Maleic Anhydride Market Size, Share & Trends Analysis Report By Application (1,4-BDO, UPR, Additives, Copolymers), By Region (Asia Pacific, North America, Europe, Central & South America, MEA), And Segment Forecasts, 2019 - 2025

- Report ID: 978-1-68038-191-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry:Bulk Chemicals

Report Overview

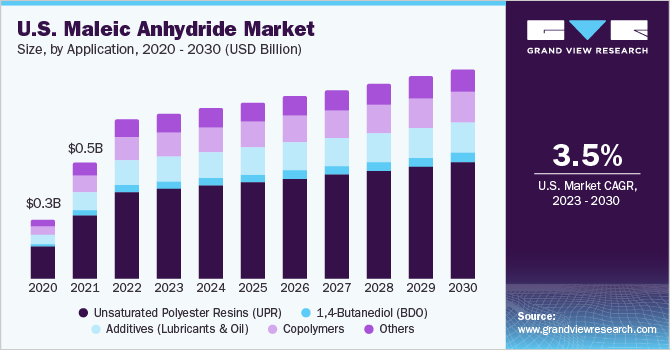

The global maleic anhydride market size valued at USD 2.77 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2019 to 2025. Increasing demand forUnsaturated Polyester Resins (UPR)and 1,4-Butanediol (BDO) is expected to augment market growth over the forecast period. UPRs are widely used as body filler for reconstruction and repair of damaged parts of vehicles. Maleic Anhydride (MAN) is an organic intermediate used for the production of several industrial chemicals, such as malic or maleic acid, UPRs, lubricating oil additives, alkenyl succinic anhydrides, andfumaric acid.

The molecular structure of MAN makes it an excellent crosslinking and conjunction agent. It also forms an integral structural component in industrial copolymers. In terms of consumption, the U.S. leads the market in North America. High demand for UPR and additives in building & constructions coupled with technological advancement in manufacturing technologies has been the major driving factor. Product demand in the U.S. is primarily driven by the refurbishment of the existing infrastructure. The growth is further supported by the U.S. government’s efforts to improve the energy efficiency of buildings. Maleic anhydride is used to manufacture1,4-butanediol (BDO)由戴维职业cess Technology (DPT).

In this process, MAN is converted to the ester, which then undergoes fixed-bed hydrogenolysis to make a mixture of BDO, Tetrahydrofuran (THF), and GBL. BDO is an intermediate chemical for THF, Polytetramethylene Ether Glycol (PTMEG), Gamma-Butyrolactone (GBL), Polybutylene Terephthalate (PBT), andPolyurethane (PU). These chemicals are widely used in engineeringplastics, fibers, medicines, artificial leather, cosmetics, pesticides, hardener, plasticizers, solvent, and rust remover. Increasing cases of car accidents on a global level are expected to propel the demand for UPR as they help repair dents caused during accidents.

According to the United States Census Bureau, over 9 million vehicles were involved in fatal and non-fatal accidents in the region in 2017. High demand for automobiles coupled with the relatively slow growth of infrastructure has resulted in increased cases of road accidents over the past few years. Besides, UPR is also used in the manufacture of high-performance components for the automotive industry. Thus, increasing UPR demand in the automobile industry is expected to drive maleic anhydride market growth over the forecast period.

N-butane and benzene are the primary feedstock for manufacturing MAN. Prices of these feedstocks are highly dependent on the crude and naphtha outputs. Fluctuating crude oil prices have been the major reason for high fluctuation in benzene prices. However, prices for maleic anhydride have been relatively steady over the last few years owing to stable demand and supply landscape. Current prices are estimated to continue to grow steadily on account of stability in crude oil prices along with the softening of alternate raw material prices.

Application Insights

Unsaturated polymer resins were the largest application segment accounting for over 50% of global market share in 2018 and are expected to grow at a significant pace over the forecast period. These resins are used in various industries including electrical, automotive, marine, and construction on account of their cost-effectiveness, high performance, and eco-friendly characteristics.

Growth of end-user industries, such as automotive and construction, in the developing economies of Central & South America and Asia Pacific regions are expected to drive the segment. Application of UPR gives a smooth surface to the vehicles and also provides good adhesion for the paint, thereby, increasing the shelf life of the applied coat. These resins are widely used in the production of bumpers, doors, roofs, and interiors and to repair damages caused during accidents.

添加剂主要是用于改善燃料efficiency for diesel, gasoline, distillate fuels, and other lubricants. They also add to the fuel efficiency by reducing the combustion rates, under high temperatures, prolong oil change intervals, improve engine efficacy, and decrease harmful emissions.

Growing demand for specialty fuel additives across various regional markets is expected to remain a key driving factor for this segment. Rising environmental concerns regarding toxic emissions have prompted regulatory agencies across the globe to mandate norms, for instance, cleaner diesel fuel programs in the U.S.

