Private Tutoring Market Size, Share & Trends Analysis Report By Type (Academic, Non-Academic), By End-use (Preschool And Primary Students, Middle School Students), By Delivery Mode, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-150-1

- Number of Pages: 84

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Private Tutoring Market Size & Trends

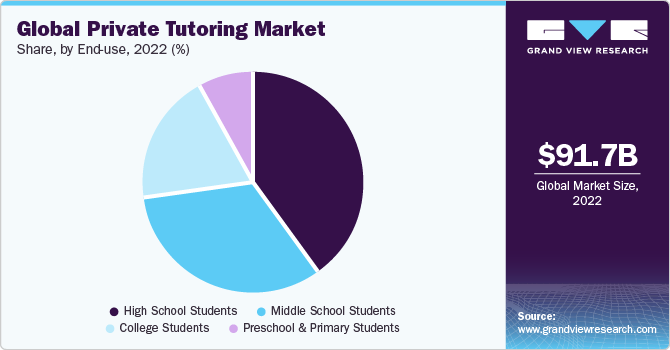

The globalprivate tutoring market size was estimated at USD 91.65 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. Increasing competition among students and the growing preference for career-oriented courses are driving the demand for private tutoring services in the forecast period. Subjects such assoftware、硬件、会计等,认为职业-oriented, are gaining prominence among college students. Private tutoring serves as a complementary educational resource and differs from private schools, which can replace mainstream schooling entirely. Families have the flexibility to integrate private tutoring into any schooling setup, be it public or private. This versatility empowers students to enhance their competitiveness, preparing them for success in a globalized world.

According to an Oxford College study, the global online learning market has expanded by over 900% since its introduction in 2000, making it the fastest-growing sector in education. In 2023, approximately 49% of students have engaged in some form of online learning, underscoring its prevalence. This substantial growth in online education is a significant driver for the increasing demand for private tutoring on a global scale, as learners seek personalized guidance in thedigital learninglandscape.

In nations lacking robust public education systems, such as undeveloped countries, private tutoring acts as a financial compromise. It caters to families dissatisfied with public schools but unable to afford private school tuition. In these countries, a diverse market has emerged, driven by the availability of both online and offline tutoring services. This alternative educational solution bridges the gap for families seeking better options within their budget constraints.

In May 2021, according to a Harvard study, private tutoring is a strategy employed by communities possessing substantial economic capital but limited cultural capital. It offers a means of addressing a system that seemingly prioritizes exam results without adequately preparing students for these assessments. Also, the study reveals that many private tutoring centers are situated in regions with affluent households. These circumstances collectively contribute to the growing demand for private tutoring services.

Type Insights

Based on type, the academic segment dominated the market with a revenue share of around 68.2% in 2022. Academic private tutors offer students a unique perspective on their learning journey. They play a crucial role in clarifying complex subjects like math and science, ensuring students grasp the material more efficiently. These tutors help students stay current with their exam syllabi, providing diverse testing methods, including chapter-wise or subject-wise assessments. These practices by academic private tutors are fueling the growth of the global market.

The non-academic segment is estimated to grow at a CAGR of about 7.3% in the forecast period. As academic and extracurricular competition intensifies, parents strive to nurture well-rounded children who excel in both school and activities. U.S. Census data from 2020 reveals that 29% of girls and 24% of boys were engaged in clubs. Girls displayed higher participation rates in music, dance, language, and other lessons compared to boys. Additionally, from 1998 to 2020, the percentage of girls taking lessons increased from 33.5% to 37%, while boys' participation grew from 24% to 27%.

Delivery Mode Insights

Based on delivery mode, the offline channel segment held a majority global revenue share of about 74.1% in 2022. Offline private tutoring has a long-established presence, preceding the emergence of online tutoring. It remains a stable and enduring choice, coexisting with the advent of online tutoring. Local tutors often possess an in-depth understanding of the curriculum and educational nuances, offering precise support.

The online channel segment is set to grow at a CAGR of about 7.7% over the forecast period. The rise of online and digital tutoring platforms has revolutionized private tutoring by enhancing accessibility and convenience. These platforms facilitate one-to-one tutoring experiences, enabling personalized and flexible learning. Students can connect with expert tutors from anywhere, access a vast range of subjects, and schedule sessions that align with their individual needs and preferences. This technological transformation has expanded the reach of private tutoring, making it more tailored and efficient.

End-use Insights

Based on end-use, the high school students segment dominated the market with a revenue share of approximately 39.8% in 2022. The increasing significance of high school education, coupled with an increased awareness of the advantages associated with achieving excellent grades, particularly in the 10th and 12th standards, is driving parents to invest more in their children's high school years. In countries like India, educational institutions, both private and government, assess students based on their performance in 10th and 12th standards, making these years crucial. Subjects like science, mathematics, and English are among the key subjects for which private tutoring is sought.

私人辅导中学生是蚂蚁icipated to grow at a CAGR of about 7.6% over the forecast period. These students rely on tutors to enhance their school curriculum, which, in turn, enhances their exam performance. This also helps them to study as well as participate in other curricular activities.

