Patient Positioning Systems Market Size, Share & Trends Analysis Report Products (Tables, Accessories), By Application (Surgery, Diagnostics), By End Use, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-066-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry:Healthcare

Report Overview

The global patient positioning systems market size was valued at USD 1.19 billion in 2021 and is expected to expand at a CAGR of 4.4% during the forecast period. The growing geriatric population, increasing prevalence of cancer, rising awareness among the patient population, and surging expenditure on diagnostic procedures are expected to boost the market during the forecast period. Technological innovations and the rising prevalence of non-communicable diseases are the major driving factors for this patient positioning equipment market. For instance, in February 2022, Mireye introduced its intelligent imaging technology that automates the patient positioning process for X-ray examinations.

Increasing hospital investments to upgrade operating rooms further drives the patient positioning equipment market. For instance, in March 2020, the Alberta government committed $100 million to upgrade hospital operating rooms. Due to the COVID-19 pandemic, there was major growth in the hospitalization of individuals. The healthcare industry wasn’t prepared for this extent of hospitalization, and most healthcare infrastructure collapsed under the immense burden of COVID-19-affected patients.

Currently, as the pandemic starts to subside, and the sector is returning to normalcy, governments are focusing on recognizing the cracks in their healthcare infrastructure and are taking initiatives to bolster the same. The patient positioning systems market is projected to benefit from this up-gradation of healthcare establishments across the world. For instance, in July 2021, A J Hospital, based in Mangaluru, India revealed the installation of Ultra-Modern CT systems, the 128 Slice Dual Energy CT scanner with AI (artificial intelligence). This machine uses AI for optimizing patient positioning and providing scanning support to technologists.

Technological advancements in sensors, such as optic fiber technology, cancer tracking sensors, and MEMS sensors, are expected to fuel market growth. These systems help keep patients in a comfortable and stable position during radiotherapy as well as treatment delivery. The growth of this market is further supplemented by the increasing prevalence of cancer. According to the WHO, Cancer is a leading cause of death globally, reporting for almost 10 million deaths in 2020, or nearly one in six deaths. While as per the National Cancer Institute statistics, there were approximately 16.9 million cancer survivors in the U.S. as of January 2019. The number of cancer survivors is expected to increase to 22.2 million by 2030. This steady increase in disease prevalence acts as a market driver throughout the forecast period.

Increasing awareness and rising expenditure on diagnostic procedures are also expected to increase the demand for patient positioning systems in the market. According to the National Health Services (NHS), there were 40.3 million imaging tests performed in England in the year September 2020 to August 2021. Additionally, there are many awareness campaigns regarding early cancer diagnosis such as the National Awareness and Early Diagnosis Initiative (NAEDI) in the UK. This, in turn, is expected to increase the demand for patient positioning systems.

Product Insights

The products analyzed in this study include tables and accessories. The tables segment is expected to dominate the market with a share of over 79% in 2021 owing to increased demand and a rising number of hospitals, ambulatory centers, and other settings such as specialty centers and diagnostics centers. The tables segment is expected to retain its lead over the forecast period due to the rising demand for efficient and accurate diagnostic imaging, which is creating growth opportunities for the segment.

The accessories segment is expected to witness the fastest growth in the market, owing to the increasing number of patients undergoing different types of surgeries and diagnoses. There is a greater demand for diagnosis in developing countries such as India and China, which may drive sales of patient positioning systems over the forecast period. Hill-Rom Services, Inc., STERIS, and others offer a broad range of accessories to cater to market demand.

Application Insights

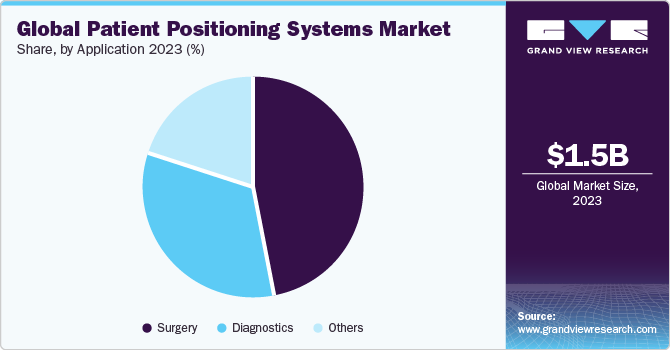

Based on application, patient positioning systems are segmented into diagnostics/imaging, surgery, and others. The surgery segment held the largest share of over 45% in 2021 owing to the increasing prevalence of chronic diseases such as cancer. Additionally, there is an increase in healthcare expenditure globally. This is anticipated to further supplement the growth of this application. Besides, an increasing number of surgical procedures being performed coupled with technological advancements is anticipated to drive the market.

The diagnostics segment is estimated to grow at a lucrative rate over the forecast period, due to increasing expenditure on diagnostics/imaging, globally. Diagnostics tests represent more than 3.0% of total healthcare spending. These tests also play a major role in a doctor’s decision-making process. Almost all cancer diagnoses are based on laboratory tests and their results. Furthermore, the growing demand for diagnosis of chronic disease and rising aging demographics, which is expected to boost the demand for diagnostics, which in turn, supports market growth.

