Nail Salon Market Size, Share & Trends Analysis Report By Service (Manicure, Pedicure), By End-user (Men, Women), By Age Group (Below 18, 19 to 40), By Region (Asia Pacific, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-088-5

- Number of Pages: 0

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry:Consumer Goods

Report Overview

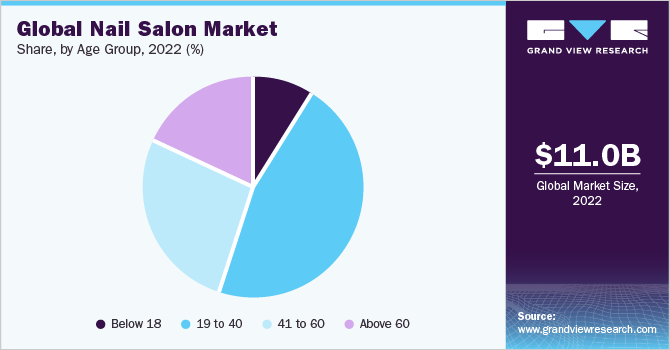

The globalnail salon market sizewas valued atUSD 11.00 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2023 to 2030. There has been a growing emphasis on personal appearance and grooming in recent years. People are more conscious about their overall appearance, including their nails. Nail salons provide a convenient and specialized service to cater to this demand. The COVID-19 pandemic has significantly impacted the nail salon industry, bringing about several notable trends and changes. Nail salons have implemented rigorous safety measures to ensure the well-being of both customers and staff. These measures include mandatory mask-wearing, frequent sanitization of tools and surfaces, hand sanitizing stations, and social distancing measures within the salon.

Adhering to strict hygiene protocols has become a top priority for nail salons to instill confidence in customers. Post-COVID-19 pandemic many nail salons have shifted to appointment-only systems to manage customer flow and reduce overcrowding. This helps prevent long wait times for customers. Online booking platforms and mobile apps have become popular for scheduling appointments and managing salon capacity effectively.Moreover, millennials value self-expression and individuality. Nail salons offer a canvas for creative expression through unique nail designs, colors, and embellishments. Many millennials seek out nail technicians who can create customized and intricate nail art.

In addition, millennials are driving innovation in the nail industry by embracing vibrant acrylics, ombre accents, and novel techniques. Influential figures like Kylie Jenner, Nicki Minaj, Billie Eilish, and Cardi B have popularized acrylic nails, relying on skilled professionals to cater to their nail care needs. The internet, particularly the vast resources available online, serves as a valuable tool for discovering new and captivating nail designs. Millennials are active users of social media platforms like Instagram, where they share their experiences, including nail treatments and designs. This has created a trend-driven culture around nail art and has increased the popularity of nail salons.

Social media platforms, particularly TikTok, have emerged as significant influencers in the industry. TikTok’s short and concise video format aligns with millennial preferences, offering a seamless browsing experience for quick and easy access to a multitude of nail art tutorials. Furthermore, technology has played a significant role in shaping the nail salon industry. The availability of new and advanced nail care products, tools, and equipment has improved the quality of services and expanded the range of treatments offered. In addition, technological advancements in marketing, online presence, and customer engagement have helped salons reach a wider audience and provide a seamless customer experience, likely favoring the market growth.

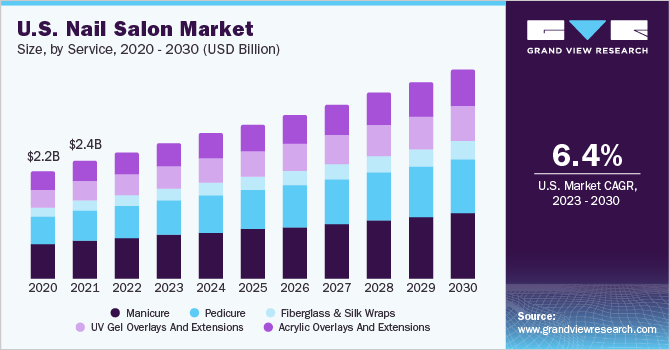

Service Insights

The manicure service segment dominated the market with a share of around 32% in 2022. Manicures are often viewed as a form of self-care and relaxation. Many people enjoy the pampering experience of getting their nails done and consider it a treat or a way to unwind. The need for self-care and relaxation provides an ongoing demand for manicure services, as individuals prioritize regular visits to nail salons for a rejuvenating experience.

The UV gel overlays and extensions service is projected to register a CAGR of 9.5% from 2023 to 2030. By incorporating gel polish into their service offerings, salons can attract customers seeking a longer-lasting and low-maintenance manicure. The application and removal process of gel polish typically requires professional expertise and specialized equipment, creating a demand for salon services. Customers often prefer professional assistance to ensure precise application, proper curing, and safe removal of gel polish. This drives the demand for UV gel overlays and extensions among consumers.

End-user Insights

The women segment dominated the market with a share of around 69% in 2022. The frequency of women customer visits to nail salons goes beyond the mere provision of nail services and encompasses a holistic experience focused on relaxation and self-care. It serves as a ritualistic practice where they can momentarily step away from their hectic routines, unwind, and indulge in pampering. This emphasis on providing a comprehensive and rejuvenating experience caters to the growing demand for wellness-oriented services within the nail salon industry, enhancing customer satisfaction and fostering long-term loyalty.

