Men’s Health Supplements Market Size, Share & Trends Analysis Report By Type (Sports Supplements, Reproductive Health Supplements), By Age Group, By Formulation, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-095-8

- Number of Pages: 200

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalmen’s health supplements market sizewas valued atUSD 63.75 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 9.70% from 2023 to 2030. The growth of the men’s health supplements industry can be attributed to the increasing attention toward maintaining health and the rising trend of preventive healthcare. Moreover, increasing nutritional deficiencies among men is another factor influencing the demand for health supplements for men. For instance, according to Fullscript, more than 40% of U.S. adults arevitamin Ddeficient.

The COVID-19 pandemic had a positive impact on the men’s health supplements market as people became more conscious about their health and well-being. Moreover, it has shifted the paradigm toward preventive healthcare and thus the demand for men’s health supplements has increased. Traditionally marketers have focused on female consumers, but in recent times, men’s health supplements have gained popularity to help men maintain their fitness levels and energy. According to a report by the Council for Responsible Nutrition, around 73% of men use health supplements to support overall well-being and 42% of men’s supplement users are interested in supplements that offer complete health and wellness benefits. Thus, the changing consumption pattern of these products across men is likely to create momentum for the global market in the coming years.

Moreover, the rising inclination toward personalized nutrition for better catering to health needs is projected to offer significant growth opportunities for the industry. In addition, the presence of several risk factors, comorbidities, genetics, and lifestyle factors have also contributed to the high demand for personalized supplementation. Thus, the higher demand for customized supplementation is pushing market players to introduce novel products. For instance, in January 2023, Nourished and Neutrogena partnered to develop personalized 3D-printed skindietary supplementsfor men and women. Similarly, in July 2022 Healthycell launched next-generation customized supplement products in partnership with Panaceutics.

Furthermore, convenient accessibility of men’s health supplements owing to the growing number of e-pharmacies and high penetration e-commerce platforms is likely to facilitate market expansion. E-commerce platforms have started to gain traction in developing economies such as China, India, and Mexico. In addition, a large number of market players are introducing their offerings on e-commerce platforms to strengthen their business avenues. For instance, in March 2022 Cymbiotika launched its e-commerce store in the UK for natural supplements.

Type Insights

Weight management supplements accounted for the largest market share of 35.76% in 2022 and are expected to witness significant growth during the forecast period. Factors such as the rising cases of obesity and related health ailments, such as diabetes, cardiovascular diseases (CVDs), and hypertension are projected to drive product demand. For instance, as per the National Institute of Diabetes and Digestive and Kidney Diseases obesity is a serious concern among adults and around 1 in 3 men (34.1%) are overweight. Thus, the surging obese population has propelled the demand for low-calorie diets andweight managementproducts. In addition, the growing trend of fitness, social media penetration, and growing inclination toward aesthetics are other factors propelling market growth.

Anti-aging supplements are projected to grow at the fastest CAGR of 11.18% from 2023 to 2030. Factors such as the rising elderly population, high desire for a youthful appearance, and increasing disposable income are projected to drive a high growth rate of the segment. Moreover, changing lifestyles, and growing inclination toward aesthetics are further supporting segment expansion. The higher demand foranti-aging productsamong consumers is pushing manufacturers to introduce new products with enhanced safety and fewer side effects. In May 2022, Wonderfeel announced the U.S. patent application for the launch of Yongr, a revolutionary formulation to address signs of aging.

Age Group Insights

The 31-45 segment dominated with a market share of 30.85% in 2022. The higher revenue share of the segment is attributed to the higher awareness about supplement-based products in this age group, potential buying power, and larger adoption of supplements. In addition, men in the age group of 31-45 are the largest consumer pool for companies to target their products as these consumers often demand various supplements to support their lifestyle. Moreover, the majority portion of this consumer group is highly influenced by social media, and thus, companies use social media platforms to promote their products more appealingly. For instance, wellness andsports supplementcompanies are using social media platforms like Instagram, Facebook, and others to maximize their product reach.

60岁以上年龄组段预计将注册ister the fastest CAGR of 10.70% from 2023 to 2030. Increasing life expectancy, rising awareness about well-being, and increasing disposable income are anticipated to support the higher growth rate of the segment. Moreover, rising consumer interest in natural products owing to higher safety profile than synthetic ones is another factor contributing to industry expansion.

