Rotary Air Compressor Market Size, Share & Trends Analysis Report By Lubrication (Oil-free, Oil-filled), By Type (Stationary, Portable), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-136-1

- Number of Pages: 169

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Advanced Materials

Rotary Air Compressor Market Size & Trends

Theglobal rotary air compressor market size was estimated at USD 11.44 billion in 2022and is anticipated to grow at a compound annual growth rate (CAGR) of 4.4% from 2023 to 2030. Growth in demand for energy-efficient products, expansion of the rotary air compressor's application areas, increase in the number of infrastructure projects, penetration of IoT, andIndustry 4.0are the major factors driving the market growth. In addition, these compressors are ideal pneumatic solutions for any task that needs secure, ongoing access to compressed air. In a variety of industrial settings, including oil & gas, manufacturing, food packaging, construction, automotive, chemical, pharmaceutical, and energy, these compressors also power pneumatic tools. These aforementioned factors are further anticipated to propel the market growth over the forecast period.

此外,扶轮空气压缩机可以确保一个continuous sweeping motion in contrast to the reciprocating air compressor, which has excessive pulsing and surging of the airflow. The heat produced during air compression by rotary air compressors is reduced, which aids in lowering the amount of water produced during operation. As a result, less water will enter the compressor or other final applications. These aforementioned factors are expected to augment the market demand over the forecast period.

The demand for portable rotary air compressors in the U.S. has been driven by various factors, including their versatility, convenience, and mobility. Portable rotary air compressors are often used in construction sites, automotive maintenance, and other applications where on-the-go air supply is needed. They are valued for their compact size, ease of transportation, and ability to power pneumatic tools and equipment. The demand for portable air compressors may also be influenced by trends in home improvement, outdoor activities, and the growth of industries that require portable pneumatic solutions.

When compared to other types ofair compressors, such as reciprocating air compressors, rotary air compressors are an improved type. The air is compressed inside these compressors using rotary movements and positive displacement technology. Two opposingly rotating rotors can be found inside the rotary air compressor. The air is compressed as it travels along the rotors because the distance between them gets smaller. Compressed air is produced resulting in a decrease in volume, which can subsequently be applied to the necessary situation.

Rotary air compressor run continuously, in contrast to reciprocating air compressors. As a result, there is no need to switch off the air compressor so the pistons may rest and cool and pause for an air receiver tank to fill up before using the air. In addition, because these compressors operate at a lower temperature and may run continuously without damaging any essential parts, overheating is not a concern. These aforementioned factors are expected to drive the demand for rotary air compressors in the coming years.

The demand for rotary air compressors in the U.S. is driven by increased energy efficiency, reliability, low maintenance requirements, and their ability to deliver consistent compressed air. These compressors are favored in industries that require continuous and high-volume air supply, such as manufacturing, automotive, construction, and pharmaceuticals. In addition, advancements in technology and automation, along with the need for precise control of various processes, contribute to the demand for rotary air compressors.

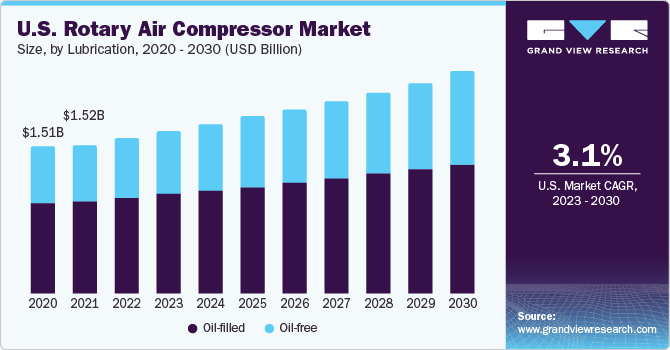

Lubrication Insights

Based on lubrication, the oil-filled lubrication segment led the market in 2022 with the largest revenue share of 61.7%. Oil-filled rotary air compressors are a type of air compressor that uses oil for lubrication and cooling of the compressor's internal components. These compressors are commonly used in industrial settings where continuous and heavy-duty air supply is required. The oil helps reduce friction between moving parts, extending the life of the compressor and reducing wear and tear. Further, the oil creates a seal between rotors, preventing air leakage and ensuring efficient compression.

