Southeast Asia Lingerie Market Size, Share & Trends Analysis Report By Product (Briefs, Bras, Shapewear, Others), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-142-1

- Number of Pages: 126

- Format: Electronic (PDF)

- Historical Range:

- Industry:Consumer Goods

Market Size & Trends

TheSoutheast Asia lingerie market size was valued at USD 3,424.8 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. The rising disposable income levels across the region have resulted in increased consumer spending on fashion and intimate wear. This trend is projected to drive the lingerie market in the region during the forecast period. Furthermore, the shifting cultural attitudes toward lingerie, emphasizing self-expression and confidence, are expected to further boost the demand for lingerie in the region.

东南亚的消费趋势和偏好n women in the lingerie market are shaped by a combination of cultural influences, changing societal norms, and evolving fashion sensibilities. One prominent trend is the increasing demand for lingerie that is both comfortable and stylish. Southeast Asian women seek intimate apparel that not only feels comfortable for everyday wear but also incorporates fashionable elements, allowing them to express their individuality and personal style. New brands are entering the Southeast Asian market, influencing women's fashion choices. For instance, in July 2023, Chinese brand NEIWAI opened its first store in Singapore. The brand offers lingerie among other clothing items in the country with a vast range of men’s products.

Consumers in Southeast Asia are responding positively to lingerie brands that promote body positivity and inclusivity. They appreciate brands that prioritize comfort and confidence over unrealistic beauty standards. This trend drives product innovation and encourages a more positive and affirming lingerie shopping experience for individuals of all backgrounds and identities. For instance, SOKO, a start-up lingerie brand based in Malaysia, focuses on inclusivity, empowerment, and diversity through its campaigns, products, and marketing strategies. It represents women through a diverse lens to re-imagine the over-sexualized lingerie shopping experience in Southeast Asia. Its website also offers learning resources for women, such as a size calculator, how-to guides, and chatting with a fit specialist.

Women in Southeast Asian countries are increasingly seeking lingerie that prioritizes comfort and well-being. The concept of creating lingerie that prioritizes women's emotional values and self-expression while considering comfort is a prominent trend in Southeast Asia’s lingerie market. This trend reflects the evolving preferences and values of Southeast Asian consumers, who are increasingly seeking lingerie that aligns with their lifestyles. As a result, lingerie brands that embrace these values and cater to the market's specific needs are expanding their reach in the countries and are likely to thrive and drive positive changes in the local lingerie industry. For instance, in June 2023, AOG, a brand focused on women's health lingerie, was launched in Indonesia. The production of women's health lingerie by AOG integrates three patented technologies, including psychology, biomechanics, and human anatomy, and caters to products based on the cultural characteristics and climate of Southeast Asia. Two series of products, such as vest styles and classic back-clasp, were introduced at Indonesia's brand launch event.

Distribution Channel Insights

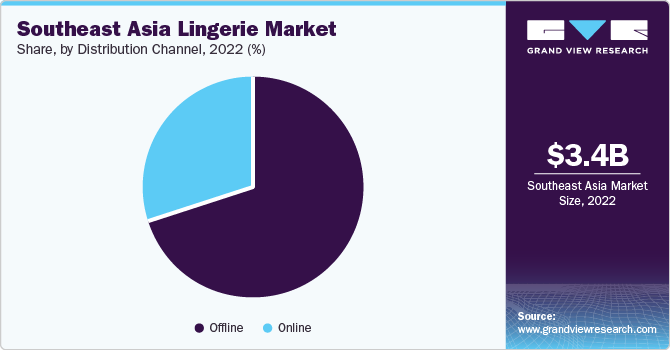

The sales of lingerie through offline channels accounted for a 69.7% share in 2022. Offline stores allow consumers to physically examine the fabric, fit, and comfort before making a purchase. Furthermore, in recent years, many stores typically feature fitting rooms where customers can try on various lingerie styles and sizes to ensure a comfortable and proper fit. As a result, offline channels will continue to be the dominant sales platform for lingerie in the Southeast Asia region.Furthermore, offline retail channels cater to a broad range of customers, from high-end boutiques to department stores and discount shops. This diversity in shopping options ensures that customers with varying budgets and style preferences can find lingerie that suits their needs, contributing to driving demand among a broader customer base. For instance, a Vietnam-based provider of lingerie, Hana Lady, offers a wide range of lingerie and sleepwear for women. The company operates through its two physical stores in Ho Chi Minh, Vietnam, and an online portal.

