Learning Management Systems Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Delivery Mode, By End-user, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-946-4

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry:Technology

Report Overview

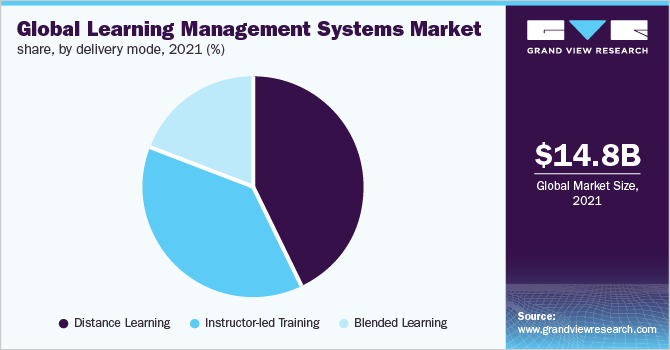

The global learning management systems market was valued at USD 14.78 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.5% from 2022 to 2030. The emergence of several new technologies, tailored to the COVID-19 impact, has fueled the learning management system (LMS) market growth. Development in multimedia graphics, high-speed telecommunication networks, and affordable digital devices are the factors contributing to the increasing adoption of LMS.

The market showed positive change amid COVID-19 and is expected to witness massive spending and investments led by enterprises, educational institutions, and governments during the coming years. Strategic alliances with the LMS providers are predominant strategies embraced by the eLearning market players.

Big data,Artificial intelligence(AI), online learning, and mobile learning are the vital elements driving market expansion. These new e-learning trends are likely to be growing market trends during the forecast period. Advanced communication technologies are rapidly altering classroom teaching, all over the world.

Using gaming mechanisms in the learning process makes it easier to engage users on a high level and enhances the retention process. The use of badges, quests, and avatars makes users motivated to compete and achieve better results.

Education technologies benefit students and teachers by facilitating interactive and collaborative learning. Currently, the internet is accelerating the adoption of distance learning due to its escalating proliferation across the population. As a result, many companies are expanding their portfolio by acquiring or merging with companies to deliver creative content to increase their market share.

For instance, in May 2022, Class Technologies Inc. acquired Blackboard Inc., one of the prominent EdTech companies serving higher education, government clients, and businesses. Through this acquisition, the company aims to focus on delivering creative resources to various companies and speeding up innovation in its flagship learning management system.

COVID-19 Insights

The COVID-19 pandemic has significantly influenced the LMS market operations. The pandemic has intensified the demand for e-learning platforms; several lockdown measures adopted by various nations have influenced educational institutions to take on learning management systems. The governments of various nations urged educational institutions to deploy online learning platforms, in 2020.

For instance, in February 2020, the government of China mandated education providers to leverage online learning platforms. These measures have contributed to the growth of the market for learning management systems (LMS). As the e-learning market is escalating, the LMS market is likely to have fascinating growth post-pandemic.

Component Insights

The solution segment dominated the market with an above 65.0% share in 2021. Market players such as Cornerstone, Oracle, SAP, and others are integrating advanced technologies such asMachine Learning(Ml), Artificial Intelligence (AI), and analytics in the existing learning management system (LMS) platforms.

For instance, in 2021, Cornerstone announced new content offerings for the corporate workforce. The company focused on enhancing its curated content through partnerships and investing in original content creation. Cornerstone also offers Skill Pill configurable catalogs, which allow enterprises to select certain courses and tailor their records to meet their specific requirements.

服务部分是大调的预期增长得更快ing the forecast period. The substantial increase in the service segment is related to the rising demand for installation and technical assistance. Education and learning service providers offer various educational services, including implementation, consultancy, and support. Learners can use these services to help with curriculum development along with the smooth performance and maintenance of current activities. Integration-as-a-service is a feature of the advanced system that decreases installation time and complexity. Similarly, the business consulting sub-segment will likely lead this market due to the improved collaborations and communications between trainers and learners.

Deployment Insights

The on-premises segment dominated the market with more than 50.0% share in 2021. The on-premises segment is likely to show declining demand in the coming years. On-premises deployments have features of complete control, customization, better integration, and longer deployment.

培训和发展部门,所有the businesses, are rapidly adopting mobile learning. The majority of the companies adopt technology-assisted learning, which allows employees to create, save, and display innovative ideas in the workplace. Companies that adopt mobile learning solutions have seen an increase in productivity, as well as creativity plus loyalty among their employees.