Oil-filled rotary air compressors offer advantages such as higher efficiency, longer lifespan, and quieter operation compared to oil-free compressors. However, they require regular maintenance to monitor oil levels, change oil filters, and replace lubricating oil. Whereas oil-free rotary air compressors operate without the use of lubricating oil in the compression chamber. Instead of relying on oil for lubrication and sealing, these compressors use other methods to achieve efficient compression.

Oil-free rotary compressors are known for producing clean and oil-free compressed air, which is essential in applications where air quality is critical. They also require less maintenance compared to oil-filled compressors and eliminate the risk of oil contamination in the air supply. Oil-free compressors have been developed to be energy-efficient, with advanced control systems that adjust output based on demand, reducing energy consumption. These aforementioned factors are anticipated to propel the market demand over the forecast period.

Both rotary air compressors with oil and those without oil aid businesses in maximizing efficiency in high-volume compression applications. Rotary air compressors provide continuous airflow, unlike reciprocating compressors, which eliminate the need to interrupt operations while a receiver tank fills. These compressors offer a variety of benefits in addition to this 100% duty cycle, including higher CFM per HP than rotary compressors, long working life, easy & infrequent maintenance, exceptional energy efficiency, clean air output, especially when using oil-free systems, quieter operation, and safe operation. These aforementioned factors are expected to drive the demand for rotary air compressors over the forecast period. For instance, in March 2023, Sullair launched LS190-260 Series models, which are used in general manufacturing, power generation, steel production, mining, and more.

Type Insights

Based on type, the stationary segment led the market in 2022 with the largest revenue share of 57.6%. Stationary compressors are commonly used in industries with continuous air demand, such as manufacturing, automotive, and large-scale construction projects. Furthermore, these compressors generally have higher power and capacity, making them suitable for industrial and commercial applications with high air demand. These aforementioned factors are expected to augment the demand for stationary rotary air compressor over the forecast period.

Stationary rotary air compressors are designed to be permanently installed at a fixed location, whereas portable rotary air compressors are designed for mobility. Stationary rotary air compressors are typically larger and more powerful, with the capacity to handle heavy-duty and continuous air supply requirements. On the other hand, portable compressors are smaller, compact, and equipped with handles or wheels for easy transportation. Their size and design make them suitable for on-the-go applications.

The portable rotary air compressor type segment is anticipated to witness the fastest CAGR of 4.9% over the forecast period. Portable compressors are used for smaller-scale applications, including DIY projects, pneumatic tool operation, tire inflation, and smaller construction tasks. Furthermore, portable compressors are designed for easy setup and operation without the need for complex installation These aforementioned factors are expected to propel the demand for portable rotary air compressors over the forecast period.

Sullair, for instance, provides tier 3 markets with portable lubricated rotary air compressors from the 260 Series. The Kubota V3307 engine, which is turbocharged and complies with Tier 3 emissions standards, powers the 260 series diesel compressors. It has two pressure options: 7.36 m3/min at 6.9 bar or 5.66 m3/min at 10.3 bar. Originally intended for usage in hazardous situations like South American mining and Middle Eastern oil & gas activities, these products are now employed in harsh conditions.

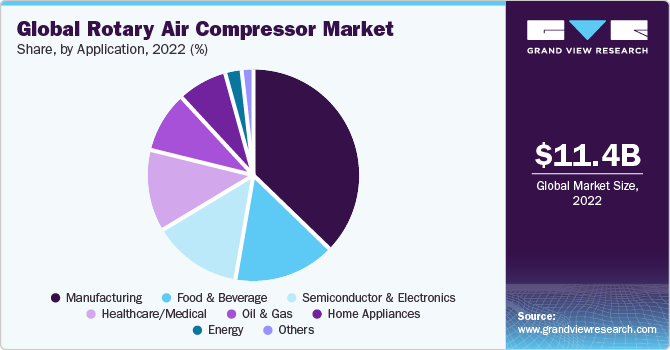

Application Insights

Based on application, the food & beverage application segment is anticipated to witness the fastest CAGR of 5.9% over the forecast period. Rotary air compressors have gained popularity in the food & beverage industry owing to their ability to provide clean, contaminant-free compressed air. Furthermore, rotary air compressors have a wide range of uses in food processing. Compressed air can be used for cutting & preparing products or developing clean & consistent packaging.

