North America Traditional Toilet Seat Market Size, Share & Trends Analysis Report By Bowl Shape (Elongated, Round), By Raw Material, By Application, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- 代表ort ID: GVR-4-68040-130-3

- Number of Pages: 95

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

代表ort Overview

TheNorth America traditional toilet seat market sizewasUSD 892.3 million in 2022和预期的年复合增长growth rate (CAGR) of 5.5% from 2023 to 2030. The market is expected to experience significant growth in North America over the coming years due to the expansion of real estate and the rise in commercial construction. The market has regained its footing since the COVID-19 pandemic and has been witnessing strong demand in the post-pandemic environment as more consumers across developing countries plan on remodeling their houses and upgrading their restrooms.

The sustainability trend in North America is driving the emergence of traditional toilet seats crafted from eco-friendly materials. Manufacturers are now utilizing renewable resources such as bamboo, reclaimed wood, andrecycled plasticsto create durable and biodegradable toilet seats. For instance, in January 2023, Bemis Manufacturing Company, a prominent manufacturer of bidet and toilet seats, in North America announced the launch of “Greenleaf”, an innovative product crafted entirely from 100% recycled plastic. This eco-conscious seat and cover are constructed using post-industrial recycled plastic, ensuring durability while minimizing environmental impact.

Moreover, the expanding commercial sector in North America will propel the demand for traditional toilet seats. In schools, offices, and similar institutional settings with high restroom usage and diverse users, the need for hygienic and safe toilet seats is vital. Durable options reduce replacements and upkeep. These institutions often opt for cost-effective, enduring products that cater to user requirements. In 2019-2020, the presence of 98,577 public schools, 30,492 private schools, and 3,982 degree-granting post-secondary institutions emphasizes the demand for traditional toilet seats.

With the increasing costs of housing and mortgage rates, homeowners in North America are more frequently involved in home remodeling or improvement projects aimed at altering their conventional household layouts. According to the 2022 U.S. Houzz Bathroom Trends report, the median expenditure for primary bathroom projects nationwide increased by almost 13% as compared to 2021, reaching USD 9,000. In addition, individuals undertaking major bathroom renovations that involve upgrading the toilet allocated three times more funds toward their renovations compared to those undertaking minor renovations (USD 15,000 versus USD 5,000, respectively).

In addition, with the expanding real estate and commercial construction sectors, the bathroom fittings market is expected to grow in the coming years in the North American region. According to the Redfin Corporation, a residential real estate brokerage, the U.S. housing market’s value hit USD 46.8 trillion in June 2023. The increasing infrastructural developments as well as new building permits in the region are expected to boost the market. This expansion is anticipated to boost the demand for traditional toilet seats in both commercial and residential settings.

Innovations in terms of appearance, functionality, and sustainability offer various opportunities for market players to expand their product portfolio, boosting the market growth of traditional toilet seats in North America. Kohler Co. offers a manual bidet toilet seat crafted fromplastic. This innovative product features a dual function, delivering ambient water for both front and rear cleansing. In addition, its manually operated handle eliminates the need for batteries or electrical power.

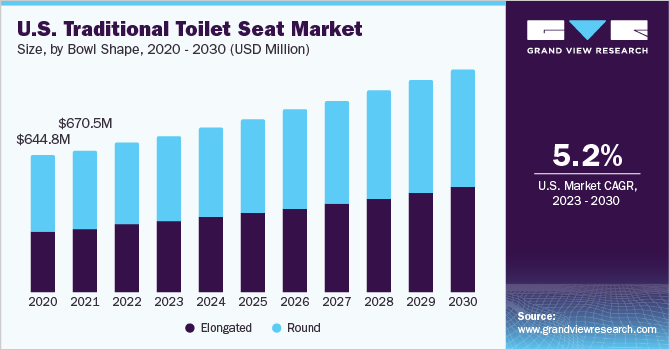

Bowl Shape Insights

In terms of bowl shape, the round shape bowl segment dominated the market with a revenue share of over 55.3% in 2022. The main benefit of a round toilet lies in its ability to fit snugly into smaller bathroom areas, offering a space-efficient solution. It is particularly suitable for children's use, and some households install round toilets in kids' bathrooms. Due to its space-efficient design, rounded traditional toilet seats are primarily utilized in residential environments. Consumers frequently exhibit a preference for implementing eco-friendly solutions in such cases.