The online sales channel is expected to grow at a CAGR of 6.2% from 2023 to 2030, driven by increasingly fashion-conscious consumers willing to invest in quality lingerie that reflects the latest trends. These online platforms often feature customer reviews and ratings for products, empowering shoppers to make well-informed decisions based on the experiences of others. This feedback proves invaluable when buying lingerie, as it aids customers in assessing the quality, fit, and overall satisfaction with the product. Ase-commerceand online marketing continue to flourish, numerous brands have successfully established a robust online presence, attracting a substantial customer base. For instance, Malaysia-based Damiko Lingerie offers a wide variety of lingerie products through its online store.

E-commerce encompasses a wide range of online transactions, including retail sales, while online marketplaces are platforms that facilitate transactions between multiple buyers and sellers. According to a 2020 study conducted by Commerce. Asia, an e-commerce ecosystem technology andbig datasolutions company, purchases made by Malaysians during the Movement Control Order (MCO), ladies underwear witnessed the fastest sales growth of 909% compared to other types of purchases.

Product Insights

的内裤在20占56%以上的份额22 in the Southeast Asia lingerie market. Briefs are a practical choice for everyday wear and are suitable for various activities, including sports and physical exercise, which is expected to drive product demand during the forecast period. Furthermore, effective marketing campaigns by leading brands, coupled with the wide variety of brief styles, have increased the popularity of briefs. To meet the growing demand for different types of briefs, numerous regional and international players offer a wide variety of brief styles across Southeast Asia. For instance, the Vietnam branch of Japan-based lingerie company Quadrille Nishida provides a diverse range of women's briefs and other lingerie products. The branch also accommodates ODM and OEM orders from international customers. Similarly, Jockey International Inc. (USA) markets and distributes lingerie by the Jockey brand in Indonesia, Thailand, the Philippines, Malaysia, Singapore, and Vietnam.

TheShapewear market预计将以6.0%的复合年增长率增长从2023年到吗2030, owing to the increasing awareness among consumers regarding the role of shapewear in providing a streamlined look under various outfits. The shapewear industry has gained significant momentum of late, adapting to evolving cultural trends focused on body positivity, diversity, and inclusivity in terms of sizing and gender representation. New offerings in this segment have attracted a new and diverse customer base and have also challenged traditional preconceptions about shapewear.Gen-Z consumers are considerably responsible for this change in the shapewear market as they prioritize inclusivity more than any other generation and seek products that align with their values and desire for authenticity.

Country Insights

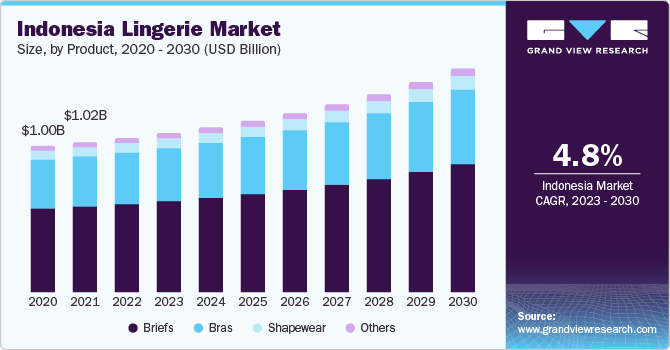

Indonesia accounted for a 30.9% share and held a market size of USD 1,056.4 million in 2022 in the Southeast Asia lingerie industry. Indonesia is the most populous country in Southeast Asia, with over 270 million people, nearly half of whom are female (138 million). This large and diverse population provides a substantial customer base for lingerie products. Furthermore, the country has witnessed a rise in disposable income over the years, leading to increased consumer spending, including on fashion and intimate wear. These factors are driving the demand for lingerie in Indonesia.

The Singapore lingerie market is expected to grow at a CAGR of 6.9% from 2023 to 2030, driven by increasingly fashion-conscious consumers willing to invest in quality lingerie that reflects the latest trends. Moreover, the rise of sustainable lingerie startups (such as Perk by Kate and Ashley Summer Co) in the country is further augmenting market growth.The trend of "Underwear as Outerwear" is a growing phenomenon in Singapore, where bras with pretty straps, lace, and intricate designs have become a significant fashion statement. This trend reflects a shift in the perception of lingerie from purely functional undergarments to fashion accessories that are meant to be shown off.

