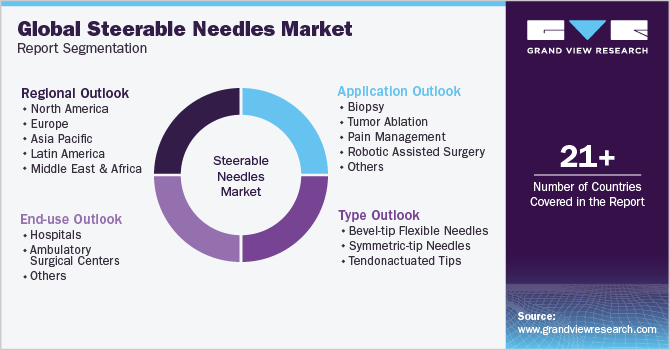

Steerable Needles Market Size, Share & Trends Analysis Report By Type (Bevel-tip Flexible, Symmetric-tip), By Application (Biopsy, Tumor Ablation, Robotic Assisted Surgery), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-132-0

- Number of Pages: 130

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Steerable Needles Market Size & Trends

The globalsteerable needles market sizewas estimated atUSD 1.20 billion in 2022和预期的年复合增长growth rate (CAGR) of 6.38% from 2023 to 2030. This growth can be attributed to the high demand for steerable needles with improved targeting capabilities and maneuverability, which has recently increased due to several benefits, such as shorter hospital stays, decreased discomfort, and quicker recovery. Thus, rising demand and adoption rate of steerable needles are anticipated to drive the market growth during the forecast period.

The growing prevalence of chronic diseases, such as cardiovascular disease (CVD), cancer, and neurological disease, has increased worldwide. According to the National Association of Chronic Disease Directors, approximately 60% of the U.S. adult population has at least one chronic disease. Chronic conditions such as cancer, CVD, and diabetes are the leading causes of death in the U.S. Steerable needless plays an important role in accurate chronic disease diagnosis, treatment, and drug delivery, which is fueling the market growth.

Steerable needles are mostly useful for any needle-based procedure, including thermal ablation, brachytherapy, and biopsy. As per the NCBI study published in 2022, around 9.6 million surgical procedures were performed and analyzed, of which nearly 11.2% were minimally invasive surgeries (MIS) and 2.9% were robot-assisted in 2018. In addition, 10.7 million ambulatory surgical procedures were performed in 2018 in the U.S. Thus, rising awareness about MIS procedures among patients and surgeons is anticipated to drive the demand for steerable needles in different healthcare settings over the forecast period.

Several key players are acquiring smaller players to strengthen their market positions. For instance, in December 2020, Olympus Corporation acquired Veran Medical Technologies, Inc. (VMT), a privately held medical device company engaged in developing and commercializing new devices such as endobronchial instruments, includingneedles.这种策略使得公司能够提高寡糖r capabilities, expand their product portfolio, and improve their competencies.

Type Insights

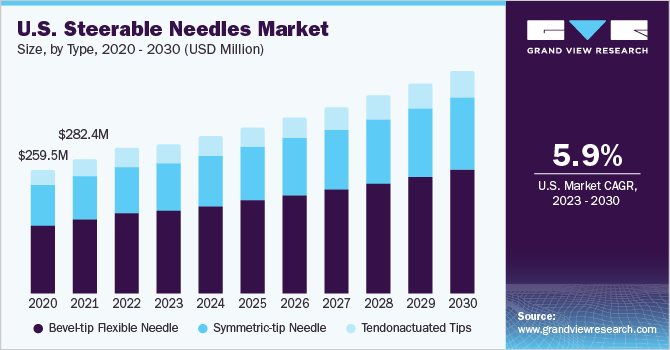

Based on type, the market is segmented into bevel-tip flexible needless, symmetric-tip needles, and tendon-actuated tips. The bevel-tip flexible needles segment accounted for the largest market share of 54.70% in 2022. This can be attributed to the wide availability of bevel-tip flexible needle products and their manufacturers worldwide. These bevel-tip flexible needles are an upgrade of the clinical puncture needles and can potentially reduce surgery traumas and enhance puncture accuracy. Developing and introducing new technologically advanced floor-standing steerable needless further contributes to the segment growth.

