Mutual Fund Assets Market Size, Share & Trends Analysis Report By Investment Strategy, By Type, By Distribution Channel, By Investment Style, By Investor Type, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-105-8

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

The globalmutual fund assets market sizewas estimated atUSD 553.80 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. The mutual fund Asset Under Management (AUM) was valued at USD 56.2 trillion in 2022. Diversification is a significant growth driver of the global market. Mutual funds allow investors to diversify their investments across a broad range of assets, such as stocks, bonds, and commodities. This diversification helps mitigate risk by spreading investments across various sectors and asset classes, potentially leading to more stable and consistent returns. Mutual funds provide professional management, further driving the market growth.

Investors who lack the time, expertise, or resources to manage their own portfolios can benefit from the expertise of professional fund managers. These managers conduct thorough research, analysis, and decision-making on behalf of investors, aiming to achieve the fund's investment objectives. The presence of experienced fund managers instills confidence in investors and attracts them to invest in mutual funds. Enhanced liquidity is a prominent driver propelling the growth of the market. Unlike certain alternative investment options, mutual funds offer investors seamless access to their funds. The flexibility provided by mutual funds allows investors to transact in fund shares at the prevailing Net Asset Value (NAV) on any business day.

This liquidity feature empowers investors to make investment decisions aligned with their financial objectives and adapt to evolving market conditions, fostering a favorable investment environment. The simplicity and convenience associated with investing in mutual funds serve as key drivers for market growth. Mutual funds offer a user-friendly investment vehicle that caters to a diverse investor base, including those with limited investment expertise. Investors can enter the market with modest investment amounts and gain access to professionally managed and diversified portfolios, alleviating the need for extensive market analysis or individual stock selection.

This accessibility and ease of use contribute to the widespread appeal of mutual funds, fostering market expansion. However, the growth is restrained by the potential for market volatility and investment risk. Mutual funds are subject to fluctuations in the financial markets, which can result in the loss of principal for investors. In addition, certain types of mutual funds, such as those focused on specific sectors or emerging markets, may carry higher levels of risk. To overcome this restraint, investors can adopt a diversified investment approach by spreading their investments across multiple asset classes and fund categories.

COVID-19 Impact Analysis

The COVID-19 pandemic has increased investor interest and participation in the market. As traditional investment avenues, such as real estate and fixed deposits, faced uncertainties during the pandemic, investors sought alternative options, with mutual funds being one of them. This increased demand has led to a growth in mutual fund assets as more investors allocate their funds to these investment vehicles. Moreover, the pandemic has accelerated the adoption of digital platforms and online investing. With lockdowns and social distancing measures in place, investors turned to online platforms to access and manage their investments.

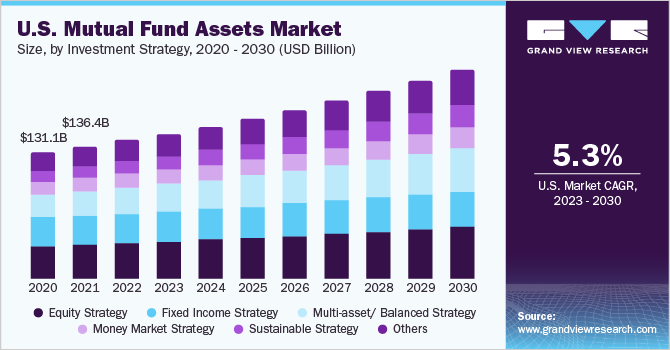

Investment Strategy Insights

我股票策略部分主导市场n 2022 and accounted for a revenue share of more than 26.0%. Investing in equity mutual funds offers the advantage of gaining exposure to a diverse portfolio of companies, mitigating the risks associated with holding individual stocks. This diversification strategy allows investors to access various markets and styles, enabling the construction of well-rounded portfolios tailored to their specific financial objectives. By spreading investments across multiple companies, equity mutual funds provide a comprehensive approach to achieving investment goals while minimizing the vulnerability associated with relying solely on a single stock.

The sustainable strategy segment is anticipated to register significant growth over the forecast period. In recent years, sustainable investing has gained prominence as investors prioritize addressing global challenges, such as climate change, income inequality, and corporate governance. There are multiple offerings aligned with sustainability available for investors, such as ESG Integration Funds, Negative Screening Funds, and Impact Funds, among others. These funds help investors lower risk exposure and, at the same time, align their investments with personal values, fueling the segment's growth.

