Plant-based Bars Market Size, Share & Trends Analysis Report By Product Type (Protein Bars, Granola/Cereal Bars), By Nature (Organic, Conventional), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-071-1

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Consumer Goods

Report Overview

The globalplant-based bars market sizewas valued atUSD 2.73 billion in 2022and is expected to grow at acompound annual growth rate (CAGR) of 14.0% from 2023 to 2030. One of the primary reasons for the growth of plant-based bars is the increasing emphasis of consumers on health and wellness. With the rise in chronic health conditions such as obesity, diabetes, and heart disease, many people are looking for healthier snack options that can provide them with the nutrients and energy they need to stay healthy. Plant-based bars are a good source of protein, fiber, and healthy fats, and they often contain fewer calories and less sugar than traditional snack bars.

Moreover, plant-based bars are also popular among people with dietary restrictions such as vegans, vegetarians, and those with food allergies or intolerances. These bars are often free from common allergens such as dairy, soy, and gluten, making them a safe and convenient snack option for people with dietary restrictions. For instance, Greens Gone Wild, LLC. is a key company offering vegan and gluten-free protein bars. In addition, plant-based bars are convenient and easy-to-grab on-the-go snacking options. With busy lifestyles, many people do not have time to prepare healthy meals or snacks, and plan-based bars provide a quick and easy solution. They are also portable and can be taken anywhere, making them ideal for people who are always on the move.

The plant-based bars market is further growing owing to the increasing availability of plant-based bars in a variety of flavors. With so many different ingredients and flavors to choose from, people can find a plan-based bar that suits their taste preferences and dietary needs. In addition, the increasing concern over sustainability and the environment are contributing to market growth. Many people are becoming more conscious of the impact their food choices have on the planet and are opting for plant-based options that are more sustainable and eco-friendlier than traditional animal-based products.

植物性蛋白质的酒吧是一个很好的来源,which is essential for building and repairing tissues in the body, and for producing enzymes, hormones, and other important molecules. Many plant-based protein sources, such as nuts and seeds, also contain healthy fats, which are important for maintaining healthy skin, hair, and nails, as well as for absorbing fat-soluble vitamins such as vitamins A, D, E, and K. Moreover, Sustainability is a growing concern for many consumers, and the impact of food production on the environment has become a significant issue. Many people are turning to plant-based diets as a way to reduce their carbon footprint and support more sustainable food production practices.

Plant-based bars are often marketed as a more sustainable snack option because they are made with plant-based ingredients. Plant-based agriculture requires less water and land than animal agriculture, making it a more sustainable and eco-friendly food production method. Many plant-based bar manufacturers also use eco-friendly packaging, such as compostable or biodegradable materials, to further reduce their impact on the environment. For instance, GoMacro, LLC. Is a key company that offers its products in sustainable packaging i.e. it has 100% recyclable or compostable packaging.

Furthermore, many plant-based bar manufacturers use social media platforms such as Instagram and Facebook to market their products to a younger demographic. Influencers and celebrities often promote plan-based bars, making them more appealing to younger consumers who are interested in health and wellness. However, the high cost of producing plant-based bars is a significant challenge in the production of plant-based bars, which can make them more expensive than traditional snack bars. This high cost is often due to the use of high-quality, natural ingredients and eco-friendly packaging.

Product Type Insights

Plant-based protein bars accounted for a share of over 35% in 2022. The popularity of plant-based diets has been on the rise in recent years, with many people opting for a more plant-based lifestyle. As a result, there has been an increased demand for plant-based protein sources, including plant-based protein bars. Many manufacturers are now catering to this demand by creating a wide variety of plant-based protein bars that are delicious and packed with nutrition.One of the main reasons why plant-based protein bars were not as popular in the past was due to their taste and texture. However, with advancements in food technology and manufacturing, many plant-based protein bars now taste and feel just as good as traditionalsnack bars. As a result, more consumers are turning to plant-based protein bars as a tasty and nutritious snack option.

Plant-based energy bars are anticipated to grow at a CAGR of 15.9% over the forecast period from 2023 to 2030. The busy and fast-paced lifestyles of people today often make it difficult for them to find the time to eat nutritious meals. Energy bars provide a convenient and portable source of nutrition that can be eaten at any time, making them a popular choice for people on the go. Moreover, the increasing popularity of sports and fitness activities has also contributed to the growth of the energy bar market. Athletes and fitness enthusiasts often consume energy bars before, during, or after their workouts to provide them with the necessary nutrients and energy to perform at their best.

Nature Insights

传统的部分占的份额over 85% in 2022. Conventional plant-based bars are often cheaper and are more affordable for consumers who are on a tight budget. Conventional plant-based are easily available and are often sold in mainstream grocery stores and online retailers, making them more accessible to consumers.Companies that produce these bars often invest heavily in marketing campaigns, which can include television commercials, social media advertising, and influencer partnerships. This exposure makes consumers more familiar with conventional plant-based bars, and they may be more likely to choose these products over others. Thus, the aforementioned factors are contributing to segment growth.

