Robot-assisted Endoscope Market Size, Share & Trends Analysis Report By End-use (Hospitals, Outpatient Facilities), By Region (North America, Asia Pacific, Europe, Latin America, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-127-5

- Number of Pages: 250

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

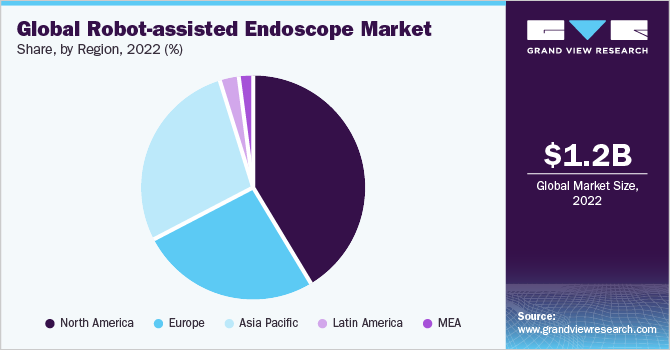

The globalrobot-assisted endoscope market sizewas valued atUSD 1.24 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. The factors, such as greater diagnostic capabilities, and quicker recovery periods, have led to consistent growth in the market. The development of more advanced and functional robot-assisted endoscope systems can be attributed to substantial technological developments in the fields of robotics and endoscopy. The demand for sophisticated endoscopic technology, particularly robot-assisted endoscopes, has increased with the rising prevalence of chronic diseases like cancer and gastrointestinal disorders.

The increased prevalence of chronic diseases, including pancreatic cancer, inflammatory bowel disease, and gastroesophageal reflux disease (GERD), among individuals of all ages as a result of unhealthy lifestyles, is one of the key reasons driving the market's expansion. For instance, in February 2021, the International Foundation for Gastrointestinal Disorders (IFFGD) reported that 10%–15% of people worldwide were suffering from irritable bowel syndrome (IBS) at the time. As per the reports published by the Centers for Disease Control and Prevention in April 2022, 3.1 million elderly population in the United States suffer from IBS. Robotic endoscopy is viable & safe and enhances clinical & surgical results for patients with IBD.

Such advantages of robotic endoscopy in identifying irritable bowel syndrome and inflammatory bowel syndrome are anticipated to fuel demand and accelerate market expansion. Moreover, the increasing expenditures in endoscopic visualization systems’ technological advancements by a variety of market participants are anticipated to fuel the market's expansion over the projected period. For instance, Virtuoso Surgical committed twenty million dollars in funding in September 2022 for the development of endoscopic surgery robots. Among the surgeries performed are endoscopic neurosurgery, uterine fibroids, bulging prostate, bladder cancer, and central airway blockage removal.

However, during the projected time, the market's growth is anticipated to be constrained by relatively expensive surgical endoscopic procedures, problematic repayment strategies, and strict regulatory reforms. Themarket for robotic endoscopic deviceshas experienced substantial damage from the COVID-19 epidemic. Global lockdowns substantially harmed the diagnostics and imaging sector and reduced public mobility. The non-urgent diagnostic procedures and screening programs were delayed reducing the strain on the healthcare system. For instance, the COVID-19 pandemic caused a backlog of roughly half a million endoscopic procedures, which were necessary for identifying gastrointestinal tumors and disorders, by January 2021, according to a report published by University College London, in March 2021.

The story also stated that more than 90% fewer endoscopies were performed in the UK following the shutdown. Due to the severe lockdown requirements, endoscopic treatments were drastically reduced, which had a significant effect on the market's expansion. Robotic and traditional endoscopic procedures, however, gained more traction when the lockdowns were relaxed in most nations. Moreover, the regulatory grants for various robotic endoscopic platforms drive the market growth. For instance, in May 2022, the U.S. FDA granted 510(k) clearance to Auris Health, Inc., an affiliate of Johnson & Johnson MedTech firm Ethicon, Inc., for use in endourological treatments. With this approval, MONARCH became the first and only multispecialty, adaptable robotic device that could be used for bronchoscopy and urology procedures. It is intended to make it easier for urologists to precisely and carefully access and view specific regions of the kidney.

End-use Insights

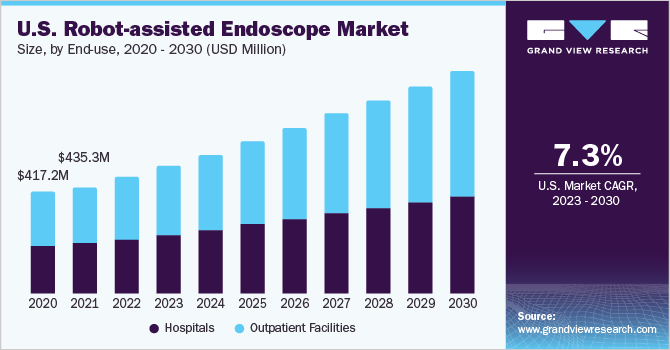

The outpatient facilities segment dominated the market with a revenue share of 53.31% in 2022. This includes day surgery clinics or ambulatory surgery centers (ASCs), which have been using robot-assisted endoscopes more frequently in their procedures. Outpatient facilities strive to offer patients convenient and effective medical care. Minimally invasive procedures are prioritized wherever possible in outpatient settings. This target is in accordance with the goal that robot-assisted endoscopes, which provide less invasive alternatives for numerous diagnostic and treatments, aim to achieve.

