Multiomics Market Size, Share & Trends Analysis Report By Product & Service (Instruments, Consumables), By Type (Single-cell, Bulk), By Platform, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-136-5

- Number of Pages: 180

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Multiomics Market Size & Trends

Theglobal multiomics market size was estimated at USD 2.03 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 15.3% from 2023 to 2030. The growth of the market can be attributed to the increasing demand for single-cell multiomics and advancements in omics technologies. Moreover, the categories such as genomics,proteomics, metabolomics, and transcriptomics are gaining momentum for healthcare purposes. The COVID-19 pandemic had a positive impact on the industry. The multiomics approaches have been considered for COVID-19 diagnosis and insights. Various studies and research were conducted to understand the multiomics role in the COVID-19 diagnosis.

For instance, according to the study published by the MDPI in September 2021, multiomics technology can provide significant new insights to understand COVID-19. In addition, large datasets generated by the high-throughput multiomics approaches possess much information that can help in therapeutic developments.

Researchers have undertaken numerous efforts to develop platforms and multiomics databases to assist in COVID-19 data analysis and research. For instance, in August 2021, a new multidimensional dataset, COVIDome, was released to the public for COVID-19 multiomics research and data analysis. This dataset was helpful to collaborate in real-time and transmit data for the clinical management of COVID-19. Such developments have driven the market growth during the COVID-19 pandemic.

The industry is expected to witness significant growth due to increasing demand for single-cell multiomics. Companies are developing novel single-cell platforms. For instance, in February 2023, BD (Becton, Dickinson, and Company) introduced a single-cell multiomics platform, BD Rhapsody HT Xpress System, to help in scientific discovery in various fields, including genetic disease research, immunology, cancer and chronic disorder research.

The increasing interest among researchers in the field of single-cell genomics is also expected to boost the market demand. According to the research published by the National Library of Medicine in March 2023, single-cell genomics has wide applications in the field of cardiovascular disorder research. It can be utilized in heart development, Myocardial Infarction (MI), Cardiac Ischemia-Reperfusion (I/R) Injury, atherosclerosis, atrial fibrillation, cardiac hypertrophy, and heart failure.

Single-cell genomics can facilitate novel treatments for cardiovascular diseases (CVDs). Furthermore, the prevalence of CVDs is increasing significantly. According to the American Heart Association, around 19.1 million people across the world lost their lives due to CVDs in 2020. Thus, with the increasing CVDs, the demand for single-cell genomics is also expected to increase significantly, driving market growth.

Product & Service Insights

The product segment accounted for the largest market share of 60.5% in 2022. The products are further segmented into instruments, consumables, andsoftware. The growing developments and increasing product launches are expected to drive the segment growth. Companies are undergoing partnerships to develop novel platforms and instruments for multiomic research and analysis. For instance, in April 2023, Bio-Techne collaborated with Lunaphore to develop a fully automated spatial multiomics solution. Such developments are anticipated to drive the segment’s growth over the forecast period.

The service segment is projected to grow at the fastest CAGR of 17.4% from 2023 to 2030. Due to the increasing demand, participants are offering numerous services focusing on multiomics. For instance, in September 2023, Psomagen, a multiomics contract research organization, introduced Spatial Biology services. This service integrates various omics platforms, including transcriptomics,genomics, and proteomics. Thus, increasing service offerings are anticipated to drive the segment growth in the coming years.

Type Insights

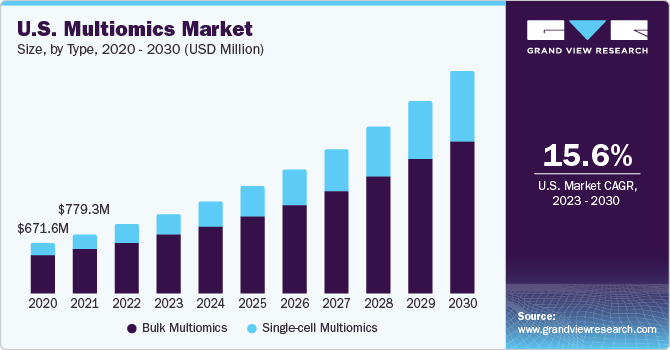

Based on type, the multiomics market is segmented into single-cell multiomics and bulk multiomics. The bulk multiomics segment dominated the type segment in 2022. Typically, bulk multiomics is essential for systematically explaining disorder pathogenesis and different phenotypes at the individual level. The various advantages of bulk multiomics can be attributed to the segment's dominance. These advantages include the simple experimental process and affordable large-scale sample dissection. Moreover, bulk multiomics approaches do not need living cells.

