Metal Matrix Composite Market Size, Share & Trends Analysis Report By End-use (Ground Transportation, Electronics), By Product (Refractory, Aluminum), By Region, And Segment Forecasts, 2020 - 2027

- Report ID: 978-1-68038-408-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Advanced Materials

Report Overview

The global metal matrix composite market size was valued at USD 339.3 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2020 to 2027. Increasing demand for lightweight and high-performance materials in the automotive and aerospace industries is anticipated to drive the market over the coming years. These composites comprise metal alloys reinforced with fibers, particulates, whiskers, or wires. Metal matrix composite (MMC) have extensive demand in the aerospace and automotive industries owing to their superior mechanical properties and a wide scope of application. Moreover, increasing fuel prices have triggered the need for lightweight components to boost the fuel-efficiency, which, in turn, is projected to have a positive impact on market growth.

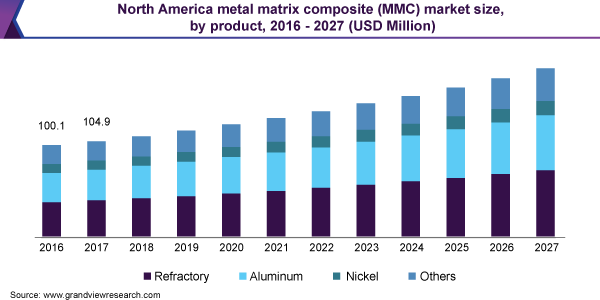

North America is projected to be the largest regional market over the forecast period due to high product demand on account of the robust growth of the aerospace & defense, electronics, and automotive industries. The U.S. is particularly an important manufacturer of commercial aircraft, large passenger aircraft, defense aircraft, and cargo jets. Moreover, stringent regulations regarding automotive emissions in the region are anticipated to drive the product demand over the forecast period.

越来越多的环境问题和严格的阿宝llution control norms have forced automotive and aerospace component manufacturers to control automotive emissions. One of the most vital factors that affect vehicular pollution and fuel efficiency is the curb weight, reduction of which drastically increases fuel efficiency and reduces pollution. This, in turn, is anticipated to boost the demand for MMCs over the coming years.

Various processes used for the manufacturing of MMCs are generally classified into liquid-state and solid-state processes, based on the temperature of the metallic matrix during the processing. Commonly used liquid-state processes include stir casting, compocasting, squeeze casting, and spray forming, whereas solid-state processes includepowder metallurgy, diffusion bonding, and Friction Stir Welding (FSW).

However, factors, such as low yield, high manufacturing costs, and complex fabrication methods, are expected to limit market growth. Major market players are investing heavily in R&D initiatives to develop cost-effective products. In addition, several government organizations are also funding projects that are focused on the development of new products and manufacturing processes.

Product Insights

The refractory product segment led the metal matrix composites market in 2019 and accounted for over 39% of the overall share. Refractory materials primarily comprise tungsten, niobium, rhenium, and molybdenum. The demand for these materials in various industries is expected to rise owing to their lightweight and high durability attributes. Growing demand for durable and high-precision equipment in the electronics industry is further expected to boost the segment growth over the forecast period.

Composites involving tungsten carbides, molybdenum, and niobium carbides serve as a major constituent in various industries, such as automotive, mining, metal processing, aerospace, electrical, and electronics. Tungsten carbide has many applications in heat sinks, resistance welding, and ammunition manufacturing. Growing demand for display devices and new electronic products is further likely to spur the segment growth.

The aluminum product segment, in terms of revenue, is anticipated to register a CAGR of 6.6% over the forecast period. Aluminum-based MMCs are commonly used and expected to have high market penetration in aerospace and automotive application industries owing to their favorable properties, such as high stiffness, greater strength, improved temperature properties, reduced density, improved wear resistance, and controlled thermal expansion.

Nickel andnickel alloysare extensively used in aerospace, marine, and automotive industries owing to their ability to withstand a wide variety of operating conditions, including corrosive environments, high stresses and temperatures, toughness, strength, metallurgical stability, and combination of these factors. However, poor creep resistance and high density are expected to limit their use in certain applications.

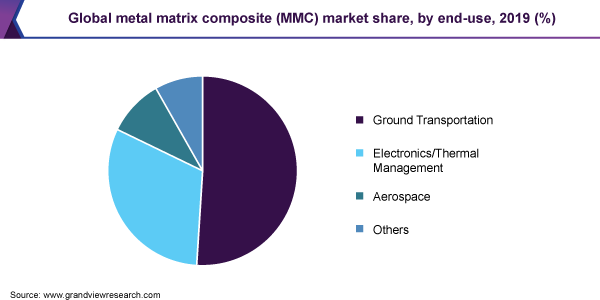

End-use Insights

Ground transportation led the market and accounted for over 50% of the global revenue share in 2019. The ground transportation industry is characterized by factors including commodity trade, regional economy, business, travel activity, and consumer spending. The increasing demand for high-performance materials in bulk and passenger vehicles within the transportation industry is expected to drive the segment growth over the forecast period.

Metal matrix composites are used in several vehicle components, such as brake fins, driveshafts, and engine components. In addition, MMCs are used to produce several railway vehicle components, including brake rotor, caliper liner, engine block, piston, and bearings. The growing importance of lightweight railway vehicles is expected to augment the demand for MMCs in the ground transportation end-use segment over the forecast period.

