Aligner therapy is one of the fastest-growing areas in orthodontics, driven significantly by patients who regard it as a more comfortable, convenient, and discreet alternative to fixed appliances. On the other hand, the teens segment is expected to register the fastest growth rate of 36.59% over the forecast period. This can be attributed to aesthetic concerns as teens are more conscious about their appearance. Clear aligners provide a more aesthetically appealing alternative to traditional braces, as they are virtually invisible when worn. In addition, social media influence is also playing a major role as it is shaping the perception of beauty and attractiveness among teenagers.

Dentist Type Insights

Based on the dentist types, the orthodontists segment accounted for the largest share of 66.84% in 2022 owing to the fact that the majority of the patients are referred to specialists for treatments like clear aligner therapy. Orthodontists are experts in identifying, treating, and preventing tooth and jaw misalignment. They undergo additional training and study to become specialists in the field, making them more dependable in the eyes of patients choosing clear aligner therapy.

The general dentist segment is expected to witness the fastest CAGR of 34.79% over the forecast period. This growth can be attributed to comprehensive dental care as they offer a wide range of services, such as therapeutic procedures (fillings and crowns), cosmetic dentistry, dental hygiene, and basic oral surgery. Furthermore, as per Canalyst, adata analyticssite, GD can and does prescribe Invisalign at a much lower rate than orthodontists.

Duration Insights

Based on duration, the market is further segmented into comprehensive malfunction (treatment > 12 months/ > 40 sets of Aligner), medium treatments (treatment > 6-12 months/ 20-40 sets of Aligner), and small little beauty Alignments. The medium treatment segment accounted for the highest share of 51.18%, which is attributed to the advantages associated with the treatment procedure with clear aligners, as they are highly effective in correcting mild to moderate teeth misalignments. The severity of the orthodontic issues has a significant impact on the length of the therapy.

Treatment times might vary depending on the disease, but minor problems, such as small gaps between the teeth can usually be fixed in 6 months. The usual length of time for clear aligner therapy, particularly for teenagers, is 12 months, according to Fine Orthodontics, an orthodontic practice in the United States. However, the small beauty alignments segment is likely to register the fastest growth rate of 34.79% over the forecast period.

End-use Insights

根据用途广泛,市场进一步segmented into hospitals, standalone practices, group practices, and others. The standalone practices segment held the highest market share of 52.39% in 2022 and is also projected to have a significant CAGR over the forecast period. Private dentistry practices usually offer a broader range of treatment options, including cosmetic dentistry, orthodontics (such as braces or clear aligners),dental implants, and other specialized procedures.

This gives patients more choices to explore the specialized treatments that may not be readily available in public dentistry. According to Today’s RDH, a digital media company for Registered Dental Professionals, there are many benefits of choosing a private/standalone dental service and some of the benefits include a wider range of dental treatments, shorter wait times, specialist and quality service as well as high adoption of latest equipment and quality materials for both diagnostics and treatment.

Distribution Channel Insights

The offline distribution channel segment dominated the market with a revenue share of 75.27% in 2022 since Align Technology is the most dominant player in the market, and the company carries out its sales operations solely through offline channels. Invisalign can offer discounts as high as 35%, encouraging dentists and orthodontists to actively sell as many teeth-straightening aligners as possible, which increases their per-patient profits.

However, due to the rise in the number of Direct-to-Consumer (DTC), clear aligner companies globally are adopting online sales channels. Business-to-customer sale is the current trend in the market; however, the new trend that is gaining momentum is DTC sales. This is when the company directly sells its products to patients without a dental professional being involved. Clear aligners have become a more popular choice among consumers and expand access to treatment.