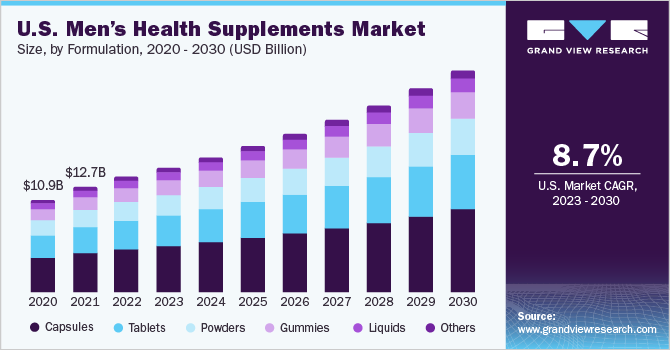

Formulation Insights

胶囊与r段主导市场evenue share of 35.38% in 2022. A high number of products available in capsule form owing to the lower cost, high convenience, high shelf life, and greater patient compliance are projected to drive the segment growth. Capsules appear to be more feasible in the case of smaller formulations. Furthermore, they require minimal excipients (such as binders), which increases their appeal to the end user. Manufacturing advancements have provided capsule manufacturers with a wide range of options to offer brand owners, including various shell colors, designs, shapes, and imprints. Moreover, various strategic initiatives undertaken by market players are expected to fuel the market growth. For instance, in February 2023 Capillus launched a scientifically proven hair wellness supplement in capsule form for both women and men. Thus, rising product launches are further anticipated to support segment expansion.

The gummies segment is projected to exhibit the fastest CAGR of 11.22% from 2023 to 2030. The rising demand from the young and middle-aged population, rising preferences over tablets and capsules and surging interest of manufacturers to develop gummies-based supplementations are fueling segment uptake. For instance, in January 2023, Modicare expanded its offerings with the launch of its Well Gummies product range to support skin, nail, and hair health.

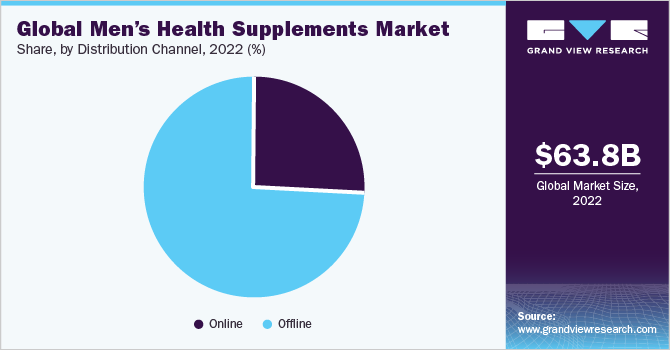

Distribution Channel Insights

离线部分sh捕获的最大的市场are of 74.35% in 2022. The presence of established supermarkets/ pharmacy chains like Walgreens, Walmart, Boots, and CVS Pharmacy significantly contribute to the segment expansion. In addition, offline shopping offers personalized guidance from pharmacists/ doctors, and it also offers a wide variety of products to choose from for customers.

On the contrary, the online segment is projected to register the fastest CAGR of 10.64% from 2023 to 2030. An increase in the number of self-directed consumers is one of the important factors driving the online pharmacies segment. In addition, various discounts offered by online pharmacies in the form of coupons and cashback are another factor fueling segment uptake. Moreover, many key participants in the men’s health supplements and wellness space are launching their businesses on e-commerce platforms to serve a large consumer base and acquire a larger market share.

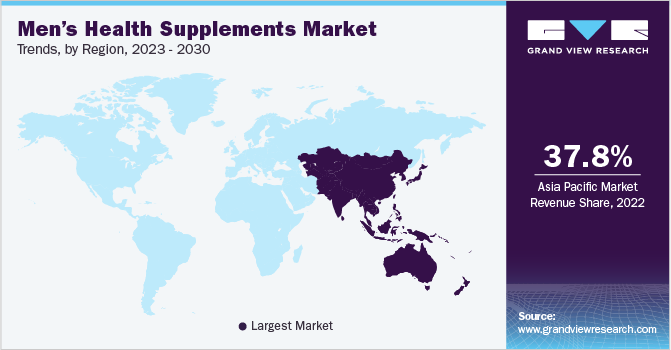

Regional Insights

Asia Pacific dominated the men’s health supplements market with a share of 37.78% in 2022 and the region is projected to register the fastest growth during the forecast period. The large patient pool and robust demand for supplements are the factors likely to contribute to a higher revenue share of the region. In addition, rising investments by companies in the region to strengthen their presence and distribution networks are also fueling regional industry. For instance, in June 2023 European Wellness Biomedical Group signed a MoU for the exclusive distribution of skincare supplementation products in China.

