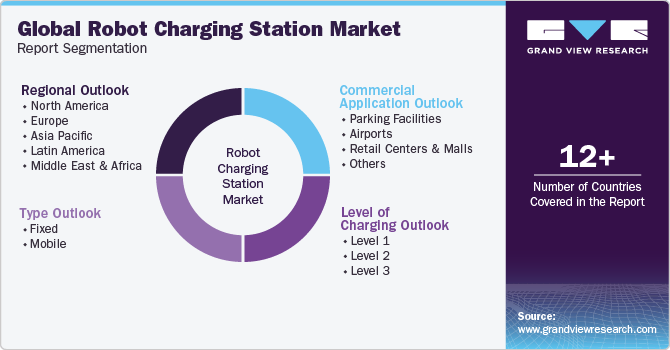

Robot Charging Station Market Size, Share & Trends Analysis Report By Type (Fixed, Mobile), By Level Of Charging, By Commercial Application (Parking Facilities, Airports, Retail Centers & Malls), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-145-7

- Number of Pages: 115

- Format: Electronic (PDF)

- Historical Range: 2023 - 2030

- Industry:Technology

Robot Charging Station Market Size & Trends

The globalrobot charging station market size was estimated at USD 0.40 million in 2023and is expected to grow at a compound annual growth rate (CAGR) of 42.9% from 2023 to 2030. The growth can be attributed to the rising adoption ofelectric vehicles(EVs) across the globe which has necessitated innovative charging solutions to meet the increasing demand. The emphasis on autonomous driving technology has extended to charging infrastructure, leading to the integration of AI & ML algorithms for precise and efficient docking and charging processes. The need for seamless and convenient charging experiences has spurred the development of advanced robot charging stations capable of autonomously locating and connecting to EVs. The efforts to enhance sustainability and reduce carbon emissions have prompted investments in eco-friendly charging solutions, further accelerating the growth of the market.

Several robot charging solution providers across the globe are increasingly focusing on launching charging robots to offer customers efficient charging connectivity. In March 2023, NaaS Technology launched an automated EV charging robot, marking a significant development in the realm of the technology. The robot's capabilities include autonomous detection of vehicles, seamless charging operations, and automatic payment processing. This strategic move by NaaS Technology underscores its commitment to exploring the vast potential of the country's NEV market. The introduction of this innovative charging robot addresses the growing need for convenient on-the-go EV charging solutions.NaaS believes that intelligent and unmanned charging systems will redefine the charging experience, ultimately unlocking substantial opportunities in the smart charging market, especially asautonomous vehiclesbecome a reality.

An emerging trend in the robot charging station market is the seamless integration ofartificial intelligenceand the pursuit of full autonomy. Charging stations are increasingly equipped with advanced AI algorithms that allow them to not only locate and connect to electric vehicles independently but also adapt to changing environmental conditions. These smart solutions can optimize charging strategies based on factors like battery health, grid demand, and user preferences, making the charging process more efficient and user-friendly. As EV adoption continues to rise, the demand for AI-driven robot charging stations is expected to grow, driving innovation in this sector.

Robot charging stations are evolving to support various modes of charging to cater to a wide range of EVs. This trend includes the development of robotic arms and adapters that can accommodate different charging standards, voltages, and connector types. By offering compatibility with diverse EV models and charging infrastructure, these stations ensure flexibility and accessibility, making EV ownership more appealing to a broader audience. Manufacturers are also exploring the potential for wireless charging capabilities, which would further enhance convenience and reduce the physical wear and tear on charging connectors.

The sustainability aspect of robot charging stations is gaining prominence as the world shifts towards greener transportation solutions. Manufacturers are focusing on energy-efficient designs and materials to reduce the environmental footprint of these charging stations. Additionally, some charging stations are equipped with renewable energy integration, such as solar panels or wind turbines, allowing them to harness clean energy sources for charging. Energy management systems are also being implemented to optimize charging times during off-peak hours, helping to balance grid loads and promote the efficient use of electricity.

