North America Industrial Gases Market Size, Share & Trends Analysis Report By Product (Nitrogen, Oxygen), By Application, By Application By Product, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-088-0

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Bulk Chemicals

Report Overview

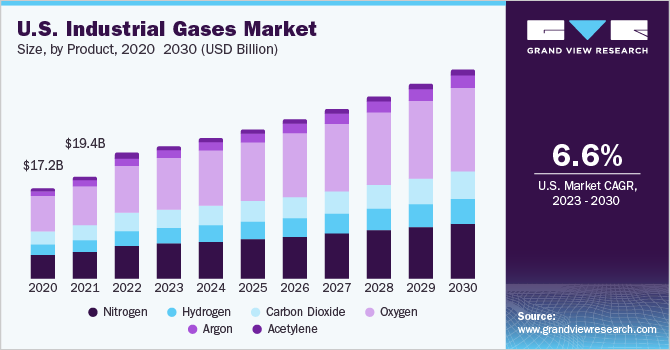

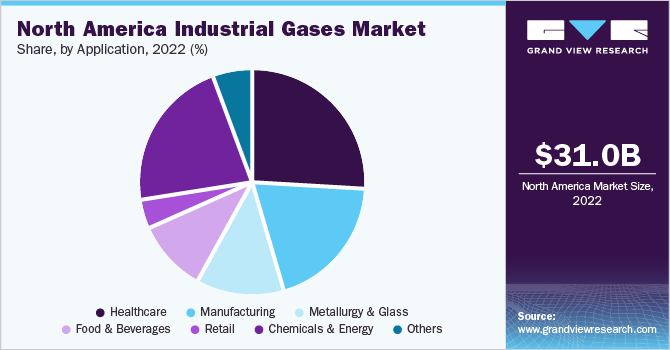

TheNorth America industrial gases market sizewas valued atUSD 31.0 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. This is attributed to ongoing industrialization and the increasing application of these gases in various industries such as healthcare, manufacturing, metallurgy, and food & beverages in North America.Industrial gasesare increasingly consumed in the healthcare sector owing to their surging applicability in medical applications. Oxygen is the largest and most commonly used industrial gas in medical applications. It is utilized in respiratory therapy. Oxygen is also used in anesthesia and life support systems. This trend is driving the growth of the product market in the region.

Moreover, industrial gases are used in the food & beverages industry for multiple applications such as modified atmosphere packaging (MAP), carbonizing, freezing, and chilling food products and beverages. Modified atmosphere packaging (MAP) uses industrial gases such as nitrogen, carbon dioxide, and oxygen to preserve food products and beverages for a long period. Industrial gases like nitrogen and oxygen find application in the electronics industry. For example, gases like nitrogen and argon gases are used in the production of plasma screens, while helium is mostly used for the development of hard disk drives.

The leading industrial gas companies such as Linde plc, Air Liquide, and Messer constitute a majority of the share of the market in the region owing to these players having multiple production plants in different counties across the region. For instance, Linde plc has its production facilities primarily in the U.S., Canada, and Mexico in North America. The presence of different laws and regulations related to the storage and transportation of industrial gases in North America that manufacturers and distributors of these gases are required to abide by restricts the growth of the product market.

Product Insights

Oxygen dominated the market with the highest revenue share of 38.1% in 2022, owing to the versatility and essentiality of oxygen making it a vital component in the chemicals and healthcare industries. Medical oxygen is essential in hospitals and health clinics for carrying out therapies and various surgeries. Moreover, oxygen is also used for metal cutting, welding, cleaning, and melting applications. In the food industry, it is used to maintain the fresh and natural color of red meat.

液态氧常用调药的al industry for the production of antibiotics, anesthetics, heart medications, etc. Moreover, it is widely used in the chemicals industry for various applications. Oxygen is used as a reactant in a number of chemical reactions for producing acetylene, ethylene oxide, and methanol by carrying out partial oxidation of hydrocarbons. It is also used in combination with acetylene and other fuel gases in metal manufacturing plants for scarfing, metal cutting, hardening, welding cleaning, and melting applications.

The cryogenic form of nitrogen is used in cooling, food freezing, and metal treating applications. It is also used in biological sample preservation and other temperature-related applications. The compressed form of nitrogen is employed in propellants, as well as in pneumatic applications.