Type Insights

The open-ended segment dominated the market in 2022 and accounted for a revenue share of more than 82.0%. The dominance can be attributed to its flexibility and liquidity features. Open-ended mutual funds do not have a fixed number of shares and can redeem existing shares or issue new shares based on investor demand. This allows investors to buy or sell shares anytime, providing easy access to their investments. The open-ended structure also enables the fund manager to actively manage the portfolio by adjusting holdings based on market conditions and investment objectives. This flexibility and convenience have made open-ended mutual funds the preferred choice for many investors, contributing to their dominance in the market.

The close-ended segment is anticipated to register significant growth over the forecast period. Close-ended mutual funds often invest in specialized or niche sectors with the potential for higher growth and profitability. This attracts investors who are seeking potentially higher returns on their investments. In addition, the limited number of shares in close-ended funds creates a sense of exclusivity, which can generate demand and drive up prices. Furthermore, the fixed maturity period of close-ended funds appeals to investors looking for long-term investment opportunities with a clear exit strategy.

Distribution Channel Insights

The direct sales segment dominated the market in 2022 and accounted for a revenue share of over 35.0%. Direct sales offer investors the convenience and flexibility to purchase mutual fund units directly without intermediaries, such as brokers or financial advisors. This gives investors greater control over their investment decisions and potentially saves on distribution fees or commissions. Moreover, direct sales provide transparency and direct communication between the mutual fund company and the investor, allowing for a better understanding of the fund's performance, fees, and investment strategy.

The financial advisor segment is anticipated to register significant growth. Many investors seek professional advice and guidance when making investment decisions, particularly those with complex financial situations or long-term goals. Financial advisors have the knowledge and expertise to help investors navigate the intricacies of mutual fund investing and create tailored investment strategies. Moreover, financial advisors provide personalized investment recommendations based on their clients' risk tolerance, financial objectives, and time horizon. This customized approach appeals to investors who value a personalized investment experience.

Investment Style Insights

The active segment dominated the market in 2022 and accounted for a revenue share of over 71.0%. Active management aims to outperform the market by carefully selecting and managing investments based on in-depth research and analysis. This approach appeals to investors who seek the potential for higher returns and believe in professional fund managers' expertise. Moreover, an active investment style offers active decision-making, allowing fund managers to adjust their portfolios based on market conditions and investment opportunities. This flexibility and adaptability attract investors who want their investments to be actively managed and responsive to market changes.

被动段预计注册团体nificant growth over the forecast period. Passive investing involves tracking a specific market index or benchmark, such as the S&P 500, rather than attempting to outperform it. This approach appeals to investors prioritizing broad market exposure and long-term stability over actively managed strategies. Moreover, passive mutual funds typically have lower management fees compared to actively managed funds, as they require less active decision-making and research. This cost-effectiveness attracts investors who are conscious of fees and seek to optimize their investment returns.

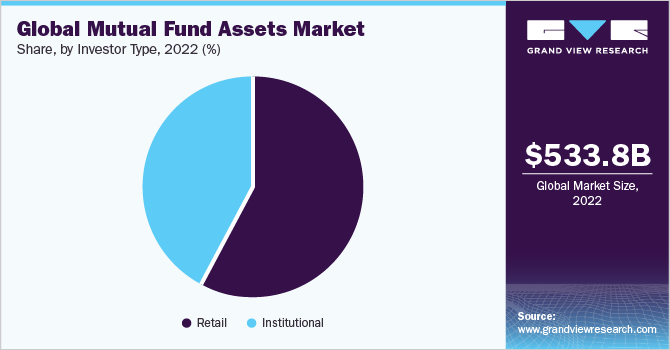

Investor Type Insights

The retail segment dominated the market in 2022 and accounted for a global revenue share of over 58.0%. Mutual funds provide retail investors with a wide range of investment options, including equity funds, bond funds, and hybrid funds, catering to different risk preferences and investment objectives. This versatility allows retail investors to customize their investment strategy according to their financial goals and risk tolerance. Moreover, mutual funds often have lower investment minimums compared to other investment vehicles, making them more accessible to retail investors with limited capital. This lower barrier to entry allows retail investors to participate in the market and benefit from professional management and potential market returns.

机构部分是regist预期er significant growth over the forecast period. Institutional investors, such as pension funds, insurance companies, and sovereign wealth funds have substantial financial resources and long-term investment objectives. They seek diversified investment opportunities to achieve their specific investment goals, including generating stable returns, managing risk, and meeting the needs of their beneficiaries or policyholders. Mutual funds offer a wide range of investment strategies and asset classes that cater to the specific requirements of institutional investors.

