MRI Ferromagnetic Detection Systems Market Size, Share & Trends Analysis Report By Type (Stationary, Portable), By Region (North America, Asia Pacific), By End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-117-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalMRI ferromagnetic detection systems market sizewas estimated atUSD 435.00 million in 2022and is projected to grow at a compound annual growth rate (CAGR) of 14.87% from 2023 to 2030. The market is primarily driven by factors, such as increasing MRI installations across hospitals & other healthcare establishments, growth in healthcare expenditure in developing countries, and technologically advanced solutions, such as advanced software for faster scanning. In addition, rising investments from manufacturers in the advanced sensor technology used in ferromagnetic detection systems are further propelling their demand. Ferromagnetic detection systems are used in MRI screening procedures to avoid accidents or other issues related to external ferromagnetic objects, such as cell phones,hearing aids, and pocket knives.

This step is a critical screening component, considering the serious risks associated with the exposure of foreign bodies to the powerful magnetic field of MRI systems. For instance, in 2018, a 32-year-old man brought an oxygen tank into the magnet room and was pulled into the scanner where the tank ruptured. This caused the man to inhale liquid oxygen and lose his life. A similar incident happened in Korea in October 2021. The detection of hazardous elements in or on a patient is not feasible by MRI screening. For instance, the patient may not be aware of the metallic specifics related to the implants, foreign bodies, or devices, or the patient's medical records may lack information about metallic implants.

因此,它已经表明,ferromagnetic detection devices are useful for identifying the ferromagnetic materials in patients as part of the screening sets. Advancements in MRI technology have propelled the demand for advanced MRI systems across various healthcare establishments globally. As per OECD, the number of MRI units per million population in the U.S. was 38 per million in 2021. In addition, key vendors in the ecosystem offering novel portfolios in the category further boost the deployment of MRI units. For instance, Phillips introduced its AI-enabled MR imaging portfolio in November 2021, which offers improved diagnostic quality, streamlined workflow, and faster analysis.

这些最近的事态发展在父印度河try, product demand is projected to increase significantly in the coming years. Furthermore, the mandate of safety measures & precautions in MRI rooms also increases the use of MRI ferromagnetic detection systems. For instance, all gowns must be MRI-safe i.e. no metallic snaps, buttons, or zippers are allowed. Personnel must avoid jewelry, metallic writing instruments, watches, and wireframe eyeglasses. Therefore, all external objects are expected to be screened via ferromagnetic detection devices to assure the safety of patients and high image quality. Moreover, the growing demand for portable devices, especially for pre-screening patients with ease and efficiency, further boosts the industry’s growth. Key vendors in the industry have introduced advanced sensor technologies that diversify the offerings in the market to stay competitive.

Type Insights

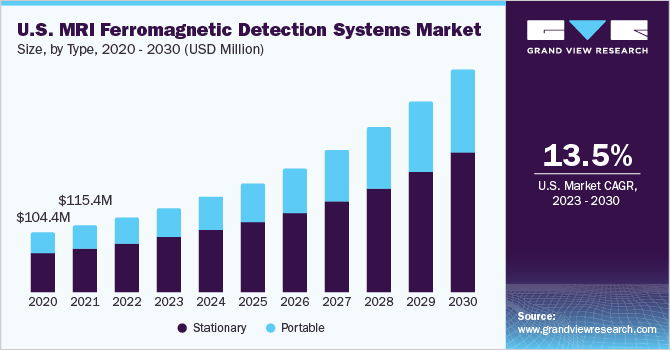

The stationary MRI ferromagnetic detection system segment accounted for the largest share of 65.89% in 2022. The stationary type offers accurate and reliable detection of medium to large ferromagnetic threats. For instance, FerrAlert Halo II Plus by Kopp Development can be placed at the entrance into the MRI exam room and provides considerable assistance in the safety of patients and staff or equipment, further avoiding any injuries. The portable segment is projected to grow at the highest CAGR of 16.2% during the forecast period.

This is owing to their ease of use, advanced sensor technology, and low costs. Hand-held or portable devices enable rapid analysis of the patient for any foreign ferromagnetic objects. Moreover, patients are generally inquired about their past surgical operations or accidents that indicate the presence of metal objects inside the body. However, the patient may need to be made aware of the presence of metal in their bodies, or the questionnaire may get misinterpreted as invasive. Hence, pre-MRI inspection assists in addressing such issues and avoiding further hazards caused by external ferromagnetic objects in MRI scanning.

End-use Insights

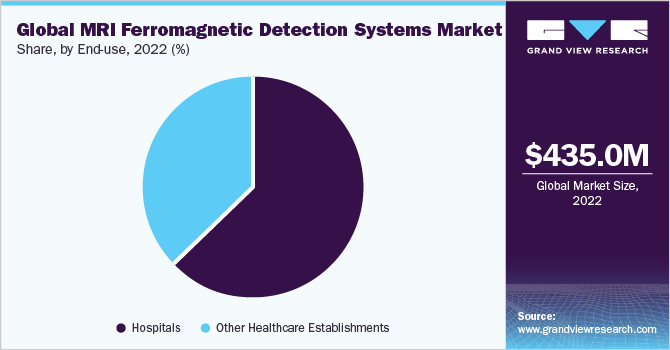

The hospital segment dominated the market with a 63.16% revenue share in 2022. This dominance can be attributed to the rising demand for advanced medical devices, considerable technological advancements in emerging economies, and rising healthcare expenditure in developing economies, especially in the medical imaging segment. For instance, the U.S. health and medical R&D spending accounted for USD 245.1 billion in 2020, which is 11% more compared to the previous year. In addition, favorable reimbursement scenarios, a significant boost in the advanced & fast diagnostic devices, and increased healthcare spending per capita boost the demand for ancillary markets, including MRI ferromagnetic detection systems.

