Multivitamin Gummies Market Size, Share & Trends Analysis Report By Source (Gelatin, Plant-based Gelatin Substitute), By End-user, By Application, By Sales Channel, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-102-5

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

Report Overview

The globalmultivitamin gummies market sizewas estimated atUSD 5.15 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 11.2% from 2023 to 2030. The growth of the multivitamin gummies industry is attributed to rising consumer awareness towards maintaining health coupled with growing vitamin deficiencies globally. Multivitamin gummies include an array of vitamins such as C, A, D, E, K, B6, thiamine, B12, andfolic acid. The gummies support multiple bodily functions such as bone health, energy production, and immunity.

Consumers are increasingly seeking products that provide health benefits and provide good taste. Several manufacturers are banking on the trend by providing a myriad of flavors to be used in multivitamin gummies to garner consumers’ interest. In addition, rising consumer awareness of nutrition and health is also supporting the demand for the market. Additionally, the COVID-19 pandemic has highlighted the importance of strong immunity and immunity-rich foods leading to increased demand for gummy supplements that help people conveniently consume multivitamins in a single dosage.

Further, favorable support by NGOs, government agencies, and regulatory bodies is driving the demand for multivitamin gummies. For instance, in June 2022, the U.S. Food & Drug Administration (FDA) announced the launch of a new initiative termed “Supplement Your Knowledge” which aims to educate consumers, healthcare professionals, and educators on the benefits ofdietary supplements.

Moreover, several manufacturers are introducing innovative gummy formulations which are addressed to specific age groups and health concerns thereby driving the demand for multivitamin gummies among the adult populace. For example, vitafusion, a Church & Dwight Co. Inc. brand offers vitafusion multi +immune support and vitafusion multi + beauty adult multivitamin gummy which addresses immunity health and skin & hair health.

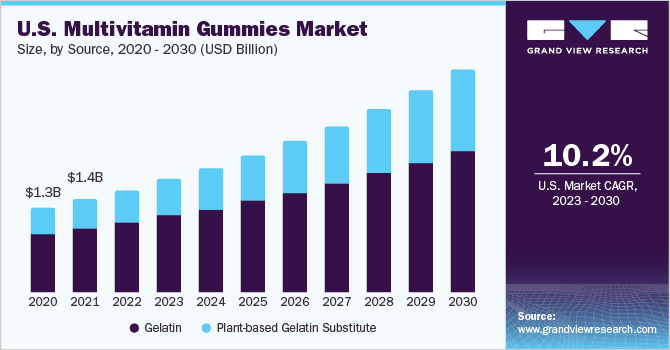

Source Insights

In terms of source, the market is bifurcated into gelatin and plant-based gelatin substitute. The gelatin segment held the largest revenue share of 68.3% in 2022. Factors such as longer shelf life, optimum chewiness, and texture are the major factors driving the demand for gelatin-based multivitamin gummies.Gelatinoffers a unique texture and chewiness to gummies which appeals to several consumers. Gelatin also acts as stabilizing agent in gummies which helps in maintaining the structure of gummies and prevents moisture loss. Several manufacturers are actively working on modifying gelatin for its optimum usage in supplement gummies. For instance, in January 2023, Gelita announced the launch of fast-setting gelatin Confixx which is starch-free. The fast-setting gelatin allows manufacturers to work on different types of active ingredients and simplify the production process.

The plant-based gelatin substitute showcased the fastest CAGR of 13.1% during the forecast period. The growing popularity of the health and wellness movement has sparked interest among consumers toward naturally sourced and clean-label ingredients thereby boosting the demand for the segment. Several manufacturers are increasingly utilizing plant-based gelatin sources such as agar-agar, seaweed, and fruit pectin to generate consumer interest. For instance, in May 2023, SmartyPants Vitamins announced the launch of gelatin-free gummies for women, toddlers, and prenatal and postnatal use. The gummies are formulated with vitamins D3, K1, and B12 and are certified by a clean label project.

End-user Insights

The adult segment dominated the market and held the largest revenue share of 32.6% in 2022. Factors such as the rising incidence of multivitamin deficiency among the adult populace coupled with the ease of usage are the main factors driving the usage of multivitamin usage among adults. Gummies are easier to consume than conventional pills and tablets and can also help adults with hectic lifestyles to consume supplements owing to their ease of use. For instance, in November 2021, Netherlands-based JediVite announced the launch of multivitamin gummies for adults. The gummies are fortified with vitamin B, vitamin K, and zinc.

