Operating Room Equipment Market Size, Share & Trends Analysis Report By Product (Anesthesia Devices, Endoscopes, OR Tables, OR Lights, Electrosurgical Devices), By End-use, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-503-8

- Number of Pages: 133

- Format: Electronic (PDF)

- Historical Range: 2014 - 2015

- Industry:Healthcare

Industry Insights

The global operating room equipment market size was valued at USD 26.24 billion in 2016 and is projected to grow with a CAGR of 7.2% during the forecast period. The surging volume of surgeries globally and technological innovations in medical devices are some of the driving forces responsible for the growth of the market. Aging of the population is also one of the key factors contributing to growth.

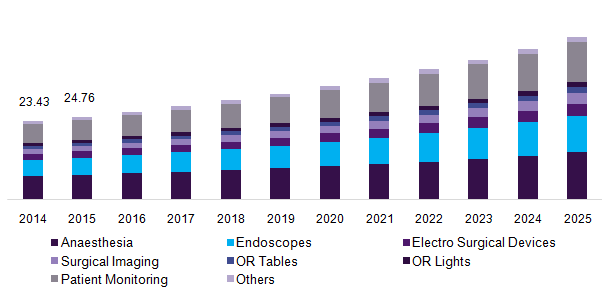

Operating room equipment market, by product, 2014 - 2025 (USD Billion)

The growing popularity of minimally invasive procedures owing to associated benefits such as lesser trauma, reduced hospital stays, and cost-effective procedures is one of the contributing factors responsible for the expansion of the market. Increasing investment by government bodies across the globe is also driving the market. For instance, the Indian government, under its Pradhan Mantri Swasthya Suraksha Yojana approved INR 620 crores for the cost of construction and INR 200 crores for the procurement of medical equipment & modular operation theaters. In 2014, the Government of Mexico released a National Infrastructure Program that indicates major projects to be executed through 2018. The program covers telecommunication, transportation, energy, water, tourism, and health sectors. For the health sector, the government has undertaken 87 projects with an investment of USD 6.1 billion to upgrade several hospitals & clinics and construct new specialized ones.

Furthermore, rising investments for the up-gradation of hospitals, the development of new operating rooms, and an increase in the number of new hospitals &ambulatory surgery centersare expected to propel growth in the future. In 2016, KIMS hospital in Kent, UK, opened its fifth operating theater to cope up with growing demand for orthopedic surgeries and invested GBP 250,000 in new technologies for its newly opened operating room. In 2016, the Wanda Group, a Chinese conglomerate, decided to invest CNY15 billion for the development of hospitals across the country. The investment is intended for building three hospitals in Chengdu, Qingdao, and Shanghai. Under this initiative, Wanda Group has partnered with UK-based International Hospitals Group (IHG) that would be managing the new hospitals constructed.

Improving healthcare infrastructure in emerging economies, rising interest of foreign hospital chains in expanding their networks in these economies, and growing collaborations between hospitals & foreign investors are anticipated to drive the market. In 2015, the Brazilian government enacted a new amendment that allows foreign investments in healthcare companies, hospitals, and specialized clinics.

Product Insights

In 2016, the anesthesia devices segment held the largest chunk of the market. Technological advancements and growing usage of anesthesia machines in the surgery centers contribute to a large share of the segment. Anesthesia machines are commonly used in almost all types of surgeries. Also, the rapid adoption of the Anesthesia Information Management Systems (AIMS) contributes to the large share of the revenue share.

The increasing prevalence of chronic diseases and illnesses has led to a rise in surgical procedures. Anesthesia plays a crucial role in surgery, and anesthesia equipment plays a vital role in providing sufficient & accurate delivery of anesthesia necessary for surgical procedures. The increasing geriatric population who are highly susceptible to various disorders and degenerative diseases is one of the key factors responsible for the rising demand for surgeries.

However, the endoscopes segment is expected to witness the fastest growth over the forecast period. Increasing patient preference for endoscopic procedures, rising awareness about minimally invasive procedures, and growing adoption of technological innovations in surgical procedures are some of the driving forces responsible for the growth of the segment in the coming years. The rise in the incidence of cancer, gastrointestinal disorders, and lifestyle-related diseases are expected to further expand the market.

End-use Insights

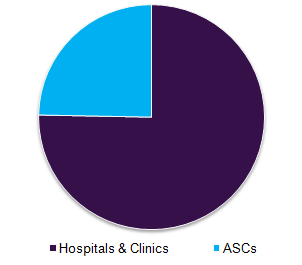

In 2016, the hospital segment held the majority of the share accounting for about 75%.

