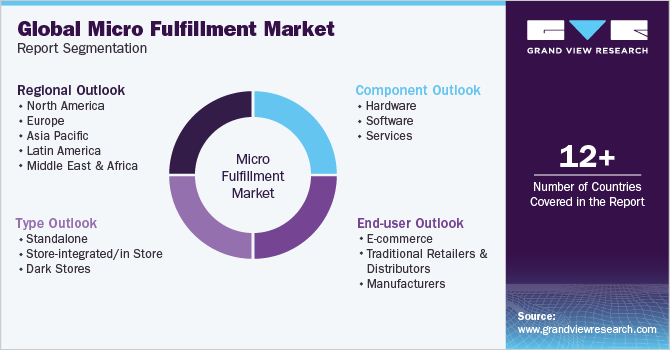

Micro Fulfillment Market Size, Share & Trends Analysis Report By Component (Hardware, Services), By End-user (E-commerce, Manufacturers), By Type (Store-integrated/In-store, Standalone), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-103-9

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

全球micro fulfillment market sizewas estimated atUSD 3.58 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 34.8% from 2023 to 2030. The rising adoption of micro fulfillment centers (MFCs) by the e-groceries industry has bolstered the market's growth. In addition, factors, such as customization and personalization, offered by service providers for the layouts of MFCs are fueling market growth. The e-groceries industry embraces micro fulfillment as a strategic response to the rapidly growing demand for online grocery shopping. Consumers are increasingly seeking the convenience and time-saving benefits of ordering groceries online, and businesses in this sector are recognizing the need to optimize their operations to meet these evolving customer preferences.

微观实现解决方案提供一个令人信服的职业position for e-grocery businesses by enabling efficient and fast order processing and delivery. MFCs are designed to optimize the order fulfillment process. They leverage automation technologies, robotics, and advanced software systems to expedite picking, packing, and shipping operations. This leads to faster and more accurate order processing, reducing turnaround times and enhancing customer satisfaction. In addition, micro fulfillment solutions seamlessly integrate with omnichannel strategies, allowing businesses to fulfill online orders, enable click-and-collect services, and support other fulfillment options.

This integration provides a consistent and unified shopping experience across different sales channels includinge-commerce, traditional retails, and distributors, strengthening customer engagement and loyalty. Moreover, e-commerce significantly contributes to the growth of the target market. The growth of e-commerce has led to a surge in online shopping. Consumers increasingly turn to online platforms to purchase everyday items, groceries, and other products. This increased demand for online shopping creates a need for efficient and fast order fulfillment, which micro fulfillment centers are designed to address. In addition, traditional large-scale warehouses are expensive to operate, requiring significant space, labor, and infrastructure investments.

MFCs, being smaller in size, can be more cost-effective to set up and operate. High implementation cost is a restraint for the market. The upfront investment required to establish a MFC is substantial, which can deter some companies from adopting this solution. The cost of acquiring or leasing a suitable facility for micro fulfillment, along with the necessary equipment like racking systems, conveyor belts, sorting systems, robots, and automated picking technologies, can be high. The size and complexity of the MFCs centers will impact the overall cost. In addition, they heavily rely on advanced technology systems for inventory management, order processing, and warehouse automation. Investing in software solutions, hardware infrastructure, and integrating various systems is a significant upfront expense.

COVID-19 Impact

The economic downturn caused by the pandemic has led to financial constraints for many businesses. Retailers, especially small- and medium-sized enterprises, had limited resources to invest in new infrastructure like micro fulfillment centers. Budget cuts and cost-saving measures resulted in postponed or canceled projects, impacting the growth of the market. In addition, the pandemic caused an increase in operational costs for MFCs. Implementing additional safety measures, such aspersonal protective equipment(PPE), sanitization protocols, and physical distancing measures, added to the operating expenses. These additional costs have impacted the profitability of micro fulfillment operations, especially for smaller businesses with limited resources.

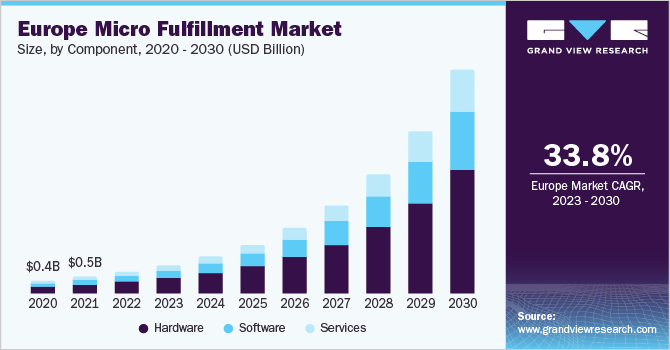

组件Insights

On the basis of components, the market has been further segmented into hardware, software, and services. The service segment is anticipated to register the highest CAGR of 37.1% over the forecast period. This can be attributed to the increasing demand for expertise & consultation, technology integration & software solutions, maintenance & support, and scalability & flexibility. Implementing a micro fulfillment system requires specialized knowledge and expertise in areas, such as automation, robotics, software integration, and operational efficiency. Service providers offer consulting services to help businesses assess their requirements, design customized solutions, and optimize operational workflows.

