Latin America Intermediate Bulk Container Liner Market Size, Share & Trends Analysis Report By Capacity, By Application (Food & Beverage, Industrial Liquids, Household Products), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-084-5

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Bulk Chemicals

Report Overview

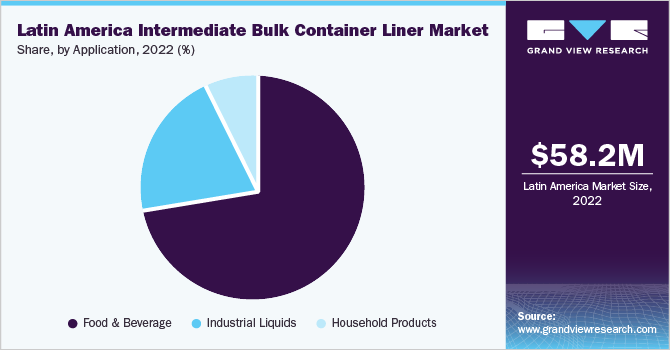

The拉丁美洲中间马散货集装箱班轮rket sizewas estimated atUSD 58.2 million in 2022,预计年复合增长的恶性肿瘤h rate (CAGR) of 5.3% from 2023 to 2030. This growth can be attributed to increased international trade agreements in the region, such as the Latin American Integration Association, promoting inter-regional trade of bulk products, thereby promoting the requirement of IBC liners. Additionally, Brazil and Mexico have a significant export market for food & beverage products such as edible oil, fruit concentrate,fruit puree, tomato puree, and others further driving the market growth for these liners in the region.

The Brazil intermediate bulk container (IBC) liner market is driven by the thriving food and beverage industry within the country. According to the Brazilian Food Industry Association (ABIA), the food & beverage sector achieved remarkable revenue of USD 209 billion, recording a significant surge of 16.6% in 2022. This growth directly contributes to the increasing demand for intermediate bulk container liners, as they play a vital role in the transportation of food & beverage products throughout the country and to its import partners.

Moreover, the demand for intermediate bulk container liners is further driven by the stringent requirements set by regulatory bodies such as the National Health Surveillance Agency (ANVISA). For instance, ANVISA has specific requirements set for the packaging of perishable food products, such as milk and fruit puree to prevent these products from contamination during storage and transportation. To align with this regulation, food & beverage manufacturers opt for these packaging solutions, which further drives the market growth for packaging fulfilling these requirements at an economical cost which further can contribute to the IBC liners demand in the country.

Capacity Insights

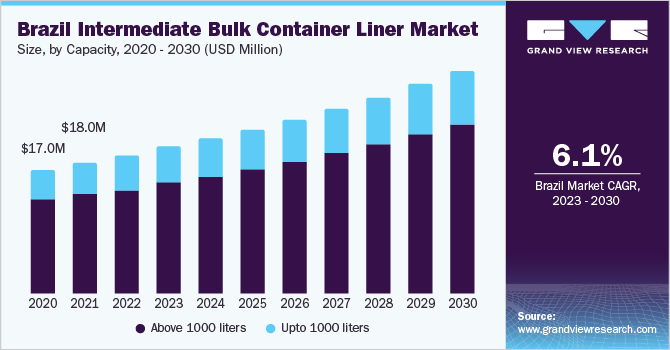

Based on capacity, the Latin America intermediate bulk container (IBC) liner market is further categorized into above 1000 liters and up to 1000 liters. Among these, the above 1000 liters capacity range recorded a higher market share of over 73.0% in 2022. This is attributed to the extensive utilization of intermediate bulk container liners in industries such as industrial liquids and agriculture chemicals. These industries deal with larger volumes of materials and require efficient bulk storage and transportation solutions.

The upto 1000 liters capacity range is expected to grow at a CAGR of 5.1% during the forecast period 2023-2030. This growth is due to the wide application of these liners in the food & beverage and household product industries. These industries typically require smaller to medium quantities of IBC liners for storage and transportation purposes, driving the growth of the segment. These liners are also known as industrial bag-in-box liners and include sizes ranging from 2oo liters to 1000 liters.

Application Insights

Based on application, the Latin America intermediate bulk container (IBC) liner market is further segmented into food & beverages, industrial liquids, and household products. Among these, the food & beverages segment recorded the highest market share of over 72.0% in the base year 2022. This is owing to the growing export and import trade of food & beverage products among Latin American countries. The intermediate bulk container liner is required at various stages of the food & beverages supply chain, including storage, transportation, and distribution of products such as syrups, sauces, and alcoholic & non-alcoholic beverages. These liners help preserve the quality and freshness of the products while facilitating efficient handling and logistics management.

Furthermore, the food safety and quality regulations in the region further emphasize the need for reliable and compliant packaging solutions such as intermediate bulk container liners, which drives the market demand for this application. For instance, the Hazard Analysis and Critical Control Points (HACCP) system is widely adopted by food manufacturers, suppliers, and distributors in Latin America. This system mandates reliable food packaging such as intermediate bulk container liners to avoid product contamination, ensuring the safety and quality of the products.

The industrial liquids segment is anticipated to grow at a CAGR of 5.0% over the forecast period 2023-2030. This growth is driven by the thriving industrial sector, including chemical manufacturing, oil & gas, and other liquid-based industries. These industries handle large volumes of liquids, making the application of intermediate bulk container liners with a capacity range above 1000 liters essential for efficient storage and transportation. These liners offer a secure and leak-proof packaging solution that plays a vital role in maintaining the integrity of industrial liquids. They ensure that the liquids remain uncontaminated and of high quality till their final distribution, which further increases the segment demand.

