Poland Metalworking Fluids Market Size, Share & Trends Analysis Report By Product (Mineral, Synthetic, Bio-based), By Application, By End-use, By Industrial End-use, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-087-8

- Number of Pages: 93

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Bulk Chemicals

Report Overview

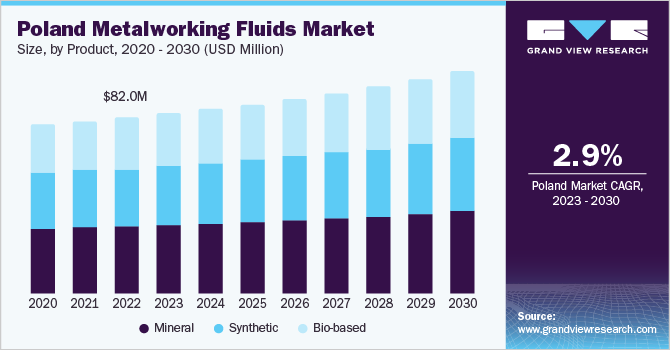

ThePoland metalworking fluids (MWFs) market sizewas valued atUSD 82.0 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 2.9% from 2023 to 2030. This is attributed to increasing consumer spending and extensive application of MWFs in various industries such as construction, energy, power, and agriculture. In the transportation industry, MWFs are used in the manufacturing of tanks, aircraft, and jets. MWFs assist in operations where heat dissipation is critical for effective machining and helps in the production of high-quality products. Most transportation equipment used in the aerospace and automobile industries use metal treatment fluids in their manufacturing processes. These machines are used in the manufacturing of various components, including transmissions, engines, and suspension systems.

Poland has received U.S. $80.21 billion from Europe's budget for 2021-27, making it the largest net beneficiary of EU funds among all member states. The country intends to allocate the money toward the development of its transportation and energy sectors, resulting in numerous projects aimed at enhancing its road, railway, and waterway infrastructure. This, in turn, is expected to drive the demand for metalworking fluids due to an increase in the use of transportation in the coming years as per the data provided by the International Trade Association.

Poland is focusing on advanced manufacturing technologies such as Industry 4.0 and automation to increase productivity and competitiveness. These technologies require high-performance metalworking fluids to optimize the machining process. This will further pose an opportunity for the metalworking fluids industry to develop specially formulated metalworking fluids for machining processes. For instance, in 2020, Mercedes-Benz began producing engines and batteries in Poland. The new emission-free plant powered by renewable energy exemplifies Industry 4.0 manufacturing.

然而,环境法规和di不当sposal of metalworking fluids may hinder the market growth during the forecast period. As, the, extraction of raw materials, manufacturing processes, and packaging all contribute to the carbon footprint associated with these fluids.

Product Insights

The mineral-based product segment dominated the market with the highest revenue share of 38.2% in 2022. This is due to their wide usage widely owing to their easy availability and cost efficiency. Mineral-based MWFs in Poland serve aerospace, electricity, rail, and marine industries owing to increasing government spending. Turning, grinding, broaching, drilling, and milling are different machining operations where metalworking fluids are used in these end-use industries.

Manufacturers of mineral-based metalworking fluids in Poland serve a wide range of end-use industries including aerospace, electricity, rail, and marine owing to increasing government spending in these industries. Most small manufacturers prefer mineral-based metalworking fluids due to their low prices.

Synthetic oils are manufactured from synthetic and chemical materials. There are mainly two types of synthetic metalworking fluids: semi-synthetic and fully synthetic. Semi-synthetic metalworking fluids are a blend of synthetic and oil-based components whereas fully synthetic are made entirely from synthetic components. They are mostly preferred, as they are less prone to bacterial growth and can be used for a longer period.

Synthetic metalworking fluids are witnessing a strong demand as they offer superior capabilities such as increased tool life and an excellent surface finish. The fluids are widely used to reduce friction between workpieces, which helps eliminate waste and improve the sump life.