The electronics/thermal management end-use segment, in terms of revenue, is anticipated to witness the fastest CAGR over the forecast period. Recent advances in microelectronics coupled with shifting trends in the use of electronic components, including semiconductors and computer parts, are expected to drive the demand for MMCs in the electronics industry over the foreseeable future.

These composites offer enhanced specific stiffness and strength, which improve the overall performance of aircraft. The demand for MMCs in the aerospace industry is primarily driven by their extensive usage in commercial and military aircraft. Moreover, owing to the enhanced resilience to thermal and mechanical stress, the demand in space-related applications is also expected to grow over the forecast period.

Regional Insights

North America led the market and accounted for 43.2% of the global revenue share in 2019 owing to the presence of several major automotive and aerospace manufacturers in the region. Moreover, stringent government regulations pertaining to automotive pollution along with the increasing need for fuel-efficient vehicles are expected to drive the MMC market in the region over the forecast period.

Led by Germany, France, Italy, and the U.K., the product demand in Europe is anticipated to grow significantly. The well-established automotive, aerospace & defense, construction, and electronics industries are expected to continue to grow in the region, which is also likely to boost market development.

重击oping countries in the Asia Pacific region, such as India and China, are expected to witness faster gains in the market due to the expansion of the manufacturing sector and strong growth in automotive production. In addition, the high concentration of electronics manufacturers in China, Japan, South Korea, and Taiwan is expected to offer sustainable growth opportunities for MMC manufacturers over the forecast period.

The growing defense & aerospace industry in the Middle East is projected to boost the demand for MMCs over the forecast period. In addition, countries, such as the UAE and Kuwait, are also expanding their trucking and freight transportation sectors to meet the growing demand from consumers and expanding the retail sector. These factors are expected to have a positive impact on the overall market growth.

Key Companies & Market Share Insights

The global market is moderately consolidated in nature. Major companies compete on the basis of various parameters including corporate reputation and product performance, price, quality, reliability, and technical competence. The strategies adopted by market players include new product development and expansion of the manufacturing capacity, product portfolio, and distribution network.

The key trend observed in the market includes long-term agreements and joint ventures between MMC manufacturers and leading end-user companies. This enables the market players to retain their clients, thereby ensuring long-term business opportunities. The end-use manufacturers invest in long-term relations to develop application-specific products and, thus, gaining competitive advantage in the market. Some of the prominent players in the metal matrix composite market are:

Materion Corporation

GKN plc

3M

ADMA Products, Inc.

TISICS Ltd.

Thermal Transfer Composites LLC

DWA Aluminum Composites USA, Inc.

CPS Technologies Corp .)oration

Deutsche Edelstahlwerke GmbH

Plansee Group

Sandvik AB

Mi-Tech Tungsten Metals, LLC

DAT Alloytech Company Limited

AMETEK Specialty Metal Products

CeramTec

Santier, Inc.

Metal Matrix Composite Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 360.0 million |

Revenue forecast in 2027 |

USD 558.5 million |

Market volume in 2020 |

8,395.0 tons |

Volume forecast in 2027 |

12,842.5 tons |

Growth Rate (Revenue) |

CAGR of 6.4% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Volume in tons, revenue in USD million and CAGR from 2020 to 2027 |

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; South America; Middle East & Africa |

Key companies profiled |

Materion Corp.; GKN plc; 3M; ADMA Products, Inc.; TISICS Ltd.; Thermal Transfer Composites LLC; DWA Aluminum Composites USA, Inc.; CPS Technologies Corp.; Deutsche Edelstahlwerke GmbH; Plansee Group; Sandvik AB; Mi-Tech Tungsten Metals, LLC; DAT Alloytech Co. Ltd.; AMETEK Specialty Metal Products; CeramTec; Santier, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

定价和purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global and regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global metal matrix composite market report on the basis of product, end-use, and region:

Product Outlook (Volume, Tons;Revenue, USD Million, 2016 - 2027)

Aluminum

Nickel

Refractory

Others

End-use Outlook (Volume, Tons;Revenue, USD Million, 2016 - 2027)

Ground transportation

Electronics/Thermal Management

Aerospace

Others

Regional Outlook (Volume, Tons;Revenue, USD Million, 2016 - 2027)

North America

Europe

Asia Pacific

Central & South America

Middle East & Africa

Frequently Asked Questions About This Report

b.The global metal matrix composite market size was estimated at USD 339.3 million in 2019 and is expected to reach USD 360.0 million in 2020.

b.The global metal matrix composite market is expected to grow at a compound annual growth rate of 6.4% from 2020 to 2027 to reach USD 558.5 million by 2027.

b.North America dominated the metal matrix composite market with a share of 34.1% in 2019. This is attributable to the robust growth of aerospace & defense, electronics, and automotive industries.

b.Some key players operating in the metal matrix composites market include Sandvik AB, Materion Corporation, GKN PLC, Plansee SE, 3M, Sumitomo Electric Industries, Ltd., CPS Technologies Corporation, Hitachi Metals, Ltd., Deutsche Edelstahlwerke GmbH, and 3A Composites International AG.

b.Key factors that are driving the metal matrix composite market growth include the growing transportation industry on account of increasing global and domestic trade and increasing demand for composite alloys used for manufacturing durable and lightweight parts for electronics/thermal management, ground transportation, aerospace, marine, defense, and nuclear industries.