Insulin Delivery Devices Market Size, Share & Trends Analysis Report By Product (Insulin Syringes, Insulin Pens, Insulin Pumps, Insulin Injectors), By End Use (Hospitals, Homecare), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-991-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Healthcare

Report Overview

The global insulin delivery devices market size was valued at USD 12.5 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2030. Insulin delivery devices includingsyringes, pens, pumps, and jet injectors are used to deliver insulin to diabetic patients. One of the foremost factors contributing to the growth of the market is the surging number of diabetics due to aging, obesity, and unhealthy lifestyles. Obesity is believed to be a major factor leading to the development of diabetes in individuals. According to the WHO, in 2014, over 1.9 billion people were identified to be overweight, of which, around 600 million people were obese.

Risk factors, such as obesity and being overweight are highly linked to the incidence of diabetes, which is rising by epidemic proportions, thus rendering a high prevalence of diabetes. Consequently, the large population afflicted with diabetes is driving the market for insulin delivery devices. In addition, the high demand for advanced insulin delivery devices is supporting the adoption of recently launched innovative pen devices and portable pumps, which is estimated to boost the market growth. However, stringent government rules and regulations governing the product approval process and the high cost of insulin analogs in diabetes care management could hinder the market growth.

The outbreak of COVID-19 led to dramatic turmoil in the market for insulin delivery devices. Nearly 40% of the global Covid 19 facilities reported the admissions of people with diabetes. However, ~45% of those patients, didn’t receive routine medical care due to the fear of the virus spreading. One in every 5 patients, experienced the reduced availability ofblood glucose monitoring devicesand ~20% experienced the delaying of refilling of insulin pumps, mainly due to financial constraints. Disruption in the supply chain due to closure of manufacturing sites, shipping delays or shutdowns, and trade limitations or export bans on life-saving drugs such as Insulin.

China imposed a ban on life-saving drugs to export in the U.S., in March 2020. This led to the reduction in raw material supply for the manufacturing of insulin in the U.S. On the other hand, the market players like Eli Lilly, Sanofi, and Novo Nordisk, disapproved the shortage claims and fulfilled the market needs, by increasing manufacturing levels. But, the lack of reimbursement from the government, insurance losses, economic setbacks experienced by buyers, and the high cost of insulin, have led to the decline in the market for insulin delivery devices. It is said to grow at a steady rate by mid-2022.

Product Insights

The insulin pens segment held the largest revenue share of 36.5% in 2021 owing to its advantages over other products. Factors such as its high adoption rate, user-friendly design, and rising popularity among consumers contributed to the largest revenue share of this segment. The growing focus of manufacturers on promoting innovation and advancements is another major factor yielding the high share. For instance, in January 2014, Novo Nordisk launched a new device, NovoPen Echo in the U.S. This is the first device of its kind, available in the U.S., with a memory function and half-unit dosage features. Thus, product advancements are expected to propel the demand for insulin pens in the near future.

End-use Insights

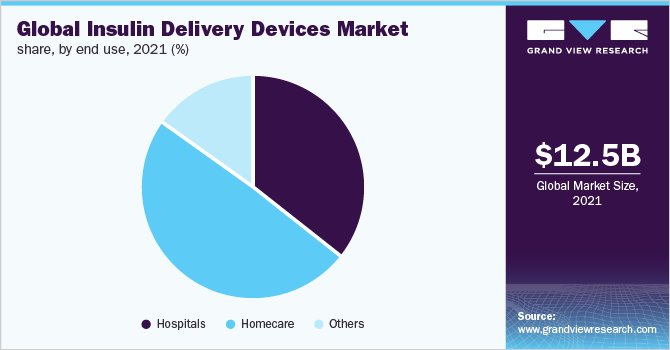

家庭护理部分胰岛素delive主导ry devices market and accounted for the largest revenue share of 48.9% in 2021. It is anticipated that the home care segment will maintain its position in the market for insulin delivery devices during the forecast period. The key factors resulting in significant growth of the segment are increasing awareness of diabetes care and the growing adoption of insulin delivery devices amongst patients for home use.

The use of insulin devices at home saves on visiting costs, hospital or clinic fees, and waiting time. The advanced devices, including pumps, pens, and injectors, are small in size, highly portable, and can be used anywhere at any time. Thus, greater access to these devices and their higher user-friendliness has made insulin users opt for self-care diabetes management options.