The organic segment is anticipated to grow at a CAGR of 22.4% over the forecast period. The increasing demand for organic products among consumers is a primary factor contributing to the market growth. Organic plant-based bars are often perceived as healthier than conventional options. Organic products are often free from artificial additives and preservatives, which can be found in conventional snack bars. Consumers who are concerned about their health are more likely to choose organic plant-based bars over conventional options. Moreover, the increasing availability of organic plant-based bars is also contributing to their growing popularity. In recent years, organic plant-based bars have become more widely available in grocery stores, health food stores, and online retailers. This increased accessibility has made it easier for consumers to try organic plant-based bars and incorporate them into their diets.

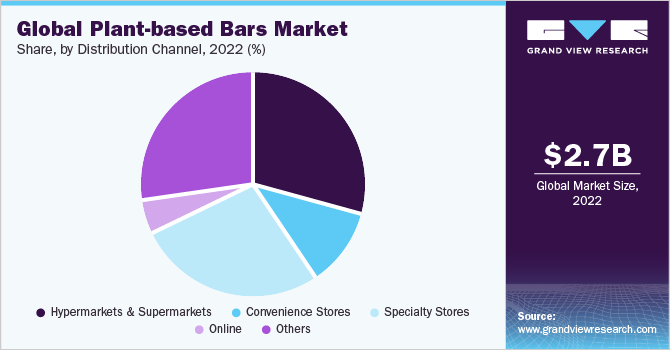

Distribution Channel Insights

The hypermarkets & supermarkets accounted for a share of over 25% of the global revenue in 2022. hypermarkets and supermarkets can offer a wide variety of plant-based products to consumers. These retailers have a large footprint and can stock a diverse range of products to cater to the needs and preferences of their customers. As a result, consumers can easily find plant-based products that suit their dietary preferences and requirements in one location. Moreover, the pricing of plant-based products in hypermarkets and supermarkets is often competitive. As these retailers purchase products in bulk, they can offer them to consumers at lower prices compared to smaller retail settings. This makes plant-based products more affordable and accessible to a wider range of consumers.

The sales through the online channel are projected to grow at a CAGR of 16.0% over the forecast period. The convenience of online shopping has made it easier for consumers to purchase plant-based bars. Online retailers offer a wide range of plant-based bars that can be easily accessed and purchased from the comfort of one's own home. Online retailers often offer a range of products that cater to specific dietary needs, such as gluten-free, dairy-free, or soy-free options. This makes it easier for consumers with dietary restrictions to find plant-based bars that meet their needs. Additionally, online retailers often offer competitive pricing for plant-based bars. This is due to lower overhead costs compared to physical stores, which can result in lower prices for consumers. Online retailers also often offer discounts, promotions, and bulk purchasing options, making plant-based bars more affordable for consumers.

Regional Insights

欧洲举行的份额超过35%的全球目标et in 2022. Consumers in the region are choosing to reduce their consumption of animal products and are increasingly turning to plant-based alternatives such as plant-based bars. The availability of plant-based bars in Europe has increased in recent years. Many supermarkets and health food stores now stock a wide variety of plant-based bars, making it easier for consumers to find and purchase these products. This has led to greater consumer awareness and interest in plant-based bars.

Moreover, there is a growing trend towards veganism and vegetarianism in Europe. Many people are choosing to follow a plant-based diet for ethical, environmental, or health reasons. Plant-based bars are a convenient and portable snack option for people following a vegan or vegetarian diet, and this has led to increased consumption of these products. According to an article published by Glanbia plc, Germany, the UK, and France are the top three consumers of plant-based protein ingredients.

The market in Asia Pacific is anticipated to grow at a CAGR of 16.1% over the forecast period. Asia Pacific has a large and growing population of vegetarians and vegans. In many countries in the region such as India, vegetarianism and veganism are linked to religious or cultural practices. As a result, there is a strong demand for plant-based products, including plant-based bars, among these populations. The availability of plant-based bars in the Asia Pacific region has increased in recent years.

Many health food stores and supermarkets now stock a wide variety of plant-based bars, making it easier for consumers to find and purchase these products. Additionally, the region has a large and growing market for healthy and natural food products. Many plant-based bars are made with natural and organic ingredients and are marketed as a healthier snack option. This has led to increased demand for these products among health-conscious consumers in the region.

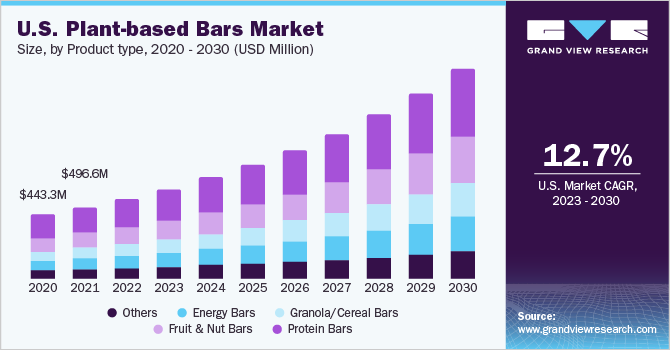

Furthermore. plant-based foods have been a significant growth driver for U.S. retail food in the long term. This can be attributed to the consumer interest in reducing their meat consumption and increasing their consumption of plant-based foods, including plant-based bars, as a healthier snack option. As a result, the adoption of plant-based foods has increased in the U.S.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