The single-cell multiomics segment is anticipated to witness the fastest CAGR of 17.8% during 2023-2030. The higher growth rate is attributed to the increasing demand for single-cell multiomics to understand complex biological systems. In addition, the participants are focusing on these types of products. For instance, in October 2020, Mission Bio, Inc. introduced a complete Tapestri Single-cell Multiomics Solution to develop precision cancer therapies. This solution combines two assays in a single platform and offers deeper insight into therapy relapse and resistance. Such initiatives and product launches are anticipated to boost the segment growth over the forecast period.

Platform Insights

The genomics segment dominated the market with a revenue share of 40.6% in 2022. There has been development of several advanced products in the genomics industry. Moreover, companies are increasing their offerings in this segment, which further propels the segment's growth. For instance, in May 2023, Google Cloud introduced an AI-powered Multiomics Suite. This offering can help in the interpretation of genomic data and in designing precision treatments. Thus, launches focusing on genomic data interpretation are expected to drive segment growth over the forecast period.

Themetabolomicssegment is projected to exhibit the fastest growth with a CAGR of 17.5% from 2023 to 2030. The increasing prevalence of cancer across the world and the rising number of studies focusing on multiomics approaches for cancer research are expected to drive the segment growth. According to the study published in February 2018, metabolomics plays an essential role in prognosis research of pancreatic cancer.

Application Insights

The cell biology segment dominated the market with a revenue share of 38.8% in 2022. Integrating multiomics approaches is revolutionizing the understanding of cellular biology within the contexts of both health and disease. Moreover, numerous solutions are available to understand cell biology. For instance, in February 2023, BioSkryb Genomics introduced two platforms that can enable single-cell multiomic analysis. Such products can help in the understanding of cell biology using multiomic platforms.

肿瘤段预计展览fastest growth with a CAGR of 18.0% from 2023 to 2030. The rising incidences of cancer and the growing utility of multiomics for cancer are anticipated to drive the segment growth. Researchers and companies are undertaking numerous efforts to help cancer patients using multi-omic approaches. For instance, in September 2022, Freenome, a biotech company, launched the Sanderson Study, combining its multiomics platform with real-world data to identify multiple cancers.

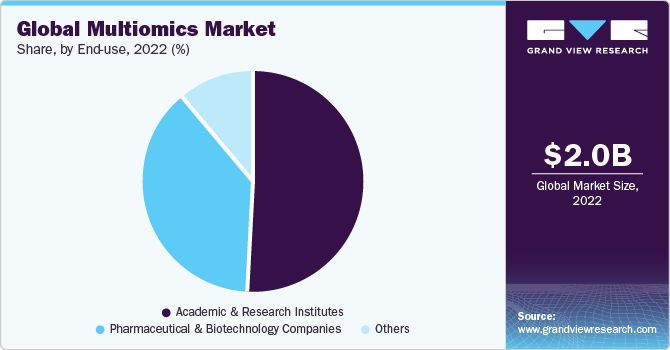

End-use Insights

The academic and research institutes segment captured the largest market share of 50.7% in 2022. The increasing studies and research focusing on multiomics approaches, including genomics, proteomics, metabolomics, and transcriptomics, are anticipated to drive segment growth over the forecast period. Moreover, this segment is receiving funding and investment for conducting research in this field. For instance, in September 2023, the National Institutes of Health established the Multiomics for Health and Disease Consortium and provided USD 50.3 million for multiomics research. This consortium includes professionals from various universities, including the University of California, Columbia University, and Washington University.

制药和生物技术公司赛格ment is projected to register the fastest CAGR of 17.5% from 2023 to 2030, owing to the potential benefits that multiomics technologies offer in drug discovery, development, and personalized medicine. Thus, the adoption of multiomics bybiotechnologyand pharmaceutical companies is anticipated to increase significantly to accelerate drug discovery and development.

