RNA Therapy Clinical Trials Market Size, Share & Trends Analysis Report By Modality, By Phase, By Therapeutic Areas (Rare Diseases, Anti-infective, Anticancer, Neurological), By Region, And Segment Forecasts, 2023 - 2030

- 报告ID: gvr - 4 - 68040 - 100 - 2

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

The globalRNA therapy clinical trials market sizewas estimated atUSD 2.56 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 3.84% from 2023 to 2030. The market growth is majorly driven by the growing prevalence of genetic and rare diseases, a rise in R&D funding, the demand for novel therapies, and a favorable regulatory environment. Moreover, increasing RNA therapy approval is expected to drive market growth. Numerous oligonucleotide drugs are approved, and multiple is in phase III clinical trials, mainly for genetically well-defined rare disorders. The current bolus of investment in RNA therapeutics is likely to lead the future clinical success across multiple modalities and disease areas.

The success of RNA-based COVID-19 Vaccines is a major contributor to the RNA therapy clinical trial market. The development and widespread use of COVID-19 vaccinations based on mRNA by Pfizer-BioNTech and Moderna has successfully demonstrated the potential of RNA therapeutics on a worldwide scale. The safety and efficacy of mRNA-based technologies have been strongly demonstrated by the approval of mRNA vaccines. This approval has propelled confidence among regulatory bodies, researchers, and investors, encouraging further exploration ofmRNA therapeuticsin clinical trials.

Furthermore, the success of mRNA vaccines has led to significant attention from funding organizations and investors. The growing interest in mRNA therapies has attracted additional funding opportunities, enabling more research institutions and entities to carry out clinical trials in the arena. For instance, in April 2023, Sanofi announced that it will provide the MIT lab of Professor Daniel Anderson USD 25 million over a period of five years to support its research in creating messenger RNA delivery technology.

The increasing prevalence of genetic and rare diseases is expected to create opportunities for market growth in the coming years. According to the U.S. Department of Health & Human Services, over 10,000 known rare disorders that affect around 1 in 10 individuals (or 30 million individuals) in the U.S. Globally, an estimated 3.5 to 5.9% of people have a rare disease, many of which are RNDs, which are usually identified in childhood. mRNA technology enables the development of a broad range of therapeutic modalities including gene editing, protein replacement, andcancer immunotherapy. This versatility makes mRNA therapy a useful platform for addressing various rare diseases, resulting in boosting market growth.

On the other hand, increasing adoption of mRNA in cancer vaccines is also expected to boost the market growth in the forecast period. For the treatment of melanoma, colorectal, and pancreatic cancer using an mRNA vaccine, numerous clinical trials are now being conducted. mRNA cancer vaccines can be used as a personalized therapy or as a one-vaccine-to-many-people technique. Dendritic cells take the vaccine's mRNA and deliver it to T cells, directing them to search out and eliminate cancer cells.

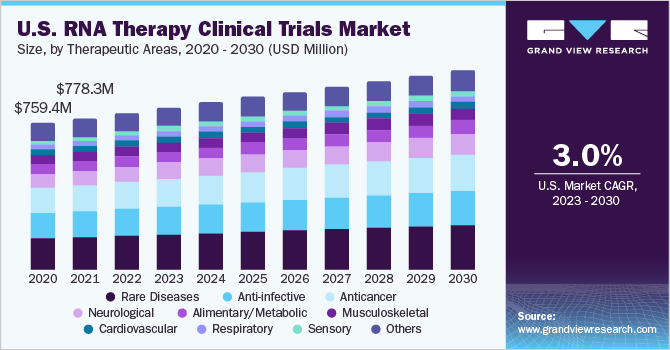

Therapeutic Areas Insights

Based on therapeutic areas, the market is divided into rare diseases, anti-infective, anticancer, neurological, musculoskeletal, alimentary/metabolic, cardiovascular, respiratory, sensory, and others. The rare diseases segment dominated the global market with a revenue share of more than 21.0% in 2022. According to the data published by the American Society of Gene & Cell Therapy (ASGCT), around 267 RNA therapies are currently in the pipeline for rare diseases (from preclinical through pre-registration). For non-oncology rare disorders, Duchenne’s muscular dystrophy, cystic fibrosis, and amyotrophic lateral sclerosis are the most commonly targeted indications.

