Indoor Distributed Antenna Systems Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Type (Active, Passive, Hybrid), By Ownership, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-138-8

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Technology

Market Size & Trends

The globalindoor distributed antenna systems market size was valued at USD 4.67 billion in 2022and is expected to expand at a compound annual growth rate (CAGR) of 17.5% from 2023 to 2030. The widespread use of tablets, smartphones, and various wireless gadgets has generated a growing demand for fast and reliable wireless connections. The emergence of the Internet of Things (IoT) and the adoption of 5G networks have driven the demand for higher-capacity and extensive indoor wireless coverage. Moreover, regulations and mandates for public safety communications, such as FirstNet in the U.S., have increased the adoption of indoor distributed antenna systems (DAS) in places such as airports, stadiums, and commercial buildings to ensure that emergency services have reliable connectivity.

This demand extends to indoor spaces, where people increasingly expect uninterrupted access to communication and data services. These solutions are indispensable for enterprises seeking to foster a conducive work environment. By ensuring that employees and customers remain seamlessly connected, businesses can unlock improved productivity and heightened customer satisfaction, thus fostering growth and success.

Thedistributed antenna systems(DAS) embody a comprehensive network of strategically positioned antennas that span the expanse of a building or indoor environment. These antennas are intricately connected to a central hub or base station, which serves as the nerve center for disbursing wireless signals throughout the facility. The overarching objective of DAS is to amplify and extend the coverage and capacity of wireless networks, encompassing various communication mediums such as cellular, Wi-Fi, and public safety communications.

The system is tailored to bolster wireless coverage and capacity, specifically within the confines of buildings, structures, or enclosed spaces. The significant importance of these systems stems from the increasing need for connectivity, their critical impact on business productivity and public safety, and the rising data requirements in our modern digital era. As technology advances, the market is pivotal in ensuring that individuals and organizations can enjoy a smooth and reliable indoor wireless experience.

Indoor distributed antenna systems play a pivotal role in various industries, such as healthcare, manufacturing, hospitality & commercial, transportation & logistics, and others by ensuring robust indoor wireless connectivity. In office buildings, they facilitate uninterrupted communication and access to critical business applications, enhancing productivity and visitor experiences. DAS enriches the shopping experience in shopping malls, supports location-based marketing, and drives customer engagement.

Within healthcare facilities, it's a lifeline for timely communication among healthcare professionals and provides patients with connectivity for comfort and stress reduction. DAS accommodates high-density crowds at stadiums and arenas, enhancing attendee experiences and enabling effective event organization. In the hospitality sector, these systems meet the evolving connectivity needs of guests and conferences, improving guest satisfaction and attracting events. Across these diverse use cases, indoor DAS is a connectivity enabler, fostering improved experiences, productivity, and safety, making it an integral part of modern indoor infrastructure.

COVID-19 Impact

The global markets experienced a downturn due to mandatory shutdowns and stay-at-home orders implemented to curb the spread of COVID-19. This led to a significant increase in layoffs and a reduction in planned expansions across various industries. In 2020, the International Labor Organization (ILO) estimated that approximately 400 million jobs were lost worldwide during the second quarter of 2020 due to the impact of COVID-19. This subsequently impacted this market as well. However, the shift towards remote and hybrid work models redirected focus to the importance of having reliable indoor connectivity. In the retail sector, disruptions prompted a re-evaluation of strategies, emphasizing technology-driven solutions like distributed antenna systems to improve the shopping experience.

The healthcare sector highlighted the pivotal role of distributed antenna systems (DAS) in facilitating efficient communication and telemedicine. Entertainment sector venues adapted by implementing distributed antenna systems to support safety measures and enhance the user experience. The hospitality industry encountered challenges, but those establishments that remained open or adapted to remote work recognized the necessity of a robust indoor distributed antenna system. In summary, despite the initial slowdown, the pandemic emphasized the critical role of this system across various sectors, leading to renewed interest and investment in connectivity requirements in the post-pandemic era.

Component Insights

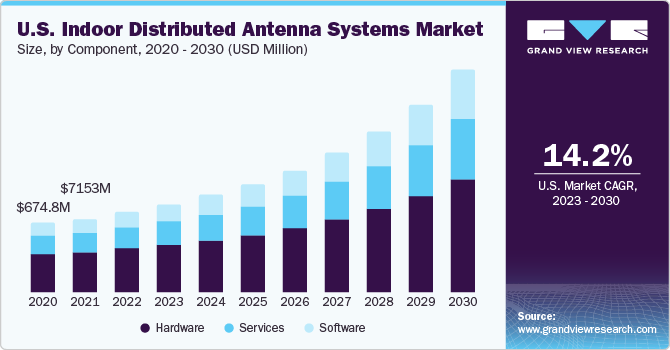

Based on component, the market is trifurcated into hardware, software, and services. The hardware segment accounted for more than 55% of revenue share in 2022. The hardware segment is further categorized as antenna nodes, base stations, and others (radio frequency cables, connectors and splitters,fiber optics). The primary role of DAS hardware components, such as antennas, cabling, and amplifiers, is to extend wireless coverage and capacity within indoor spaces.