In January 2023, Bobo's announced the launch of a new line of protein bars that contain 15 grams of protein and is made using clean and simple ingredients. The newly launched protein bar is available in two flavors, double chocolate almond butter and chocolate chip peanut butter. Moreover, these new protein bars are verified as kosher, gluten-free, and non-GMO

In July 2022, Laird Superfood announced the launch of plant-based proteins containing adaptogens. The brand launched its first snack with functional properties to meet the increasing consumer demand for functional superfoods. The newly launched protein bar includes 10 grams of protein sourced from peas

In February 2022, ALOHA announced the launch of its organic plant-based bars in four new flavors including cookie dough, peanut butter cup, coconut chocolate almond, and peanut butter chocolate chip at Whole Foods Market, and is available all across the nation

In July 2021, Barebells Functional Foods AB announced the launch of two new flavors of protein bars made entirely from plants. These bars come in Salty Peanut and Hazelnut Nougat flavors, are 100% vegan and free from dairy, contain 15 grams of protein, and are devoid of both added sugar and palm oil

In June 2021, RXBAR launched its first-ever plant-based protein bar. The new offering, called RXBAR Plant, replaces the egg whites in RXBAR's regular bars with 10 grams of plant-based protein. The product is available through RXBAR's official website along with various retail outlets including Kroger, Target, and others

In January 2021, Whole Truth Foods launched a selection of energy bars that are free from dairy and whey. These bars are entirely plant-based and have been awarded vegan certification. Additionally, they do not contain any gluten, added sugar, soy, or preservatives. The brand's new line of bars is available in five unique flavors, such as mocha almond fudge, cocoa cranberry fudge, fig apricot orange, peanut choco fudge, and almond choco fudge

Some prominent players in the global plant-based bars market include:

Kellogg's

Greens Gone Wild, LLC.

General Mills Inc. (LÄRABAR)

88 ACRES

GNC Holdings, LLC

Rise Bar

MadeGood

Växa Bars

Clif Bar & Company

GoMacro, LLC

Plant-based Bars MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 3.11 billion |

Revenue forecast in 2030 |

USD 7.80 billion |

Growth rate |

CAGR of 14.0% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product type, nature, distribution channel, region |

Regional scope |

North America; Europe; Asia Pacific;Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; UAE; Saudi Arabia |

Key companies profiled |

Kellogg's; Greens Gone Wild, LLC.; General Mills Inc.; 88 ACRES; GNC Holdings, LLC; Rise Bar; MadeGood; Växa Bars; Clif Bar & Company; GoMacro, LLC |

Customization scope |

免费定制(相当于8肛交报告ysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

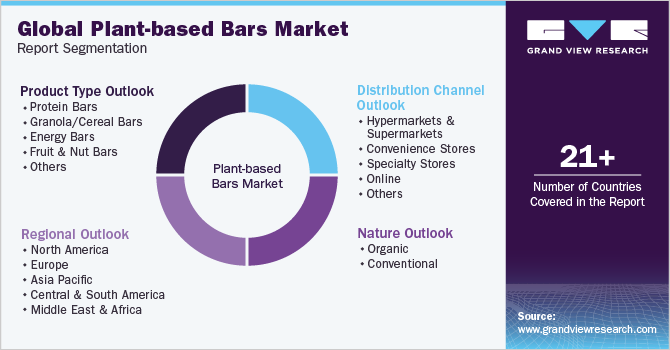

Global Plant-based Bars Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global plant-based bars market report based on product type, nature, distribution channel, and region:

Product Type Outlook(Revenue, USD Million, 2017 - 2030)

Protein Bars

Granola/Cereal Bars

Energy Bars

Fruit & Nut Bars

Others

Nature Outlook(Revenue, USD Million, 2017 - 2030)

Organic

Conventional

Distribution Channel Outlook(Revenue, USD Million, 2017 - 2030)

Hypermarkets & Supermarkets

Convenience Stores

Specialty Stores

Online

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

China

Japan

India

Australia & New Zealand

Central & South America

Brazil

Middle East & Africa

UAE

Saudi Arabia

Frequently Asked Questions About This Report

b.The global plant-based bars market size was estimated at USD 2.73 billion in 2022 and is expected to reach USD 3.11 billion in 2023.

b.The global plant-based bars market is expected to grow at a compound annual growth rate of 14.0% from 2023 to 2030 to reach USD 7.80 billion by 2030.

b.Europe dominated the plant-based bars market with a share of 35.6% in 2022. Consumers in the region are choosing to reduce their consumption of animal products and are increasingly turning to plant-based alternatives such as plant-based bars.

b.Some key players operating in the plant-based bars market include Kellogg's; Greens Gone Wild, LLC.; General Mills Inc.; 88 ACRES; GNC Holdings, LLC; Rise Bar; MadeGood; Växa Bars; Clif Bar & Company; and GoMacro, LLC.

b.One of the primary reasons for the growth of the plant-based bars market is the increasing emphasis of consumers on health and wellness.