Their expertise and consultation are crucial in ensuring the successful implementation of micro fulfillment centers and maximum efficiency. The hardware segment held the largest revenue share in 2022 and is expected to dominate the market throughout the forecast period. MFCs require specialized hardware components to facilitate efficient order picking, packing, and sorting processes. This includes automated storage and retrieval systems (AS/RS),conveyor belts, sortation systems, robotic arms, shelving units, and other equipment. These sophisticated technologies involve complex engineering, precision manufacturing, and integration with software systems, which contribute to higher costs.

Type Insights

On the basis of types, the market is classified into standalone, store-integrated/in-store, and dark stores. The store-integrated/in-store segment dominated the market with a revenue share of about 47%. Retailers with physical stores can leverage their existing brick-and-mortar locations to fulfill online orders. This approach allows them to utilize their store space and inventory, potentially reducing the need for separate dedicated fulfillment centers. Retailers can efficiently serve in-store shoppers and online customers by integrating micro fulfillment capabilities into their stores. The store-integrated micro fulfillment model can also create synergies between online and in-store shopping experiences.

For example, retailers can offer options like buy-online-pick-up-in-store (BOPIS), allowing customers to conveniently collect their online orders and make additional purchases in-store. This can drive increased foot traffic and boost overall sales. The dark stores segment is anticipated to register a significant CAGR over the forecast period. The rapid growth of e-commerce has increased the demand for efficient and fast order fulfillment. Dark stores are specifically designed for online order processing and do not serve in-store customers. With the continuous rise in online shopping, the demand for dark stores is expected to grow significantly. Attabotics is a warehouse automation solution provider that offers vertical storage and retrieval system that can be leveraged in MFCs for dark stores to optimize space utilization and streamline the fulfillment process.

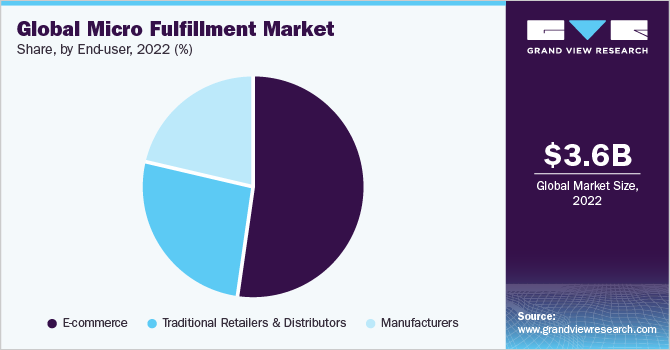

End-user Insights

The end-user segment is furthercategorized into e-commerce, traditional retailers & distributors, and manufacturers. The traditional retailers & distributors segment is anticipated to register the highest CAGR of 36.2% over the forecast period. Traditional retailers and distributors often have an established network of physical stores, warehouses, and distribution centers. This existing infrastructure can be leveraged for micro fulfillment operations. Traditional retail spaces often have unused or underutilized areas that can be repurposed for MFCs. By converting a portion of the store or using backroom space, offline traders can optimize their space utilization and create a dedicated area for efficient order fulfillment.

This approach maximizes the use of existing assets and minimizes the need for additional warehousing space. The e-commerce segment dominated the market and is expected to remain dominant throughout the forecast period. The exponential growth of e-commerce has transformed the retail landscape. Consumers are adopting online shopping due to convenience, wider product selection, and competitive pricing. This surge in online orders necessitates efficient fulfillment processes, driving the demand for micro fulfillment solutions.

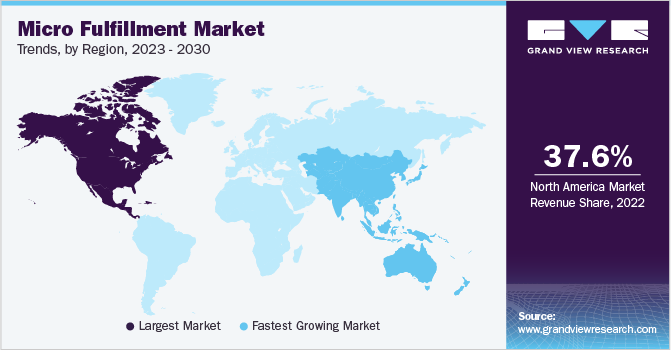

Regional Insights

North America held the largest share in the micro fulfillment market in 2022 and accounted for a share of 37.6% of the global revenue. The region is known for its technological advancements and innovation. North American companies have been at the forefront of developing and implementing cutting-edge technologies in the micro fulfillment space. This includes automation, robotics,artificial intelligence, and data analytics, which have significantly improved the efficiency and scalability of micro fulfillment operations. In addition,North America has witnessed significant growth in e-commerce adoption, with many consumers embracing online shopping. The Census Bureau of the Department of Commerce reported that the estimated retail sales for the first quarter of 2023 reached USD 1,799.5 billion.