医院专注于投资up-gradation of operation theaters as they are one of the highest revenue-generating sources. Furthermore, the growing demand for hybrid operating rooms and increasing investments in infrastructure & advanced technologies for efficient outcomes are also expected to drive growth.

例如,2017年3月,圣迈克尔的医生al Center, New Jersey, U.S. invested around more than USD 21 million in its systems and medical equipment to improve and modernize the hospital and make it technologically advanced. The new equipment being installed in the OR include high-resolution monitors, operating towers, endoscopic towers, C-arms, and other equipment.

门诊手术中心预计将紧急情况e as the fastest-growing segment during the forecast period. The number of ambulatory surgical centers has grown owing to rising demand from key participants in surgical care that includes patients, physicians, and insurers. The surging number of ambulatory surgical centers and growing demand is driven by patient satisfaction, high quality, cost-effective procedures, and efficient practices by physicians are anticipated to propel the growth of the market.

Operating room equipment market, by end-use, 2016 (%)

Regional Insights

North America dominated the operating room equipment market in 2016 with a revenue share of around 37.3%. Increasing prevalence of chronic diseases in the region, large geriatric population base, sophisticated healthcare infrastructure, and rising number of ambulatory surgical centers are key market growth drivers. Rising demand for minimally invasive surgeries and higher adoption of technological advancements are also driving growth in the region.

Asia Pacific is expected to register the fastest growth over the coming years. Factors responsible for faster emergence are a high prevalence of chronic diseases, large patient pools, and a growing number of hospitals & healthcare facilities with improving infrastructure in the region. The large population base with high unmet needs in the region attracts many foreign investors to expand their business in emerging markets such as India, China, and Singapore.

Furthermore, the growing trend of medical tourism in Asian countries is expected to contribute to growth in the region. Affordability of treatment, ease of access, government support, and the emergence of new medical tourism destinations in the Asia Pacific region is anticipated to contribute to the growth of the market in the region. Thailand, Malaysia, South Korea, Singapore, India, and China are some of the popular medical tourist destinations in the Asia Pacific and are expected to experience a boom in the coming years.

Operating Room Equipment Market Share Insights

Some of the significant players include Koninklijke Philips N.V.; STERIS plc, Stryker; KARL STORZ GmbH & Co. KG; Siemens Healthineers; Hill-Rom (Trumpf Medical); Getinge AB; Medtronic; and GE Healthcare. Huge funding for R&D coupled with new product launches is crucial strategies deployed by leading companies to capture a larger share of the global market.

Report Scope

Attribute |

Details |

The base year for estimation |

2016 |

Actual estimates/Historical data |

2014 - 2015 |

Forecast period |

2017 - 2025 |

Market representation |

Revenue in USD Million & CAGR from 2017 to 2025 |

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

Country scope |

U.S., Canada, Germany, UK, Japan, China, Brazil, Mexico, South Africa |

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors and trends |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments Covered in the Report

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global operating room equipment market based on product, end-use, and region:

Product Outlook (Revenue, USD Million; 2014 - 2025)

Anesthesia Devices

Endoscopes

Operating Room Tables

Operating Room Lights

Electrosurgical Devices

Surgical Imaging Devices

Patient Monitors

Others

End-use Outlook (Revenue, USD Million; 2014 - 2025)

Hospitals

Ambulatory Surgical Centers

Regional Outlook (Revenue, USD Million; 2014 - 2025)

North America

The U.S.

Canada

Europe

Germany

UK

Asia Pacific

Japan

China

Latin America

Brazil

Mexico

MEA

South Africa

Frequently Asked Questions About This Report

b.The global operating room equipment market size was estimated at USD 31.5 billion in 2019 and is expected to reach USD 33.7 billion in 2020.

b.The global operating room equipment market is expected to grow at a compound annual growth rate of 7.2% from 2019 to 2027 to reach USD 48.4 billion by 2027.

b.The anesthesia devices segment dominated the global operating room equipment market with a share of 29.7% in 2019.

b.Some key players operating in the operating room equipment market include Koninklijke Philips N.V.; STERIS plc, Stryker; KARL STORZ GmbH & Co. KG; Siemens Healthineers; Hill-Rom (Trumpf Medical); Getinge AB; Medtronic; and GE Healthcare.

b.Key factors that are driving the operating room equipment market growth include the surging volume of surgeries globally and technological innovations in medical devices.