In the energy industry, cryogenic hydrogen gas serves as a potential transport fuel and a low-carbon alternative to natural gas and refined oil. Hydrogen is converted to synthetic liquid fuels, ammonia, methanol, and synthetic methane for transportation purposes. In addition, hydrogen fuel cell electric vehicles (FCEVs) are witnessing increased sales owing to zero tailpipe emissions of pollutants.

Application Insights

The healthcare segment dominated the market with the highest revenue share of 26.4% in 2022, owing to their increasing application of industrial gases like oxygen and nitrogen in the healthcare industry. Industrial gases are increasingly used in North America because of the surged government spending for providing improved healthcare and medical technologies to the masses.

Gases, such as nitrogen, helium, and carbon dioxide are also used in various medical processes and therapies for sedation and treatment of respiratory diseases such as chronic obstructive pulmonary disease (COPD), as well as for offering respiratory support to newborn infants. With a focus on developing innovative gas-based therapies to meet the evolving medical requirements of patients, the market for industrial gases used in the healthcare sector is expected to experience significant growth in North America in the coming years.

Industrial gases such as nitrogen, oxygen, hydrogen, and carbon dioxide are extensively used in the chemicals & energy industry for various applications. Nitrogen is a versatile gas widely used for pressurizing chemical liquids in pipelines. It also serves as a protective medium for oxygen-sensitive materials and helps eliminate volatile organic chemicals (VOCs) from process streams. Nitrogen is increasingly used as an inert gas in energy generation plants. It acts as a blanket to isolate critical products from the air.

Country Insights

在北美产品市场的增长can be attributed to the surged demand for these gases from various end-use industries such as energy and chemicals, food & beverages, and healthcare in the region. Moreover, the leading industrial gas companies such as Linde plc, Air Liquide, and Messer constitute a majority of the share of the market in the region owing to the high demand for compressed and cryogenic gases offered by them in North America. These players have multiple production plants in different counties across the region. For instance, Linde plc has its production facilities primarily in the U.S., Canada, and Mexico in North America.

The U.S. has emerged as one of the major producers and consumers of industrial gases owing to the presence of a large number of industrial gas manufacturers such as Air Liquide, Linde plc, Messer, and Air Products and Chemicals in the country. The growing healthcare industry in the U.S. and the increasing research and development activities related to this industry owing to the spread of the COVID-19 pandemic have propelled the demand for the product in the country.

Moreover, the growth of the healthcare industry in the U.S. is driven by the surging demand for quality health services, the increasing elderly population base, and rising instances of chronic ailments. According to the U.S. Census Bureau, over 16.8% of people in the country were aged 65 years and above in 2021, thereby fueling the demand for an advanced healthcare system in the U.S. Thus, the surging demand for healthcare services in the country is expected to drive the consumption of industrial gases such as oxygen and nitrogen used in medical applications in the U.S. in the coming years

Key Companies & Market Share Insights

Some key companies actively operating in this market are Air Products & Chemicals Inc.; The Linde Group; Air Liquide; and Messer Group. Companies adopt expansion strategies to increase the reach of their products in the market and the availability of their products and services in diverse geographical areas.

For instance, Linde plc in February 2022 designed, built, and acquired a new hydrogen production facility in France, effectively doubling its current capacity by the first half of 2024. This plant will help meet the rising demand for hydrogen from Linde's nearby merchant customers as well as supply BASF's new hexamethylenediamine (HMD) manufacturing facility.

Players also adopt product development strategies to increase market share by serving more end-use industries and the availability of their products and services in diverse geographical areas. For instance, Air Liquide in January 2023 signed multiple long-term on-site contracts for its Industrial Merchant business line providing customers with nitrogen, oxygen, or hydrogen, particularly in the expanding markets of glass, metals, water purification, and secondary electronics. Some prominent players in the North America industrial gases market include:

Messer North America, Inc.

Air Products and Chemicals, Inc.

Linde plc

Air Liquide

Matheson Tri-Gas, Inc

BASF SE

MESA Specialty Gases & Equipment

Universal Industrial Gases, Inc.