Regional Insights

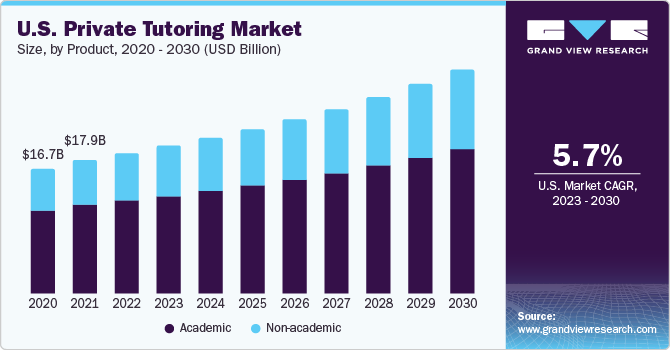

The demand for private tutoring in North America is growing at a CAGR of 6.0% during the forecast period. There is a significant educational gap between kids from different socioeconomic origins in the U.S. A sizable consumer base and the existence of reputable ICT solution providers are the main drivers of this significant market share. For example, the U.S.-based EdTech Company Chegg Inc. debuted the "Learn with Chegg" feature in January 2022 to provide customized learning options. Within this feature, students have the opportunity to structure their studies effectively by utilizing a range of Chegg's offerings, encompassing practice problems, flashcards, expert assistance, writing support, and other AI-driven features. The region consists of a number of prominent service providers, including ArborBridge, Chegg Inc., Club Z! Inc., and Kaplan, Inc.

Asia Pacific dominated the market with a revenue share of about 35.16% in 2022. The presence of emerging economies, including India, has a significant impact on the growth and dominance of this market. Government-backed initiatives, like educational projects targeting rural areas, are set to stimulate the adoption of online tutoring services. In January 2022, the Internet and Mobile Association of India (IAMAI) introduced the India EdTech Consortium (IEC), an e-learning platform offering affordable and high-quality education by top educators. Notable companies such as Great Learning; Vedantu; upGrad; BYJU’S; TOPPR; Careers 360; Times Edutech & Events Ltd; and Unacademy are participants in the IEC.

Key Companies & Market Share Insights

The market for private tutoring is increasingly competitive with the presence of both large and small-scale manufacturers. Prominent players have been adopting strategies such as mergers & acquisitions, partnerships, product launches, innovation, and promotions to stay competitive in the markets.

In April 2023, Mathnathism LLC expanded its location in Al Olaya, Riyadh, Kingdom of Saudi Arabia; Al Juraina, Sharjah, United Arab Emirates; South Kensington, London, United Kingdom; and Al Maqtaa, Abu Dhabi, United Arab Emirates. These openings contribute to the brand's overall global footprint that now spans 70+ centers across eight countries outside of the U.S. and Canada.

In June 2020, Chegg Inc. completed an acquisition by adding Mathway, a mathematics-focused problem-solving platform, to its portfolio. This strategic move enhances Chegg's service offerings, providing students with access to comprehensive mathematical support and resources.

Key Private Tutoring Companies:

- Educomp Solutions Ltd.

- Sylvan Learning, LLC

- Daekyo Co., Ltd.

- 咕on Institute of Education Co., Ltd.

- Kaplan Inc.

- Action Tutoring

- Chegg, Inc.

- Ambow Education Holding Ltd.

- TAL Education Group

- Mathnasium LLC

Private TutoringMarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 97.11 billion |

Revenue forecast in 2030 |

USD 154.8 billion |

Growth rate |

CAGR of 6.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, delivery mode, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia & New Zealand; Brazil; South Africa; UAE |

Key companies profiled |

Educomp Solutions Ltd.; Sylvan Learning, LLC; Daekyo Co., Ltd.; Kumon Institute of Education Co., Ltd.; Kaplan Inc.; Action Tutoring; Chegg, Inc.; Ambow Education Holding Ltd. ; TAL Education Group; Mathnasium LLC |

Customization scope |

免费定制(相当于8肛交报告ysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Private Tutoring Market Report Segmentation

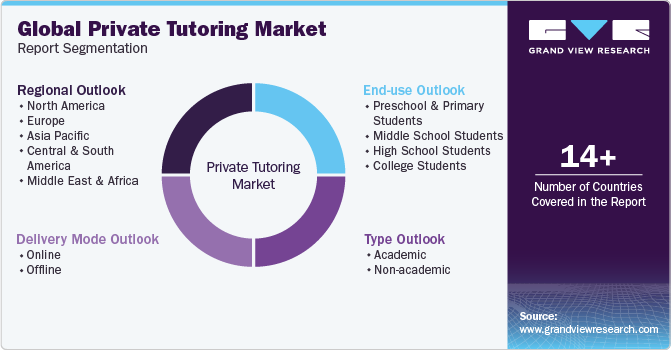

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global private tutoring market report based on type, delivery mode, end-use, and region:

Type Outlook (Revenue, USD Billion, 2017 - 2030)

Academic

STEM and Language Subjects

Social Sciences

Professional Courses

Others

Non-Academic

Life Skills Coaching

Hobbies, Interests, and Arts

Technology and Digital Skills

Professional Development

Others

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

Preschool and Primary Students

Middle School Students

High School Students

College Students

Delivery Mode Outlook (Revenue, USD Billion, 2017 - 2030)

Online

Offline

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Spain

Italy

Asia Pacific

China

India

Japan

Australia & New Zealand

Central & South America (CSA)

Brazil

Middle East & Africa (MEA)

South Africa

UAE

Frequently Asked Questions About This Report

b.The global private tutoring market was estimated at USD 91.65 billion in 2022 and is expected to reach USD 9711 billion in 2023.

b.The global private tutoring market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 154.8 billion by 2030.

b.North America dominated the private tutoring market with a share of around 35.16% in 2022. Government-backed initiatives, like educational projects targeting rural areas, are set to stimulate the adoption of online tutoring services.

b.Some of the key players operating in the private tutoring market include Educomp Solutions Ltd., Sylvan Learning, LLC, Daekyo Co., Ltd., Kumon Institute of Education Co., Ltd., Kaplan Inc., Action Tutoring, Chegg, Inc., Ambow Education Holding Ltd., TAL Education Group, Mathnasium LLC.

b.Key factors that are driving the private tutoring market growth include factors such as growing awareness among the parents regarding the competition among the students on a global level which needs to be excelled in academics as well as in the non-academical subjects like musical instrument, dance, and more.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."