By strategically placing antennas and using quality cabling, distributed antenna systems (DAS) ensure that cellular and wireless signals reach every building corner, eliminating dead zones and ensuring a seamless user experience. Indoor DAS hardware is designed to support multiple frequencies and technologies, including cellular,Wi-Fi, and public safety communications. This flexibility ensures that the DAS can adapt to changing wireless standards and evolving user needs, making it a future-proof solution for indoor connectivity.

段预计将见证的服务fastest CAGR of 19.1% throughout the forecast period. Services play a critical role in tandem with hardware components, delivering comprehensive solutions for optimal indoor wireless connectivity. Their significance is underscored by a range of benefits, such as reliable connectivity, enhanced user experience, improved wireless coverage, and enhanced data speeds that drive market growth. DAS service providers offer expertise and tailored consultation, ensuring that distributed antenna systems solutions align with unique indoor requirements.

Professional installation services maximize system effectiveness, optimizing coverage and performance. Network optimization enhances voice and data quality, delivering a seamless user experience. Regular maintenance and support minimize downtime and disruptions, while compliance with industry standards ensures safety and regulatory adherence. Scalability accommodates evolving demands, and cost-efficient solutions mitigate errors, yielding long-term savings. Streamlined deployment processes expedite implementations, and an improved user experience fosters satisfaction. Lastly, these services provide organizations with a competitive edge, attracting and retaining customers and tenants.

Type Insights

Based on type, the market is segmented into active, passive, and hybrid. The active segment led with a 33.0% revenue share in 2022. Active DAS plays a pivotal role in the indoor DAS market due to its ability to efficiently amplify and distribute wireless signals within buildings. Their significance stems from several key benefits that drive their growth. Active indoor distributed antenna systems offer enhanced coverage, eliminating dead zones and ensuring consistent connectivity, which is especially vital in large venues such as stadiums and malls.

Secondly, these systems improve network capacity, handling high data traffic during crowded events without compromising service quality. Their scalability supports future expansion and is carrier agnostic, catering to diverse user bases. In addition, active distributed antenna systems optimize network performance, deliver high data rates, and are crucial for public safety communication. Investing in active indoor distributed antenna systems provides businesses and venues with a competitive edge, reliability, and future-proofing in an ever-evolving telecommunications landscape.

The hybrid indoor DAS segment is anticipated to grow at a considerable CAGR of 19.5% throughout the forecast period. Hybrid indoor distributed antenna systems are gaining significant importance in the indoor distributed antenna systems market due to their ability to leverage the strengths of both active and passive distributed antenna systems solutions. Their key advantages drive their adoption. Hybrid DAS systems offer optimal coverage, intelligently combining active and passive components to ensure comprehensive wireless signal distribution throughout buildings. They provide flexibility in deployment, allowing organizations to balance performance requirements with cost-effectiveness.

Scalability is a notable feature, enabling these systems to grow with evolving connectivity demands. Hybrid distributed antenna systems solutions optimize costs by using passive components where appropriate and active components where needed, ensuring a strong return on investment. They also deliver reliability, support multiple carriers, adapt to emerging technologies, optimize network performance, and enhance the overall user experience. The versatility of hybrid DAS makes them suitable for various indoor environments, meeting the diverse needs of different industries.

Ownership Insights

Based on ownership, the indoor DAS market is segmented into carrier, neutral, and enterprise. The neutral ownership segment accounted for more than 42% of revenue share in 2022 and is anticipated to grow at the highest CAGR of 19.0% throughout the forecast period. Neutral ownership is a pivotal market due to its carrier-neutral approach to indoor wireless connectivity. They hold significance by providing a platform that benefits cellular carriers and property owners, driving growth in several ways.

Firstly, they are carrier-agnostic, accommodating multiple cellular providers simultaneously, making properties more appealing to a diverse range of tenants and users. This flexibility in carrier selection enhances tenant attraction for property owners. Secondly, neutral DAS systems reduce carrier deployment costs and streamline operations for property owners by eliminating the need for individual carrier-specific infrastructure installations in each building. Moreover, these systems prioritize delivering optimal wireless coverage and capacity for all users, ensuring a consistent and high-quality indoor user experience.

航空公司所有权的方法使无线carriers to control their network infrastructure within indoor environments fully. By doing so, carriers can tailor coverage to their specific needs, ensuring optimal signal quality and capacity for their subscribers. This ownership model directly addresses the ever-increasing data demands of users, guaranteeing faster data speeds and improved user experiences. Moreover, it bolsters a carrier's competitive edge by offering seamless connectivity, elevating customer satisfaction, and fostering brand loyalty. In essence, carrier ownership of Indoor DAS is driven by the pressing need to assert control over network quality, reduce congestion, and maintain a strategic foothold in the fiercely competitive telecommunications landscape.