Regional Insights

北美市场主导胰岛素德尔ivery devices and accounted for the largest revenue share of 37.5% in 2021. The rising diabetic population and the accessibility of technologically advanced devices are the factors contributing to the high market growth in North America. According to statistics by the CDC in 2016, around 29 million people in the U.S. are still suffering from diabetes, among them 21.0 million patients were diagnosed, whereas 8.1 million patients remained undiagnosed. Also, according to the Canadian Diabetes Association, the prevalence of diabetes is growing in Canada and it is estimated to reach around 5 million by 2025. Thus, the large patient base suffering from diabetes and its growing prevalence is expected to boost the growth in this region.

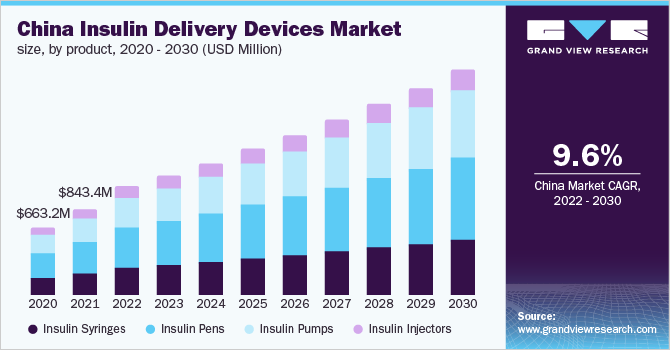

In Asia Pacific, the market for insulin delivery devices is expected to grow fast over the forecast period. Developing economies, such as China and India, are expected to witness the highest growth during the study period due to the presence of a large population base suffering from diabetes and its rising awareness amongst individuals. In addition, global vendors are expanding their business in Asia Pacific and providing high-end products for diabetes care, which is the major factor contributing to the growth.

Key Companies & Market Share Insights

The market for insulin delivery devices is ruled by three major players, namely, Novo Nordisk, Eli Lilly, and Sanofi. These leaders are constantly adopting developmental strategies such as collaborations, acquisitions, partnerships, mergers, marketing agreements, and new product launches to strengthen their portfolios. For instance, Eli Lilly developed a biosimilar version of insulin glargine, Rezvoglar KwikPen, that received FDA approval in December 2021. Also, in November 2021, Sanofi partnered with Roche, to increase the adoption of disposable insulin pens. Further, these players are collaborating with local players to improve their market reach. Some of the prominent players in the insulin delivery devices market include:

Novo Nordisk A/S

Sanofi

Eli Lilly and Company

Biocon Ltd.

Ypsomed AG

Wockhardt Ltd.

Medtronic

Abbott Laboratories

F. Hoffmann-La Roche, Ltd.

Insulin Delivery Devices Market Report Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 15.6 billion |

Revenue forecast in 2030 |

USD 27.7 billion |

Growth Rate |

CAGR of 7.4% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, end use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Brazil; Mexico; South Africa |

Key companies profiled |

Novo Nordisk A/S; Sanofi; Eli Lilly and Company; Biocon Ltd.; Ypsomed AG; Wockhardt Ltd.; Medtronic; Abbott Laboratories; F. Hoffmann-La Roche, Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insulin delivery devices market based on product, end use, and region:

Product Outlook (Revenue, USD Million, 2018 - 2030)

Insulin syringes

Insulin pens

Insulin pumps

Insulin injectors

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Homecare

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

Asia Pacific

China

India

Latin America

Brazil

Mexico

Middle East and Africa

South Africa

Frequently Asked Questions About This Report

b.The global insulin delivery devices market size was estimated at USD 12.5 billion in 2021 and is expected to reach USD 15.6 billion in 2022.

b.全球胰岛素输送设备市场费用cted to grow at a compound annual growth rate of 7.4% from 2022 to 2030 to reach USD 27.7 billion by 2030.

b.North America dominated the insulin delivery devices market with a share of 37.5% in 2021. This is attributable to the rising diabetic population and the accessibility of technologically advanced devices.

b.Some key players operating in the insulin delivery devices market include Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Biocon Ltd., Ypsomed AG, Wockhardt Ltd, Medtronic, Abbott Laboratories, F. Hoffmann-La Roche, Ltd.

b.Key factors that are driving the insulin delivery devices market growth include to surging number of diabetics due to aging, obesity, and unhealthy lifestyles