大多数供应商正从一个本地deployment to cloud-based solutions. Market players release cloud-based software and collaborate with businesses to provide end-users the innovative and premium content. For instance, in August 2021, D2L Corporation acquired Bayfield design, specializing in writing and designing cloud courses and delivering them to students and employees.

By way of this acquisition, the company aims to offer trainers and students premium digital curriculum courses by giving access to the premium courses, launched by Bayfield design and providing exceptional services to the students and parents.

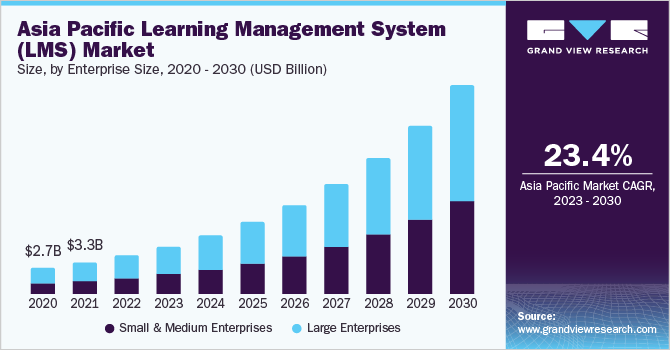

Enterprise Size Insights

The large enterprise size segment dominated the market with a market share of above 60.0% in 2021. Companies have accepted the usage of LMS software, which has several advantages, including lower training and development costs, centralized training resources, faster training, and more. The factors listed above are anticipated to increase the demand for LMS software designed for the corporate and education industries in large enterprises.

The players are collaborating with enterprises to increase customer base and innovative content. For instance, in March 2022, Cornerstone acquired EdCast Inc., a provider of a learning platform for worldwide institutions, enterprises, and governments. Through this acquisition, the company aims to accelerate the value of customers by providing some innovative learning, skill-building, and content, with the help of EdCast Inc.

The small & medium enterprise segment is expected to show significant growth during the forecast period. Adopting a learning management system has benefited many worldwide institutions, educational organizations, along with enterprises. Every business level needs LMS software, as the firms require training for safety compliance.

Small enterprise size needs LMS for various aspects, including cost-effectiveness, tracking employee progress, employee training, and others. Cloud infrastructure has made the LMS platform affordable and convenient for small firms and startups.

Delivery Mode Insights

The distance learning segment dominated the market with a market share of more than 40.0% in 2021. Further, the instructor-led training (ILT) segment is anticipated to portray the highest CAGR of 20.6% during the forecast period. Instructor-led training program encourages discussion and interaction of instructors with learners and employees, delivering a seamless learning experience.

The demand for LMS in academics has increased since it manages educational content, online course administration, and student work assessment. Distance learning is likely to show moderate growth in the coming years, and employees along with students are likely to adopt instructor-led training over distance learning.

Blended learning incorporates more educational advancements such as virtual classrooms, mobile learning, and webinars. These methods combine various levels of interaction and content delivery via digital mediums. The primary purpose of blended learning is to improve the teaching experience, and it can also include personalized teaching methods for better learning outcomes. Blended learning is primarily joint in higher academic and K-12 schools. Blended learning offers flexibility, improved education, corporate training, and improved return on investment (ROI).

End-user Insights

The academic section dominated the market with more than 58.0% share in 2021. In terms of end-user, the market is categorized into corporate and academic. A learning environment should provide personalized and flexible training programs that address each learner's specific needs. E-learning should use a holistic and ecological learning strategy to strengthen learning systems and ensure that they can adapt to future developments in education and technology.

On the other hand, new technology developments, such as mobile learning and AI and ML in academic learning settings, can give the education industry the resources it needs to create a modernized learning module for the future that is highly focused on digital learning.

The corporate sector's usage of the LMS market is expected to rise as it provides flexibility in conducting training, meetings, and onboarding processes. The retail industry has adopted e-learning, given training to their sales employees, and provided product insights. Corporate LMS software keeps all of your e-Learning content in one place. The LMS software could save the staff time searching through multiple drives and devices for content while also lowering the risk of losing important training material and data.