Rotary air compressors are employed in the same ways in the beverage sector as they are in the food business. This helps boost efficiency and consistency in packing and filling. Rotary air compressors are also useful in the beverage business, as they help power liquid through machinery and distribute it uniformly. These aforementioned factors are anticipated to propel the demand for rotary air compressors for the food & beverage industry during the forecast period.

The oil & gas application segment held a 13.7% revenue share in 2022. Rotary air compressors are utilized as backup, trim, and point-of-use units in a variety of applications such as gas compression, onshore & offshore drilling, pipeline & process services, and well testing. These aforementioned factors are anticipated to augment the market demand in the coming years.

The adoption of advanced automation technologies in the oil & gas industry, as well as the growing demand for reliable and consistent compressed air, are some of the factors driving the segment growth. The ability of rotary air compressors to operate in harsh and remote environments without the risk of equipment failure and high operational costs is contributing to the increasing demand for such solutions in the oil & gas industry.

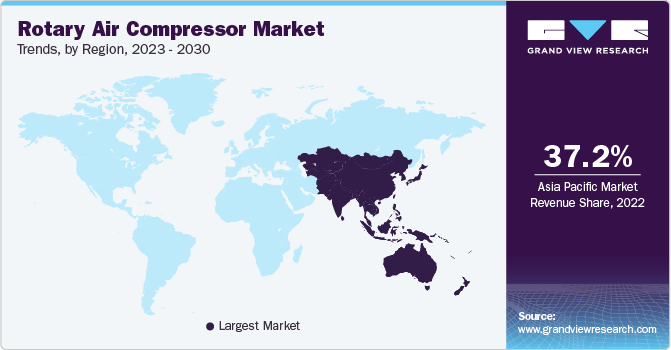

Regional Insights

Asia Pacific region dominated the market in 2022 with the largest revenue share of 37.2%. The region has a significant industrial sector with diverse applications that may drive demand for rotary air compressors in the region. China is a major hub for electronics manufacturing, including the production of semiconductors, microchips, and other electronic components. The electronics industry requires clean and oil-free compressed air for sensitive manufacturing processes. With the increasing demand for electronic products and the growth of the electronics manufacturing sector in China, there may be a corresponding demand for rotary air compressors to meet the stringent requirements for compressed air quality.

North America region is anticipated to witness a CAGR of 3.4% over the forecast period. Regulatory bodies in North America, such as the United States Food and Drug Administration (FDA) and the Occupational Safety and Health Administration (OSHA) have established strict air quality guidelines in a variety of industries, including pharmaceuticals and healthcare, resulting in the increasing adoption of rotary oil-free air compressors in critical applications to meet the established standards.

Recent growth in the European economy, especially growth across industries such as manufacturing, electronics, healthcare, processing, and food & beverages, has positively influenced the purchasing power of potential customers from these industries. In addition, the increasing need for rotary air compressors that can deliver oil-free, clean air in the above-mentioned applications is also expected to fuel the market growth.For instance, in May 2022, ELGi Compressors Europe, a subsidiary of air compressor manufacturer ELGi Equipment Limited, introduced its air compressor portfolio in Spain tailored for use by small and large-scale manufacturing industries. This portfolio included ELGi’s AB 11 - 22kW (AB Series) oil-free water-injected screw air compressors, offering high air purity and energy efficiency.

The demand for rotary air compressors in Central and South America has been growing in recent years due to increased awareness of the negative impact of oil-contaminated air on health, safety, and environmental concerns. The use of rotary air compressors is particularly prevalent in industries such as food & beverage, pharmaceuticals, and electronics, where high-quality compressed air is essential for the manufacturing process. Further, recent trends in this region show that manufacturers are embracing energy-saving technologies to reduce their carbon footprint and improve their operational efficiency. This includes the adoption of rotary air compressors, which are more energy-efficient, easier to maintain, and environmentally friendly compared to reciprocating compressors.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including geographical expansions, product launches, and mergers & acquisitions to enhance market penetration and cater to the changing technological requirements. For instance, in June 2023, Power Equipment Direct collaborated with ABAC Air Compressors to launch its unique rotary screw machines in the U.S. The AS Series of rotary screw air compressors is built with ground-breaking integrated block technology that reduces downtime, maximizes efficiency, and simplifies maintenance, making it an ideal choice for automotive, industrial, and other applications that require a reliable source of air.