COVID-19 Impact Analysis

The COVID-19 pandemic had a moderate impact on the robot charging station market. Initially, the industry faced disruptions in supply chains and manufacturing processes due to lockdowns and restrictions, leading to delays in product development and deployment. However, as the pandemic persisted, it also accelerated certain trends within the market. The heightened focus on contactless and touchless solutions in response to health concerns prompted a surge in the demand for autonomous robot charging solutions and systems. These systems, capable of performing charging operations without human intervention, gained traction as they aligned with the need for reduced physical interaction.

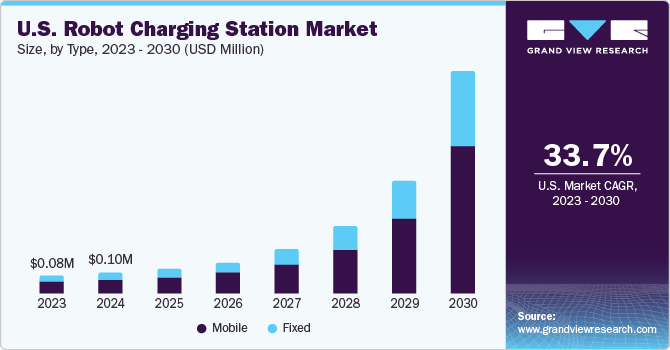

Type Insights

基于类型,移动充电段dominated the market in 2023 and accounted for more than 63.0% share of the global revenue. The ability to roam freely and serve multiple vehicles in various locations makes mobile robot EV chargers an attractive solution for urban environments, parking facilities, and areas with high EV traffic. These innovative charging systems, unlike traditional fixed chargers, are designed to be agile and adaptable, capable of autonomous movement within a defined area. This mobility allows them to efficiently locate EVs in need, reducing the need for dedicated charging stations. As EV adoption continues to rise, this trend underscores the importance of versatile and dynamic charging solutions that can meet the evolving needs of the owners while optimizing space utilization and infrastructure costs.

fixed-charging段预计将增长a CAGR of 41.0% over the forecast period. As EVs continue to evolve with larger battery capacities, fixed robot charging stations are adapting by offering higher charging capacities. These stations are designed to deliver rapid and ultra-fast charging, significantly reducing the time required to replenish an EV's battery. This trend aligns with the growing demand for faster charging experiences, catering to the needs of both consumers and commercial fleets.

The adoption of these high-power charging stations is expected to play a crucial role in reducing range anxiety and further promoting the widespread adoption of electric vehicles. Furthermore, the trend of modular and scalable charging infrastructure is gaining traction. Fixed robot charging station are being designed with modular components that can be easily expanded or upgraded to accommodate additional charging stalls. This scalability allows charging station operators to adapt to changing demand patterns and efficiently utilize their infrastructure investment.

Level of Charging Insights

The level-2 segment dominated the market in 2023 and accounted for more than 42.0% share of the global revenue. Level 2 chargers, known for their versatility and moderate charging speed, are undergoing a transformation to meet the evolving needs of electric vehicle owners. One prominent trend is the integration of enhanced connectivity features. These chargers are now equipped with advanced connectivity options, enabling users to remotely monitor and control the charging process through mobile apps or web interfaces. This does not only enhance user convenience but also allows smart grid integration, enabling dynamic load management and participation in demand response programs. As the world moves toward a more interconnected and digital future, these chargers are poised to play a vital role in shaping the seamless and intelligent charging experience.

The level 3 segment is expected to grow at the highest CAGR of 44.1% over the forecast period. The ability of these chargers to address the increasing demand for ultra-fast charging is a significant factor contributing to the growth of the market. One notable trend is the deployment of higher charging power levels, pushing the boundaries of charging speed. They often feature liquid-cooled systems to manage the heat generated during rapid charging, ensuring the longevity of both the charger and the battery. These chargers are being designed with a focus on modular and scalable infrastructure which allows charging station operators to expand capacity very easily.