End-use Insights

机器最终用途的MWFs wi主导th the highest revenue share of 39.2% in 2022 owing to its extensive use in machining processes such as milling, drilling, turning, and grinding. These fluids provide lubrication, cooling, chip removal, extended tool life, low friction, and precise and accurate cuts. They also contribute to improved surface finishes on machined components.

Rising demand for manufacturing equipment is expected to drive the growth of the MWFs market. They are used in machining operations to improve the sump life, which eventually leads to a reduction in overhead costs for manufacturers. This advantage has resulted in increasing demand from small-scale manufacturers on account of tight procurement budgets.

Poland has a growing transportation equipment-manufacturing sector, which involves the production of various vehicles and their components. The country has established itself as a significant player in the automotive and aerospace industries, as well as other segments of transportation equipment manufacturing. Thus rising demand for transportation further leads to increasing machinery needs. This further drives the demand for MWFs in Poland.

Industrial End-use Insights

The electricity and power industrial end-use segment of metalworking fluids dominated with the highest revenue share of 25.6% in 2022 owing to its usage in the manufacturing processes of power generation equipment, such as turbines, generators, transformers, and electrical motors. They help in machining, cutting, forming, and ensuring precision in the production of metal components used in power generation systems. In addition, MWFs are employed in the fabrication of electrical components, including connectors, contacts, and conductors. They assist in machining, stamping, forming, improving cutting performance, reducing heat generation, and enhancing surface finish.

The main application of MWFs is in cooling and heat dissipation applications within power generation systems. They are applied to cool down electrical components, such as transformers and power electronics, to maintain optimal operating temperatures and prevent overheating.

MWFs c的制造业中发挥着至关重要的作用onstruction and related equipment, offering unique advantages that contribute to their widespread use. These fluids have the remarkable ability to enhance tool strength, deliver exceptional surface finishes on workpieces, improve workpiece efficiency, and facilitate high-quality fabrication. As a result, metalworking fluids have gained significant demand in the construction industry. This industry produces a wide range of equipment, such as excavators, loaders, forklifts, cranes, and dozers.

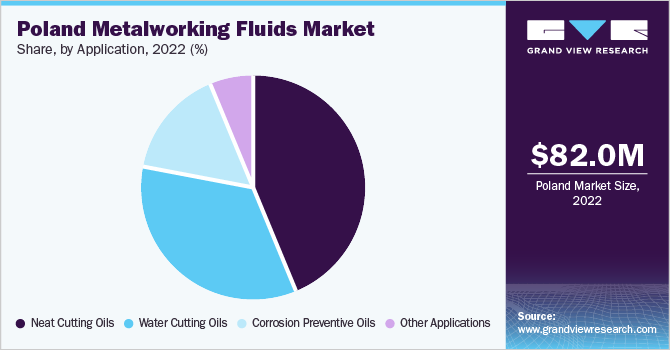

Applications Insights

Neat cutting oil application segment of MWFs dominated with the highest revenue share of 45.9% in 2022 owing to its superior lubricating and cutting performance that prolongs the life of metal equipment and tools by preventing corrosion and rusting. Neat cutting oils also provide outstanding lubrication and cutting performance, enabling high output and performance while maintaining high standards for surface finish and dimensional accuracy. They are simple to use and require little time to maintain cutting oil quality.

The majority of cutting operations and many machining processes use neat cutting oils. Due to their capacity to offer economical solutions, these oils have seen an increase in demand from the high-volume manufacturing sector. These oils are used in many machining processes like drilling, hobbing, turning, honing, and broaching because they improve surface finish and increase the tool life. Furthermore, the demand for neat cutting oils is expected to increase over the forecast period especially to process high-alloy steels in heavy equipment manufacturing.

Water-soluble cutting oils are the most commonly used metalworking fluids in the manufacturing industry. There are three major types of water-cutting oils based on the percentage of mineral oil. Soluble water-cutting oil has 50% to 80% mineral oil content whereas semi-synthetic water-cutting oil contains 30% to 50% mineral oil. Synthetic water-cutting oils contain no mineral oil.