Regional Insights

North America dominated the market with a share of 48.45% in 2022, and the region is projected to register the fastest growth throughout the forecast period. The presence of key players in the region supports the highest revenue share. Moreover, companies are undertaking numerous efforts to strengthen their presence is also fueling regional industry. For instance, in February 2023, Tempus, the U.S.-based company, collaborated with Actuate Therapeutics to help discover and further validate biomarker profiles in patients who have cancer. Tempus is using the multiomics approach in this project to improve research and increase novel scientific insights. Such strategies are driving regional expansion.

Asia Pacific is expected to grow at a significant CAGR of 17.8% from 2023 to 2030. The growth of the region can be attributed to various factors, including the rising prevalence of chronic conditions, the widespread product adoption for analysis and visualization, and technological advances coupled with rising research and development (R&D) investments. Moreover, various companies are introducing studies based on multiomics. For instance, in May 2021, using a multiomics approach, Burning Rock Biotech Limited introduced the PRESCIENT study, the first blood-based, pan-cancer early-detection study in China. Thus, the increasing focus of players in the Asia Pacific region also highlights the regional market's growth over the forecast period.

Key Companies & Market Share Insights

The key players are undertaking various strategic initiatives to maintain their market presence. In addition, myriad strategic initiatives enable market players to strengthen their business avenues. For instance, in September 2023, MGI, a provider of technology and tools for life science, introduced the DCS Lab Initiative to stimulate crucial scientific research. This initiative also encourages large-scale multiomics laboratories. Under the initiative, the organization is offering products for numerous applications, including cell omics, DNA sequencing, and spatial omics based on DNBSEQ technologies, to specified research institutions around the globe. Moreover, in April 2023, biomodal, formerly Cambridge Epigenetix, introduced a new duet multiomics solution that can enable simultaneous phased reading of epigenetic and genetic information in a single, low-volume sample. Some prominent players in the global multiomics market include:

BD

Thermo Fisher Scientific Inc.

Illumina, Inc

Danaher

PerkinElmer Inc.

Shimadzu Corporation

Bruker

QIAGEN

Agilent Technologies, Inc.

BGI

Multiomics Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 2.35 billion |

Revenue forecast in 2030 |

USD 6.38 billion |

Growth rate |

CAGR of 15.3% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product & service, type, platform, application, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

BD; Thermo Fisher Scientific Inc.; Illumina, Inc; Danaher; PerkinElmer Inc.; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Multiomics Market Report Segmentation

This report forecasts revenue growth at the global level, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global multiomics market report based on product & service, type, platform, application, end-use, and region:

Product & Service Outlook (Revenue, USD Million, 2018 - 2030)

Products

Instruments

Consumables

Software

Services

Type Outlook (Revenue, USD Million, 2018 - 2030)

Single-cell Multiomics

Bulk Multiomics

Platform Outlook (Revenue, USD Million, 2018 - 2030)

Genomics

Transcriptomics

Proteomics

Metabolomics

Integrated Omics Platforms

Application Outlook (Revenue, USD Million, 2018 - 2030)

Cell Biology

Oncology

Neurology

Immunology

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Academic and Research Institutes

Pharmaceutical & Biotechnology Companies

Others

RegionalOutlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

China

India

Japan

South Korea

Australia

Thailand

South Korea

拉丁美洲

Brazil

Mexico

Argentina

Middle East and Africa (MEA)

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global multiomics market size was estimated at USD 2.03 billion in 2022 and is expected to reach USD 2.35 billion in 2023.

b.The global multiomics market is expected to grow at a compound annual growth rate of 15.3% from 2023 to 2030 to reach USD 6.38 billion by 2030.

b.North America dominated the multiomics market with a share of 48.4% in 2022. This is attributable to large number of service providers and end users within the region

b.Some key players operating in the multiomics market include BD; Thermo Fisher Scientific Inc.; Illumina, Inc; Danaher; PerkinElmer Inc.; Shimadzu Corporation; Bruker; QIAGEN; Agilent Technologies, Inc.; BGI

b.Key factors that are driving the market growth include increasing advancements in omics technology and decreasing costs of omics technologies

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."