Application Insights

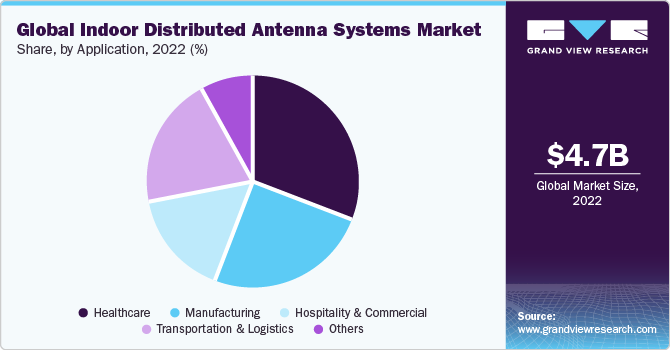

Based on application, the market is segmented into healthcare, manufacturing, hospitality & commercial, transportation & logistics, and others (government, educational institutes, and warehouses). The healthcare segment accounted for the largest revenue share of 30.8% in 2022. The significance of these systems within the healthcare sector arises from seamless and real-time communication, which is essential for medical staff to coordinate patient care and access electronic health records, which distributed antenna systems facilitate, leading to improved patient outcomes. In addition, augmentingtelemedicine servicesrequires robust indoor wireless connectivity, and DAS supports effective virtual consultations and remote patient monitoring.

这些系统提高整个病人雄厚ce by enabling patient and family connectivity, particularly during hospital stays. Moreover, DAS in healthcare facilitates and ensures immediate and reliable communication for first responders during emergencies, improving response times and patient safety. Compliance with strict regulatory requirements regarding indoor communication, data access, and data security is another significant aspect, and DAS helps healthcare facilities meet these standards. Furthermore, distributed antenna systems investments offer long-term value by improving patient care, reducing operational inefficiencies, and attracting top medical talent. As the Internet of Things (IoT) becomes more integrated into healthcare facilities, distributed antenna systems can accommodate the increasing number of connected devices.

The transportation & logistics segment is anticipated to grow at a considerable CAGR of 20.5% throughout the forecast period. The transportation and logistics industry significantly drives the growth of the market, primarily due to its critical need for efficient communication and data connectivity within transportation hubs and logistics facilities. It enhances operational efficiency by facilitating seamless communication, reducing delays, and optimizing cargo handling.

Additionally, indoor distributed antenna systems enable real-time tracking of shipments, vehicles, and assets, improving logistics management and enhancing supply chain visibility. Moreover, it supports safety and security measures, ensuring reliable communication for emergency response systems. In public transportation terminals and airports, distributed antenna systems enhance the passenger experience by providing uninterrupted mobile connectivity. Furthermore, it promotes employee productivity, facilitates warehousing efficiency, and helps companies meet regulatory compliance standards. Facilities with reliable indoor connectivity gain a competitive advantage, attracting logistics and transportation providers.

Regional Insights

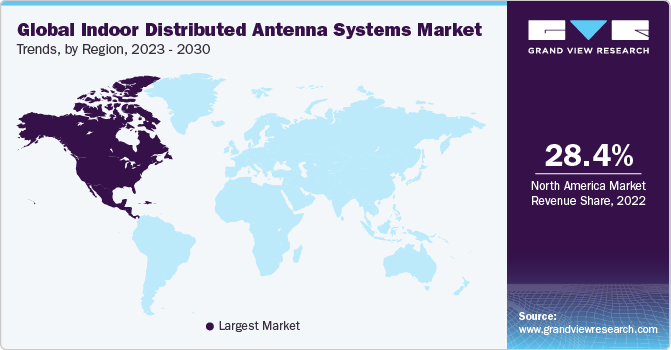

North America led the overall market with a market share of 28.4% in 2022. Indoor DAS holds significant importance in North America due to the region's advanced telecommunications landscape and the increasing demand for uninterrupted connectivity. The region's population is highly connected with widespread smartphone and IoT device usage, making indoor DAS crucial for meeting the demands of seamless data access and communication. North America prioritizes public safety compliance, where indoor DAS systems support first responders and emergency communication. Furthermore, these systems are integral to the corporate sector, fostering productivity, collaboration, and customer engagement. It also plays a vital role in the advanced healthcare system, retail innovation, transportation hubs,data centers, government facilities, and educational institutions.