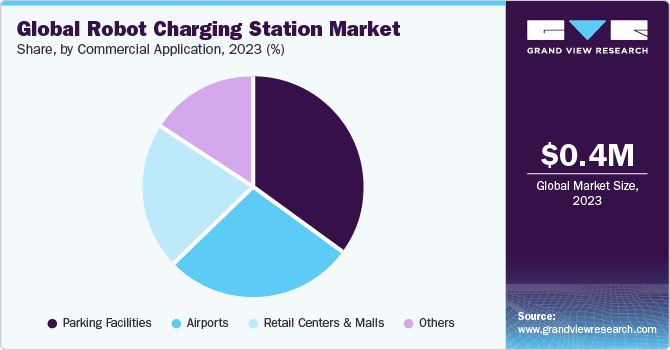

Commercial Application Insights

The parking facilities segment dominated the market in 2023 and accounted for more than 35.0% share of the global revenue. Robot charging stations in parking facilities are evolving to offer not just charging services but also autonomous EV monitoring and maintenance capabilities. These stations can autonomously manage the charging needs of multiple EVs, optimizing charging schedules based on usage patterns and energy demand. This trend not only streamlines EV operations but also enhances the overall sustainability of commercial parking facilities by ensuring efficient use of electricity. These systems are increasingly incorporating user-friendly interfaces and payment options, making it easier for customers and employees to access charging services.

The retail centers & malls segment is expected to grow at a moderate CAGR over the forecast period. As EVs continue to surge, these establishments are recognizing the value of providing convenient and efficient charging solutions for their customers. They offer a dynamic and user-friendly service, enhancing the overall user experience. These stations are not only user-centric but also eco-conscious, often integrating renewable energy sources and smart-grid connectivity to reduce their environmental footprint. The result is a win-win situation: retail centers and malls offer a compelling service to EV owners, attracting more foot traffic and promoting longer stays, while simultaneously contributing to the sustainability efforts of the broader community.

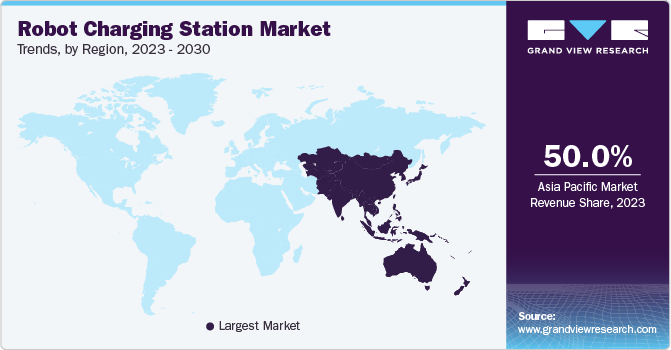

Regional Insights

Asia Pacific dominated the market, accounting for more than 50.0% share of the overall revenue, and is expected to retain its dominance over the forecast period.The region’s growth is notably influenced by the swift expansion of EV infrastructure, fueled by determined government programs and policies endorsing eco-friendly transportation. The region's proactive investments in EV adoption are propelling substantial growth in robot charging stations, with an emphasis on scalability and compatibility to cater to the rapidly expanding EV market. Furthermore, advancements in technology and manufacturing are driving the development of cost-efficient and highly effective robot charging solutions, broadening their accessibility to a wider spectrum of consumers..

Latin America is expected to grow at a moderate CAGR over the forecast period. Governments and private entities are ramping up efforts to expand charging infrastructure, focusing on creating a more extensive and accessible network to encourage EV usage. This emphasis on accessibility extends to underserved and remote areas, where the development of charging stations is becoming a crucial part of fostering equitable access to sustainable transportation solutions. Latin America is witnessing a surge in local innovation and manufacturing of robot charging technology. Homegrown companies are tailoring solutions to regional needs and conditions, promoting the growth of a self-sustained EV ecosystem. These stations are engineered for adaptability, accommodating a variety of EV models and charging standards, reflecting the diverse mobility landscape of the region.

