Maternal Mental Health Market Size, Share & Trends Analysis Report By Disease Indication (Postpartum Depression, Dysthymia), By Therapy (Interpersonal Psychotherapy, Antidepressants), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-098-3

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

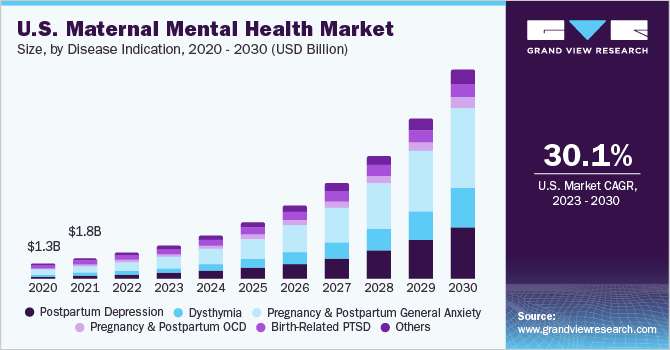

The globalmaternal mental health market sizewas estimated atUSD 6.22 billion in 2022and is projected to grow at a compound annual growth rate (CAGR) of 28.43% from 2023 to 2030. The major driving factors for the market’s growth are expected to be the increased government funding to reduce maternal mortality, increasing incidence of post-partum depression, rise in awareness programs, and efforts in improving practices around maternal mental health. Maternal mental health is an important issue globally, as it affects not only the well-being of mothers but also the health and development of their children. A recent study by PostpartumDepression.org found that one in seven women will be affected by postpartum depression in 2023. With approximately four million live births annually in the U.S., approximately 600,000 postpartum depression cases are reported among them.

COVID-19 had a substantial effect on peripartum mental health outcomes. According to research by the University of Michigan School of Nursing and Michigan Medicine, one in three women who had childbirth at the beginning of the pandemic experienced postpartum depression. In contrast, one in five had key depressive symptoms. In addition, a separate study from the University of Michigan team also found that those who had childbirth during the first six months of the pandemic reported more distress and anxiety. Postpartum mental health was a significant but comparatively overlooked outcome during the COVID-19 pandemic.

Maternal mental health is an important issue globally, and efforts are being undertaken to increase the funding related to its research, education, and treatment. The United Chinese Community Enrichment Services Society, also known as S.U.C.C.E.S.S., received a USD 1.2 million fund from the Government of Canada in December 2022 to support postpartum mothers’ and their families’ mental health in Asian and South Asian immigrant communities. With the aid of this funding, S.U.C.C.E.S.S. will be able to improve the referral procedures used by doctors and midwives to connect diverse immigrant communities in the Tri-Cities region of British Columbia with community support, such as mental health services.

Therefore, postpartum women and their families from all over the province will have access to the best medical care that is both trauma-informed and culturally appropriate, as well as support from their service providers. This declaration is also a component of a USD 100 million investment made during the Budget 2021 to assist initiatives that improve mental health and prevent mental illness in areas impacted by the COVID-19 pandemic. Moreover, in January 2021, U.S. Senator Kirsten Gillibrand announced USD 17 million in funding to enhance maternal healthcare services and to address the national crises of maternal mortality and postpartum depression (PPD). Moreover, in March 2022, Black Maternal Health Caucus received funding of approximately USD 1 billion for Maternal Health Urgencies in the Appropriation bill.

Furthermore, a favorable regulatory scenario coupled with a reimbursement scenario offers lucrative opportunities in the review period. For instance, Washington, D.C. and the 38 states have expanded Medicaid under the Affordable Care Act to offer a continued pathway to postpartum coverage following the previously required 60-day period. However, in some of those states and the non-expansion states, women may lose Medicaid coverage postpartum if their incomes are above 138% of the federal poverty level. Many expansion and non-expansion states have applied for Section 1115 waivers to extend Medicaid beyond 60 days and to higher income levels. For instance, Missouri has an approved 1,115 waiver to offer coverage to a limited population of postpartum individuals with substance use disorders and maternal mental health treatment.

