North America Fire Pits Market Size, Share & Trends Analysis Report By Product Type (Wood Burning, Propane), By End-use (Indoor, Outdoor), By Type, By Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- 代表ort ID: GVR-4-68040-103-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

代表ort Overview

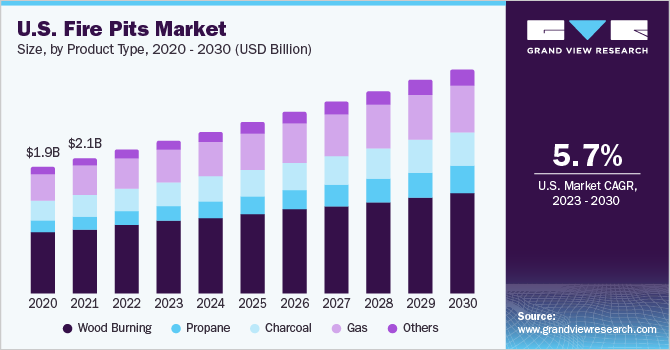

TheNorth America fire pits market sizewas estimated atUSD 2.74 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030.Fire pitsare among the most popular ways of improving outdoor living areas among homeowners across North America, as indicated by the American Society of Landscape Architects (ASLA). In several parts of the U.S. and Canada, builders are compelled to create outdoor living spaces that provide homeowners with the most usable square footage possible. This situation is predicted to drive the demand for fire pits in North America. The market is also boosted by rising property sales, a shift toward urban lifestyles, and increasing demand for fire pits.

The increasing demand for differentiated products and services leads to more research and development (R&D) spending. R&D is also a technique used by key market players to make financial profits while addressing environmental and social challenges through technologies and products. The global optimization for manufacturing and modularization has unlocked resources for investments in design, product development, and marketing in the decorative appliance industry. For instance, in April 2021, Breeo, a brand of Warming Trends, launched the world’s largest smokeless fire pit - Breeo X30, with new customizable options; this makes it the ultimate experience in backyard cooking and entertainment.

The distribution business strategy for fire pit decorative appliances is a critical indicator that influences the performance of the industry in the future. The majority of businesses in this sector offer their goods through channels that include retail stores, individual or corporate dealers, and B2B channels such as distributors and contractors. In addition, maintaining exclusive channel partners and distributors is a convenient strategy for higher penetration of products in the market. Thus, manufacturers primarily opt for this distribution channel across regions and countries. For instance, in November 2020, True Value Hardware, a wholesaler that supplies over 4,500 independently owned stores, stated that the sale of wood-burning fire pits increased by 300%.

The pandemic had a significant impact on work culture, and many people still prefer the flexibility of working from the comfort of their homes. Being at home most of the day is more likely to encourage the purchase of home amenities. The International Casual Furnishings Association (ICFA) reported that 71% of Americans spent up to seven hours per week outside in 2022, much more time than they did the year before. In addition, approximately 78% of respondents said they have improved their outdoor living areas in 2021, according to the same research.

Product Type Insights

In 2022, the wood-burning fire pits segment dominated the market in North America with a revenue share of approximately 48%. These wood-burning fire pits serve as homemade camping-style fire pits that are typically located away from the primary house site for safety. Market players have been engaging in product launches due to the increasing demand for such fire pits. In November 2021, for instance, TIKI, a Wisconsin-based brand, introduced a new product to its lineup: the Portable Fire Pit. This innovative product offers the advantages of its Patio Fire Pit, as well as other benefits such as a low-smoke experience and an ash pan for easy clean-up. It can be used with TIKI Wood Packs for a quick and consistent fire or with real wood.

The propane fire pits segment is anticipated to register a CAGR of about 9.2% during the forecast period. Homeowners prefer propane-based fire pits instead of raw materials such as wood because propane-based fire pits are available in different sizes, appeal, and price ranges. In addition,propaneburns cleaner without generating sparks or ash, which may cause inconvenience or safety concerns for individuals. Unlike conventional log fires, which leave coals burning for hours, the flames of a propane fire pit can be easily extinguished. In addition, propane fire pits can be safely positioned on open porches with overhead roofs, making them suitable for a wider range of outdoor spaces.