The geriatric segment is expected to showcase the fastest CAGR of 12.2% during the forecast period. The rise in the aging populace coupled with rising awareness among the elderly toward bone & joint health is driving the demand for multivitamin gummies among the elderly. Older adults frequently face age-related concerns such as immune support, cognitive function, and immune support. Multivitamin gummies are formulated with Vitamin D, antioxidants, and calcium and these ingredients can help provide nutritional support to the aging population. In December 2022, GNClaunched GNC Mega Men and Women 50+ multivitamin gummies which are specifically formulated for adults above 50.

Application Insights

In terms of application, the prenatal health segment held a significant revenue share of 16.02% in 2022. Growing awareness towards the consumption of prenatal vitamins and nutrition is contributing to the demand for multivitamin supplements. In addition, marketing initiatives by supplement manufacturers, care providers, and healthcare professionals have further emphasized the significance of prenatal supplementation among pregnant mothers. Bayer AG’s brand One a Day offers prenatal gummies which include vitamin D, niacin, biotin, folate, vitamin B12, and DHA.

The skin/hair/nails segment is anticipated to showcase the fastest CAGR of 12.1% during the forecast period. Factors such as social media influence and consumer awareness of skin and hair health are boosting the demand for vitamin gummies. U.S.-based company Nature’s Way offers hair, skin, and nail multivitamin gummies under its Alive! Brand. The gummies contain biotin, zinc, vitamin E, vitamin C, and pectin.

Sales Channel Insights

The OTC segment dominated the market and held the largest revenue share of 75.4% in 2022. Extensive marketing efforts by supplement manufacturers coupled with the expansion of e-commerce are proliferating the demand for multivitamin gummies through this channel. Companies operating in the gummy industry are increasingly adopting attractive packaging, and innovative designs to promote their products through the smaller convenience stores and pharmacies. In addition, the wide availability of numerous brands through online channels and easy payment methods is further fuelling the demand for the segment.

The prescribed segment is expected to showcase the fastest CAGR of 11.6% over the forecast period. A rise in vitamin deficiencies coupled with extensive marketing efforts by pharmaceutical firms toward the importance of complete nutrition is benefiting the demand for prescribed supplements.

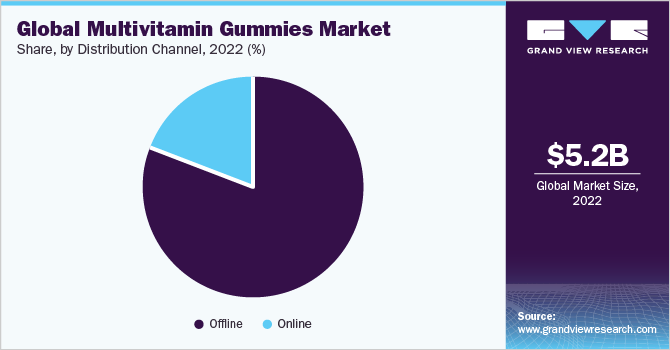

Distribution Channel Insights

The distribution channel segment is bifurcated into online and offline. The offline segment held the largest share of 81.3% in 2022. Supermarkets and hypermarkets typically offer a wide range of multivitamin gummy brands and variants. This variety allows consumers to choose products that align with their preferences, such as specific flavors, formulations, or targeted health benefits. In June 2020, U.S.-based Gerber announced the launch of multivitamin gummies Lil’ Brainees and Grow Mighty available in supermarkets.

The online segment is anticipated to grow at a CAGR of 11.9 % during the forecast period. Online distribution channel offers a wide variety of gummy varieties for several brands, including specialized formulations for specific age group and dietary preferences. This wider product selection enables consumers to find gummies that cater to their specific needs. In April 2022, Vestige Market Pvt. Ltd announced the launch of Vita+Min gummies through both online and offline channels.

Regional Insights

北美地区举行了收入占主导地位的年代hare of 37.6% in 2022 owing to the presence of numerous players in the gummy industry. Manufacturers in the region are incorporating newer manufacturing technologies and utilizing innovative packaging to garner consumer interest. Additionally, manufacturers collaborate with online retailers like Amazon to provide direct delivery to end users.

