North America Silicone Market Size, Share & Trends Analysis By Product (Fluids, Gels, Resins, Elastomers), By End-use (Electronics, Transportation, Construction, Energy, Healthcare), By Region, And Segment Forecasts, 2023 - 2030

- 代表ort ID: GVR-4-68040-107-0

- Number of Pages: 133

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Bulk Chemicals

代表ort Overview

TheNorth America silicone market sizewas estimated atUSD 4.28 billion in 2022and is projected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. The market is poised for growth due to increasing demand across multiple industries, such as automotive, construction, electronics, healthcare, and consumer goods. Silicone's versatility and wide range of applications, including sealants, adhesives, coatings, andelastomers, make it a sought-after material. In addition, the market is driven by the growing emphasis on sustainability, as silicone offers eco-friendly properties, recyclability, durability, and low toxicity. Technological advancements in silicone manufacturing processes and product innovations are further contributing to market expansion, enabling improved performance, and opening doors to new applications over the forecast period.

![]()

The U.S. silicone market is expected to perform moderately owing to limited opportunities by market maturity of both manufacturing industries in general and the use of silicones. However, continuous product innovation and ongoing technological developments are expected to promote the application of silicone in emerging markets, such aselectric vehicles(EVs) and health & personal care, which, in turn, is expected to fuel the market growth over the forecast period. Moreover, suppliers continue gaining market share through value-added product development and creating inroads into applications that conventionally use other materials.

Several states in the U.S., including California, New Jersey, Washington, and Louisiana, are using tax credits, exemptions, and rebates to fuel the procurement of EVs. New Jersey and Washington exempt EVs' sale and use tax, while California offers rebates to plug-in hybrid electric vehicles (PHEVs) and other light-duty zero-emission vehicles. These tax incentive programs implemented by different states in the U.S. are likely to boost the market for EVs, which, in turn, is projected to fuel the consumption of silicone over the forecast period. The silicone market in the U.S. is witnessing significant growth and playing a pivotal role in various industries. Silicone, a versatile polymer known for its exceptional properties, is finding widespread applications across the country.

Product Insights

In terms of product, the fluid segment led the market and held a revenue share of over 44.0% in 2022. This growth can be attributed to its remarkable versatility and widespread utility. Silicone fluids exhibit a broad spectrum of viscosities, allowing them to serve a multitude of industries and applications. Their adaptability makes them a vital ingredient in a diverse range of products, including personal care items like shampoos and cosmetics, automotive fluids for lubrication and cooling, and various industrial applications. The exceptional thermal stability of silicone fluids makes them suitable for high-temperature environments, and their excellent electrical insulation properties add to their appeal in electronic and electrical applications.

The dominance of the fluid segment is reinforced by the reliability and trust that the industry places in silicone fluids. Their resistance to extreme temperatures, chemical inertness, and low toxicity make them a preferred choice in critical applications. In addition, the ease of handling and formulation flexibility further bolster their popularity among manufacturers. Therefore, the fluid segment has firmly established itself as the go-to solution in the North America silicone industry, meeting the diverse demands of different industries and solidifying its position as the primary driver of the market's growth.

End-use Insights

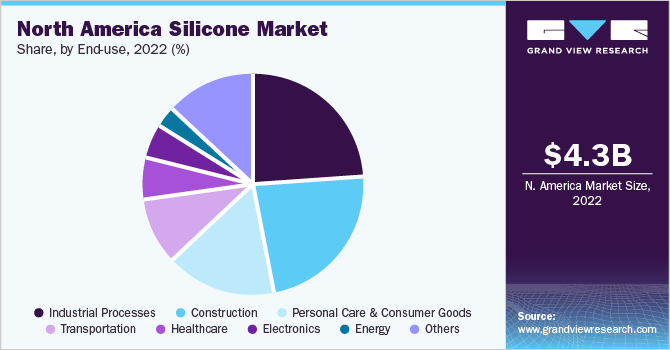

In terms of end-use, the industrial processes segment led the market and held a revenue share of more than 23.0% in 2022. This is attributed to the remarkable properties of silicone that cater to a wide array of industrial applications. Silicone's unique characteristics, such as high thermal stability, excellent electrical insulation, and resistance to chemicals, make it highly sought after in various industrial settings. Silicone finds extensive use in industries such as automotive, electronics, construction, and aerospace, where it serves as a crucial component in coatings, lubricants,adhesives and sealants. Its ability to withstand extreme temperatures and harsh environments makes it invaluable in industrial processes, where reliability and performance are of utmost importance.

The adaptability of silicone to different manufacturing processes further solidifies its dominance in the industrial sector. Its versatility allows it to be molded into various forms, such as gels, fluids, and rubbers, making it an ideal material for diverse industrial applications. With such a wide range of benefits and applications, the industrial processes segment continues to drive the growth of the North America Silicone industry, meeting the specialized needs of industries and contributing to technological advancements across various sectors.

Regional Insights

The U.S. dominated the market and held the largest revenue share of over 88.0% in 2022. This is attributed to its robust industrial and economic landscape. The U.S. is home to a diverse range of industries, such as automotive, electronics, healthcare, and construction, which are significant consumers of silicone-based products. Its strong manufacturing base and extensive research and development activities facilitate the widespread adoption of silicone in various applications. Moreover, the country's emphasis on innovation and technological advancements further bolsters its position as a key player in thesilicone market.