The elongated shape bowl segment is projected to grow at a CAGR of 6.0% in the North America market. This elongated shape is favored for its aesthetics and may suit taller individuals. Moreover, elongated bowls can offer better accessibility for people with disabilities, and the Americans with Disabilities Act (ADA) necessitates elongated toilets in public restrooms. Residential consumers in the region who prioritize eco-friendliness aim to install toilet seats crafted from sustainable materials.

Raw Material Insights

In terms of raw material, the polypropylene material segment dominated the North America market in 2022 with a revenue share of around 42.5%. Polypropylene, known for its cost-effectiveness and resistance to scratches and stains, is an ideal choice for consumers seeking a toilet seat that is easy to maintain. This material's durability and stain-resistant properties are particularly well-suited for homes and those desiring a cost-effective option.

The wooden traditional toilet seat segment is set to grow at a CAGR of about 6.4% in the forecast period. Wooden toilet seats have superior strength and a polished finish. They are also heavier and are warmer to the touch. Wooden toilet seats are available in cover patterns that complement the overall design theme. These seats offer greater durability and are available in various finishes and styles. They are especially suited for consumers who prefer a rustic or traditional bathroom ambiance.

Application Insights

In terms of application, the residential segment dominated the North American market in 2022 with a revenue share of about 65%. As per the housing layout patterns in America, almost all the bedrooms have an attached washroom. According to the U.S. Census Bureau, in 2022, out of 368,000 multi-family units, 139,840 had two bedrooms, and 40,480 had three or more bedrooms. The higher the number of bedrooms, the greater the number of bathrooms, leading to increased demand for traditional toilet seat installations in residential application.

Commercial application of traditional toilet seats in North America is set to grow at a CAGR of about 6.3%. The rapid expansion of the hospitality sector is likely to contribute to the demand for traditional toilet seat installations. According to the U.S. Hotel Construction Pipeline Trend Report by Lodging Econometrics in 2023, at the close of the second quarter of 2023, the hotel construction pipeline stood at 5,572 projects with 660,061 rooms, with projects up 7% year-over-year and rooms up 6% year-over-year. Such trends in the hotel industry are anticipated to boost the demand for high-end traditional toilet seats in the coming years.

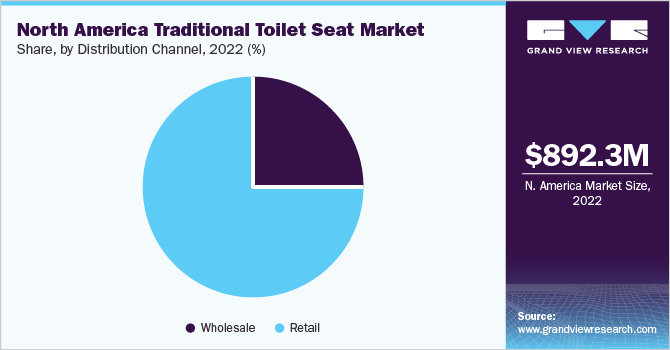

Distribution Channel Insights

In terms of distribution channel, the retail channel segment dominated the North American market in 2022 with a share of about 75%. Additional discounts and product diversity in big-box retail stores significantly influence consumer buying behavior. These large-scale retail outlets attract a substantial portion of the consumer market due to their extensive offerings and competitive prices. According to a supply chain survey conducted by CNBC in 2023, around 67% of consumers look for discounts before buying in retail stores like Walmart.

The wholesale channel segment is projected to grow at a CAGR of 6.3% in the forecast period. The growing number of commercial establishments in the region directly fuels the demand for toilet seats. Manufacturers often partner with local specialty stores to provide bulk products. Compliance with ADA regulations drives bulk purchases of accessible toilet seats. Bwanaz is a renowned U.S. wholesale supplier, partnering with prominent retail chains such as Walmart. Collaborating with leading American manufacturers, Bwanaz aids local businesses by offering a spectrum of top-tier products.

Regional Insights

In 2022, the U.S. emerged as the industry leader in the traditional toilet seat market in North America, capturing a significant share of over 78%. The increased awareness about hygiene and demand for comfort and convenience has led to improved design and innovation in the traditional toilet seat market in the U.S. For instance, in June 2023, Cleana, a Boston-based technology company, and a team of engineers from Boston University and Massachusetts Institute of Technology developed a semi-automatic toilet seat that raises or lowers itself to improve hygiene.

