Investigational New Drug CDMO Market Size, Share & Trends Analysis Report By Product (Small Molecule, Large Molecule), By Service (Contract Development, Contract Manufacturing), By End User, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-537-3

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Healthcare

Report Overview

The global investigational new drug CDMO market size was valued at USD 4.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.9% from 2021 to 2028. The market growth can be attributed to factors such as the increasing outsourcing services by pharmaceutical companies, rising R&D investments, and stringent regulations for conducting clinical studies. The FDA's role in the development of a novel drug begins when the drug's sponsor decides to test the new molecule's diagnostic or therapeutic potential in humans after screening it for pharmacological activity and acute toxicity potential in animals. The molecule then changes its legal position under the Federal Food, Drug, and Cosmetic Act, becoming a new drug subject to the drug regulatory system's specific requirements.

According to the post-pandemic pharmaceutical landscape, the industry would see a rise in innovation, with cancer and rare diseases expected to benefit the most. Due to the recent surge in investigational new drug (IND) applications, contract services are predicted to grow substantially, with an estimated 75 annual FDA approvals expected by 2025. From April 2020 to June 2020, the FDA received 3,806 IND applications, more than in the preceding eight years combined (3,576 in 2012-2019).

Besides, in May 2020, the FDA has issued two new guideline documents for industry and investigators of COVID-19 drugs and biological products. The FDA's expectations for new treatment drug development initiatives in the fight against COVID-19 are underlined in these two guidances, “COVID-19 Public Health Emergency: General Considerations for Pre-IND Meetings Requests for COVID-19 Related Drugs and Biological Products” and “COVID-19: Developing Drugs and Biological Products for Treatment of Prevention”.

According to this Pre-IND Guidance, all COVID-19 drug development interactions should be initiated through IND meeting requests, which were given to provide broad considerations to assist sponsors in developing Pre-IND meeting requests for COVID-19-related drugs. The FDA recommends that drug development applications be submitted through the Pre-IND programs rather than a pre-Emergency Use Authorization in order to improve the quality and content of IND submissions and streamline prospective sponsor bids.

The review and approval processes for IND applications and NDAs are continually evolving, thus influencing approval trends. In mid-2018, FDA Commissioner Scott Gottlieb declared plans to upgrade the agency’s office of drug review, and the agency issued draft guidance documents on the way the FDA would include patient input in regulatory decision-making. In reality, when it comes to regulatory approvals, the FDA has to take real-world evidence from off-label drug use into account. When evaluating drugs for approval, the FDA and other regulatory agencies take patient-reported outcomes into consideration.

Product Insights

The small molecule segment held the largest share of 89.0% in 2020 and is likely to remain dominant over the forecast period. This is largely due to the increasing number of small molecules in development. Small molecules constitute more than 90% of the drugs currently in the market. Over a seven-year period from 2010 to 2017, the U.S. FDA approved a total of 262 novel molecular entities (NMEs), with small molecules accounting for 76%. Also, in 2018, small molecules accounted for over 71% of FDA-approved drugs.

The large molecule segment is anticipated to register the fastest CAGR of 8.8% throughout the forecast period. This is largely due to pharmaceutical and biotech companies investing more in the discovery and development of large molecule therapeutic proteins due to their specificity, which allows for the targeting of previously difficult-to-address conditions in disease states, such as oncology, neurology, and metabolic disease. Biologics are expected to account for 50% of the top 100 drugs in 2020, increasing from 20%. More pharma and biotech companies would be interested in moving more innovative biotherapeutics through the development pipeline as rapidly as feasible, and outsourcing provides sponsors with immediate access to expanded capacity and specialized expertise as they compete in the large molecule space.

Service Insights

合同发展段主导market with a revenue share of 85.5% in 2020. The segment is also projected to expand at the fastest CAGR during the forecast period. The contract development offers several benefits over in-house development of drugs, such as access to industry experts, less time to market, cost-effectiveness, and more focus on core competencies. Most small-sized pharmaceutical and biopharmaceutical companies prefer outsourcing their drug development activities due to the lack of internal capabilities. This is expected to drive the market over the forecast period.

The contract manufacturing segment is anticipated to witness lucrative growth over the forecast period. Sponsor firms developing the therapeutics are encountering extreme pressure to control costs and accelerate time to market approval. Though safety and efficacy ultimately dictate the success of a new drug, other factors, for instance, manufacturing strategy and execution can largely impact the cost and timeline of the drug development program. Hence, it is important that a sponsor selects a CMO that has a complete understanding of the IND application process.

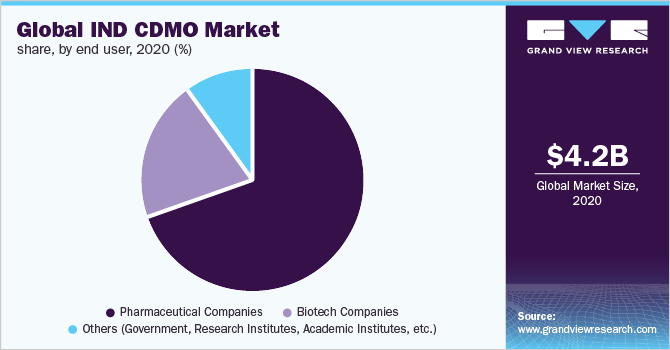

End-user Insights

The pharmaceutical companies segment led the market and accounted for 69.4% in 2020. This can be attributed to the increasing investments in the pharmaceutical sector. There are roughly 7,000 different rare diseases that impact 350 million people worldwide, and more research is being done than ever before. In 2017, the FDA authorized two cell-based gene therapies, bringing the total number of active Investigational New Drug Applications (INDAs) for gene and cell therapies to over 700.