Type Insights

经典的火坑段主导朝鲜America market in 2022 with a revenue share of approximately 40%. Classic fire pit designs are commonly available for purchase at retail stores or can be customized and manufactured according to specific preferences. For instance, Hayneedle Inc., an e-commerce site based in Nebraska, U.S. offers a traditional and classic fire pit collection of various brands. The fire pits come in different features such as grills, free cover, and various product types such as wood burning and gas.

The tabletop fire pits segment is set to grow at the fastest CAGR of 9.7% over the forecast period. These pits utilize gas power, sourced either from a propane tank or an underground gas connection. In September 2022, Solo Stove launched a new collection of tabletop fire pits known as Mesa. Irrespective of the outside space a user has access to, a tabletop fire pit enhances the appearance of any setting and enables anybody to enjoy the sound of a crackling fire. By offering new options that cater to evolving customer preferences and addressing specific needs, market players have been stimulating consumer interest and creating a sense of novelty towards tabletop fire pits.

End-use Insights

Outdoor use of fire held the largest revenue share of approximately 67% in 2022. The trend of smokeless fire pits is encouraging more outdoor use by minimizing smoke and providing a cleaner and more enjoyable fire experience. In August 2022, Solo Stove introduced the Fire Pit 2.0 version, an upgraded iteration of its smokeless fire pit line. This update includes patented features such as a removable fuel grate and ash pan, enhancing the fire pit's versatility as a centerpiece on outdoor tables or an ambient addition to the surroundings.

Indoor usage of fire pits is projected to register a CAGR of approximately 6.5% during the forecast period. Indoor fire pits are surging in popularity due to their appealing aesthetics and ability to provide a similar level of comfort as outdoor fireplaces. Portable indoor fire pits eliminate the need for the construction of a campfire or a dedicated fire pit space. One notable example is the Stix Portable Fire Pit by EcoSmart Fire, a U.S.-based company that offers a stainless-steel twist on the traditional campfire.

Sales Channel Insights

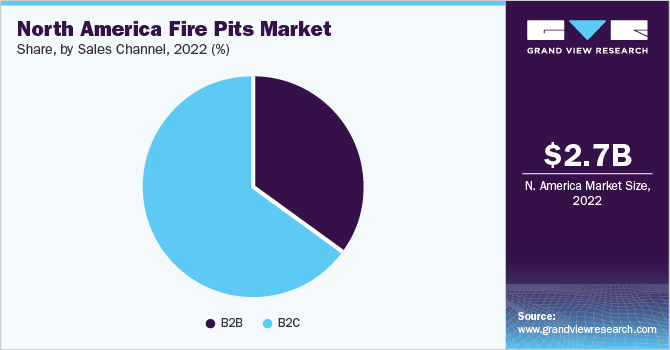

In North America, the B2C channel dominated the market with a revenue share of approximately 65% in 2022. According to ICFA, in March 2021, 90% of Americans agreed that their outdoor living space is more valuable than ever, with 78% making exterior upgrades during COVID-19. Fire pits have risen to the top on the list of additions as more people choose to stay indoors and yearn to spend more time outside. This scenario is expected to drive the demand for the incorporation of fire pits, specifically fire tables, and bowls.

The B2B channel is projected to register the fastest CAGR of approximately 6.4% from 2023 to 2030. An advanced way of life with an increase in the appropriation of Western traditions and quick socializing trends like dining outdoors in gardens, social events, and grilling & barbecue activities in the patio area are factors creating various opportunities for the fire pit market at hotels, cafés, pools, and other locations. Fire features, such as a torch, a fire table with chairs around it, or a huge fire bowl on a high pedestal, add decorative components to enhance outdoor spaces.

Regional Insights

The U.S. dominated the North America fire pits market with a share of approximately 82% in 2022. The demand for fire pits in the U.S. is increasing as more and more homeowners are upgrading and extending their outdoor living space. The pandemic also affected the industry growth for outdoor living spaces. For instance, according to the 2022 Outdoor Furnishings Trend Report from the ICFA, 89% of households surveyed already have outdoor living spaces, and 91% of them expected to improve them even more. Over the projected period, this is anticipated to boost the expansion of the fire pits market.

