Microbiome Sample Preparation Technology Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Workflow, By Application, By Disease Type, By End-use, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-975-4

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Healthcare

Report Overview

The global microbiome sample preparation technology market size was valued at USD 242.0 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2022 to 2030. The advancement in microbiome-based therapeutics, coupled with the declining cost of sequencing and increasing investment in microbiome research, is anticipated to contribute to market growth. For instance, in October 2021, Corundum Systems Biology Inc. announced to contribute of USD 1.0 million to a two-year research initiative by Holobiome Inc. of the U.S. The project is expected to examine the gut microbiome's role in pain sensitivity regulation, paving the way for future microbial therapies, consumer goods, and/or diagnostics aimed at addressing pain in a wide range of patients.

COVID-19大流行导致突然spur in demand for consumables and reagents of microbiome sample preparation technology. The need for sequencing SARS-CoV-2 has shown tremendous opportunities for key players within the market owing to the rapid mutations. Attributing to the global pandemic, a highly sensitive molecular diagnosis is estimated to reduce false negative reverse transcription PCR (RT-PCR) results, which has been identified as a critical clinical need for a robust diagnostic tool for the identification of COVID-19.

Microbiome-based therapeutics directly impact the demand for sampling technologies for microbiomes. The compounds produced that affect cellular and organismal activities by the gut microbial community have been discovered to have a significant impact on host physiology in recent years as it serves as an effective route of communication in host-microbe interactions. For instance, in August 2022, Digbi Health, a company involved in gut microbiome and genetic-related care, participated in Global Prevention Accelerator Program by Novo Nordisk. The program was designed to invite potential start-ups to present their solutions and selected players are anticipated to receive funding support from Novo Nordisk.

Other determinants such as a steady reduction in the costs of genomic testing are anticipated to increase the penetration rate of microbiome sampling in emerging countries. For instance, in February 2020, Nebula Genomics launched an at-home whole genome sequencing service for USD299. Nebula's sequencing is a far more extensive test than those offered by 23andMe and Ancestry, which rely on a procedure known as genotyping.

According to research, the gut microbiome has been associated with chronic disorders, including depression, obesity, type 2 diabetes, and some types of cancer. Microbiome tests can assist patients to assess their gut microbes’ response to different foods, thereby lowering the probability of chronic diseases and their associated medical costs. Similarly, the increasing prevalence of chronic diseases, rising medical expenses, and a greater emphasis on disease prevention are expected to contribute to the growth. From 2019 to 2027, U.S. health spending is expected to reach a 5.4% annual rate, accounting for USD 6.2 trillion by 2027, which is also expected to have an impact on demand.

此外,筹集资金和资金计划for microbiome-based research is anticipated to surge the demand for microbiome sample preparation technology from academic and research institutions. In 2022, five academic institutions received grants from the National Cancer Institute, U.S., including Harvard School of Public Health, Columbia University Health Sciences, Graduate School of Public Health and Health Policy, and New York University School of Medicine. The grant ranged from USD 387,513 to 717,936.

Product Insights

The consumables segment accounted for the largest share of over 85.0% in 2021 and is anticipated to maintain a similar trend during the forecast period. This is driven by the increasing demand for purification/extraction kits and DNA library preparation kits during COVID-19.

For instance, in June 2021, SpeeDx Pty, Ltd., an Australia-based company specializing in molecular diagnostics solutions, and MolGen, an innovative provider of DNA/RNA extraction technology, collaborated for the supply and distribution of their products across Europe and the Asia Pacific. The partnership is set to benefit both companies by combining MolGen's DNA/RNA extraction portfolio along with SpeeDx's diagnostic assay technology.

Instruments are anticipated to exhibit a stable and steady growth rate during the forecast period as the purchase frequency by the end-users of the product is low owing to a longer lifespan than consumables. Innovations in this domain include automated systems such as Maxwell RSC and Maxwell RSC 48 Instrument, which can work on preprogrammed methods and simultaneously process up to 16 and 48 samples, respectively, thus anticipated to improve the growth rate.

Workflow Insights

Sample extraction/isolation held the largest share of over 20.0% in 2021. Microbiome research is one of the important focus areas for ongoing studies in medicine and diagnostics to understand the impact of the microbiome on human health Studies in this domain rely on robust extraction methods that can provide efficient DNA extraction and eliminate inhibitory constituents from the sample. The extraction method used can vary based on the composition of the sample as certain cell types may require harsher methods for efficient extraction.

For instance, MGI Tech Co. offers a DNA extraction kit for purifying and extracting high-quality microbial genomic DNA from frozen and fresh human stool samples. It can be used for numerous areas, such as intestinal flora research, metagenomics analysis, and probiotics research. The product is applicable for PCR, metagenomics sequencing, and RT-PCR.