The biotech companies segment is anticipated to register a lucrative growth rate of 7.0% over the forecast period. The basic research is carried out both independently and in collaboration with researchers and others from various parts of the biomedical research ecosystem, such as disease foundations and patient organizations, venture capital, and pre-competitive consortia. It faces a lengthy development period that is unique to the field. A new drug's normal timeline from the filing of the IND to market entrance, following regulatory approval, is around eight years. During those eight years, the process is organized into phases of research, testing, and FDA evaluation, all of which have the potential for the medicine to fail at any point.

Regional Insights

North America held the largest share of 41.1% in 2020. This can be attributed to the increased R&D investments by life sciences and pharmaceutical companies, which are expected to boost the demand for contract manufacturing in the region. In the U.S., it takes an investigational drug an average of 12 years to get from the lab to the medicine cabinet. Only five medications out of every 5,000 that go through preclinical research make it to human clinical trials. The FDA has approved one of the five medications that have been tested in people. As a result, the likelihood of a novel drug reaching the market is only 1 in 5,000.

Asia Pacific is anticipated to register the fastest growth rate of 7.7% throughout the forecast period. Biotech companies from Europe and North America are expanding their operations in the region. There has also been an influx of principal investigators (PIs) and prominent opinion leaders. Governments have been working to improve their regulatory systems and align them more closely with European and American standards. As a result, economies such as Greater China, South Korea, and Singapore have gained significant benefits.

For example, in China, regulatory delays have decreased by 16 months since 2016. The Chinese National Medical Products Administration (NMPA) has recommended fast-track reviews for clinical priority indications and breakthrough technologies. Recently, a set of reforms was announced with the purpose of improving drug review processes, reducing the time it takes to revise (IND) and NDA applications, and accelerating the development of innovative new drugs.

Key Companies & Market Share Insights

Market players are implementing a range of strategic activities, such as new partnership agreements, collaborations, and mergers and acquisitions, with the objective of boosting their services and manufacturing services to gain a competitive advantage.

For instance, in June 2021, Charles River Laboratories International, Inc. acquired Vigene Biosciences, Inc. The acquisition expanded its existing cell and gene therapy contract manufacturing capabilities and provided a complete gene-modified cell treatment solution in the U.S. Some prominent players in the global investigational new drug (IND) CDMO market are:

Covance Inc.

Charles River Laboratories Inc.

Cambrex Corporation

IQVIA Holdings Inc.

Syneos Health

Lonza

Catalent

Recipharm AB

Siegfried Holding AG

Thermo Fisher Scientific Inc.

Investigational New Drug CDMO Market Report Scope

Report Attribute |

Details |

Market Size value in 2021 |

USD 4.3 billion |

Revenue forecast in 2028 |

USD 6.8 billion |

Growth Rate |

CAGR of 6.9% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, service, end-user, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE |

Key companies profiled |

Lonza; Catalent; Recipharm AB; Siegfried Holding AG; Thermo Fisher Scientific Inc.; Covance Inc.; Charles River Laboratories; Cambrex Corporation; IQVIA Holdings Inc.; Syneous Health |

Customization scope |

免费定制(相当于8肛交报告ysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global investigational new drug CDMO market report on the basis of product, service, end-user, and region:

Product Outlook (Revenue, USD Million, 2016 - 2028)

Small Molecule

Large Molecule

ServiceOutlook (Revenue, USD Million, 2016 - 2028)

Contract Development

Small Molecule

Bioanalysis and DMPK Studies

Toxicology Testing

Pathology and Safety Pharmacology Studies

Drug Substance Synthetic Route Development

Drug Substance Process Development

Form Selection Crystallization Process Development

Scale-up of Drug Substance

Pre Formulation

Preclinical Formulation Selection

First In Man Formulation/ Process Development

Analytical Method Development / Validation

Release Testing of Drug Substance and Drug Product

Work Up Purification Steps

Telescoping & Process Refining

Initial Optimization

Formal Stability of Drug Substance and Drug Product

Large Molecule

Cell Line Development

Process Development

Upstream

Microbial

Mammalian

Others

Downstream

MABs

Recombinant Proteins

Others

Contract Manufacturing

Small Molecule

Oral Solids

Liquid and Semi-solids

Injectables

Others

Large Molecule

MABs

Recombinant Proteins

Others

End-user Outlook (Revenue, USD Million, 2016 - 2028)

Pharmaceutical Companies

Biotech Companies

Others (Government, Research Institutes, Academic Institutes, etc.)

Regional Outlook (Revenue, USD Million, 2016 - 2028)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

Japan

China

India

Australia

South Korea

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE