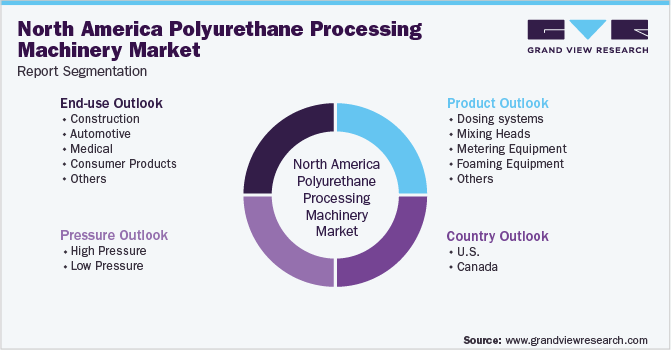

North America Polyurethane Processing Machinery Market Size, Share & Trends Analysis Report By Product (Dosing Systems, Mixing Heads), By Pressure (High Pressure, Low Pressure), By End-use, By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-035-1

- Number of Pages: 137

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Advanced Materials

Report Overview

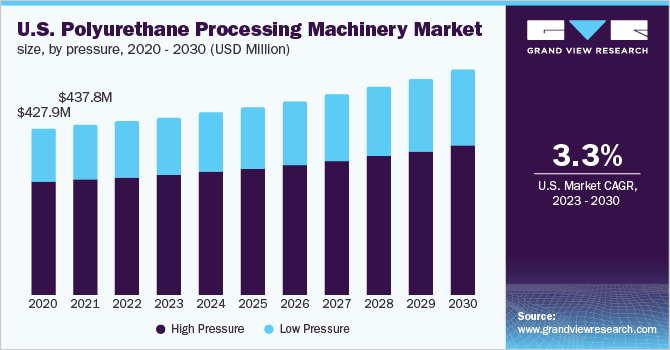

的North America polyurethane processing machinery market size was estimated at USD 550.9 million in 2022 and is expected to expand at a compounded annual growth rate (CAGR) of 3.4% from 2023 to 2030. The growing application of polyurethane in the medical field and related new developments are expected to facilitate the growth. The COVID-19 outbreak had a severe effect on the market globally. Construction, automotive, manufacturing, and other sectors remain closed for the majority of months in the year 2020 as a result of supply chain disruption and constraints. As a result, demand for the polyurethane processing unit decreased, impacting industry expansion.

存在明显的老年人口, advanced healthcare infrastructures, and high discretionary income of patients in the country act as drivers for the growth of the healthcare sector in the U.S. Some of the reasons driving the development of thepolyurethane processing machinery marketin the country include increasing demand for medical equipment and growing healthcare expenditure in the U.S.

A few major pharmaceutical companies, including Johnson & Johnson, 3M Health Care Business, Abbott Laboratories, and Pfizer Inc., have their presence in the U.S. Moreover, the rapid growth of the U.S. pharmaceutical industry is expected to augment the demand for medical devices in the country. Ongoing advancements in the field of surgeries in the country in the form of method standardization and technological progressions are anticipated to lead to the flourishing healthcare sector in the U.S.

This, in turn, contributes to the surged usage of polyurethane processing technology for developing medical components in the region. For instance, Hennecke Inc. set up its new North American headquarters in Pittsburgh, Pennsylvania, U.S., which has a research and development laboratory, a modern parts warehouse, and areas for machinery repair and mixed rebuilding services.

的U.S. polyurethane processing machinery market’s growth is anticipated to be driven by increasing polyurethane foam production operations for use in mattresses, carpets, andfurniture. For instance, the Returning American Manufacturing Potential Act, which was launched in August 2022, is anticipated to support domestic small and medium-sized manufacturing companies and accelerate the processing of polyurethane, increasing demand for machinery.

In addition, it is predicted that new residential and commercial construction will increase demand for polyurethane processing. A common insulating material for cavity walls, roofs, floors, and around pipes in structures is polyurethane. Demand for new building construction and ancient building repair is being driven by population growth and urbanization. For instance, the growing need for developing green buildings also plays a significant role in fostering low-carbon economic growth and guaranteeing a clean energy transition as more firms and governments try to reach carbon neutrality by 2050. Therefore, the growing importance of green buildings is expected to fuel the demand.

Product Insights

的mixing heads product segment accounted for more than 30.0% of the revenue share in 2022. Mixing heads are responsible for the mixing of the chemicals supplied by the previous system and later distribute the mixture or blend through various methods such as spraying and closed or open pouring. Various types of mixing heads used in polyurethane processing machinery include straight-style mix heads, L-Style mix heads, and spray-style mix heads

的dosing systems product segment accounted for 20.3% of the revenue share in 2022. Dosing systems are the equipment used for the injection and spraying of PU elastomers and foams in closed and open molds. These systems are also used as protective coatings to reinforce, insulate, seal, and protect the surface. Dosing parts are required for any chemical reaction and are designed to match the process parameters and properties of the chemicals.

武器装备的发泡pment segment is likely to grow at a CAGR of 4.9% over the forecast period. Polyurethane foaming equipment is used to foam integral skin, rebound elastic material, and hard materials such as panels, shoe soles, rotationally molded products, hollow structures, and transfer pumps. PU foaming equipment is majorly used for manufacturing molded components, non-continuous rigid foam, self-skinning foam, and cold-curing foam. The applications of different types of foams include decoration, furniture, refrigerators, insulation materials, and various components of automobiles.

Metering units can be either low or high-pressure. Regardless of classification, the units are required to maintain and deliver a high level of precision, often within ±1%. Low-pressure machines can handle as many individual components as needed to meet formulation requirements, whereas high-pressure devices are normally limited to two or three components. For applications such as pour-in-place gaskets, output capabilities range from a few ounces or milliliters per second to 1000 lb/min or more

Pressure Insights

的high-pressure segment accounted for more than 67.5% of the revenue share in 2022. High-pressure polyurethane processing machinery includes precision metering pumps and high-pressure mix heads used for producing PU flexible foams, rigid foams, and PU skin foams. High-pressure machines provide high-quality foam with uniform cell structure and superior insulation performance. The high-polyurethane processing machinery market is projected to grow significantly over the forecast period as the product offers wide mixing ratios, stable laminar flow, short cycle times, short lead time, accurate injection time, easy maintenance, and excellent control options.

的low-pressure segment is likely to grow at a CAGR of 3.9% during the forecast period. Several applications that require higher viscosities, smaller quantities, or different levels of viscosity among the various chemicals used in a mixture are supported by low-pressure PU processing machines. Many industries use low-pressure PU processing equipment, especially those that need polyurethane coatings, sealants, elastomers, and adhesives. For instance, in the automobile sector, these devices are used to produce gloss and guarantee color retention in vehicle coatings, protecting the vehicle from corrosion and scratches.

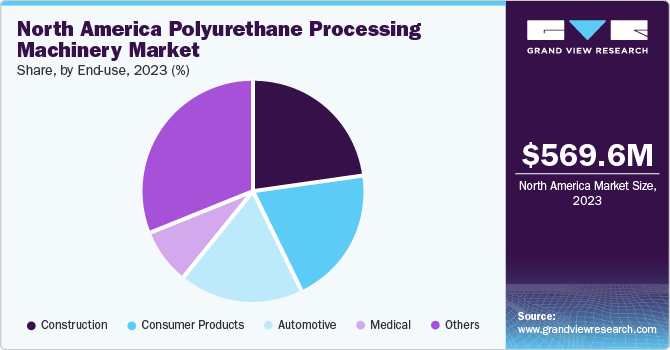

End-use Insights

的other end-use segment which includes insulation equipment, turntable systems, overhead track systems, and floor track systems dominated the market in 2022 with a share of 31.5%. PU insulation equipment is used in domestic and professional refrigeration such as in the production of the thermos, ice machines, and vending machines, as well as refrigerated cells, cabinets, and doors

的stringent regulations about green buildings in the U.S. are expected to augment the demand for polyurethane as an insulation material. The ability of the material to reduce heat loss in buildings during cold weather and keep buildings cool in hot temperatures aids its penetration as an insulating material in cavity walls, roofs, pipes & boilers, and floors.

的automotive end-use segment is likely to grow at a CAGR of 4.2% during the forecast period. Polyurethane is used in the automotive industry owing to its ability to provide protection and comfort.Polyurethane foamsare used in various interior components such as headrests, armrests, and seats owing to their cushioning property, which aids in reducing the stress and fatigue associated with driving. Furthermore, polyurethane is used for providing insulation against the noise and heat of the engine.

Medical-grade polyurethane foam is used in various devices that are implanted in the body as it is highly compatible with the human body. Mix heads and metering machines help ensure precise molding and mixing of the medical-grade PU foam. Properties of PU foam, such as high biocompatibility, tear resistance, abrasion resistance, toughness, and flexibility, aid its penetration into the medical industry.

Country Insights

的expansion of the industrial sector and rising investment levels are predicted to be the main drivers of demand for polyurethane processing equipment in North America. North America is expected to experience significant growth during the projected period, led by expanding industrialization in Canada.

的U.S. led the market and accounted for 81.1% of the revenue share in 2022. The presence of a significant geriatric population, advanced healthcare infrastructures, and high discretionary income of patients in the country act as drivers for the growth of the healthcare sector in the U.S. Some of the reasons driving the development of the polyurethane processing machinery market in the country include increasing demand for medical equipment and growing healthcare expenditure in the U.S.

Canada is likely to grow at a CAGR of 3.6% during the forecast period. The prevalence of chronic diseases in Canada such as hypertension 25%, osteoarthritis 14%, diabetes 11%, asthma 11%, chronic obstructive pulmonary disease 10%, cancer 8%, and dementia 7% has led to the surged demand for medical devices. Polyurethane is used in medical applications as it is highly flexible, as well as resistant to chemicals and abrasion. It is compatible with the human body. The increasing demand for medical products developed from polyurethane and the rising healthcare expenditure in Canada are expected to drive the market’s growth in the country.

Canada's ethnic diversity and growing consumer discretionary income level offer a wide range of food and consumer goods selling options. E-commerce provides significant potential for U.S.-based exporters who want to enter the Canadian market by connecting the nation's industrial, governmental, and consumer buying channels. For instance, over 27 million people used e-commerce in Canada in 2021, and it's predicted that by 2025, retail e-commerce sales will reach USD 40.3 billion. Thus, the growing e-commerce industry will drive the demand for polyurethane processing machinery for consumer products in Canada.

Key Companies & Market Share Insights

的manufacturers adopt several strategies, including acquisitions, mergers, joint ventures, new product developments, and geographical expansions, to enhance market penetration and cater to the changing technological requirements from various end-use such as automotive, construction, medical, consumer goods, and others

For instance, in October 2022, Krauss Maffei launched two new addictive manufacturing lines. A long-lasting 405-nm industrial laser, an automated build plate changer, and two tan systems are the foundation of the machine. According to the manufacturer, handling and assembling of parts can be done separately using the tank system.

In addition, in February 2021, Graco Inc. launched Voltex Dynamic Mix Valve, which is designed for dispensing two-component foaming urethanes and silicones, and it delivers uniform and constant blending of difficult-to-dispense chemicals for a variety of applications. This valve is particularly useful in upcoming applications of electric vehicle (EV) batteries such as foam encapsulationSome prominent players in the North America polyurethane processing machinery market include:

KraussMaffei

Hennecke Inc.

Cannon USA, Inc.

FRIMO

Hunter Polyurethane Equipment

ESCO

Linden Industries, LLC

MAX PROCESS EQUIPMENT, LLC

Polyurethane Machinery Corporation

Graco Inc.

North America Polyurethane Processing Machinery Market Report Scope

Report Attribute |

Details |

Revenue forecast in 2030 |

USD 717.2 million |

Growth rate |

CAGR of 3.4% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, pressure, end-use, country |

Country Scope |

U.S.; Canada |

Key companies profiled |

KraussMaffei; Hennecke Inc.; Cannon USA, Inc.; FRIMO; Hunter Polyurethane Equipment; ESCO; Linden Industries, LLC; MAX PROCESS EQUIPMENT, LLC; Polyurethane Machinery Corporation; Graco Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

North America Polyurethane Processing Machinery Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America polyurethane processing machinery market report based on product, pressure, end-use, and country:

Product Outlook (Revenue, USD Million, 2018 - 2030)

Dosing systems

By Pressure

By End-use

Mixing Heads

By Pressure

By End-use

Metering Equipment

By Pressure

By End-use

Foaming Equipment

By Pressure

By End-use

Others

By Pressure

By End-use

Pressure Outlook (Revenue, USD Million, 2018 - 2030)

High Pressure

Low Pressure

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Construction

Automotive

Medical

Consumer Products

Others

Country Outlook (Revenue, USD Million, 2018 - 2030)

U.S.

Canada

Frequently Asked Questions About This Report

b.的North America polyurethane processing machinery market size was estimated at USD 550.9 million in 2022 and is expected to reach USD 562.1 million in 2023

b.的North America polyurethane processing machinery market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.4% from 2023 to 2030 to reach USD 717.2 million by 2030

b.U.S. dominated the North America polyurethane processing machinery market with a revenue share of 81.0% in 2022. The presence of a significant geriatric population, advanced healthcare infrastructures, and high discretionary income of patients in the country act as drivers for the growth of the healthcare sector in the U.S. Some of the reasons driving the growth of the polyurethane processing machinery market in the country include increasing demand for medical equipment and growing healthcare expenditure in the U.S.

b.Some of the key players operating in the North America polyurethane processing machinery market include KraussMaffei, Hennecke Inc., Cannon USA, Inc., FRIMO, Hunter Polyurethane Equipment, ESCO, and among others.

b.的key factors that are driving the North America polyurethane processing machinery market include the growing usage of polyurethane in the medical sector and associated new developments are predicted to facilitate the growth of the market for polyurethane processing equipment.