The men end-usersegment is projected to register a CAGR of 8.7% from 2023 to 2030. Well-maintained nails can be regarded as a fashion-forward statement or an extension of one's personal brand. Men who prioritize their appearance and seek to express themselves through fashion may opt to visit nail salons to ensure their nails are stylishly maintained, complementing their overall aesthetic. According to an article in The Times of India on September 2020, Enrich, a unisex salon chain in India, stated that the female-to-male ratio has changed from 70:30 in 2019 to 60:40. Men are availing various services, such as pedicures and manicures.

Age Group Insights

Nail salons for the age group 19 to 40 years dominated the market with a share of over 46% in 2022. Individuals in this age group frequently attend special occasions like weddings, parties, or social events. Nail salons provide services, such as manicures, pedicures, and nail extensions, that can enhance their appearance for these events, complementing their outfits and overall style. According to a blog by NailCon in October 2022, GenZ (specifically of the age group 19 to 26 years) and millennials (specifically of the age range 27 to 40 years) spend more money on nail salon services.

Nail salon for the age group below 18 years is estimated to grow with the fastest CAGR of 10.2% over the forecast period. Nail salons catering to teenagers often create a welcoming and age-appropriate ambiance. They may have vibrant decor, trendy music, and a friendly staff that understands the preferences and tastes of teenagers, ensuring a comfortable and enjoyable experience. For instance, Revive Nails & Massage Therapy based in the U.S. offers manicures and pedicures specifically for children at an average price of USD 14 and USD 15 respectively.

Regional Insights

North America dominated the global market with a share of over 33% in 2022. The expansion of nail salon franchises plays a significant role in fueling theU.S. market growth. In the wake of the pandemic, nail salon brands established in the past decade are strategically focusing on franchise expansion, while upholding their dedication to maintaining high standards of cleanliness and using chemical-free processes. Prose Nails, for example, just opened its 27th facility in Sandy Springs, Georgia.Asia Pacific is expected to grow at a CAGR of 9.4% from 2023 to 2030.

There has been an increase in the number of male customers visiting nail salons in the Asia Pacific region. Men are embracing nail care as part of their grooming routine and seeking professional services for nail maintenance and styling. The Indian market has seen significant growth and evolving preferences in recent years. BBlunt, a nail salon company in India, reported to note a significant change in consumer trends as the frequency of visit of male customers were more post-pandemic lockdown. The ratio of female customers to male customers in BBlunt changed from 70:30 to 55:45 for services, such as haircuts, manicures, and pedicures.

Key Companies & Market Share Insights

The market exhibits a mix of established players and emerging entrants. Key industry players are recognizing the rising trend of nail salons and intensifying their efforts to capture this market opportunity. To safeguard their market share, these players are diversifying their service offerings to cater to evolving customer preferences and demands.For instance:

In June 2022, John Barrett partnered with a luxury condo building 53 West 53 in Manhattan. The partnership aims to create easy access and treated it as a priority for the people of the building for a complete wellness center through pre-appointments

In December 2021, MiniLuxe, a Boston-based nail salon chain, accomplished an important milestone by finalizing the largest Capital Pool Company (CPC) offering in TSX history, demonstrating the market's trust in its dedication to healthy workplace conditions and delivering quality service at a premium

Some of the key players operating in the global nail salon market include:

Revive Nails & Massage Therapy

Alluring Nails & Tanning

Milano Nail Spa The Height

Soho Beauty & Nail Boutique

J and J Nails & Spa

Hana Nail

Shian Nails

Nailaholics

LOTUS NAILBAR & SPA

ZAZAZOO Nail Salon

Nail SalonMarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 11.96 billion |

Revenue forecast in 2030 |

USD 20.30 billion |

Growth rate |

CAGR of 8.0% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Service, end-user, age group, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; China; India; Japan; South Africa; Brazil |

Key companies profiled |

Revive Nails & Massage Therapy; Alluring Nails & Tanning; Milano Nail Spa The Height; Soho Beauty & Nail Boutique; J and J Nails & Spa; Hana Nail; Shian Nails; Nailaholics; LOTUS NAILBAR & SPA; ZAZAZOO Nail Salon |

Customization scope |

免费定制(相当于8肛交报告ysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

GlobalNail SalonMarket ReportSegmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this report, Grand View Research has segmented the global nail salon market report based on service, end-user, age group, and region:

Service Outlook (Revenue, USD Million, 2017 - 2030)

Manicure

Pedicure

Fiberglass & Silk Wraps

UV Gel Overlays And Extensions

Acrylic Overlays And Extensions

End-user Outlook (Revenue, USD Million,2017 - 2030)

Men

Women

Age Group Outlook (Revenue, USD Million,2017 - 2030)

Below 18

19 to 40

41 to 60

Above 60

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Asia Pacific

China

India

Japan

Central & South America

Brazil

Middle East & Africa

South Africa

Frequently Asked Questions About This Report

b.The global nail salon market was estimated at USD 11.00 billion in 2022 and is expected to reach USD 11.96 billion in 2023.

b.The global nail salon market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 20.30 billion by 2030.

b.North America dominated the nail salon market with a share of around 34% in 2022. Factors such as trends in nail fashion, customer preferences for quality and cleanliness, and innovations in nail care techniques influence the dynamics and growth of the nail salon service market.

b.的一些关键球员在指甲萨罗城n market include Revive Nails & Massage Therapy; Alluring Nails & Tanning; Milano Nail Spa The Height; Soho Beauty & Nail Boutique; J and J Nails & Spa; Hana Nail; Shian Nails; Nailaholics; LOTUS NAILBAR & SPA; ZAZAZOO Nail Salon

b.推动指甲沙龙市场的关键因素growth include individuals seeking to enhance the appearance and health of their nails, as well as those looking for a relaxing and pampering experience.