图书馆准备被认为是最next-generation sequencing platform that requires ligation of adapters to the fragment ends. The fragmented DNA is subjected to end repair to form blunt ends followed by attachment of the deoxyadenosine 5′-monophosphate (dAMP) tail to the 3' end, for applications in the Illumina platform. The tail is required for avoiding concatamer formation and it facilitates ligation of adaptors having complementary dT overhangs.

Application Insights

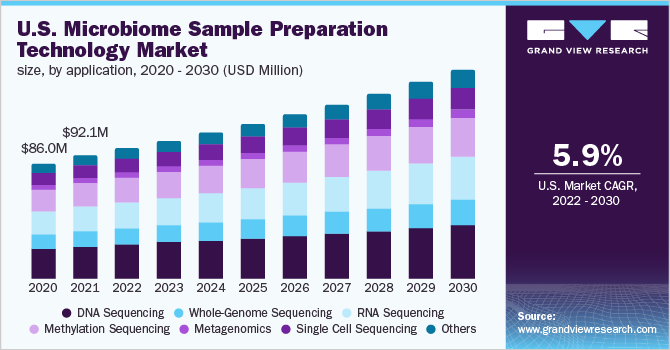

TheDNA sequencingsegment held the largest share of over 25.0% in 2021. Sequencing is essential to various fields, ranging from basic biology to human evolution. Moreover, technological advancements that assure cost-effective sequencing are expected to support market growth.

For instance, in June 2022, a start-up company, Ultima Genomics stated at a meeting in Florida that with the advancement of existing technology, the company can offer human genomes for USD 100, which is one-fifth of the existing rate. However, at present, the majority of the market is captured by Illumina.

The metagenomic segment is anticipated to record the fastest growth rate during the forecasted period. The metagenomics approach can offer the identification of a wide range of pathogens, including novel and rare pathogens, and facilitate the characterization of the microbiome. Along with that, additional insights about disease epidemiology, the phylogeny of causative agents, and aid in the development of diagnostic tests for novel agents are fueling growth. The increasing scope of metagenomics is anticipated to supplement segment growth.

Disease Type Insights

Gastrointestinal disorders captured the largest revenue share of over 50.0% in 2021. The majority of the GI issues such as IBS, C. difficile, and Crohn's disease can be diagnosed using microbiome sample analysis. IBD, which includes ulcerative colitis (UC) and Crohn's disease (CD), is a relapsing-remitting gastrointestinal inflammatory illness that causes varying degrees of intestine damage and can lead to local and extra-intestinal problems.

自身免疫性疾病段预计grow at the fastest rate during the forecast period and support the overall growth of the market. Autoimmune disorders have been a key area of research and one of the most emerging fields of medical sciences across the globe. For instance, a study published in January 2022 assessed the association between autoimmune diseases and gut microbiota. The study stated that the relationship between CeD andT1D and Bifidobacterium genus offered significant insights into the gut microbiota-mediated development process of autoimmune disorder.

End-use Insights

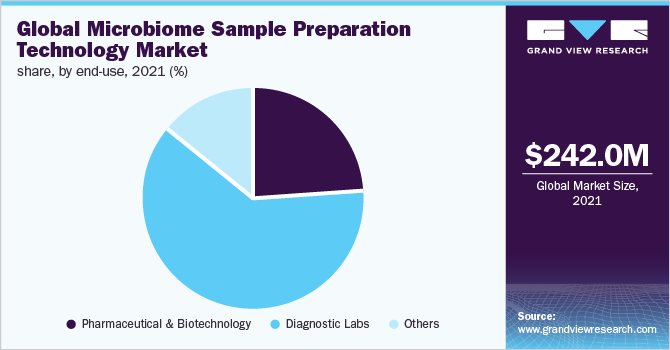

The diagnostic labs segment held the largest revenue share of over 60.0% in 2021 as the diagnostics lab is one of the key segments wherein microbiome sampling finds its application. Being said, it is used in the diagnosis of autoimmune disorders, various types of cancers, gastrointestinal disorders, and many other medical conditions. The rising number of clinical trials analyzing microbial samples in order to diagnose various medical conditions is also a key growth factor.

The involvement of pharmaceutical and biotechnology companies in the market is at a moderate rate. However, the increasing investment in the market is anticipated to attract key new players to the market. For instance, as of march 2020, microbiome therapies and diagnostic firms have received a total of USD 4.49 billion in funding. The majority of these transactions occurred between 2014 and 2019, with nearly 300 different investment entities participating in over 80% of the 233 finance rounds reported and 90% of the monies committed in the last five years.

