销售点软件市场规模、分享和趋势乐鱼体育手机网站入口Analysis Report By End-user (Healthcare, Retail), By Application (Fixed, Mobile), By Deployment Mode (On-premise, Cloud), By Organization Size, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68038-417-8

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- Industry:Technology

Report Overview

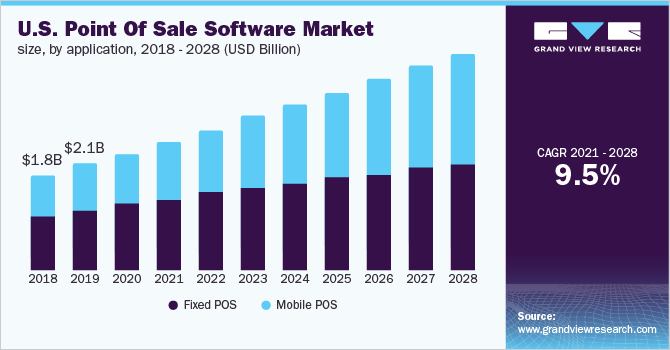

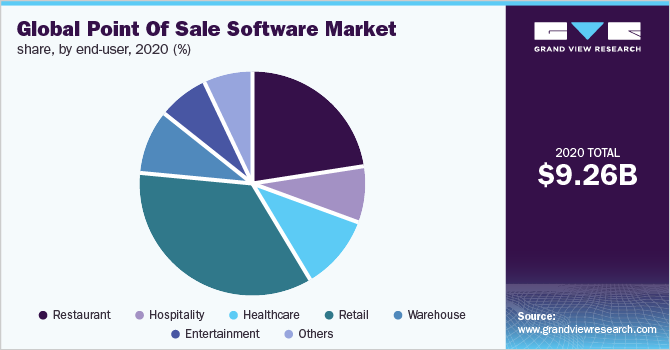

The global point of sale software market size was valued at USD 9.26 billion in 2020 and is expected to register a compound annual growth rate (CAGR) of 9.5% from 2021 to 2028. The COVID-19 pandemic negatively affected several business sectors including retail, restaurant, travel, and entertainment, subsequently affecting the profitability of point of sale (POS) software vendors.

However, increased demand for contactless payment options came as a respite, creating a favorable scenario for market players. Although the pandemic had an adverse impact on several sectors, a few industries including retail and restaurants sustained due to online shopping and food delivery system. The shift to online sales led to a rise in the number of online food deliveries and groceries that favored the demand for contactless payment getaways.

POS solutions have made in-roads in several sectors owing to their ability to offer custom and advanced analytical functions. These terminals or systems backed by powerful software capabilities help business operators to ease out day-to-day business activities while helping them focus on their core business activities. Increased demand for tailored-made POS or check-out systems across diverse business applications will result in the development of sophisticated software solutions that form the core element of these systems. The development of software that supports an array of sectors while offering analytical capabilities to monitor the data captured through daily business operations is expected to upkeep the market growth over the forecast period.

A trend to develop software for standalone terminals or buildings and an all-in-one system for retail/restaurant chains are also expected to favor industry growth over the next seven years. A POS software offers the flexibility of installation on different devices, including desktops, tablets, orlaptops. It is compatible with any operating system, making it a go-to choice for any vendor. The ability to deploy web-based solutions, specifically among SMBs, is also a key emerging trend in the industry. The cloud-based mPOS software demand has gained traction owing to cost-effective and hassle-free installation. Small businesses are also more inclined to deploy web-based solutions owing to their affordability and direct access from the internet or web browser, which is expected to impel the overall market growth over the forecast period.

POS software providers consider various factors during the software development phase, such as support to a myriad of operating systems, payment modes, and the ability to create and manage customer databases in a structured format. For instance, merchants demand a flexible and cost-effective POS solution compatible with various hardware devices, such as laptops, mobiles, PC, and tablets. These hardware devices operate on different operating systems, such as Windows, Linux, macOS, Android, and iOS, and need compatible software. Thereby, vendors ensure the availability of software for different devices and operating systems to cater to large and small businesses alike.

The COVID-19 pandemic has changed the business landscape wherein end-users are compelled to use modern point of sale technology. Upgraded POS solutions to facilitate online orders & payments and unified analytics would help understand & meet new customer expectations, adapt to market change, prepare for future lockdowns or similar situations, and improve the ability to sell both online and in-store. The retail, packaged food service, and other businesses opted for online sales channels (e-commerce) to cater to consumer needs during the pandemic by offering contactless product delivery at the doorstep. POS vendors leveraged this opportunity to upgrade solutions for retailers and restaurateurs to enable their management of both online and in-store sale information and payment option. The market vendors found new growth avenues by capturing the changing demand scenario. However, the restricted movement and ban on non-essential services affected the end-user revenue growth, consequently impacting the demand for POS systems and compatible software.