Regional Insights

North America dominated the market in 2022 and accounted for a revenue share of more than 30.0%. The region has a well-developed and mature financial market, with a strong presence of asset management companies and financial institutions that offer mutual funds. The depth and breadth of the North American financial industry attract a large number of investors, both institutional and retail, who trust and rely on mutual funds as a preferred investment vehicle. Moreover, North America has a culture of investing and a high level of financial literacy among its population. The region's investors are well-informed and actively seek investment opportunities to grow their wealth, with mutual funds being a popular choice.

The Asia Pacific regional market is anticipated to register the fastest CAGR from 2023 to 2030. The region is witnessing significant economic growth and rising middle-class populations, leading to an increase in disposable income and a growing appetite for investment opportunities. As individuals and households accumulate wealth, they are increasingly turning to mutual funds as a means of investment to diversify their portfolios and seek potential returns. Moreover, the development of financial markets and the liberalization of investment regulations in many Asia Pacific countries have opened up opportunities for both domestic and international fund managers to offer a wide range of mutual funds.

Key Companies & Market Share Insights

市场的竞争格局是生产erized by a diverse range of players, including mutual fund companies, asset management firms, and financial institutions. Major players in the market compete based on factors, such as fund performance, brand reputation, investment strategies, and customer service. Established mutual fund companies with a strong track record and a wide range of fund offerings often have a competitive advantage. However, the market also sees the presence of smaller, specialized firms that focus on niche investment strategies or cater to specific investor preferences.

In July 2023, Franklin Templeton, a prominent global fund manager, introduced the Franklin Sealand China A-shares fund, aiming to provide retail investors in Singapore with an opportunity to invest in the China A-shares market. The fund's primary focus is on investing in China A-shares and equity securities of Chinese companies listed on the local stock exchange, with the objective of achieving long-term capital appreciation. The fund portfolio will comprise approximately 35 to 55 stocks, encompassing various industries, sectors, and market capitalizations. Some of the prominent players in the global mutual fund assets market include:

BlackRock, Inc.

The Vanguard Group, Inc.

Charles Schwab & Co., Inc.

JPMorgan Chase & Co.

FMR LLC

State Street Corporation

Morgan Stanley

BNY Mellon Securities Corp.

Amundi US

Goldman Sachs

Franklin Templeton

Mutual Fund Assets Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 586.47 billion |

Revenue forecast in 2030 |

USD 936.10 billion |

Growth rate |

CAGR of 6.9% from 2023 to 2030 |

Base year of estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Investment strategy, type, distribution channel, investment style, investor type, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; Luxembourg; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa |

Key companies profiled |

BlackRock, Inc.; The Vanguard Group, Inc.; Charles Schwab & Co., Inc.; JPMorgan Chase & Co.; FMR LLC; State Street Corp.; Morgan Stanley; BNY Mellon Securities Corp.; Amundi U.S.; Goldman Sachs; Franklin Templeton |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

Pricing and purchase options |

利用定制购买选项来满足您的穰ct research needs.Explore purchase options |

Global Mutual Fund Assets Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the mutual fund assets market report based on investment strategy, type, distribution channel, investment style, investor type, and region:

Investment Strategy Outlook (Revenue, USD Billion, 2017 - 2030)

Equity Strategy

Fixed Income Strategy

Multi-asset/Balanced Strategy

Sustainable Strategy

Money Market Strategy

Others

Type Outlook (Revenue, USD Billion, 2017 - 2030)

Open-ended

Close-ended

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

Direct Sales

Financial Advisor

Broker-dealer

Banks

Others

Investment Style Outlook (Revenue, USD Billion, 2017 - 2030)

Active

Passive

Investor Type Outlook (Revenue, USD Billion, 2017 - 2030)

Retail

Institutional

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Canada

Europe

Luxembourg

UK

Germany

France

Asia Pacific

China

India

Japan

South Korea

Australia

Latin America

Brazil

Mexico

Middle East & Africa

Kingdom of Saudi Arabia (KSA)

UAE

South Africa

Frequently Asked Questions About This Report

b.The global mutual fund assets market size was estimated at USD 553.80 billion in 2022 and is expected to reach USD 586.47 billion in 2023.

b.The global mutual fund assets market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 936.10 billion by 2030.

b.North America dominated the mutual fund assets market with a share of 30.48% in 2022. The region has a well-developed and mature financial market, with a strong presence of asset management companies and financial institutions that offer mutual funds.

b.Some key players operating in the mutual fund assets market include BlackRock, Inc.; The Vanguard Group, Inc.; Charles Schwab & Co., Inc.; JPMorgan Chase & Co.; FMR LLC; State Street Corporation.; Morgan Stanley; BNY Mellon Securities Corporation; Amundi US; Goldman Sachs; Franklin Templeton.

b.Key factors that are driving the market growth include diversification of investments and enhanced liquidity.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."