Regional Insights

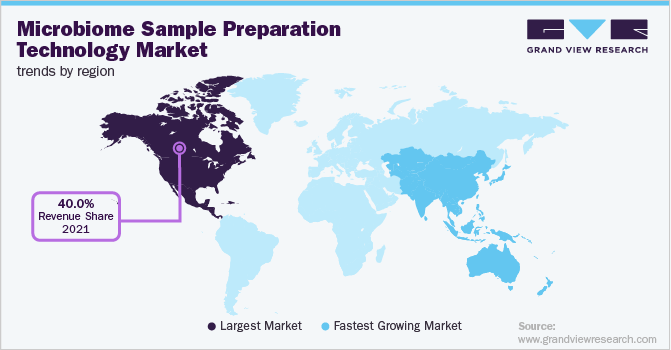

North America held the dominant share of over 40.0% in 2021. This major share can be the result of rising funding opportunities, partnerships and collaborative efforts by the regional players, and the expanding use of technological developments in the U.S. For instance, Persephone Biosciences, a microbiome research firm, entered into an agreement with Janssen Biotech in Sep 2021, for the use of patient samples from Janssen’s cancer clinical trial. Furthermore, the increased usage of instruments and consumables in the North American market has been attributed to the high penetration of genomic research projects in the pipeline throughout the region.

The Asia Pacific is anticipated to be the fastest-growing region over the forecast period due to the significant commercial growth of new start-ups and the strategic decisions of multinational entities. For instance, in South Korea, CJ CheilJedang invested 4 billion won (USD3.56 million) in 2019 in KO Biolabs, which is developing microbiome-based psoriasis and asthma treatments. In July 2021, the company also acquired a 44% stake at 98.3 billion won in ChunLab, a provider of microbiome precision analysis technology.

Key Companies & Market Share Insights

Major players are designing and implementing various strategies including new product launches, investment in start-ups or related companies through mergers and acquisitions, regional expansion, and strategic collaborations to accelerate their market presence. For instance, in May 2021, Bio-Rad Laboratories launched SEQuoia RiboDepletion Kit to streamline the RNA-Seq library prep workflow. This kit is designed to retain sRNA transcripts, thus supporting researchers targeting rare transcripts or working with limited/degraded samples. This strengthened the company's position in the market. Some prominent players in the global microbiome sample preparation technology market include:

QIAGEN

BGI

Bio-Rad Laboratories, Inc.

Perkin Elmer, Inc.

Agilent Technologies Inc.

Illumina, Inc.

F. Hoffmann-La Roche Ltd.

Danaher Corporation

Microbiome Sample Preparation Technology Market Report Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 256.2 million |

Revenue forecast in 2030 |

USD 411.7 million |

Growth rate |

CAGR of 6.1% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, workflow, application, disease type, end-use, region |

Regional scope |

北美;欧洲;亚洲Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE |

Key companies profiled |

QIAGEN; BGI; Bio-Rad Laboratories, Inc.; Perkin Elmer, Inc.; Agilent Technologies Inc.; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Microbiome Sample Preparation Technology MarketSegmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global microbiome sample preparation technology market report based on product, workflow, application, disease type, end-use, and region:

Product Outlook (Revenue, USD Million, 2018 - 2030)

Instruments

Extraction System

Workstation

Liquid Handling Instrument

Other Sample Preparation Instruments

Consumables

Purification/Extraction Kits

Library prep kits

DNA Library Preparation Kits

RNA Library Preparation Kits

Library Quantitation & Amplification kits

Clean-up and Selection Kits

Microbiome DNA Enrichment

Others

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

Sample Extraction/Isolation

Sample Quantification

Quality Control

Fragmentation

图书馆准备

Target Enrichment

Library Quantification

Pooling

Application Outlook (Revenue, USD Million, 2018 - 2030)

DNA Sequencing

Whole-Genome Sequencing

RNA Sequencing

Methylation Sequencing

Metagenomics

Single Cell Sequencing

Others

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

Autoimmune Disorder

Cancer

Gastrointestinal Disorders

Others

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Pharmaceutical & Biotechnology

Diagnostic Labs

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

亚洲Pacific

Japan

China

India

South Korea

Australia

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global microbiome sample preparation technology market size was estimated at USD 242.0 million in 2021 and is expected to reach USD 256.2 million in 2022.

b.The global microbiome sample preparation technology market is expected to grow at a compound annual growth rate of 6.1% from 2022 to 2030 to reach USD 411.7 million by 2030.

b.North America dominated the microbiome sample preparation technology market with a share of 44.27% in 2021. This is attributable to a significant number of venture investments and well-established NGS service providers

b.Some key players operating in the microbiome sample preparation technology market include QIAGEN; BGI; Bio-Rad Laboratories, Inc.; Perkin Elmer, Inc.; Agilent Technologies Inc.; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation

b.Key factors that are driving the microbiome sample preparation technology market growth include advancements in microbiome-based therapeutics coupled with the declining cost of sequencing