Robot-assisted endoscopes are appealing for outpatient settings because they frequently result in quicker recovery times and shorter operation times. The segment is also expected to grow at the fastest CAGR from 2023 to 2030. Robot-assisted endoscopes can help eliminate the need for more involved surgical procedures and shorten hospital stays, making them cost-effective for outpatient facilities. Outpatient facilities may see an increase in demand for such treatments due to the increased prevalence of gastrointestinal illnesses and other conditions that call for endoscopic operations. Robotic endoscopes can help to effectively address this demand.

Regional Insights

North America dominated the global market with a revenue share of 41.81% in 2022. The existence of a well-established healthcare industry, hospitals' financial capacity to invest in robotic endoscopy equipment, public awareness of robot-assisted medical procedures, and the presence of a sizable market participant base in the area are the key drivers of market growth. The increasing number ofclinical trialstudies for robot-assisted endoscopes boosts market growth. For instance, in December 2022, the first patient was registered in the Extend URO the United States clinical study for the Hugo robotic surgical assistance, according to Medtronic plc, a pioneer in global healthcare technology.

Dr. Michael R. Abern performed the robotic-assisted prostate at Duke University Hospital in North Carolina. During the projected period, the market’s expansion is anticipated to be aided by the accessibility of sophisticated robotic endoscopies and their widespread use in surgical procedures.For instance, the Flex robotic system is a surgical system featuring a flexible robotic endoscope, according to information published by the City of Hope Cancer Center in May 2022. With the use of this minimally invasive technology, surgeons can reach parts of the mouth and throat that are difficult to reach. The otolaryngologists at Cancer Treatment Centers of America (CTCA) had received extensive training in using the Flex robotic system to treat patients with head and neck cancer.

这些尖端的机器人endo的可用性scopic tools in North America demonstrates the uptake of cutting-edge technologies. During the anticipated period, this circumstance is anticipated to accelerate the market's growth. Asia Pacific is expected to register the fastest CAGR of 9.5% during the forecast period. The regional demand is anticipated to be driven by factors, such as increased disposable income, healthcare costs, and the prevalence of chronic disorders. In addition, the need is anticipated to be fueled by the increasing use of robotic systems in healthcare facilities. Moreover, the increasing investment in cutting-edge medical technologies and procedures, such as robotic-assisted endoscopies, has resulted from rising healthcare spending in nations like China and India.

Key Companies & Market Share Insights

To sustain a high level of competitive rivalry, market participants are investing an extensive amount of funds in the development and launch of new products. For instance, in August 2022, at Brigham and Women’s Hospital in Boston, EndoQuest Robotics deployed its ELS (endoluminal surgical system). The endoluminal robotic surgery instrument known as the ELS system enables therapeutic endoscopy specialists and doctors to execute both upper and lower gastrointestinal procedures without leaving scars by using a trans-anal or trans-oral method. These initiatives support the market's continuing competitiveness. Some of the prominent players in the globalrobot-assisted endoscope market include:

Asensus Surgical US, Inc.

Intuitive Surgical

Auris Health, Inc.

Johnson & Johnson Services, Inc.

Brainlab AG

Medtronic plc.

Boston Scientific Corporation

Stryker

Robot-assisted Endoscope Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 1.36 billion |

Revenue forecast in 2030 |

USD 2.36 billion |

Growth rate |

CAGR of 8.2% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

End-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Asensus Surgical US, Inc.; Intuitive Surgical; Auris Health, Inc.; Johnson & Johnson Services, Inc.; Brainlab AG; Medtronic plc.; Boston Scientific Corporation; Stryker |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Robot-assisted Endoscope Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the robot-assisted endoscope market report on the basis of end-use, and region:

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Outpatient Facilities

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

South Korea

Thailand

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa (MEA)

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global robot-assisted endoscopes market was valued at USD 1.24 billion in 2022 and is expected to reach USD 1.36 billion in 2023.

b.The global robot-assisted endoscopes market is expected to expand at a CAGR of 8.2% from 2023 to 2030 to reach USD 2.36 billion by 2030.

b.North America dominated the global robot-assisted endoscopes market with a revenue share of 41.81% in 2022. The existence of a well-established healthcare industry, hospitals' financial capacity to invest in robotic endoscopy equipment, public awareness of robot-assisted medical procedures, and the presence of a sizable market participant base in the area are the key drivers of growth.

b.Some of the prominent players in the robot-assisted endoscopes market include: • Asensus Surgical US, Inc. • Intuitive Surgical • Auris Health, Inc. • Johnson & Johnson Services, Inc. • Brainlab AG • Medtronic plc. • Boston Scientific Corporation • Stryker

b.The factors such as greater diagnostic capabilities, quicker recovery periods, have led to a consistent growth in the market for robot-assisted endoscopes.