The Europe market for men’s health supplements is expected to grow at a significant CAGR of 9.55% from 2023 to 2030. The significant demand for health products across the region, high per capita income, and easy accessibility to products owing to established retail chain networks are expected to support the regional market. Moreover, the rising inclination toward preventive healthcare and the presence of large numbers of industry participants are further facilitating the regional market.

Key Companies & Market Share Insights

The key players in the men’s health supplements market are undertaking various strategic initiatives to maintain their market presence. In addition, various strategic initiatives help market players to bolster their business avenues. For instance, in June 2023, Token Communities, Ltd launched its two naturopathic supplements in the Asia market. The newly launched supplement is for type-2 diabetes and blood pressure. Some prominent players in the global men’s health supplements market include:

Nature's Lab

Nordic Naturals

NOW Foods

Irwin Naturals

GNC

The Vitamin Shopee

Amway

Life Extension

新的一章,公司。

Metagenics LLC

Men’s Health Supplements Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 69.12 billion |

Revenue forecast in 2030 |

USD 132.13 billion |

Growth rate |

CAGR of 9.70% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, age group, formulation, distribution channel, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

Key companies profiled |

Nature's Lab; Nordic Naturals; NOW Foods; Irwin Naturals; GNC; The Vitamin Shopee; Amway; Life Extension; New Chapter, Inc.; Metagenics LLC |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Men’s Health Supplements MarketSegmentation

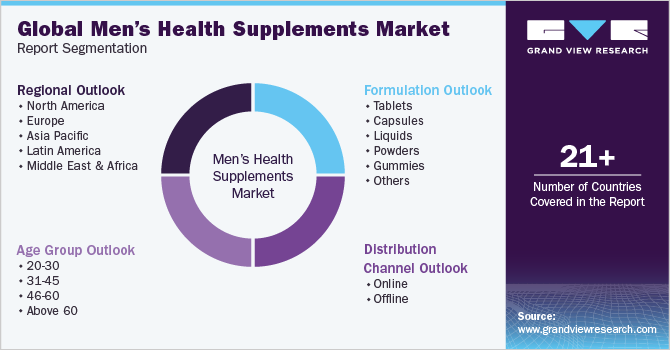

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global men’s health supplements market report based on type, age group, formulation, distribution channel, and region:

Type Outlook (Revenue, USD Million, 2018 - 2030)

Sports Supplements

Reproductive Health Supplements

Bone & Joint Health Supplements

Cardiovascular Health Supplements

Probiotic Supplements

Anti-Aging Supplements

Hair Growth Supplements

Weight Management Supplements

Immune Health Supplements

Others

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

20-30

31-45

46-60

Above 60

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

Tablets

Capsules

Liquids

Powders

Gummies

Others

分销渠道前景(收入,百万美元, 2018 - 2030)

Online

Offline

RegionalOutlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

China

India

Japan

Australia

Thailand

South Korea

Latin America

Brazil

Mexico

Argentina

Middle East and Africa (MEA)

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global men’s health supplements market is expected to grow at a compound annual growth rate of 9.70% from 2023 to 2030 to reach USD 132.13 billion by 2030.

b.The global men’s health supplements market size was estimated at USD 63.74 billion in 2022 and is expected to reach USD 69.12 billion in 2023.

b.Asia Pacific dominated the men’s health supplements market with a share of 37.78% in 2022. The large patient pool and robust demand for supplement among population is likely to contribute higher revenue share of the region. In addition, rising investments by companies in the region to strengthen their presence and distribution networks is also fueling regional industry.

b.Some key players operating in the men’s health supplements market include Nature's Lab; Nordic Naturals; NOW Foods; Irwin Naturals; GNC; The Vitamin Shopee; Amway; Life Extension; New Chapter, Inc.; Metagenics LLC.

b.The growth of the men’s health supplements market can be attributed to the increasing attention towards maintaining health, and rising trend of preventive healthcare. Moreover, increasing nutritional deficiencies among men is another factor influencing the demand for heath supplements for men