Regional Insights

North America accounted for the highest share, with more than 41.0% of the global revenue in 2021. North America is anticipated to dominate the LMS market due to rising Ed-tech activities. The U.S. has the highest number of universities and colleges, and this factor is likely to create opportunities for LMS providers to expand their businesses in this country.

Several drivers, restraints, and opportunities influence the learning management system market in North America. The increasing demand for effective and high-quality education or learning is critical to the market's success in North America. North America has accepted the rapid adoption of innovative learning, boosting the region's LMS market share.

On the other hand, the relinquishment of cloud-based services among associations is likely to bring immense openings for the growth of the North America learning management system market.

The Asia Pacific is likely to grow during the forecast period. India, China, Japan, and other countries of Asia Pacific are investing in and adopting learning management system platforms to promote e-learning and development. Market players in the region are emphasizing expanding business footprints.

For instance, in March 2021, LTG PLC acquired Bridge, a learning management system platform that enhances skills and performance and helps managers and employees transform their company with the help of alignment, connection, and growth. As a part of the acquisition, the company intends to combine the group of businesses that allows the customers to solve the critical and fast-moving challenges leaders face in the workplace.

Key Companies & Market Share Insights

Market players are likely to focus on developing cloud learning content and finding solutions to enhance cloud learning. LMS providers are observed to actively integrate artificial intelligence, analytics, and machine learning in existing LMS platforms. For instance, in January 2022, Docebo acquired Skills live, an educational consulting agency that offers companies professional services, combined with some latest learning technologies.

Through this acquisition, the company aims to contribute to expanding its footprints in Australia and other countries within the Asia Pacific and provide better services in the area by gathering feedback from the customer base.

Prominent market participants focus on increasing customer experience by delivering goods with multi-utility options that enable customers to study via an internet browser from the cloud. The major companies have adopted strategies to grow in the learning management market. Some of the prominent players in the global learning management systems market include:

Cornerstone

Blackboard Inc.

D2L Corporation

PowerSchool

Instructure, Inc.

Adobe

Oracle

SAP

Moodle

McGraw Hill

Xerox Corporation

Learning Management Systems Market Report Scope

报告的属性 |

Details |

Market size value in 2022 |

USD 17.27 billion |

Revenue forecast in 2030 |

USD 71.65 billion |

Growth rate |

CAGR of 19.5% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2017 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD billion, CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, trends |

Segments covered |

Component, deployment, enterprise size, delivery mode, end-user, region |

Regional scope |

North America; Europe; Asia Pacific; South America; MEA |

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; India; Brazil |

Key companies profiled |

Cornerstone; Blackboard Inc.; D2L Corporation; PowerSchool; Instructure, Inc.; Adobe; Oracle; SAP; Moodle; McGraw Hill; Xerox Corporation |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, & country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Learning Management System Market report based on the component, deployment, enterprise size, delivery mode, end-user, and region:

Component Outlook (Revenue, USD Million, 2017 - 2030)

Solution

Services

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

Cloud

On-premises

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

Small & Medium Enterprise

Large Enterprises

Delivery Mode Outlook (Revenue, USD Million, 2017 - 2030)

Distance Learning

Instructor-led Training

Blended Learning

End-user Outlook (Revenue, USD Million, 2017 - 2030)

Academic

K-12

Higher Education

Corporate

Healthcare

Banking, Financial Services, And Insurance (BFSI)

IT And Telecommunication

Retail

Manufacturing

政府和国防

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

U.K.

Germany

France

Asia Pacific

China

Japan

India

南美

Brazil

Middle East & Africa (MEA)

Frequently Asked Questions About This Report

b.The global learning management system market is expected to grow at a compound annual growth rate of 19.5% from 2022 to 2030 to reach USD 71.65 billion by 2030.

b.North America dominated the learning management system market with a share of 42% in 2021. This is attributable to the rapid growth of cloud-based learning platforms tailored with massive spending's of enterprises in EdTech and corporate learning and development programs.

b.Some key players operating in the learning management system market include Blackboard Inc., Cornerstone, D2L Corporation, PowerSchool, Instructure Inc., SAP, Oracle, Moodle, MacGraw Hill, Adobe, and Xerox Corporation.

b.Key factors that are driving the LMS market growth include the development in multimedia graphics, high-speed telecommunication networks, and affordable digital devices.

b.The global learning management system market size was estimated at USD 14.78 billion in 2021 and is expected to reach USD 17.27 billion in 2022.