Material Type Insights

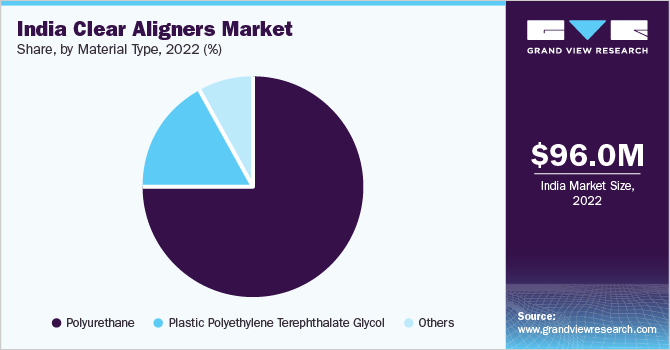

On the basis of material types, the global industry has been further categorized into Polyurethane (PU), plastic polyethylene terephthalate glycol, and others. The PU material type segment dominated the market in 2022 and accounted for the largest share of 75.26% of the overall revenue. Polyurethane has a lot of benefits when used as part of an aligner. Due to its diverse spectrum of qualities, it can be utilized for both hard and soft parts. Products made from this material have the strength to set teeth into proper alignment, while still being comfortable enough to wear for a long time.

In addition, the presence of Invisalign clear aligners that are made of polyurethane material type contributes to the segment’s growth. For aligners to work, it is essential that patients keep them in and don’t remove them. These aligners also do not get damaged from common processes, such as grinding and biting. Furthermore, PU foils are considered to offer more benefits than PETG when used for the production of aligners.

Key Companies & Market Share Insights

One of the key factors driving competitiveness among market players is the rapid adoption of advanced digital technology like intraoral scans, digital tooth set-ups, 3D printers, and CAD/CAM appliances. Moreover, a prominent number of these players are rapidly opting for strategic expansions & collaborations, and product launches to increase their geographical presence and boos sales volume in emerging & economically favorable regions. For instance, in January 2021, Dentsply Sirona acquired Straight Smile LLC (BYTE)—a leading provider in the direct-to-consumer, doctor-directed clear aligners market. This will assist the company to strengthen its SureSmile aligner business. Some of the key players in the India clear aligners market include:

Align Technology

Dentsply Sirona

Envista Corporation

Institute Straumann

SmileDirect Club

Toothsi

Novoalign

SD Aligners

India Clear Aligners Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 124.24 million |

Revenue forecast in 2030 |

USD 967.19 million |

Growth rate |

CAGR of 34.07% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

收入预测,公司排名、竞争局域网dscape, growth factors, and trends |

Segments covered |

Age, material type, end-use, dentist type, duration, distribution channel |

Country scope |

India |

Key companies profiled |

Align Technology; Dentsply Sirona; Envista Corp.; Institute Straumann; SmileDirect Club; Toothsi; Novoalign; SD Aligners |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

India Clear Aligners Market Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the India clear aligners market based on age, material type, end-use, dentist type, duration, and distribution channel:

AgeOutlook (Revenue, USD Million, 2018 - 2030)

Adults

Teens

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

Polyurethane

Plastic Polyethylene Terephthalate Glycol

Others

End-useOutlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Stand-alone Practices

Group Practices

Others

Dentist TypeOutlook (Revenue, USD Million, 2018 - 2030)

General Dentists

Orthodontists

DurationOutlook (Revenue, USD Million, 2018 - 2030)

综合故障(治疗> 12个月/ >40 sets of Aligner)

Medium Treatments (treatment > 6-12month/ 20-40 sets of Aligner)

Small Little Beauty Alignments (treatment <4-6 month/ <20 sets Aligner)

Distribution ChannelOutlook (Revenue, USD Million, 2018 - 2030)

Online

- Offline

Frequently Asked Questions About This Report

b.The India clear aligners market size was estimated at USD 96.02 million in 2022 and is expected to reach USD 124.24 million in 2023

b.The India clear aligners market is expected to grow at a compound annual growth rate of 34.07% from 2023 to 2030 to reach USD 967.19 million by 2030.

b.Based on age, the market is segmented into adults and teens. The adult segment held the largest market share of 60.82% in 2022. Malocclusion is a common dental condition that affects adult patients' quality of life.

b.The India clear aligners market is highly competitive, and includes players such as Align Technology, Dentsply Sirona, Envista Corporation, Institute Straumann, SmileDirect Club, Toothsi, Novoalign, and SD Aligners

b.The market is primarily growing due to high number of patients suffering from malocclusions and rising demand for clear aligners in the country; as per research published by NCBI, the prevalence of malocclusions amongst 8-15 years of children in India is approximately 35.40%.