The U.S. benefits from a well-established infrastructure and a mature market for silicone products, making it an attractive destination for silicone manufacturers and suppliers. Its favourable regulatory environment and strong intellectual property protection also encourage investments in the silicone industry. Therefore, the U.S. stands at the forefront of the North America Silicone Market, contributing significantly to the region's overall growth and continuing to drive advancements in silicone technology across a broad spectrum of industries.

Key Companies & Market Share Insights

在北美有机硅行业,主要玩ers have integrated their raw material production and distribution operations ensuring product quality and expanding their regional presence. This strategic move grants them a competitive edge by lowering costs and boosting profit margins. To remain at the forefront, these companies are actively engaging in research and development, creating innovative products that meet evolving market demands and end-user requirements.

For instance, in January 2023, Dow Inc., one of the leading chemical producers, launched an innovative line of liquid silicone rubbers called the SILASTIC SA 994X LSR series. This new range of rubbers boasts unique features including primer-less adhesion, self-adhesive properties, and self-lubrication. Specifically designed for two-component injection molding with thermoplastic substrates, these liquid silicone rubbers are strategically targeted toward the mobility and transportation industries. The SILASTIC SA 994X LSR series provides manufacturers in these sectors with a reliable and efficient solution that simplifies the production process, enhances performance, and ensures long-lasting durability for various applications in the mobility and transportation sectors.

Research activities focused on new materials, which combine several properties, are anticipated to gain wide acceptance in this industry in the coming years. Some prominent companies manufacturing these products include Dow Inc., Elkem ASA, Evonik Industries, GELEST, INC., Shin-Etsu Chemical Co. Ltd, Wacker Chemie AG, HEXPOL AB., and CRI-SIL Silicone Technologies, LLC. Some prominent players in the North America silicone market include:

CHT Group

Dow Inc.

Elkem ASA

Evonik Industries

GELEST, INC.

Jiangsu Mingzhu Silicone Rubber Material Co., Ltd.

KCC CORPORATION

Kaneka Corporation

Momentive

Shin-Etsu Chemical Co. Ltd

Wacker Chemie AG

HEXPOL AB.

Silchem Inc.

Specialty Silicone Products, Inc.

Illinois Tool Works Inc.

Abbvie Inc.

CRI-SIL Silicone Technologies, LLC

North America Silicone Market代表ort Scope

代表ort Attribute |

Details |

Market size value in 2023 |

USD 4.56 billion |

203年的收入预测0 |

USD 6.69 billion |

Growth rate |

CAGR of 5.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Volume in kilotons; revenue in USD million, and CAGR (%) from 2023 to 2030 |

代表ort coverage |

Revenue and volume forecast, company profiles, competitive landscape, growth factors, and trends |

Segments covered |

Product, end-use, region |

Regional scope |

North America |

Country Scope |

U.S.; Canada; Mexico |

Key companies profiled |

CHT Group; Dow Inc.; Elkem ASA; Evonik Industries; GELEST, INC.; Jiangsu Mingzhu Silicone Rubber Material Co., Ltd.; KCC CORPORATION; Kaneka Corporation; Momentive; Shin-Etsu Chemical Co. Ltd; Wacker Chemie AG; HEXPOL AB.; Silchem Inc.; Specialty Silicone Products, Inc.; Illinois Tool Works Inc.; Abbvie Inc.; CRI-SIL Silicone Technologies, LLC |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

North America Silicone Market代表ort Segmentation

This report forecasts revenue and volume growth at regional and country levels and provides an analysis of the industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the North America silicone market report based on product, end-use, and region:

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Fluids

Straight Silicone Fluids

Modified Silicone Fluids

Gels

Resins

Elastomers

High Temperature Vulcanized

Liquid Silicone Rubber

Room Temperature Vulcanized (RTV)

Others

Adhesives

Emulsions

最终用途前景(体积,吨当量;收入,Mi美元llion, 2018 - 2030)

Electronics

Transportation

Construction

Healthcare

Personal Care and Consumer goods

Energy

Industrial Processes

Others

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

U.S.

Canada

Mexico

Frequently Asked Questions About This Report

b.The North America silicone market size was estimated at USD 4.28 billion in 2022 and is expected to reach USD 4.56 billion in 2023.

b.The North America silicone market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 6.69 billion by 2030.

b.The fluid product segment dominated the North America silicone market with a revenue share of over 44.0% in 2022. This is primarily driven by its exceptional thermal stability, excellent electrical insulating properties, and its diverse applications across various industries, making it a preferred choice for numerous manufacturing processes and end-use industries such as electronics, transportation, construction, healthcare, personal care, and consumer goods, energy, industrial processes.

b.Some key players operating in the North America silicone market include CHT Group, Dow Inc., Elkem ASA, Evonik Industries, GELEST, INC., Jiangsu Mingzhu Silicone Rubber Material Co., Ltd., KCC CORPORATION, Kaneka Corporation, Momentive, Shin-Etsu Chemical Co. Ltd, Wacker Chemie AG, HEXPOL AB., Silchem Inc., Specialty Silicone Products, Inc., Illinois Tool Works Inc., Abbvie Inc., CRI-SIL Silicone Technologies, LLC.

b.Key factors that are driving the North America silicone market growth include growing construction activities that are pushing the demand for silicone.