Mexico is expected to grow at the fastest CAGR of about 7.0% in the traditional toilet seat market in North America. Bemis Manufacturing Co., a toilet seat manufacturer based in Wisconsin, U.S. expanded its presence in Mexico. As the demand for bathroom fixtures, including traditional toilet seats, continues to rise in Mexico, Bemis's expansion equips the company to effectively cater to this demand. The company completed the expansion of its Monterrey, Mexico facility in July 2017 to cater to its expanding customer base in the country. Bemis specializes in manufacturing bathroom goods, and one of its primary products is toilet seats.

Key Companies & Market Share Insights

The market for traditional toilet seats in North America is a blend of established players, evolving technologies, and changing consumer demands. A major focus of these companies has been on product launches and acquisitions.

For instance, in November 2022, LIXIL Corporation’s subsidiary brand, American Standard, introduced the City Collection of bathroom fixtures tailored to optimize space and streamline cleaning, ideal for urban living. Within this collection, the CrystaSleek toilet seat and cover stand out, utilizing a dual injection molding technique to create a refined, streamlined, and enduring design.

For instance, in January 2021, Bemis Manufacturing Company acquired Bio Bidet, a company focused on expanding the adoption of toilet seats and bidets in the U.S. With this move Bemis Manufacturing Company aims to use its market penetration and distribution network to complement the production offering and engineering capabilities of Bio Bidet.

Some prominent players in the North America traditional toilet seat market include:

LIXIL Corporation

Kohler Co.

TOTO USA

Centoco

Delta Faucet Company

Bemis Manufacturing Company

Ginsey Home Solutions

Ferguson (PROFLO)

Topseat

Jones Stephens

Plumbing Technologies, LLC

North America Traditional Toilet SeatMarket代表ort Scope

代表ort Attribute |

Details |

Market size value in 2023 |

USD 939.0 million |

Revenue forecast in 2030 |

USD 1,367.1 million |

Growth rate |

CAGR of 5.5% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million, and CAGR from 2023 to 2030 |

代表ort coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Bowl shape, raw material, application, distribution channel, region |

Regional scope |

North America |

Country scope |

U.S.; Canada; Mexico |

Key companies profiled |

LIXIL Corporation; Kohler Co.; TOTO USA; Centoco; Delta Faucet Company; Bemis Manufacturing Company; Ginsey Home Solutions; Ferguson (PROFLO); Topseat; Jones Stephens; Plumbing Technologies, LLC |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

North America Traditional Toilet SeatMarket代表ort Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America traditional toilet seat market report based on bowl shape, raw material, application, distribution channel, and region:

Bowl Shape Outlook (Revenue, USD Million, 2017 - 2030)

Elongated

Round

Raw Material Outlook (Revenue, USD Million, 2017 - 2030)

Plastic (Other than Polypropylene)

Polypropylene

Wood

Urea Molding Compound

Others

Application Outlook (Revenue, USD Million, 2017 - 2030)

Residential

Commercial

Hospitality & Spa

Institutional

Commercial Spaces

Others

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

Wholesale

Retail

Big Box Retail Stores

Specialty Retail Stores

Home Improvement Stores

Department Stores

Online

Regional Outlook (Revenue, USD Million, 2017 -2030)

North America

U.S.

Canada

Mexico

常见问题关于这个报告

b.The North America traditional toilet seat market was estimated at USD 892.3 million in 2022 and is expected to reach USD 939.0 million in 2023.

b.The North America traditional toilet seat market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 1,367.1 million by 2030.

b.U.S. region dominated the North America traditional toilet seat market with a share of around 78% in 2022. The demand for traditional toilet seats is expected to grow in the U.S. due to ongoing residential construction and renovation projects, as well as the enduring popularity of cost-effective and familiar bathroom fixtures among American consumers.

b.Some key players operating in the North America traditional toilet seat include LIXIL Corporation; Kohler Co.; TOTO USA; Centoco; Delta Faucet Company; Bemis Manufacturing Company; Ginsey Home Solutions; Ferguson (PROFLO); Topseat; Jones Stephens; Plumbing Technologies, LLC.

b.Key factors that are driving the North America traditional toilet seat market growth include growing consumer demand for enhanced bathroom aesthetics and comfort, increased awareness about hygiene and sanitation standards, technological advancements in toilet seat designs, as well as rising environmental concerns leading to the adoption of water-saving and sustainable options.