The anticancer segment is anticipated to grow at the fastest CAGR during the forecast period.The initial study on cancer vaccines is largely responsible for the success of the mRNA-based COVID-19 vaccines. The Pfizer/BioNTech and Moderna COVID-19 vaccines' development was sped up by utilizing the expertise of each company in the field of cancer vaccines. Personalizedvaccinesare developed based on molecular structures of tumors from patients to detect genetic alterations that could give rise to neoantigens. To determine whether neoantigens will attach to T-cell receptors and elicit an immunological response, algorithms are used.

Modality Insights

Based on modality, the RNA therapy clinical trial market has been further categorized into RNA interference, Antisense therapy, Messenger RNA, and Oligonucleotide, non-antisense, and non-RNAi.The messenger RNA segment held a major revenue share of over 35% in 2022. The COVID-19 pandemic significantly accelerated the development and use of mRNA-based vaccinations, including the COVID-19 vaccines from Pfizer-BioNTech and Moderna. Due to the efficacy of these mRNA vaccines, mRNA technology has gained attention and shown promise in the fight against infectious diseases. Moreover, there are several potential uses for mRNA treatments in a variety of illness states. They can be used to encode particular proteins that make therapeutic antibodies, activate an immunological response, or restore protein function.

On the other hand, RNA interference held a significant share of the RNA therapy clinical trial industry in 2022. RNAi has shown potential therapeutic uses for a variety of disorders. It can be used to specifically target genes linked to rare genetic abnormalities or common diseases like cancer.RNAi can also be used to inhibit viral replication by targeting viral mRNA. As a result, RNAi treatments are attracting a lot of attention and funding for a range of illness indications.

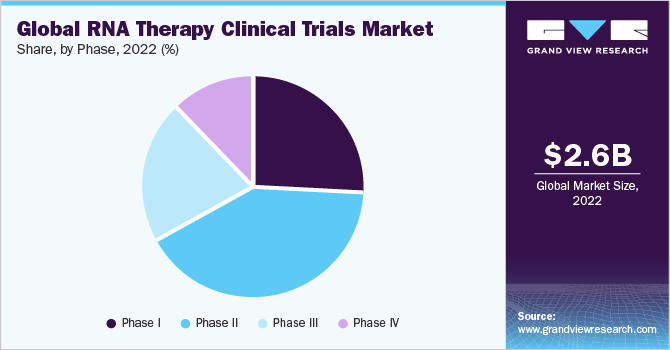

Phase Insights

Based on phases, the RNA therapy clinical trial market has been further categorized into phase I, phase II, phase III, and phase IV. The phase II segment held a major revenue share of over 41% in 2022. Rising investment in R&D and an increasing number of non-industry-sponsored and industry-sponsored clinical trials in phase II are major contributing factors to the segment's growth. Phase 2 studies enable the determination of the ideal dose and dosing regimen for RNA therapies.

The phase I clinical trials segment is expected to hold a significant market share in the coming years. Regulatory bodies such as the U.S. FDA, required data from phase 1 clinical trialsto aid the advancement of RNA therapies into later-stage trials.Phase 1 trials provide critical safety data for regulatory submissions, such as Investigational New Drug (IND) applications, which are required to move on to the next stages of clinical research.

Regional Insights

北点erica dominated the RNA therapy clinical trials market with a share of 36.58% in 2022. This is attributed to the early adoption of RNA therapies, robust research infrastructure, regulatory environment, and strong biotechnology and pharmaceutical industry. North America has been at the forefront of the development and early adoption of RNA therapies. Several key players in the field of RNA therapeutics are based in North America, and they have spearheaded clinical trials and advanced the translation of RNA-based therapies into the clinic. Additionally, a significant number of RNA therapeutics have previously received FDA approval, and many are currently undergoing various stages of clinical studies to show their efficacy for a range of disorders.

亚太地区预计将经历最大growth over the forecast period with a CAGR of 4.51%. Research and development efforts in the area of RNA therapies have rapidly increased throughout the Asia Pacific region. Academic institutions, research organizations, and biotech companies are actively involved in RNA-based research in nations including China, Japan, South Korea, and Singapore, which is resulting in a growing pipeline of possible RNA therapeutics and boosting the number of clinical studies in the area.