This represents a 0.9% increase compared to the fourth quarter of 2022. E-commerce sales experienced a significant growth of 7.8% compared to the first quarter of 2022. Meanwhile, total retail sales increased by 3.4%. E-commerce sales accounted for 15.1% of the total sales in the first quarter of 2023. Asia Pacific is expected to register the highest CAGR of 36.6% over the forecast period. Asia Pacific is home to a large and rapidly growing population, particularly in countries like China and India. This dense population and rapid urbanization create a need for efficient last-mile delivery solutions. MFCs strategically located in urban areas can cater to the growing demand for fast and convenient order fulfillment, driving market growth in the region.

Key Companies & Market Share乐鱼APP二维码

The market has a fragmented competitive landscape featuring various global and regional players. Leading industry players are adopting strategies, such as partnerships, collaborations, mergers & acquisitions, and agreements, to survive the highly competitive environment and enhance their business footprints. Moreover, some micro fulfillment providers offer micro fulfillment-as-a-service (MFaaS) models, providing turnkey solutions to retailers. With MFaaS, retailers can outsource their micro fulfillment operations to specialized providers, allowing them to focus on core business activities while benefiting from established infrastructure, technology, and expertise in micro fulfillment.

Key players are engaging in various growth strategies. For instance, in March 2023, Dematic expanded its presence by inaugurating a new office in Abu Dhabi to enhance customer support in the UAE and throughout the Gulf Cooperation Council (GCC) region. UAE is a significant logistics hub due to its strategic location between Asia, Europe, and Africa. By expanding operations in the UAE, Dematic can leverage its proximity to various markets and enhance its ability to serve customers across the region. Some of the key players in the global micro fulfillment market include:

Alert Innovation, Inc.

Dematic

Honeywell International Inc.

OPEX Corp.

Swisslog Holding AG

AutoStore

Exotec SAS

Takeoff Technologies Inc.

TGW Logistic Group GmbH

Get Fabric, Inc.

Micro Fulfillment MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 4.67 billion |

Revenue forecast in 2030 |

USD 37.74 billion |

Growth rate |

CAGR of 34.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD Million/Billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

组件, type, end-user, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; France; Germany; China; Japan; India; Australia; South Korea; Brazil; Mexico; Kingdom of Saudi Arabia; UAE; South Africa |

Key companies profiled |

Alert Innovation, Inc.; Dematic; Honeywell International Inc.; OPEX Corporation; Swisslog Holding AG; AutoStore; Exotec SAS; Takeoff Technologies Inc.; TGW Logistic Group GMBH; Get Fabric, Inc. |

Customization scope |

免费定制(相当于8肛交报告ysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

GlobalMicro Fulfillment MarketReportSegmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global micro fulfillment market report based on component, type, end-user, and region:

组件Outlook (Revenue, USD Million,2017-2030)

Hardware

Automated Storage and Retrieval Systems (AS/RS)

自动引导车辆/自主移动机器人(AGV/AMR)

Conveyor Systems

Sortation Systems

Software

Warehouse Management System

Order Management

Asset Management

Delivery & Transport Management

服务

Professional Services

Managed Services

Type Outlook (Revenue, USD Million,2017-2030)

Standalone

Store-integrated/in Store

Dark Stores

End-user Outlook (Revenue, USD Million,2017-2030)

E-commerce

Traditional Retailers & Distributors

Manufacturers

Regional Outlook (Revenue, USD Million,2017-2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Asia Pacific

China

Japan

India

Australia

South Korea

Latin America

Brazil

Mexico

Middle East & Africa

Kingdom of Saudi Arabia (KSA)

UAE

South Africa

Frequently Asked Questions About This Report

b.全球micro fulfillment market size was estimated at USD 3.58 billion in 2022 and is expected to reach USD 4.67 billion in 2023.

b.全球micro fulfillment market is expected to grow at a compound annual growth rate of 34.8% from 2023 to 2030 to reach USD 37.74 billion by 2030

b.The hardware segment dominated the global micro fulfillment market with a share of 58.30% in 2022. The increasing demand for advanced hardware components in micro-fulfillment is driven by factors such as the growing e-commerce market, the need for space optimization, rising labor costs, the focus on speed and efficiency, and technological advancements.

b.Some key players operating in the global micro fulfillment market include Alert Innovation, Inc., Dematic; Honeywell International Inc., OPEX Corporation, Swisslog Holding AG, AutoStore, Exotec SAS, Takeoff Technologies Inc., TGW Logistic Group GMBH, and Get Fabric, Inc.

b.The surge in e-commerce expansion, coupled with evolving consumer demands, advancement in automation technology, cost optimization opportunities, and the requirement for streamlined last-mile logistics, has propelled the growth of the micro fulfillment market.