Oilfield Equipment Market Size, Share & Trends Analysis Report By Product (Drilling Equipment, Pumps & Valves, Field Production Machinery, Others), By Region, And Segment Forecasts, 2015 - 2020

- Report ID: 978-1-68038-173-3

- Number of Pages: 80

- Format: Electronic (PDF)

- 嘘orical Data: 2012-2014

- Industry:Bulk Chemicals

Industry Insights

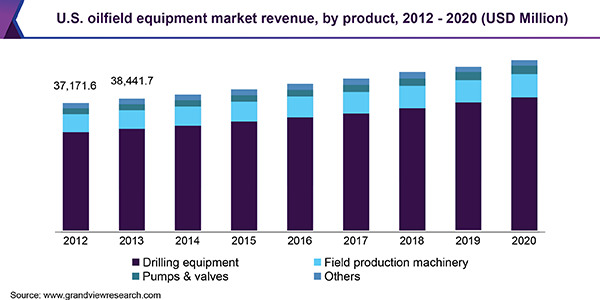

Global oilfield equipment market size was estimated at USD 97.34 billion in 2013. High demand is resulting in increased crude yielding activities which in turn are expected to drive demand over the forecast period. To yield better results, there is a need to develop high performance and efficient and reliable tools. Furthermore, the occurrence of huge unmapped hydrocarbon abundant reserves, both in onshore and offshore basins, coupled with the high dependency of the regional economy on the industry is expected to have immense potential for the oilfield equipment market in the near future.

Industry participants are expected to make heavy investments to come up with better equipment to improve recovery & productivity of crude operations. Regional governments mainly in Asia Pacific are expected to participate and encourage their use significantly to improve their energy supply and lower import rates.

Companies have also invested in technological development to ensure safety and security during use of this equipment, which is expected to drive global oilfield equipment market. Oil & gas industry shift towards developing other unconventional energy sources to meet global demand is expected to contribute significantly towards market growth over the next six years.

The entrance of equipment rental industry participants over the forecast period is expected to drive the global industry as they are highly expensive in nature and require proper technical support. Skilled workforce coupled with geopolitical issues between countries is expected to restrain the global market in the future.

The growing offshore industry, predominantly in the Persian Gulf, and many others are likely to fuel equipment growth. However, adverse environmental effects of E&P activities coupled with strict government regulations will also act as constraints for the market. The shift towards green energy sources is expected to lower energy sources extraction activities which in turn are expected to bring down global market growth over the forecast period.

Product Insights

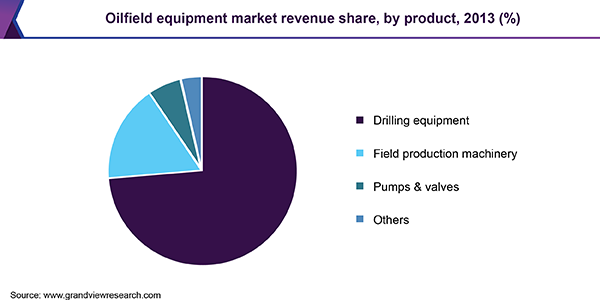

The product segment includes drilling equipment, field production machinery, pumps & valves, and other. These product types are used for performing multiple operations including crude extraction, processing, and transportation. Rising number of accidents on offshore and onshore drilling sites has necessitated the employment of production logging, testing, and survey equipment & services. These factors are anticipated to drive the drilling and exploration equipment growth over the forecast period. The purpose of oilfield equipment & services is to help operators control subsurface pressure, control borehole erosion, reduce formation damage, optimize drilling parameters including penetration rate, and enable hole enlargement & cleaning.

Drilling equipment was the leading product segment and accounted for a share of 73.65% of total market volume. Drilling rigs or augers are the key drilling tools used in the oil & gas industry. Drilling rigs are used for exploration & production activities, while augers, also known as portable rigs, are useful for remote locations especially marshy and wet areas. These augers are also used to remove unwanted water accompanied during oil extraction. Transportation of crude is the major concern for the industry on account of its toxic nature and the huge cost associated with it.

Efficient energy sources transportation means setting up of proper pipeline transport system for its safe and cost-effective movement from supplier to end users. Therefore, these pipeline systems require pumps and valves which are driving overall global demand over the forecast period. Other segment includes tools used for crude oil treatment and removal of impurities, such as harmful chemicals, before its transportation to refineries or end-use customers.

Regional Insights

North America was the leading segment on account of shale gas developments coupled with huge demand from the U.S. and Canada. Asia Pacific covered significant share and is expected to grow at the highest CAGR over the forecast period.

China is expected to establish as a major regional consumer on account of developments in crude oil & natural gas extraction operations. Latin America and the Middle East & Africa is expected to grow at a significant CAGR over the forecast period.

Significant use of drilling equipment in the horizontal wells in Italy, Denmark, the Netherlands, Norway, France, and the U.K. is further anticipated to boost industry expansion in Europe. Substantial oilfield development in offshore and unconventional reserves coupled with high adoption rate of mud-cap drilling technology in the UK, Russia and Norway is anticipated to create better opportunities for the drilling fluid companies in the near future.

Oilfield Equipment Market Share Insights

The global market is fragmented in nature and is expected to attract a significant number of service providers over the forecast period. Key market players include National Oilwell Varco, Aker Solutions, Halliburton, Schlumberger, Cameron International, Weatherford International, and Baker Hughes.

The global market comprises a wide range of market players across the value chain. There are companies such as National Oilwell Varco and FMC Technologies that manufacture and sell oilfield tools. Also, there are companies such as Halliburton, Weatherford International, and Schlumberger, which are involved in finding & extracting crude. Other companies, such as Transocean and Rowan, which own & lease out equipment mainly oil drill rigs.

Oil producers including Aker Solutions and ENI utilize oilfield equipment for exploration and production activities. Aftermarket service also plays a crucial role in the value chain of oilfield equipment as equipment training, safety, and maintenance is essential for longer equipment life. Therefore, companies using the equipment should also focus on its maintenance and safety for better life and performance.

Over the forecast period, industry participants are expected to witness high growth and enjoy profits on account of technological breakthroughs which include directional drilling, hydraulic fracturing, and horizontal drilling. In addition, rising crude demand coupled with swelling prices is further increasing exploration & production activities in remote places which in turn is expected to drive market players’ growth over the foreseeable future.

ReportScope

属性 |

Details |

Base year for estimation |

2013 |

Actual estimates/Historical data |

2012 - 2013 |

Forecast period |

2012 - 2020 |

Market representation |

Revenue in USD Million & CAGR from 2015 to 2020 |

Regional scope |

North America, Europe, Asia Pacific, RoW |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors and trends |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments covered in the report

This report forecasts volume and revenue growth at global and regional levels and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2020. For the purpose of this study, Grand View Research has segmented the oilfield equipment market on the basis of product and region:

Product Outlook (Revenue, USD Billion; 2012 - 2020)

Drilling equipment

Field production machinery

Pumps & valves

其他人

Regional Outlook (Revenue, USD Billion; 2012 - 2020)

North America

Europe

Asia Pacific

RoW