Furthermore, FS-Curtis, a manufacturer of rotary and reciprocating air compressors, introduced the ECO series oil-free air compressors in June 2022. These compressors are ISO 8573-1 certified, energy-efficient, and simple to run & maintain. Some prominent players in the global rotary air compressor market include:

Atlas Copco

CompAir

HPC Compressed Air Systems

United Air Power Ltd.

Kaeser Compressors

ELGi

Kaishan美国

Ingersoll-Rand Plc

GENERAL ELECTRIC

Gardner Denver

Hitachi Ltd.

MAN SE

Kobe Steel Ltd.

Howden Group Ltd.

Boge Kompressoren

Sullair LLC

Bauer Group

BelAire Compressors

Frank Compressors

Sollant Group

Rotary Air Compressor Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 11.94 billion |

Revenue forecast in 2030 |

USD 16.19 billion |

Growth rate |

CAGR of 4.4% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

Segments covered |

Type, lubrication, application, region |

Regional scope |

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America |

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

Key companies profiled |

阿特拉斯•科普柯;英格索兰公司;通用电气(GENERAL ELECTRIC);Gardner Denver; Hitachi Ltd.; ELGi; MAN SE; Kobe Steel Ltd.; Howden Group Ltd.; Boge Kompressoren; Sullair LLC; Kaeser Compressors; Bauer Group; BelAire Compressors; Frank Compressors; Sollant Group |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

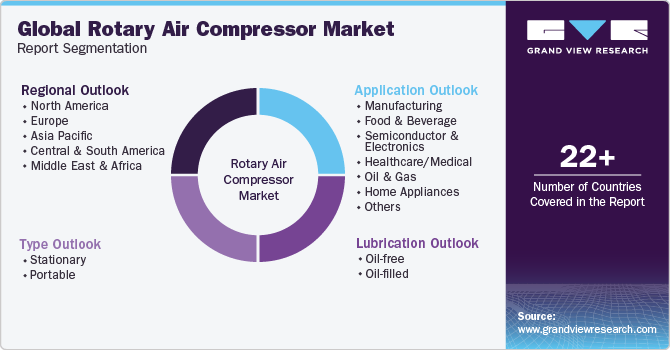

Global Rotary Air Compressor Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rotary air compressor market based on lubrication, type, application, and region:

Lubrication Outlook (Revenue, USD Billion, 2018 - 2030)

Oil-free

Oil-filled

Type Outlook (Revenue, USD Billion, 2018 - 2030)

Stationary

Portable

应用前景(收入,十亿美元,2018 -2030)

Manufacturing

Food & Beverage

Semiconductor & Electronics

医疗保健/Medical

Oil & Gas

Home Appliances

Energy

Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Asia Pacific

China

Japan

India

South Korea

Australia

Central & South America

Brazil

Argentina

Middle East & Africa

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.The global rotary air compressor market size was estimated at USD 11.44 billion in 2022 and is expected to be USD 11.94 billion in 2023.

b.The global rotary air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2023 to 2030 to reach USD 16.19 billion by 2030.

b.Asia Pacific region dominated the market and accounted for 37.2% of the global market share in 2022. The region has a significant industrial sector with diverse applications that may drive demand for rotary/screw air compressors in the region.

b.Some of the key players operating in the rotary air compressor market include Atlas Copco, compare, HPC Compressed Air Systems, United Air Power Ltd., Kaeser Compressors, ELGi, Kaishan USA, Ingersoll-Rand Plc, GENERAL ELECTRIC, Gardner Denver, Hitachi Ltd., MAN SE, Kobe Steel Ltd., Howden Group Ltd., Boge Kompressoren, Sullair LLC, Bauer Group, BelAire Compressors, Frank Compressors, Sollant Group.

b.Growth in demand for energy-efficient products, expansion of the rotary/screw air compressor's application areas, increase in the number of infrastructure projects, penetration of IoT, and Industry 4.0 are the major factors driving the market demand over the forecast period.