印第安纳州ian Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional Trials, Observational Trials, Expanded Access Trials), By Indication, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-676-9

- Number of Pages: 113

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- 印第安纳州ustry:Healthcare

Report Overview

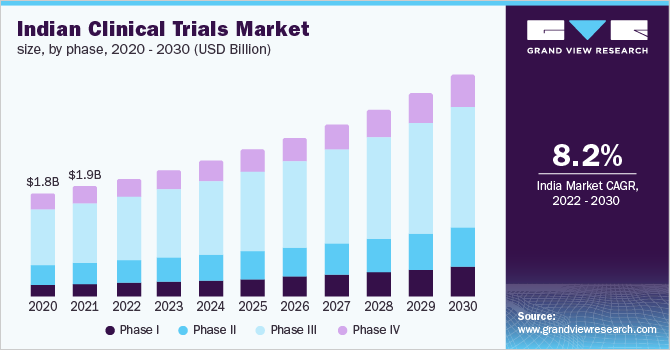

The Indian clinical trials market size was valued at USD 1.93 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.2% from 2022 to 2030. The globalization of clinical trials, adoption of new technology in clinical research, growing disease variation and prevalence, and increasing research and development promoting outsourcing are the key factors estimated to drive the market.

The government in this country is taking active initiatives to improve the R&D activities, which is expected to promote the growth of the market. Apart from this, in October 2021, the Department of Pharmaceuticals (India) proposed a new policy to reduce the time required for the approval of innovative products by at least 50% within the next two years, to improve the R&D activities in the country. Such initiatives are anticipated to further propel the growth of the market.

The digitalization of clinical trials is expected to have a positive impact on market growth. Digitalization has enabled streamlining of several trial processes such as data capture, regulatory compliance, logistics and supplies management, and others. Furthermore, with the introduction of digital therapeutics, real-time data acquisition related to safety and toxicity is becoming increasingly easy, thereby promoting timely rectification in trial design and facilitating market growth. The cost of clinical trials in India is nearly half of that incurred in the U.S. and Europe. Thus, the cost efficiency and a large treatment-naïve patient pool offered by the county are anticipated to drive the market.

The outbreak of the COVID-19 pandemic has created a catastrophic situation across the world and India faced no different scenario. The initial period of the pandemic has created a halt in research and development activities across the country due to factors such as disruption in the supply chain and the shutdown of manufacturing plants for a certain timeframe, thereby creating obstacles in the path of clinical research being conducted. Moreover, the implemented lockdown has created a reduction in the number of patient trials conducted across the country.

However, the COVID-19 pandemic had created an urgent need for treatments and vaccines, owing to which a significant number of clinical trials were performed in the country post-2021, thus reflecting a rebound in the total number of trials conducted across India. For instance, in November 2021, U.S.-based Akston Biosciences announced that it is about to start the clinical trial for its second-generation COVID-19 vaccine ‘AKS-452’ in India. Similarly, in April 2021, the Ministry of Ayush and Council of Scientific & Industrial Research in India announced that it completed a multi-center clinical trial of AYUSH 64 drug used for the treatment of mild-to-moderate COVID-19 infections in the country. The rise in the number of clinical trials for COVID-19 post-2020 is likely to have a positive impact on the market growth from 2021.

Phase Insights

The phase III segment held the largest revenue share of over 50.0% in 2021. This can be attributed to the cost-intensive nature of this segment. Phase III trials require a large patient population, which is one of the prime reasons for the high cost of this trial. Moreover, the studies in the phase last for a longer time, as compared to phase I and II, which further improves the cost of the trial and improves the segment share in the market.

The phase I segment is anticipated to register a significant growth rate of 9.9% over the forecast period owing to significant R&D investments by global as well local pharmaceutical and biotechnological firms. The demand for new treatments andbiologicsin the country is further contributing to the growth of the segment. On the basis of phase, the market is segmented into phase I, phase II, phase III, and phase IV.

印第安纳州ication Insights

The oncology segment held the largest revenue share of over 20.0% in 2021 and is anticipated to grow at the fastest rate during the forecast period. This can be attributed to the increasing prevalence of cancer in the country and the growing demand for advanced medical devices and cancer treatments. Cancer is considered to be one of the major causes of death globally and is expected to affect approximately 2 million people in India by 2040 according to the Cancer Tomorrow estimates. The majority of treatments for cancer are not effective in the last stages of the disease, which is a key reason for the growing demand for new treatment options for cancer in the country.

CNS conditions held the second-largest revenue share in 2021. A significant number of people in India are affected by neurological disorders like stroke, epilepsy, tremors, and Parkinson’s disease and the trend is similar across the globe. This is expected to have a positive impact on R&D investments for clinical trials in the country.