The Canada fire pits market is expected to register the fastest CAGR of about 7.3% from 2023 to 2030. The growth of outdoor recreational activities, such as camping andglampingin Canada has been a driving force in the fire pits market. According to the North American Camping report conducted by Kampgrounds of America, Inc. in 2022, approximately 63% of Canadians stated that the most enjoyable aspect of camping is being outdoors. Approximately 40% mentioned that they particularly enjoy gathering around the campfire, while 33% expressed that camping provides them with an opportunity to escape from crowded places. The appeal of the outdoors keeps attracting people, leading to a consistent demand for fire pits and other outdoor products.

Key Companies & Market Share Insights

市场特点是存在的ew established players and new entrants. Many big players are increasing their focus on the growing trend of fire pits. Players in the market are diversifying their service offerings to maintain market share.

In February 2023, Solo Stove launched the Mesa XL tabletop smokeless fire pit for outdoor activities. It is a larger version of its tabletop fire pit Mesa, launched last year. The new product fits nicely in any tiny outdoor space while dispersing more heat and having a longer burn life than that of Mesa.

In May 2021, The Outdoor GreatRoom Company LLC, launched Bronson Block Gas Fire Pit Kits, available in round and square shapes. Each fire pit has a distinctive, one-of-a-kind appearance due to its color variety. A control panel, two vent blocks for adequate ventilation, a Crystal Fire Plus gas burner insert and plate, and tumbling lava rock are also included in the set.

Some of the key players in the North America fire pits market include:

The Outdoor GreatRoom Company LLC

Fire Pit Art

Breeo Industries LLC

Solo Stove (Solo Brands)

Tropitone Furniture Co., Inc.

The Blue Rooster Company

Prism Hardscapes

Ohio Flame, Inc.

Camp Chef (Vista Outdoor Operations LLC)

Paloform

North America Fire PitsMarket代表ort Scope

代表ort Attribute |

Details |

Market size value in 2023 |

USD 2.90 billion |

Revenue forecast in 2030 |

USD 4.30 billion |

Growth rate |

CAGR of 5.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

代表ort coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product type, type, end-use, sales channel, region |

Regional scope |

North America |

Country scope |

U.S.; Canada |

Key companies profiled |

The Outdoor GreatRoom Company LLC; Fire Pit Art; Breeo Industries LLC; Solo Stove (Solo Brands); Tropitone Furniture Co., Inc.; The Blue Rooster Company; Prism Hardscapes; Ohio Flame, Inc.; Camp Chef (Vista Outdoor Operations LLC); Paloform |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

North America Fire PitsMarket代表ort Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America fire pits market report based on product type, type, end-use, sales channel, and region:

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

Wood Burning

Propane

Charcoal

Gas

Others

Type Outlook (Revenue, USD Million, 2017 - 2030)

Classic Fire Pit

Fire Table

Fire Pit Bowls

Tabletop Fire Pits

Chiminea

Others

End-use Outlook (Revenue, USD Million, 2017 - 2030)

Indoor

Outdoor

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

B2B

B2C

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Frequently Asked Questions About This Report

b.The North America fire pits market was estimated at USD 2.74 billion in 2022 and is expected to reach USD 2.90 billion in 2023.

b.The North America fire pits market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 4.30 billion by 2030.

b.The U.S. dominated the North America fire pits market with a share of over 82% in 2022. The demand for fire pits in the US is rising as more homeowners upgrade and extend their outdoor living space. The pandemic also affected the industry growth for outdoor living spaces.

b.Some key players operating in the North America fire pits market include The Outdoor GreatRoom Company LLC; Fire Pit Art; Breeo Industries LLC; Solo Stove (Solo Brands); Tropitone Furniture Co., Inc.; The Blue Rooster Company; Prism Hardscapes; Ohio Flame, Inc.; Camp Chef (Vista Outdoor Operations LLC); Paloform.

b.Key factors that are driving the North America fire pit market growth include the compelling need to create outdoor living spaces that provide homeowners with the most usable square footage possible. This situation is predicted to drive the demand for fire pits in North America. The market is also boosted by rising property sales, a shift toward urban lifestyles, and increasing demand for fire pits.