The symmetric-tip needles segment is expected to witness significant growth during the forecast period due to the commercialization of new symmetric-type steerable needless to address unmet needs in the market. Furthermore, the rising number of laparoscopic surgical procedures positively contributes to segment growth. As per Cleveland Clinic Statistics, around 13 million laparoscopic surgical procedures are performed worldwide each year. This is estimated to propel segment growth during the forecast period.

Application Insights

Based on application, the market is segmented into biopsy, tumor ablation, pain management, robotic-assisted surgery, and others. The biopsy segment accounted for the largest revenue share of 32.86% in 2022. This can be attributed to the increased number of biopsy procedures and the rising adoption of steerable needles in hospitals for diagnosis and treatment of disease. As per the Agency for Healthcare Research and Quality Statistics, over 1 million women have breast biopsies annually in the U.S. Approximately 20% of these biopsies result from a diagnosis of breast cancer. Currently, more than half of all breast biopsies use a core needles technique, which is anticipated to drive demand for steerable needles during the forecast period.

Furthermore, the rising number of ablation procedures and robotic-assisted surgeries is expected to boost the adoption of steerable needles in the coming years. Steerable needles play a significant role in these procedures. According to the Heart Rhythm Society (HRS), an estimated 75,000 ablation procedures are conducted annually in the U.S. Hence, huge opportunities are available for steerable needle products globally.

End-use Insights

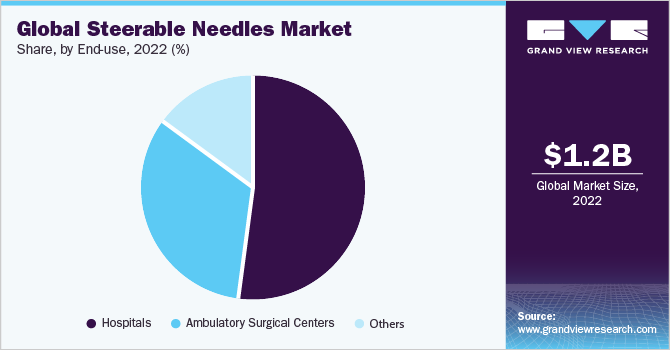

Based on end-use, the market is segmented into hospitals, ambulatory surgical centers, and others. The hospitals segment accounted for the largest revenue share of 52.53% in 2022. This can be attributed to the presence of a large number of inpatient facilities and increasing hospital admissions for diagnosis and treatment of disease. According to the American Hospital Association, in 2023, around 6,129 hospitals were available in the U.S. Thus, increasing healthcare facilities such as hospitals spurs the demand for steerable needles in the coming years.

The ambulatory surgical centers (ASCs) segment is anticipated to witness significant growth during the forecast period due to the rising preference of patients for ASCs to perform their surgery owing to financial advantage. As per Surgery Center Cedar Rapids Statistics, more than 80% of surgeries are performed in outpatient settings, including ASCs. Furthermore, it helps Medicare and insurance companies financially. For instance, the Medicare program can save USD 2.3 billion annually as patients choose ASCs over hospitals. Such factors are predicted to augment the segment growth.