The demand in the household products segment is driven by their utilization in packaging various household products, such as liquid detergents, floor cleaners, surfactants, and liquid soaps & hand wash, among others. These liners ensure effective protection of liquid detergents against contamination. Liquid detergents have gained popularity over powder detergents due to their convenience, which can further drive the demand for IBC liners.

国家的见解乐鱼APP二维码

Brazil dominated the Latin America intermediate bulk container (IBC) liner market with a market share of over 32.0% in 2022. This is attributed to the increased trade of food & beverage products in the country. The Mexico intermediate bulk container (IBC) liner market is expected to grow at a CAGR of 5.5% over the forecast period. This is due to the wide application of intermediate bulk container liners in the food & beverage industry of the country for efficient and reliable packaging solutions. The country is one of the largest producers of fruits and its processed products. These liners provide a reliable and efficient packaging solution for the storage, transportation, and handling of these liquid products.

Furthermore, the demand for these liners in Mexico is propelled by the increasing emphasis on sustainable packaging practices aligned with the country's commitment to environmental sustainability. For instance, Mexico's Secretariat of Environment and Natural Resources (SEMARNAT) has implemented initiatives to reduce plastic waste and promote sustainable packaging practices which have led packaging manufacturers to shift from traditional packaging to eco-friendly alternatives such as paper intermediate bulk containers. These containers are called collapsible containers wherein they use flexible liners which can be recycled and have a lower environmental impact. The government’s focus on developing sustainable bulk packaging solutions can positively impact the IBC liners demand in Mexico.

The Argentina intermediate bulk container (IBC) liner market’s growth is driven by several environmental regulations that promote sustainable packaging practices such as the zero-waste law, Integral Management of Solid Urban Waste. This regulation encourages manufacturers from different industries to adopt sustainable packaging solutions which led to an increased demand for sustainable intermediate bulk container liners that are reusable and recyclable in nature. For instance, Arcor, a major food and beverage company in Argentina, has adopted sustainable packaging practices and incorporates these liners as a part of its ec0-friendly packaging initiatives.

The growth of the Chile intermediate bulk container (IBC) liner market is driven by the presence of tomato processing companies in the country. Chile is considered a major exporter of tomato puree catering to Latin America as well as North America. This fuels the market growth for the intermediate bulk container (IBC) liner for safe transportation and preservation of their quality during international shipments.

The Columbia intermediate bulk container (IBC) liner market demand is influenced by the volume of imports of food products such as tomato puree, vegetable oils, and other items. To import these products the country heavily relies on these liners to transport and store bulk liquids and prevent them from contamination and leakage during shipment. However, the presence of several substitute products such as drums & barrels, flexitanks, and other bulk packaging solutions for importing food items restraints the market growth for intermediate bulk container liners in the country.

Key Companies & Market Share Insights

Key Companies resort to multiple mergers and acquisitions in a bid to gain market share in a particular region. In some cases, the companies build technological collaborations to produce an advanced product with superior performance characteristics to increase revenue. For instance, on February 1, 2023, Sealed Air announced the acquisition of Liquibox, a manufacturer of bulk liquid packaging solutions. Since Liquibox has a presence in Mexico, this acquisition is expected to help Sealed Air to accelerate and expand its presence in the Mexico IBC liner market. Some prominent players in the Latin America intermediate bulk container liner market include:

Amcor plc

Sealed Air

CHEP

Arena Products, Inc.

Scholle IPN

Liquibox

ILC Dover LP

Greif

Smurfit Kappa

Latin America Intermediate Bulk Container Liner Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 61.1 million |

Revenue forecast in 2030 |

USD 87.8 million |

Growth rate |

CAGR of 5.3% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Capacity, application, country |

Country scope |

Brazil; Mexico; Argentina; Chile; Columbia |

Key companies profiled |

Amcor plc; Sealed Air; CHEP; Arena Products, Inc.; Scholle IPN; Liquibox; ILC Dover LP; Greif; Smurfit Kappa |

Customization scope |

Free report customization (equivalent Upto 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Latin America Intermediate Bulk Container Liner Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America intermediate bulk container liner market based on capacity, application, and country:

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

Upto 1000 liters

Above 1000 liters

Application Outlook (Revenue, USD Million, 2018 - 2030)

Food & Beverage

Alcoholic Beverages

Non-Alcoholic Beverages

Others

Industrial Liquids

Household Products

Country Outlook (Revenue, USD Million, 2018 - 2030)

Brazil

Mexico

Argentina

Chile

Columbia

Frequently Asked Questions About This Report

b.The Latin America intermediate bulk container liner market was valued at USD 58.2 million in the year 2022 and is expected to reach USD 61.1 million in 2023.

b.The Latin America intermediate bulk container liner market is expected to grow at a compound annual growth rate of 5.3% from 2023 to 2030 to reach USD 87.8 million by 2030.

b.The food & beverage application segment accounted for the largest market share of over 72.0% in the Latin America intermediate bulk container (IBC) market in 2022 owing to the extensive utilization of these liners in international trade logistics management in the region.

b.The key market players in the Latin America intermediate bulk container (IBC) liner market include. Amcor plc, Sealed Air, CHEP, Arena Products, Inc., Scholle IPN, Liquibox, ILC Dover LP, Greif, Smurfit Kappa, and others.

b.The growing export and import trade in the Latin America and its trade partner regions for food & beverage, industrial liquids, and household products are driving the Latin America intermediate bulk container liner market.