Application Insights

POS software finds applications in both mobile and fixed POS terminals. The fixed segment accounted for the highest revenue share of more than 55.0% in 2020 owing to the increased preference among FSRs and QSRs. Fixed systems are considered to be more secure in terms of data privacy, hence a popular choice among several end-users. The mobile POS segment is projected to register the fastest CAGR of more than 12.0% over the forecast period.

The introduction of wireless technology evolved the payment method and business operations. The POS software integrated on tablets or smartphones provides a quick payment option via apps without the need to connect local networks with the system. Also, the payment option using a card reader attached to a tablet or smartphone-only needs supporting apps to run the scanner and complete the billing process. This ease of payment has propelled the segment's growth. Moreover, small businesses are adopting mobile POS due to its affordability, mobility, and broader application for payment processing and inventory & store management, contributing to the segment growth.

Deployment Mode Insights

The on-premise deployment for POS software accounted for the largest revenue share of over 67% in 2020 primarily due to data security and greater control offered by this deployment model. The large enterprises contributed to the high demand for on-premise deployment of POS software as they need separate front-end and back-end solutions to limit access to critical financial and business information. Moreover, the control over data and security concerns have compelled large enterprises to opt for on-premise software deployment.

The cloud deployment POS software is expected to exhibit the highest CAGR of more than 11.0% from 2021 to 2028. This growth is credited to the high demand due to low-cost deployment on the cloud, which enables the adaption of changing business landscape. The cloud-based deployment is ideal for small- and medium-sized businesses that require timely software up-gradation to support expanded business requirements. The cloud deployment offers remote access, affordable subscription-based pricing, endpoint security, sales management, and an all-in-one solution for inventory management. All these factors are expected to boost the demand for cloud-based deployment among price-conscious end-users.

Organization Size Insights

The large enterprise segment dominated the market in 2020 accounting for a revenue share of over 58%. The segment growth is credited to the high demand for customized POS software across large-scale retail stores, restaurants, and entertainment segments that need a system to manage their cash flows and business operations. As large enterprises have to streamline multiple outlets’ business and daily sales data, the solution is customized based on business type as well as function, and the solution is highly-priced compared to readily available software. The customized software for a large enterprise helps manage an array of business operations while improving customer engagement. Rising demand for advanced features, such as employee management analytics, inventory tracking, sales monitoring, customer data management, and reporting, is expected to boost product adoption across various industries.

The market for the SME segment is expected to grow at the highest CAGR over the forecast period. The growth is credited to the quick adoption of cloud-deployed mobile POS software solutions by SMEs due to their affordability & scalability and the need to improve business during the COVID-19 pandemic. Moreover, a large number of small- and medium-sized businesses expanding to different cities or states prefer POS software based on recommendations and by similar business owners while ensuring optimal budget allocation for the solution. Therefore, the SMEs’ revenue contribution to the market growth has been vital in helping the POS software vendors in increasing their market share by capturing local end-users. The market players target local small- and medium-sized businesses across the hospitality, retail, entertainment, and other industries.

End-user Insights

The retail segment emerged as the dominant end-user segment with a revenue share of 35.01% in 2020. The vast retail sector includes clothing, accessories, grocery, packaged product, electronics, and much more that require POS software as per the nature of the business function. The retail industry gradually shifted from brick-and-mortar stores to multi-channel (social media) and e-commerce retailing.

This shift in business channels augmented the need for additional features in POS software to manage both online and in-store sales. Businesses that installed POS software supporting both sales channels were able to manage operation and profit, while other businesses suffered during the COVID-19 pandemic. The retailers are extensively adopting POS solutions as mobile and web-based platforms are offering omnichannel experiences to retailing consumers and augmented the POS software market growth.

The product demand in the restaurant segment is poised to grow significantly at a CAGR of more than 9.0% over the forecast period. It is another most lucrative segment targeted by POS vendors. The online food delivery system has become popular among the younger generation and thus, the restaurants require new features in their POS software to track food delivery and take new orders and payments. This trend was further fueled during the pandemic owing to the restricted movement of people and the need for social distancing, which limited the restaurant dining capacity. Thereby, online ordering and delivery are expected to drive investments in POS software in 2021 as the effect of the pandemic persists. Moreover, the staggering growth trajectory of the POS software in restaurants is supported by the requirement for order management, marketing, data analytics, and payment.