Regional Insights

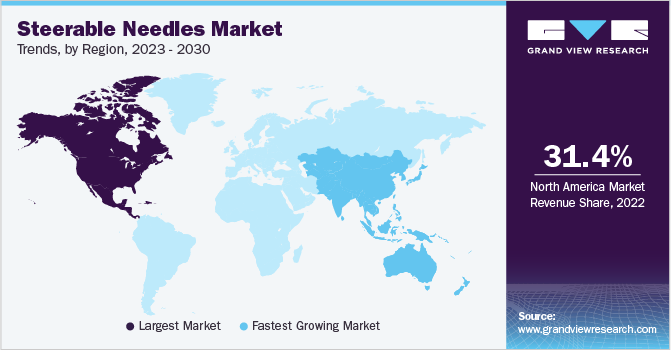

Based on region, North America accounted for the largest market share of 31.42% in 2022. This can be attributed to the strong presence of companies engaged in developing, manufacturing, and commercializing steerable needless for diagnosing and treating diseases in hospitals. The key companies that offer their products in the North American region include AprioMed, Inc.; Merit Medical Systems; Boston Scientific Corporation; Serplex Medical; and others. Thus, developing and commercializing new steerable needles in the U.S. and Canada is anticipated to surge the product demand over the forecast period.

The Asia Pacific region is expected to witness the fastest growth during the forecast period. High healthcare spending and growing investments in healthcare logistic infrastructure contribute to the growth of the market. Furthermore, the presence of countries like China and India with a high number of healthcare facilities, which was 33,000 and 69,000 in 2022. The steerable needles help healthcare settings overcome certain biopsy challenges such as the inability to reach the target site, thereby driving demand for the product in the coming years.

Key Companies & Market Share Insights

The development of new products, product modifications, and major investments in research and development (R&D) are among the key strategies adopted by market players to gain a competitive edge. In August 2022, Serpex Medical received the U.S. FDA (Food and Drug Administration) 510 (k) clearance for its Recon Steerable Sheath that provides delivery at the distal end to enable physicians to access difficult-to-reach areas of the lung. This approval will enhance disease diagnosis and increase product adoption over the forecast period, thereby driving market growth. Some prominent players in the global steerable needles market include:

AprioMed, Inc.

Merit Medical Systems.

DEAM

Johnson & Johnson Services, Inc.

Boston Scientific Corporation

Serpex Medical

Olympus Corporation

Medtronic

APT Medical Inc.

Steerable Needles Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 1.24 billion |

Revenue forecast in 2030 |

USD 1.91 billion |

Growth rate |

CAGR of 6.38% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, application, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa, Saudi Arabia; UAE; Kuwait |

Key companies profiled |

AprioMed, Inc.; Merit Medical Systems; DEAM; Johnson & Johnson Services, Inc.; Boston Scientific Corporation; Serpex Medical; Olympus Corporation; Medtronic; APT Medical Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Steerable Needles Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global steerable needles market report based on type, application, end-use, and region:

Type Outlook (Revenue, USD Million, 2018 - 2030)

Bevel-tip Flexible Needles

Symmetric-tip Needles

Tendonactuated Tips

Application Outlook (Revenue, USD Million, 2018 - 2030)

Biopsy

Tumor Ablation

Pain Management

Robotic Assisted Surgery

Others

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Ambulatory Surgical Centers

Others

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

Japan

China

India

Australia

South Korea

Thailand

Latin America

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global steerable needles market size was valued at USD 1.20 billion in 2022 and is anticipated to reach USD 1.24 billion in 2023.

b.The global steerable needles market is expected to witness a compound annual growth rate of 6.38% from 2023 to 2030 to reach USD 1.94 billion by 2030.

b.Based on type, the bevel-tip flexible needle segment accounted for a share of 54.70% in 2022 due to the growing use of bevel-tip flexible needle in different healthcare settings for diagnosing treating purpose.

b.Some of the key players in steerable needles market are AprioMed, Inc.; Merit Medical Systems; DEAM; Johnson & Johnson Services, Inc.; Boston Scientific Corporation; Serpex Medical; Olympus Corporation, Medtronic; APT Medical Inc.; among others.

b.The major factors driving the market growth are rising preference for a minimally invasive procedure, increasing prevalence of chronic diseases, and technological advancements.