End-use Insights

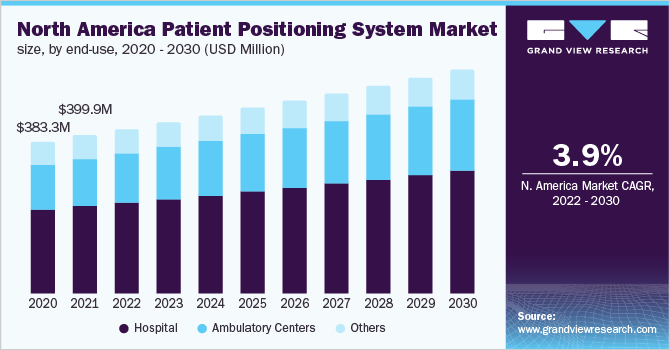

By end-use, the market for patient positioning systems is categorized into hospitals, ambulatory centers, and others. Hospitals are identified as the largest revenue segment owing to increasing healthcare expenditure globally. Additionally, increasing the number of hospitals across the globe is anticipated to drive demand in this market. Hospitals, thus, are an integral part of the healthcare industry and are a major revenue source for the entire sector, which fuels research and innovation. Therefore, multiple companies invest significant efforts, both in terms of revenue & marketing strategies, to promote their product/services among the hospitals.

However, the ambulatory centers segment is expected to grow at a faster rate. As the number of these centers soars in developed as well as developing countries, they help alleviate the pressure on hospitals and clinics. There are more than 5,800 Ambulatory Surgical Centers (ASCs) certified by Medicare in the U.S. Soaring healthcare costs are a major concern plaguing the industry and with it comes the fact that not many patients can afford the treatment they need, including surgical procedures. This has compelled healthcare providers to come up with new ways to make such services more affordable while also focusing on quality. ASCs have proven to be an effective solution in this scenario.

Regional Insights

北美主导的份额超过33%2021 owing to the rising prevalence of chronic and lifestyle-related diseases and the presence of sophisticated healthcare infrastructure. In addition, the local presence of major market players in the U.S., such as Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; and SchureMed, is expected to boost the growth of the market for patient positioning systems in North America.

Europe is also expected to hold the second-largest market share during the forecast period due to a flourishing medical device industry in the U.K., France, and Germany, in addition to rising avenues for market participants in this region. Asia Pacific is expected to register the highest CAGR as compared to other regions over the forecast period, which can be attributed to the increasing geriatric population and increasing healthcare expenditure in this region.

Key Companies & Market Share Insights

The market is fragmented with many big and small industry players. Key players are adopting business strategies including diverse product offerings, business expansion, joint ventures, regional expansion, and new product launches to gain market share. For instance, in October 2021, Esaote, an Italian company in the biomedical sector entered the world of total body magnetic resonance imaging with the novel system called “Magnifico Open”. The open magnet and easy-to-access patient table enable fast and comfortable patient positioning. Likewise, in November 2020, Canon Medical introduced a premium auto-positioning digital radiography system for patient care and optimal productivity. Some of the prominent players in the patient positioning systems market include:

Medtronic

Hill-Rom Holdings, Inc.

Stryker Corporation

Medline Industries

天空tron, LLC

Smith & Nephew

STERIS plc

Mizuho OSI

LEONI AG

OPT SurgiSystems Srl

Patient Positioning Systems MarketReport Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 1.25 billion |

Revenue forecast in 2030 |

USD 1.78 billion |

Growth Rate |

CAGR of 4.4% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2017 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; MiddleEast and Africa |

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Japan; India; China; Brazil; Mexico; South Africa; Saudi Arabia |

Key companies profiled |

Medtronic; Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; Smith & Nephew; STERIS plc; Mizuho OSI; LEONI AG; OPT SurgiSystems Srl |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. Grand View Research has segmented the global patient positioning systems market report based on product, application, end-use, and region:

Product Outlook (Revenue, USD Million, 2017 - 2030)

Tables

Accessories

Application Outlook (Revenue, USD Million, 2017 - 2030)

Surgery

Diagnostics

Others

End-Use Outlook (Revenue, USD Million, 2017 - 2030)

Hospital

Ambulatory Centers

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

Japan

India

Latin America

Brazil

Mexico

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global patient positioning systems market size was estimated at USD 1.19 billion in 2021 and is expected to reach USD 1.25 billion in 2022.

b.The global patient positioning systems market is expected to grow at a compound annual growth rate of 4.4% from 2022 to 2030 to reach USD 1.78 billion by 2030.

b.North America dominated the patient positioning systems market with a share of over 33% in 2021. This is attributable to rising prevalence of chronic and lifestyle-related diseases and presence of sophisticated healthcare infrastructure.

b.Some key players operating in the patient positioning systems market include Medtronic; Hill-Rom Holdings, Inc.; Stryker Corporation; Medline Industries; Skytron, LLC; OPT SurgiSystems Srl; SchureMed; Smith & Nephew; STERIS plc; and Leoni.

b.Key factors that are driving the patient positioning systems market growth include the growing geriatric population, increasing prevalence of cancer, rising awareness among the patient population, and surging expenditure on diagnostic procedures.