Asia Pacific is expected to grow notably with a CAGR of 20.4%.over the forecast period. Asia Pacific holds a prominent position in the market due to its vast and diverse geography and robust economy. High population density, particularly in urban areas, fuels the demand for these systems to ensure consistent and high-quality connectivity for mobile users. In addition, Asia Pacific encompasses emerging markets where indoor DAS is pivotal for fostering economic growth, supporting businesses, and extending digital services to remote areas. The region's transition to smart cities relies on indoor DAS for IoT deployment and efficient public services.

Moreover, Asia Pacific's status as a global tourism hub benefits from indoor DAS, enhancing the experience for travelers in hotels, resorts, and tourist destinations. These systems are also crucial in manufacturing, remote area connectivity, e-commerce operations,digital transformations, public safety, and disaster management. The region presents substantial investment opportunities for indoor DAS providers, with governments and businesses actively investing in digital infrastructure to drive economic development and innovation.

Key Companies & Market Share Insights

The market is highly competitive. Major players are investing in research & development (R&D) to drive innovation. Also, the key players are adopting different development strategies such as product launches, mergers & acquisitions, and others to expand their presence and share in the indoor DAS market. Along with key strategies, these players are introducing new features to improve the customer experience.

In January 2021, The Electronics and Telecommunications Research Institute (ETRI) unveiled a groundbreaking achievement, the world’s inaugural 5G Indoor Distributed Antenna System (DAS), capable of harnessing millimeter-wave (28GHz) broadband 5G signals from base stations and channeling them into indoor spaces. This cutting-edge technology unlocks the full potential of 5G, delivering peak speeds of up to 20 Gbps in indoor settings, including high-traffic areas like airports, transit stations, and expansive shopping complexes. Notably, this innovation boasts substantial enhancements in terms of transmission capacity, equipment size, and deployment cost when compared to traditional systems. Some prominent players in the global indoor distributed antenna systems market include

Commscope

Corning Incorporated

Comba Telecom Systems Holdings Ltd.

ATC TRS V LLC. (American Towers)

HUBER+SUHNER

TE Connectivity

Galtronics

Boingo Wireless, Inc.

PBE Group.

Indoor Distributed Antenna Systems Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 5.28 billion |

Revenue forecast in 2030 |

USD 16.33 billion |

Growth rate |

CAGR of 17.5% from 2023 to 2030 |

Base year for estimation |

2022 |

Historic year |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Component, type, ownership, application, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); U.A.E.; South Africa |

Key companies profiled |

Commscope; Corning Incorporated; Comba Telecom Systems Holdings Ltd.; ATC TRS V LLC; (American Towers); HUBER+SUHNER; TE Connectivity; Galtronics; Boingo Wireless, Inc.; PBE Group |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

价格和购买该俱乐部ns |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Indoor Distributed Antenna Systems Market ReportSegmentation

This report forecasts revenue growth at global, regional, and country levels and offers qualitative and quantitative analysis of the latest trends for each of the segment and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global indoor distributed antenna systems market report based on component, type, ownership, application, and region:

Component Outlook (Revenue, USD Million, 2017 - 2030)

Hardware

Antenna Nodes/Radio Nodes

Base Station

Others

Software

Services

Type Outlook (Revenue, USD Million, 2017 - 2030)

Active

Passive

Hybrid

Ownership Outlook (Revenue, USD Million, 2017 - 2030)

Carrier Ownership

Neutral-Host Ownership

Enterprise Ownership

Application Outlook (Revenue, USD Million, 2017 - 2030)

Healthcare

Manufacturing

Hospitality & Commercial

Transportation & Logistics

Others

区域前景(收入,百万美元,2017 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Asia Pacific

India

China

Japan

South Korea

Australia

Latin America

Brazil

Mexico

Middle East & Africa

Kingdom of Saudi Arabia (KSA)

U.A.E.

South Africa

Frequently Asked Questions About This Report

b.The global indoor distributed antenna systems market size was estimated at USD 4.67 billion in 2022 and is expected to reach USD 5.28 billion in 2023.

b.The global indoor distributed antenna systems market is expected to grow at a compound annual growth rate of 17.5% from 2023 to 2030 to reach USD 16.33 billion by 2030.

b.North America is expected to dominate the market and grow at a CAGR of 14.0%. Indoor DAS holds significant importance in North America due to the region's advanced telecommunications landscape and the increasing demand for uninterrupted connectivity. The region's population is highly connected with widespread smartphone and IoT device usage, making indoor DAS crucial for meeting the demands of seamless data access and communication.

b.Some prominent players in the indoor distributed antenna systems market include Commscope, Corning Incorporated, Comba Telecom Systems Holdings Ltd., ATC TRS V LLC. (American Towers), HUBER+SUHNER, TE Connectivity, Galtronics, Boingo Wireless, Inc., and PBE Group, among others.

b.Key factors driving the indoor distributed antenna systems market growth include the widespread use of smartphones, tablets, and various wireless gadgets has created a growing need for reliable and fast wireless connections.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."