Regional Insights

Construction is one of the largest end-use industries in North America. U.S. has implemented a National Infrastructure Plan to attract USD 590 billion in infrastructure investment from 2014 to 2018. Such developmental initiatives are expected to increase the spending in the construction sector, thereby boosting the demand for UPR. Growth of the marine and automotive sectors is also expected to propel the demand for UPR and MAN in the region over the next few years.

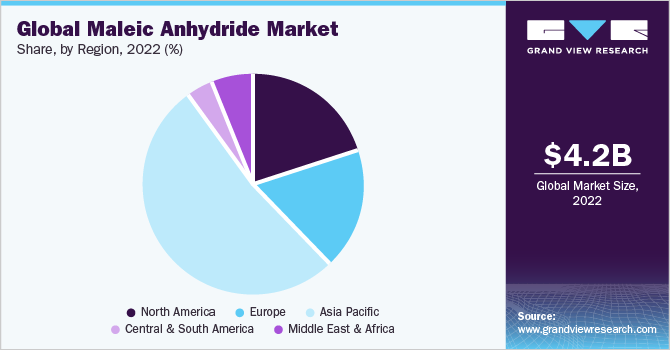

The Asia Pacific emerged as the largest manufacturer as well as consumer and is estimated to continue its dominance over the forecast years. Favorable government initiatives by the Indian and Chinese governments are expected to fuel the region’s growth. The majority of demand is expected to come from the construction and plasticizers industries in the region. Increasing construction spending in emerging economies of China, India, and Indonesia is further expected to drive the product demand in APAC.

Key Companies & Market Share Insights

The global market structure is highly segregated with the top five companies including Yabang Jiangsu, Polynt, Huntsman, Qiaoyou Shanxi, and Tianjin Bohai. These companies together accounted for over 30% of the total volume in 2018. Huntsman was the single largest manufacturer of MAN and accounted for over 9.5% of the global market share in 2018.

Huntsman has two manufacturing facilities located in Louisiana and Florida with a total capacity of 155 kilotons and another manufacturing facility in Moers, Germany in collaboration with Sasol with a capacity of 105 kilotons. Some of the prominent players in the maleic anhydride market include:

Huntsman Corporation

Laxness AG

MOL Hungarian Oil & Gas Plc

Nippon Shokubai Co., Ltd.

Thirumalai Chemicals Ltd.

Compania Espanola de Petroleos

S.A.

DSM N.V.

Maleic AnhydrideMarketReport Scope

Report Attribute |

Details |

The market size value in 2020 |

USD 3.17 billion |

The revenue forecast in 2025 |

USD 4.38 billion |

Growth Rate |

CAGR of 6.7% from 2019 to 2025 |

The base year for estimation |

2018 |

Historical data |

2014 - 2017 |

Forecast period |

2019 - 2025 |

Quantitative units |

Volume in kilotons, revenue in USD million and CAGR from 2019 to 2025 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Application, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; Germany; France; Italy; U.K.; China; India; Japan; South Korea; Brazil |

Key companies profiled |

Huntsman Corporation; Laxness AG; MOL Hungarian Oil & Gas Plc; Nippon Shokubai Co., Ltd.; Thirumalai Chemicals Ltd.; Compania Espanola de Petroleos; S.A.; DSM N.V. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global maleic anhydride market report based on application and region:

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

Unsaturated Polymer Resin (UPR)

1-4, Butanediol (BDO)

Additives

Copolymers

Others

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2014 - 2025)

North America

U.S

Canada

Europe

Germany

France

Italy

U.K.

Asia Pacific

China

India

Japan

South Korea

Middle East & Africa

Central & South America

Brazil

Frequently Asked Questions About This Report

b.The global maleic anhydride market size was estimated at USD 2.97 billion in 2019 and is expected to reach USD 3.17 billion in 2020.

b.The global maleic anhydride market is expected to grow at a compound annual growth rate of 6.7% from 2019 to 2025 to reach USD 4.38 billion by 2025.

b.Asia Pacific dominated the maleic anhydride market with a share of 57.7% in 2019. This is attributable to favorable government initiatives by the Indian & Chinese governments and increasing construction spending in emerging economies of China, India, and Indonesia.

b.Some key players operating in the maleic anhydride market include Huntsman Corporation, Laxness AG, MOL Hungarian Oil & Gas Plc, and Nippon Shokubai Co., Ltd. Several other manufacturers are Thirumalai Chemicals Ltd., Compania Espanola de Petroleos, S.A., and DSM N.V.

b.Key factors that are driving the market growth include increasing demand for Unsaturated Polyester Resins (UPR) and 1,4-Butanediol (BDO) .