Strong emerging pipelines and the launch of new drugs, such as Zuranolone and Zulresso, are among the primary factors driving the market growth. For instance, in February 2023, Biogen Inc. and Sage Therapeutics, Inc. announced that the U.S. FDA had accepted the filing of a New Drug Application for quinolone in treating PPD and major depressive disorder. In addition, in September 2022, Lipocine Inc. announced a favorable regulatory pathway on oral LPCN 1154 for postpartum depression. If approved, LPCN 1154 is anticipated to be the fastest-acting oral option for PPD, potentially for outpatient use.

Disease Indication Insights

Based on disease indication, the pregnancy and postpartum general anxiety segment held a larger share of 34 .25% market in 2022. Generalized Anxiety Disorder (GAD) during the pregnancy and postpartum period is a substantial mental health concern. In recent years, there has been an increased awareness and recognition of perinatal mental health issues, including anxiety disorders, globally. Efforts have been undertaken to improve screening, education, and access to care for pregnant women & new mothers.

Government initiatives will further propel the segment growth over the forecast period. For instance, in May 2022, the U.S. Health and Human Services Department’s Health Resources and Services Administration (HRSA) launched the Maternal Mental Health Hotline, a private toll-free hotline, for new mothers undergoing mental health challenges. With a primary investment of USD 3 million, the hotline was launched on Mother’s Day, May 8, 2022, making psychotherapists available for mental health support.

Moreover, the Fiscal Year 2023 Budget will allocate twice the initial investment, enabling the Human Services Department HRSA to increase the Maternal Mental Health Hotline’s proficient staffing and to build extra capacity in its future phases. The PPD segment is expected to grow at the fastest CAGR during the forecast period. PPD is a common condition in the U.S., and according to the CDC, approximately one in eight women experience symptoms of PPD.

In addition, the implementation of government regulations will further offer lucrative opportunities during the study period. The Affordable Care Act (ACA) requires insurance plans to cover preventive services, including screening for maternal depression, without cost-sharing. Various organizations and initiatives also aim to raise awareness, provide resources, and support research on PPD & maternal mental health.

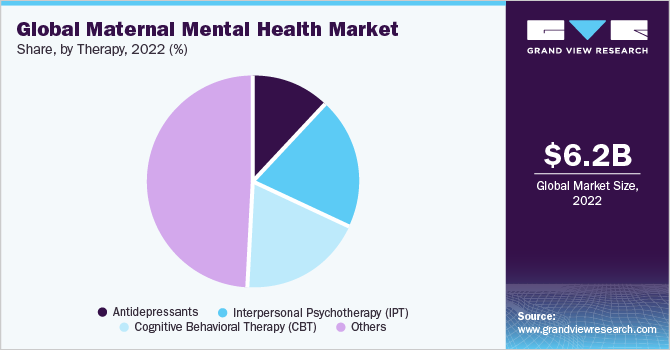

Therapy Insights

The interpersonal psychotherapy (IPT) segment held the largest share of 20.58% in 2022 and is expected to grow at the fastest CAGR during the forecast period. IPT is a psychotherapy that focuses on improving interpersonal relationships and resolving interpersonal issues. For maternal mental health, IPT can be particularly beneficial as it addresses the specific interpersonal challenges that women may face during the perinatal period.

In addition, IPT is widely accepted as an effective treatment approach for maternal mental health concerns, particularly perinatal mood disorders such as PPD and anxiety, and especially for depressed breastfeeding women. It is recognized and recommended by various professional organizations and guidelines, such as the American Psychiatric Association (APA), the American College of Obstetricians and Gynecologists (ACOG), the National Institute for Health and Care Excellence (NICE), The Canadian Network for Mood and Anxiety Treatments (CANMAT) and Postpartum Support International (PSI)

Regional Insights

North America accounted for the largest revenue share of 41.93% in 2022 and is expected to grow at the fastest CAGR during the study period. Favorable reimbursement scenarios, increasing incidence of PPD, growing awareness programs, and robust healthcare infrastructure are the major factors driving the growth of the region. As per the data published by Postpartum Depression, the reported rate of some clinical PPD among new mothers is 10% to 20%. A recent study indicated that one in seven women may develop PPD in the year following childbirth. With over four million live births being reported annually in the U.S., this corresponds to approximately 600,000 PPD diagnoses. In the U.S., approximately 900,000 women who had miscarried or had a stillbirth suffered from PPD annually.