Key Companies & Market Share Insights

The robot charging station industry is presently in its emerging phase and exhibits consolidation, with a selected group of key players employing strategic approaches to solidify their lasting presence. This landscape poses challenges for new entrants aiming to establish their position. The established participants employ a range of strategies, such as geographic expansion, continuous innovation, and customer-focused initiatives. These tactics contribute to shaping a competitive environment marked by its dynamic and forward-looking nature, ultimately benefiting all stakeholders involved in this burgeoning market.

Several companies are forging partnerships, unveiling new product offerings, and initiating collaborative ventures with fellow industry counterparts. Businesses on a global scale are rolling out internet services designed to enhance customer support and efficiency. In April 2023, Lotus launched an innovative robotic electric vehicle charger at the Shanghai motor show, boasting charging speeds of up to 500kW. Demonstrated in action at the event, the robotic charger showcased its capabilities by autonomously connecting to a Lotus Eletre SUV. This charger, yet to be named, will be available as part of a fleet comprising 50 units, offering support for all electric vehicles. It remains uncertain whether this ultra-fast charger will be available in the UK or not.

Key Robot Charging Station Companies:

- Hyundai Motor Group

- EV Safe Charge Inc.

- Mob-Energy S.A.S

- VOLTERIO GmbH

- ROCSYS

- NaaS Technology, Inc

- Volkswagen

- Autev

- EVAR Inc.

- ALVERI Ltd

Robot Charging Station Market Report Scope

Report Attribute |

Details |

Revenue forecast in 2030 |

USD 4.91 million |

Growth rate |

CAGR of 42.9% from 2023 to 2030 |

Base year of estimation |

2023 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

Segments covered |

Type, level of charging, commercial application, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; U.K.; Germany; France; Netherlands; China; Japan; South Korea; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa. |

Key companies profiled |

Hyundai Motor Group; EV Safe Charge Inc.; Mob-Energy S.A.S; VOLTERIO GmbH; ROCSYS; NaaS Technology, Inc; Volkswagen; Autev; EVAR Inc.; ALVERI Ltd. |

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Robot Charging Station Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2030. For this study, Grand View Research has segmented the global robot charging station market report based on type, level of charging, commercial application, and region:

Type Outlook (Revenue, USD Million, 2023 - 2030)

Fixed

Mobile

收费前景水平(收入,百万美元,2023 - 2030)

Level 1

Level 2

Level 3

Commercial Application Outlook (Revenue, USD Million, 2023 - 2030)

Parking Facilities

Airports

Retail Centers & Malls

Others

Regional Outlook (Revenue, USD Million, 2023 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Netherlands

Asia Pacific

China

Japan

South Korea

Netherlands

Latin America

Brazil

Middle East & Africa (MEA)

Kingdom of Saudi Arabia (KSA)

UAE

South Africa

Frequently Asked Questions About This Report

b.The global robotic charging platform market size was estimated at USD 0.40 million in 2023 and is expected to reach USD 0.46 million by 2024.

b.The global robotic charging platform market is expected to grow at a compound annual growth rate of 42.9% from 2023 to 2030 and is expected to reach USD 4.91 million by 2030.

b.The mobile segment dominated the market with a market share of more than 63.0% in 2023. The segment growth can be attributed to the ability of robotic chargers to roam freely and serve multiple vehicles in various locations, which makes mobile robotic EV chargers an attractive solution for urban environments, parking facilities, and areas with high EV traffic.

b.Some of the key players are Hyundai Motor Group, EV Safe Charge Inc., Mob-Energy S.A.S, VOLTERIO GmbH, ROCSYS, NaaS Technology, Inc, Volkswagen, Autev, EVAR Inc., ALVERI Ltd. .

b.The market growth can be attributed to the growing adoption of Electric Vehicles (EVs) globally, which has necessitated the development of innovative charging solutions to meet the increasing demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."