The other healthcare establishmentssegment is projected to grow at the fastest CAGR of 16.2% during the forecast period. These establishments include ASCs and independent imaging centers equipped with the required equipment and infrastructure. The ambulatory market is growing steeply due to government initiatives to improve and increase the number of primary care centers. Mobile MRI machines provide convenience to immobile patients and patients in remote regions. These devices have disadvantages, such as higher maintenance and transportation costs. However, high procedural volume ensures high revenue.

Regional Insights

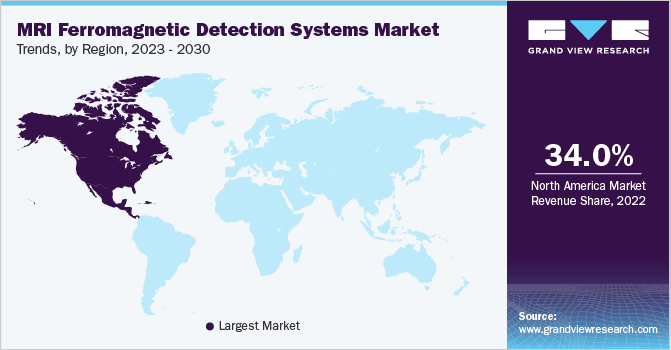

在2022年北美主导市场revenue share of 34.0%. Supportive government policies to advance preventive healthcare are one of the prime factors boosting the demand for MRI ferromagnetic detection systems in the region. In addition, high healthcare expenditure and considerable adoption of portable MRI ferromagnetic detection systems across hospitals and other healthcare establishments further propel market growth.

Asia Pacific is expected to grow at a lucrative CAGR over the forecast period. Due to its advancing healthcare system, high demand for early diagnosis through medical imaging, and a strong emphasis on technological improvements in medical devices, Asia Pacific is a prominent market for MRI ferromagnetic detection systems. As per the Inter-University Accelerator Centre (IUAC), Japan has 57.39 MRI units per million population, which is the largest globally.

Key Companies & Market Share Insights

New product launches, acquisitions, and product innovation are the major strategies adopted bykey players to retain their market share. For instance, in July 2023, ETS-Lindgren announced that it has contributed to the IEEE International Symposium on Electromagnetic Compatibility (EMC), Signal & Power Integrity (SIPI). This symposium was held at DeVos Place Convention Center in Grand Rapids, Michigan from July 31 to August 4, 2023. In November 2019, Kopp Development, Inc. acquired Mednovus, Inc. to expand the MRI safety product line to include the hand-held FerrAlert Target Scanner line. Some of the prominent players in the global MRI ferromagnetic detection systems market include:

Kopp Development Inc.

Bio-x, Magmedix Inc.

Metrasens

Tactical Solutions

C.E.I.A. S.p.A.

ITEL Telecomunicazioni S.r.l.

Nanjing Cloud Magnet Electronics Technology Co., Ltd.

ETS Lindgren

Fujidenolo Co. Ltd.

MRIFerromagnetic Detection Systems MarketReport Scope

Report Attributes |

Details |

Market size value in 2023 |

USD 490.29 million |

Revenue forecast in 2030 |

USD 1,293.77 million |

Growth rate |

CAGR of 14.87% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, competitive landscape, growth factors & trends |

Segments covered |

Type, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain, Denmark, Sweden, Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

GlobalMRIFerromagnetic Detection Systems MarketReportSegmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented theMRI ferromagnetic detection systems market report on the basis of type, end-use, and region:

Type Outlook (Revenue, USD Million, 2018 - 2030)

Stationary

- Portable

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Other Healthcare Establishments

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

China

Japan

India

Australia

South Korea

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.全球核磁共振检测铁磁系统3月ket size was estimated at USD 435.00 million in 2022 and is expected to reach USD 490.29 million in 2023.

b.全球核磁共振检测铁磁系统3月ket is expected to grow at a compound annual growth rate of 14.87% from 2023 to 2030, reaching USD 1,293.77 million by 2030.

b.North America dominated the MRI ferromagnetic detection systems market with a share of 33.95% in 2022. This is attributable to supportive government policies to advance preventive healthcare, high healthcare expenditure, and considerable adoption of portable MRI ferromagnetic detection systems across hospitals and other healthcare establishments.

b.Some key players operating in the MRI ferromagnetic detection systems market include Kopp Development Inc., Bio-x, Magmedix Inc., Metrasens, Tactical Solutions, C.E.I.A. S.p.A., ITEL Telecomunicazioni S.r.l., Nanjing Cloud Magnet Electronics Technology co., LTD, ETS Lindgren, and Fujidenolo Co. Ltd.

b.Key factors driving the market growth include increasing MRI installations across hospitals & other healthcare establishments, growth in healthcare expenditure in developing countries, and technologically advanced solutions such as advanced software for faster scanning.