In addition, Texas lawmakers enacted a bill in 2021 that extended Medicaid coverage for six months following childbirth, compared to the current 2-month limit. In the 2023 session, other bills that call for a 1-year extension have also been introduced. Additional health-related legislation priorities for the 2023 session include expanding access to and coverage for contraception, providing gender-affirming treatment for trans adolescents, and providing mental health services for youth throughout Texas. Implementation of such legislation will offer lucrative opportunities during the review period.

Key Companies & Market Share Insights

Key players in this market are adopting various organic and inorganic strategies such as partnerships, mergers and acquisitions, geographical expansions, and strategic collaborations to expand their market presence. For instance, in February 2023, Biogen Inc. and Sage Therapeutics, Inc. announced that the U.S. FDA has accepted the filing of a New Drug Application for zuranolone in the treatment of PPD and major depressive disorder. The claim has been allowed priority review and the FDA has consigned a Prescription Drug User Fee Act action date of August 5, 2023. Some key players in the global maternal mental health market include:

Therapy Mama

Canopie

Pfizer Inc

Viatris Inc.

GlaxoSmithKline Inc.

Alembic Pharmaceuticals Limited

Mallinckrodt Inc.

Sage Therapeutics, Inc.

Bausch Health Companies Inc.

Magellan Health, Inc.

Others

Maternal Mental Health Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 7.94 billion |

Revenue forecast in 2030 |

USD 45.72 billion |

Growth rate |

CAGR of 28.43% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Disease indication, therapy, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Therapy Mama, Canopie, Pfizer Inc, Viatris Inc., GlaxoSmithKline Inc., Alembic Pharmaceuticals Limited, Mallinckrodt Inc., Sage Therapeutics, Inc., Bausch Health Companies Inc., Magellan Health, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

GlobalMaternal Mental Health MarketReport Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global maternal mental health market report based on disease indication, therapy, and region:

疾病迹象前景(收入,百万美元,2018 - 2030)

Postpartum Depression

Dysthymia

Pregnancy and Postpartum General Anxiety

Pregnancy and Postpartum OCD

相关的创伤后应激障碍

Others

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

Antidepressants

Selective serotonin reuptake inhibitors (SSRIs)

Tricyclic antidepressants (TCAs)

Others

Interpersonal Psychotherapy (IPT)

Cognitive Behavioral Therapy (CBT)

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

South Korea

Australia

Thailand

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global maternal mental health market size was estimated at USD 6.22 billion in 2022 and is expected to reach USD 7.94 billion in 2023.

b.The global maternal mental health market is expected to grow at a compound annual growth rate of 28.43% from 2023 to 2030 to reach USD 45.72 billion by 2030.

b.妊娠和产后焦虑segme将军nt dominated the market in 2022 and captured the maximum share of the overall revenue. Increasing awareness and recognition of perinatal mental health issues, including anxiety disorders, is the major factor driving the segment growth.

b.Some key players operating in maternal mental health include Therapy Mama, Canopie, Pfizer Inc, Viatris Inc., GlaxoSmithKline Inc., Alembic Pharmaceuticals Limited, Mallinckrodt Inc., Sage Therapeutics, Inc., Bausch Health Companies Inc., Magellan Health, Inc.

b.Rise in government funding to reduce maternal mortality, increasing incidence of post-partum depression, rise in awareness programs, and efforts to improve practices around maternal mental health are the key factors driving the maternal mental health market.