The U.S. multivitamin gummies market is expected to showcase a significant CAGR of 10.2% over the forecast period. The demand for multivitamin gummies is being driven by a rise in consumer awareness regarding personal health and well-being. Additionally, there is a growing demand for preventive health products as individuals seek to maintain a healthy and disease-free lifestyle.

The Asia Pacific multivitamin gummies market is expected to grow at the fastest CAGR of 12.6% from 2023 to 2030. The rapid rate of urbanization and changing lifestyles has led to a significant increase in the prevalence of chronic diseases, which has played a major role in driving market growth. The growth is further bolstered by the availability of cost-effective raw materials and the growing popularity of naturally sourced products. These factors have made substantial contributions to the expansion of the market.

欧洲地区的CAGR将见证10.7% over the forecast period.The demand for multivitamin gummies and immune-boosting supplements has witnessed a significant increase in European countries. There has been a notable shift in attitudes towards health and fitness, with consumers adopting a holistic approach to achieve their fitness and health objectives.

Key Companies & Market Share Insights

The global multivitamin gummies market is characterized by intense competition, mainly attributed to several players operating in the market. Several companies operating in the market are innovative products to cater to consumer demand. For example, in May 2023, SmartyPants Vitamins announced the launch of sugar-free omega and multivitamin gummies for prenatal, kids, and women health. The products contain monk fruit and omega derived from flaxseed oil. Some prominent players in the global multivitamin gummies market include:

SmartyPants Vitamins

Pharmavite LLC

Garden of Life

OLLY Public Benefit Corporation

Vitafusion (Church & Dwight Co., Inc.)

Halcon Group

Nature’s Way Brands, LLC

MRO MARYRUTH, LLC

Viteey

Bayer AG

GNC Holdings, LLC

Multivitamin Gummies MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 5.72 billion |

2030年的收入预测 |

USD 12.03 billion |

增长率(收入) |

CAGR of 11.2% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Source, end-user, application, sales channel, distribution channel, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand, South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

Key companies profiled |

SmartyPants Vitamins; Pharmavite LLC; Garden of Life; OLLY Public Benefit Corporation; Vitafusion (Church & Dwight Co., Inc.); Halcon Group; Nature’s Way Brands, LLC; MRO MARYRUTH, LLC; Viteey; Bayer AG; GNC Holdings, LLC |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Multivitamin Gummies Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030.For this study, Grand View Research has segmented the global multivitamin gummies market report based on source, application, end-user, sales channel, distribution channel, and region:

Source Outlook (Revenue, USD Billion, 2017 - 2030)

Gelatin

Plant-based Gelatin Substitute

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

Adults

Geriatric

Pregnant Women

Children

Application Outlook (Revenue, USD Billion, 2017 - 2030)

General Health

Bone & Joint Health

Immunity

Cardiac Health

Diabetes

Skin/Hair/Nails

Prenatal Health

Others

Sales Channel Outlook (Revenue, USD Billion, 2017 - 2030)

OTC

Prescribed

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

Offline

Hypermarkets/ Supermarkets

Pharmacies

Specialty Stores

Practioner

Others

Online

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

China

Japan

India

Australia & New Zealand

South Korea

Central & South America

Argentina

Brazil

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global multivitamin gummies market size was estimated at USD 5.15 billion in 2022 and is expected to reach USD 5.72 billion in 2023.

b.The multivitamin gummies market is expected to grow at a compound annual growth rate of 11.2% from 2023 to 2030 to reach USD 12.03 billion by 2030.

b.The North America market held a dominant revenue share of 37.6% in 2022 owing to the rise in a number of health-conscious consumers coupled with high demand for skin and hair supplements.

b.Some of the major players in the multivitamin gummies market include SmartyPants Vitamins, Pharmavite LLC, Garden of Life, OLLY Public Benefit Corporation, Vitafusion (Church & Dwight Co., Inc.), Halcon Group, Nature’s Way Brands, LLC, MRO MARYRUTH, LLC, Viteey, Bayer AG, and GNC Holdings, LLC

b.The rising popularity of plant-based diets coupled with popularity of multivitamin gummies among all age groups is supporting the demand for the market.

b.U.S. multivitamin gummies market is expected to grow at the fastest CAGR of 10.2% from 2023 to 2030, driven by the presence of key players in the country.