Key Companies & Market Share Insights

Key players are adopting notable strategic initiatives such as merger & acquisition, new service launches, and partnerships to have a competitive advantage. For instance, in January 2023, Rznomics Inc. and Charles River announced a viral vector contract development & manufacturing organization partnership to initiate the clinical development of RNA-based anticancer gene therapy for patients with liver cancer. Moreover, in October 2021, GeneCentric Therapeutics and LabCorp entered a collaboration to develop & commercialize new RNA-based gene signatures as diagnostics for people with cancer. Some prominent players in the global RNA therapy clinical trials market include:

IQVIA

ICON Plc

Laboratory Corporation of America Holdings

Charles River Laboratories International, Inc.

PAREXEL International Corp.

Syneos Health

Medpace Holdings, Inc.

PPD Inc.

Novotech

Veristat, LLC.

RNA Therapy Clinical Trials MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 2.67 billion |

Revenue forecast in 2030 |

USD 3.5 billion |

Growth rate |

CAGR of 3.84% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Modality, clinical trials phase, therapeutic areas, region |

Regional scope |

北点erica; Europe; Asia Pacific; Latin America; MEA |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; India, Japan, China, Australia, South Korea, Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

IQVIA; ICON Plc; Laboratory Corporation of America Holdings; Charles River Laboratories International, Inc.; PAREXEL International Corp.; Syneos Health; Medpace Holdings, Inc.; PPD Inc.; Novotech; Veristat, LLC. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

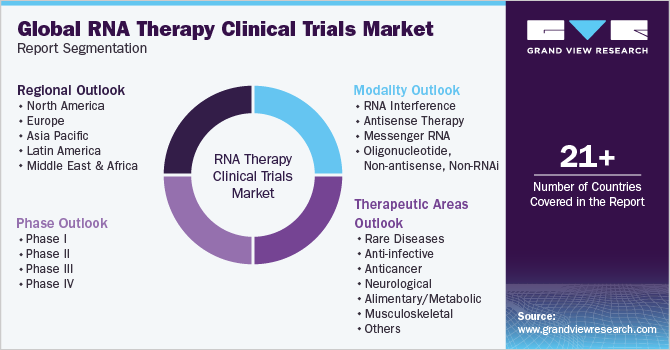

Global RNA Therapy Clinical Trials Market Report Segmentation

这份报告预测收入增长并提供an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the RNA therapy clinical trials market report based on modality, clinical trials phase, therapeutic areas, and region:

Modality Outlook (Revenue, USD Million, 2018 - 2030)

RNA interference

Antisense therapy

Messenger RNA

Oligonucleotide, non-antisense, non-RNAi

Clinical Trials Phase Outlook (Revenue, USD Million, 2018 - 2030)

Phase I

Phase II

Phase III

Phase IV

Therapeutic Areas Outlook (Revenue, USD Million, 2018 - 2030)

Rare Diseases

Anti-infective

Anticancer

神经系统

Alimentary/Metabolic

Musculoskeletal

Cardiovascular Respiratory

Sensory

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

北点erica

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Sweden

Norway

Denmark

Asia Pacific

Japan

China

India

South Korea

Australia

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global RNA therapy clinical trials market is expected to grow at a compound annual growth rate of 3.84% from 2023 to 2030 to reach USD 3.5 billion by 2030.

b.北点erica dominated the RNA therapy clinical trials market with a share of 36.58% in 2022. This is attributable to an early adoption of RNA therapies, robust research infrastructure, regulatory environment, and strong biotechnology and pharmaceutical industry.

b.Some key players operating in the RNA therapy clinical trials market include IQVIA, ICON Plc, Laboratory Corporation of America Holdings, Charles River Laboratories International, Inc., PAREXEL International Corp., Syneos Health, Medpace Holdings, Inc., PPD Inc., Novotech, Veristat, LLC.

b.Key factors that are driving the market growth include growing prevalence of genetic and rare diseases, rise in R&D funding, increase in demand for novel therapies, and a favorable regulatory environment.

b.The global RNA therapy clinical trials market size was estimated at USD 2.56 billion in 2022 and is expected to reach USD 2.67 billion in 2023.