North America Industrial Gases Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

327.1亿美元 |

Revenue forecast in 2030 |

USD 50.17 billion |

Growth Rate |

CAGR of 6.2% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, application by product, country |

Regional scope |

U.S.; Canada; Mexico |

Market Players |

Messer North America, Inc.; Air Products and Chemicals, Inc.; Linde plc; Air Liquide; Matheson Tri-Gas, Inc.; BASF SE; MESA Specialty Gases & Equipment; Universal Industrial Gases, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

North America Industrial Gases Market Report Segmentation

This report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America industrial gases market report based on product, application, application by product, and country:

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Nitrogen

Cryogenic/Liquefied

Compressed

Hydrogen

Cryogenic/Liquefied

Compressed

Carbon Dioxide

Cryogenic/Liquefied

Compressed

Oxygen

Cryogenic/Liquefied

Compressed

Argon

Cryogenic/Liquefied

Compressed

Acetylene

Cryogenic/Liquefied

Compressed

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Healthcare

Manufacturing

Metallurgy & Glass

Food & Beverages

Retail

Chemicals & Energy

Others

Application by Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Healthcare

Nitrogen

Cryogenic/Liquefied

Compressed

Hydrogen

Cryogenic/Liquefied

Compressed

Carbon Dioxide

Cryogenic/Liquefied

Compressed

Oxygen

Cryogenic/Liquefied

Compressed

Argon

Cryogenic/Liquefied

Compressed

Acetylene

Cryogenic/Liquefied

Compressed

Manufacturing

Nitrogen

Cryogenic/Liquefied

Compressed

Hydrogen

Cryogenic/Liquefied

Compressed

Carbon Dioxide

Cryogenic/Liquefied

Compressed

Oxygen

Cryogenic/Liquefied

Compressed

Argon

Cryogenic/Liquefied

Compressed

Acetylene

Cryogenic/Liquefied

Compressed

Metallurgy & Glass

Nitrogen

Cryogenic/Liquefied

Compressed

Hydrogen

Cryogenic/Liquefied

Compressed

Carbon Dioxide

Cryogenic/Liquefied

Compressed

Oxygen

Cryogenic/Liquefied

Compressed

Argon

Cryogenic/Liquefied

Compressed

Acetylene

Cryogenic/Liquefied

Compressed

Food & Beverages

Nitrogen

Cryogenic/Liquefied

Compressed

Hydrogen

Cryogenic/Liquefied

Compressed

Carbon Dioxide

Cryogenic/Liquefied

Compressed

Oxygen

Cryogenic/Liquefied

Compressed

Argon

Cryogenic/Liquefied

Compressed

Acetylene

Cryogenic/Liquefied

Compressed

Retail

Nitrogen

Cryogenic/Liquefied

Compressed

Hydrogen

Cryogenic/Liquefied

Compressed

Carbon Dioxide

Cryogenic/Liquefied

Compressed

Oxygen

Cryogenic/Liquefied

Compressed

Argon

Cryogenic/Liquefied

Compressed

Acetylene

Cryogenic/Liquefied

Compressed

Chemicals & Energy

Nitrogen

Cryogenic/Liquefied

Compressed

Hydrogen

Cryogenic/Liquefied

Compressed

Carbon Dioxide

Cryogenic/Liquefied

Compressed

Oxygen

Cryogenic/Liquefied

Compressed

Argon

Cryogenic/Liquefied

Compressed

Acetylene

Cryogenic/Liquefied

Compressed

Others

Nitrogen

Cryogenic/Liquefied

Compressed

Hydrogen

Cryogenic/Liquefied

Compressed

Carbon Dioxide

Cryogenic/Liquefied

Compressed

Oxygen

Cryogenic/Liquefied

Compressed

Argon

Cryogenic/Liquefied

Compressed

Acetylene

Cryogenic/Liquefied

Compressed

Regional Outlook(Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

U.S.

Canada

Mexico

Frequently Asked Questions About This Report

b.The North America industrial gases market size was estimated at USD 31.0 billion in 2022 and is expected to reach USD 32.71 billion in 2023

b.The North America industrial gases market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 50.1 billion by 2030.

b.Oxygen dominated the North America industrial gases market with a share of 38.1% in 2022. This is attributed to the versatility and essentiality of oxygen making it a vital component in the chemicals and healthcare industries.

b.一些关键球员操作在北美dustrial gases market include Messer North America, Inc., Air Products and Chemicals, Inc., Linde plc, Air Liquide, Matheson Tri-Gas, Inc, BASF SE, MESA Specialty Gases & Equipment, Universal Industrial Gases, Inc..

b.Key factors that are driving the market growth include increasing ongoing industrialization and increasing application of these gases in various industries such as healthcare, manufacturing, metallurgy, and food & beverages. in North America.