Water-soluble fluids are mixed with water before they are used in the cutting system. Additionally, the fluid prevents corrosion on the workpiece and machine tools by flushing chips and swarf from the cut zone. Most importantly, metalworking fluids boost output, prolong tool life, and demand less energy during the metal treatment.

Corrosion preventive oils are used in machining operations where there is a high risk of tool damage; as a result, these oils help extend sump life, which lowers manufacturing overhead costs. These oils typically contain specialized additives that offer protection against rust and corrosion. The limited financial resources and low production volumes, this has led to a rise in demand from small-scale manufacturers for corrosion preventive oils.

Additionally, an increase in the production of transportation and construction components is anticipated to increase demand for corrosion-preventive oils, which can lower maintenance costs by preventing rust. The demand for corrosion preventive oils is also anticipated to increase due to the expanding manufacturing sector and improved oil performance.

Key Companies & Market Share Insights

Major industry participants operating in the Poland MWFs market include Exxon Mobil Corporation; FUCHS; China Petroleum & Chemical Corporation; PCC Group; and Henkel Polska Sp. z o. o.

Players adopt merger & acquisition strategies to increase the reach of their products in the market and increase the availability of their products & services in diverse geographical areas. For instance, in 2021, Quaker Chemical Corporation entered into a new joint venture with Grindaix GmbH, a German provider of high-tech coolant control solutions and delivery systems, to serve a wider customer base.

Some of the players also adopt a strategy of partnerships/agreements to enhance the reach of their products in the market and increase the availability of their products and services in diverse geographical areas. For instance, Univar Solutions B.V. in 2023 entered a distribution agreement with Graphics Services Ltd. for their products such as inks, rust preventive oils, coatings,lubricants, and MWFsMWFs in Europe. Some prominent players in the Poland metalworking fluids market include:

CIMCOOL EUROPE

Henkel Polska Sp. z o. o

Master Fluid Solutions.

Oemeta Inc.

Exxon Mobil Corporation

Blaser Swisslube

Quaker Chemical Corporation

FUCHS

China Petroleum & Chemical Corporation

PCC Group.

Poland Metalworking Fluids Market Report Scope

Report Attribute |

Details |

Revenue forecast in 2030 |

USD 103.1 million |

Growth rate |

CAGR of 2.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030 |

Report coverage |

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, end-use, industrial end-use |

Country scope |

Poland |

Key companies profiled |

CIMCOOL EUROPE; Henkel Polska Sp. z o. o; Master Fluid Solutions; Oemeta Inc.; Exxon Mobil Corporation; Blaser Swisslube; Quaker Chemical Corporation; FUCHS; China Petroleum & Chemical Corporation; PCC Group. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Poland Metalworking Fluids Market Report Segmentation

This report forecasts volume and revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Poland metalworking fluids market report based on product, application, end-use, and industrial end-use:

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Mineral

Synthetic

Bio-based

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Neat Cutting Oils

Water Cutting Oils

Corrosion Preventive Oils

Other Applications

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Metal Fabrication

Transportation Equipment

Machinery

Other End-uses

Industrial End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

Construction

Electric & Power

Agriculture

Aerospace

Automobile

Rail

Marine

Telecommunication

Healthcare

Frequently Asked Questions About This Report

b.The Poland metalworking fluids market size was estimated at USD 82.0 million in 2022 and is expected to reach USD 83.9 million in 2023

b.The Poland metalworking fluids market is expected to grow at a compound annual growth rate of 2.9% from 2023 to 2030 to reach USD 103.1 milion by 2030.

b.Mineral based product dominated the Poland metalworking fluids market with a revenue share of 38.2% in 2022. This is attributable to their wide usage owing to their easy availability and cost efficiency.

b.Some key players operating in the Poland metalworking fluids market include CIMCOOL EUROPE, Henkel Polska Sp. z o. o, Master Fluid Solutions., Oemeta Inc. Exxon Mobil Corporation, Blaser Swisslube , Quaker Chemical Corporation., FUCHS, China Petroleum & Chemical Corporation, and PCC Group.

b.Key factors that are driving the market growth include increasing consumer spending and extensive application of MWFs in various industries such as construction, energy, power, and agriculture