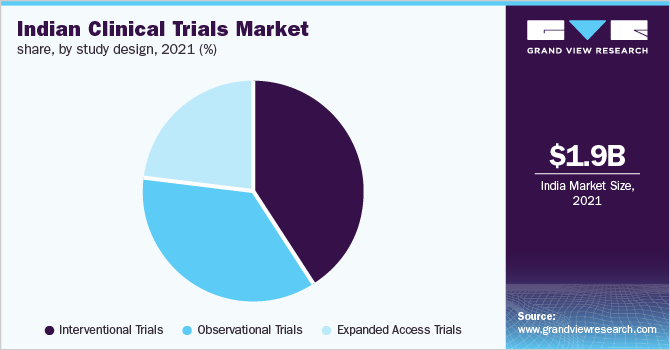

Study Design Insights

The interventional trials segment held the largest revenue share of over 40.0% in 2021 due to the large number of trials adopting this study design. This type of study design includes large randomized clinical trials and is considered one of the best study designs for detecting small to moderate effects of drugs. These studies also provide the best means of minimizing the effect of confounding, thus improving their adoption as compared to other clinical study designs.

The expanded access trials segment is anticipated to register a CAGR of 8.2% during the forecast period. Factors such as the growing incidence of serious diseases, demand for new innovative treatment options, and the high burden of chronic diseases in the country are anticipated to fuel the segment growth. Moreover, owing to the COVID-19 pandemic, an expanded access study with convalescent plasma was used in India for the treatment of patients with COVID-19. Such actions are further contributing to the segment growth.

Key Companies & Market Share Insights

Various strategies such as mergers, acquisitions, and collaborations are adopted by the key market players to maintain their market share. For instance, in December 2021, Aragen Life Sciences, an India-based CRO, acquired Intox Pvt. Ltd. in Maharashtra, India to expand Aragen’s end-to-end integrated discovery and development platform for biotechnology, pharmaceuticals, and other industries.

同样,2020年2月,印度临床stage company, Aurigene collaborated with a biotechnology companyCuris, Inc. As per the terms of the collaboration, Aurigene provided funding for conducting Phase 2b/3 randomized study on evaluating the effect of CA-170 in patients with non-squamous non-small cell lung cancer (nsNSCLC). The adoption of such strategies by the market players is likely to have a positive impact on market growth. Some prominent players in the Indian clinical trials market include:

IQVIA HOLDINGS INC.

PAREXEL International Corporation

Pharmaceutical Product Development (PPD) LLC

Charles River Laboratory

ICON PLC

PRA Health Inc.

Chiltern International LTD.

Syneos Health Inc.

SGS SA

Syngene International Limited

Aurigene Discovery Technologies Limited

Aragen Life Sciences

Abiogenesis Clinpharm Pvt Ltd

Accelsiors

Accutest Global.

Clario

Cliantha Research

Cliniminds

CliniRx

JSS Medical Research

印第安纳州ian Clinical Trials Market ReportScope

Report Attribute |

Details |

Market size value in 2022 |

USD 2.07 billion |

Revenue forecast in 2030 |

USD 3.88 billion |

Growth rate |

CAGR of 8.2% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors and trends |

Segments Covered |

Phase, study design, indication, end user |

Country scope |

印第安纳州ia |

Key companies profiled |

IQVIA HOLDINGS INC.; PAREXEL International Corporation; Pharmaceutical Product Development (PPD), LLC; Charles River Laboratory; ICON PLC; PRA Health Inc.; Chiltern International LTD.; Syneos Health Inc.; SGS SA; Syngene International Limited; Aurigene Discovery Technologies Limited; Aragen Life Sciences; Abiogenesis Clinpharm Pvt Ltd; Accelsiors; Accutest Global; Clario; Cliantha Research; Cliniminds; CliniRx; JSS Medical Research |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Indian clinical trials market report on the basis of phase, study design, indication and end user:

Phase Outlook (Revenue, USD Million, 2018 - 2030)

Phase I

Phase II

Phase III

Phase IV

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

Interventional Trials

Observational Trials

Expanded Access Trials

印第安纳州ication Outlook (Revenue, USD Million, 2018 - 2030)

Autoimmune/Inflammation

Rheumatoid Arthritis

Multiple Sclerosis

Osteoarthritis

Irritable Bowel Syndrome (IBS)

Others

Pain Management

Chronic Pain

Acute Pain

Oncology

Blood Cancer

Solid Tumors

Other

CNS Condition

Epilepsy

Parkinson's Disease (PD)

Huntington's Disease

Stroke

Traumatic Brain Injury (TBI)

Amyotrophic Lateral Sclerosis (ALS)

Muscle Regeneration

Others

Diabetes

Obesity

Cardiovascular

Others

End User Outlook (Revenue, USD Million, 2018 - 2030)

Pharmaceutical & Biopharmaceutical Companies

Medical Device Companies

Others

Frequently Asked Questions About This Report

b.The Indian clinical trials market size was estimated at USD 1.93 billion in 2021 and is expected to reach USD 2.07 billion in 2022.

b.The Indian clinical trials market is expected to grow at a compound annual growth rate of 8.2% from 2022 to 2030 to reach USD 3.88 billion by 2030.

b.第三阶段主导印度3月的临床试验ket with a share of 53.16% in 2021. This is attributable to the cost-intensive nature of this segment.

b.Some key players operating in the Indian clinical trials market include IQVIA, Inc.; ICON PLC; PRA Health Sciences; GVK Biosciences; PAREXEL International Corporation; Syneos Health; Charles River Laboratories; and Syngene International Ltd.

b.Key factors that are driving the Indian clinical trials market growth include globalization of clinical trials, rising prevalence of chronic disease, and digitalization of clinical trials.