Regional Insights

The North America regional market accounted for the largest revenue share of over 31% in 2020. The region has a presence of prominent POS software vendors as well as a high demand for advanced integrated POS software. The healthcare industry in the U.S. is expected to witness the fastest growth rate owing to the need for improving facilities in hospitals related to payment, insurance, and management of patients. According to the American Hospital Association (AHA) annual survey for the fiscal year 2018, there were 6,148 hospitals including U.S. community, and nonfederal long-term care hospitals, which indicates the requirement for cost-effective and robust POS software integrated with all insurance payment processing, patient financial services software, reporting, and accounting, to provide complete payment processing. Moreover, higher adoption of cashless payment and rapid growth of the retail, restaurant, hospitality, healthcare, and other industries in North America is anticipated to propel the product demand over the forecast period.

Asia Pacific is poised to grow at a significant CAGR of more than 11.0% over the forecast period. The rise in the adoption ofPOS terminalsin the region is credited to the strong growth in the electronic payment industry. The demand for cashless payment in retail, restaurant, entertainment, warehousing, and other industries in developing countries, such as China, India, Indonesia, and Vietnam, is augmenting the market growth. Moreover, the ever-increasing demand for POS solutions with advanced features among the rapidly growing business, such as e-commerce retail, foodservice industry, and entertainment, is expected to drive the regional market over the forecast period.

Key Companies & Market Share Insights

The vendors are focused on offering differentiated solutions for industry-specific operations at affordable prices. The niche players in the market are also strongly competing in the local market to capture the underlying opportunity across end-users. For instance, In March 2021, Lightspeed acquired Vend Limited, a cloud-based retail management software vendor based in New Zealand. The acquisition was aimed at strengthening the company’s customer base in the retail sector and establishing a strong foothold as a global Omni channel retail platform that can be integrated with POS for small- and medium-sized businesses. Moreover, in December 2020, Lightspeed had also acquired Upserve, which catered to the restaurant sector for payment solutions. In June 2021, Toast acquired xtraChef, which provides customized back-office automation for inventory management and accounts payable. The acquisition is aimed at enhancing the Toast POS solution for managing restaurant financial health. Some prominent players in the global point of sale software market include:

Clover Network, Inc.

H&L POS

IdealPOS

Lightspeed

NCR Corporation

Oracle Micros

Revel Systems

SwiftPOS

Square Inc.

TouchBistro

Toast Inc.

Point Of Sale Software Market Report Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 10.39 billion |

Revenue forecast in 2028 |

USD 19.56 billion |

Growth rate |

CAGR of 9.5% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, competitive ranking, competitive landscape, growth factors and trends |

Segments covered |

Application, deployment mode, organization size, end-user, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; France; U.K.; Germany; China; India; Japan; Brazil; Mexico |

Key companies profiled |

Clover Network, Inc.; H&L POS; IdealPOS; Lightspeed; NCR Corporation; Oracle Micros; Revel Systems; SwiftPOS; Square Inc.; TouchBistro; Toast Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

定价和purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global point of sale software market report on the basis of application, deployment mode, organization size, end-user, and region:

Application Outlook (Revenue, USD Million, 2016 - 2028)

Fixed POS

Mobile POS

Deployment Mode Outlook (Revenue, USD Million, 2016 - 2028)

Cloud

On-premise

Organization Size Outlook (Revenue, USD Million, 2016 - 2028)

Large Enterprise

Small and Medium Enterprise (SME)

End-user Outlook (Revenue, USD Million, 2016 - 2028)

Restaurants

Hospitality

Healthcare

Retail

Warehouse

Entertainment

Others

Regional Outlook (Revenue, USD Million 2016 - 2028)

North America

U.S.

Canada

Europe

Germany

U.K.

Asia Pacific

China

India

Japan

Latin America

Brazil

Mexico

Middle East & Africa (MEA)

Frequently Asked Questions About This Report

b.The retail end-user segment dominated the POS software market with a share exceeding 34.0% in 2020. This is attributable to the rapidly growing multi-channel and e-commerce retailing along with the adoption of mobile POS by small retailers.

b.Some key players operating in the POS software market include Clover Network, Inc; Lightspeed; NCR Corporation; Revel System Inc.; ShopKeep; Square, Inc.; Toast Inc.; and TouchBistro.

b.Key factors that are driving the POS software market growth include carrying out the cashless transaction, keeping track of sales, inventory records, and improve sales strategy using analytics across retail chains, restaurants, hospitality, drug stores, and automotive shops among others.

b.全球POS软件市场规模估计乐鱼体育手机网站入口at USD 9.26 billion in 2020 and is expected to reach USD 10.39 billion in 2021.

b.The global POS software market is expected to grow at a compound annual growth rate of 9.5% from 2021 to 2028 to reach USD 19.56 billion by 2028.