Women across the country are increasingly embracing their feminity and expressing it through their choice of clothing. Consumers are opting for lingerie with delicate embroidery, lace, and pops of color as it adds a feminine touch, which makes their outfits more stylish. Women in Singapore pair bralettes and lacy bras with a variety of outfits, such as cropped tops, sheer tops, and low-cut blouses, as it allows them to try out different looks.

Key Companies & Market Share Insights

Key players operating in the Southeast Asia Lingerie market are adopting various steps to increase their presence in the market. These steps include strategies such as new product launches partnerships, mergers & acquisitions, expansion, and others. Some of the initiatives include:

In July 2023, Wacoal Thailand launched its new collection, WACOAL INDIN. The collection featured underwear (bras and briefs) inspired by the natural colors of the earth. They are made from natural fibers and renewable materials such as cotton.

In July 2023, Victoria’s Secret entered a strategic partnership with Amazon to sell its lingerie and beauty products through the website in all the countries where Amazon operates.

In March 2023, Adidas Malaysia introduced its SS23 Bra Collection, which includes new high-performance bras and leggings. This launch is a part of their 'Be Supported. Be You.' campaign, with the aim of assisting more women in achieving their fitness goals by offering comfortable and supportive athletic wear available in various sizes.

Key Southeast Asia Lingerie Companies:

- Triumph Intertrade AG

- WACOAL Holdings Corp.

- Victoria's Secret & Co.

- La Perla Fashion Holding N.V.

- Oysho España, S.A. (Inditex Group)

- The Natori Company

- Young Hearts Lingerie

- GUNZE LIMITED

- Sabina Fareast Company Limited

- Jockey International, Inc.

Southeast Asia Lingerie MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 3,550.2 Million |

Revenue forecast in 2030 |

USD 5,158.8 Million |

Growth rate |

CAGR of 5.3% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD Million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, distribution channel, region |

Regional scope |

Southeast Asia |

Country scope |

Singapore, Indonesia (Jakarta), Malaysia (Kuala Lumpur), Thailand (Bangkok), Vietnam, and Philippines |

Key companies profiled |

Triumph Intertrade AG, WACOAL Holdings Corp., Victoria's Secret & Co., La Perla Fashion Holding N.V., Oysho España, S.A. (Inditex Group), The Natori Company, Young Hearts Lingerie, GUNZE LIMITED, Sabina Fareast Company Limited, Jockey International, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options. |

Southeast Asia Lingerie Market Report Segmentation

This report forecasts growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Southeast Asia lingerie market on the basis of product, distribution channel, and region:

Product Outlook (Revenue, USD Million, 2017 - 2030)

Briefs

Bras

Shapewear

Others

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

Offline

Supermarkets & Hypermarkets

Specialty Stores

Others

Online

E-commerce/Marketplaces

Company Owned Website

Regional Outlook (Revenue, USD Million, 2017 - 2030)

Singapore

Indonesia

Jakarta

Malaysia

Kuala Lumpur

Thailand

Bangkok

Vietnam

Philippines

Frequently Asked Questions About This Report

b.The Southeast Asia lingerie market size was estimated at USD 3,424.8 million in 2022 and is expected to reach USD 3,550.2 million in 2023.

b.The Southeast Asia lingerie market is expected to grow at a compounded growth rate of 5.3% from 2023 to 2030 to reach USD 5,158.8 million by 2030.

b.The briefs segment dominated the Southeast Asia lingerie market with a share of 56.33% in 2022. Briefs are a practical choice for everyday wear and are suitable for various activities, including sports and physical exercise, which is expected to drive product demand during the forecast period.

b.Some key players operating in the Southeast Asia lingerie market include Triumph Intertrade AG, WACOAL Holdings Corp., Victoria's Secret & Co., La Perla Fashion Holding N.V., Oysho España, S.A. (Inditex Group), The Natori Company, Young Hearts Lingerie

b.Key factors that are driving the market growth include shifting cultural attitudes toward lingerie, emphasizing self-expression and confidence. Also, women in the Southeast Asian countries are increasingly seeking lingerie that prioritizes comfort and well-being.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."