Team Collaboration Software Market Size, Share & Trends Analysis Report By Deployment, By Software Type, By Application (Retail, Healthcare, BFSI, IT & Telecom), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-633-2

- Number of Pages: 175

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Technology

Report Overview

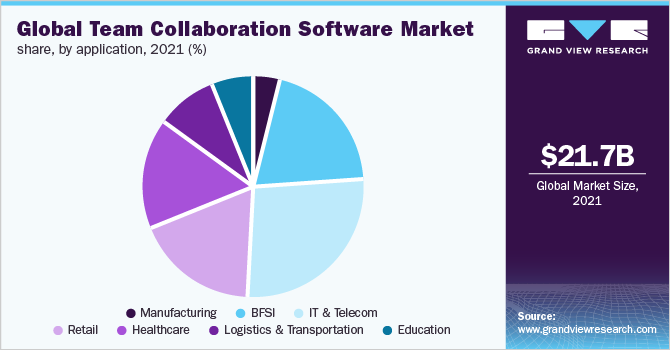

The global team collaboration software market size was valued at USD 21.69 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.5% from 2022 to 2030. The promising growth prospects of the market can be credited to the evolution of the modern workplace and the rising need to incorporate effective means of team collaboration across organizations. COVID-19 lockdowns and restrictions compelled businesses across the globe to implement the remote working model in 2020, which increased the demand for team collaboration software for virtual communication.

The demand for collaboration solutions and smart meeting rooms in offices is expected to remain strong post the pandemic, as organizations continue to adopt hybrid working models. Leading market players are introducing new solutions to encourage active collaboration and employee engagement. For instance, in January 2022, Zoom Video Communications, Inc. introduced a virtual show-floor Expo for Zoom Events that gives organizations more ways of engaging with participants. The 2D virtual space allows users to move around an avatar and communicate with sponsors, exhibitors, or other users.

The market further benefits from the integration of technologies such asArtificial Intelligence(AI) with team collaboration software solutions, which, in turn, facilitates automation and improves communication within an organization. AI can potentially increase the accuracy of voice and chat assistants and help real-time translation of messages. It can also add advanced collaboration capabilities to emerging conversational workplace platforms, including Cisco Spark, Slack, Microsoft Teams, Workplace by Facebook, Inc, and IBM Watson.

Deployment Insights

The cloud segment is expected to dominate the market and expand at a CAGR of nearly 14.0% during the forecast period. This can be attributed to the increasing demand for cloud-based platforms for effective team collaboration across enterprises, in light of the rising number of people working remotely. Besides, these cloud platforms offer flexibility to access collaborative tools throughsmartphones. They also come with enriched features, including the capability of recording events to help review the proceedings later.

COVID-19大流行起到了至关重要的作用promoting the deployment of cloud-based communication tools, such as instant messaging software and video conferencing tools, to enable effective communication across businesses while the employees work remotely. Cloud-based platforms equally allow remote teams to streamline their business operations and manage projects of all sizes.

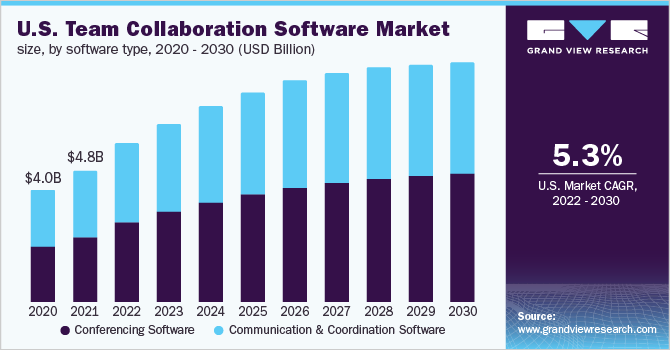

Software Type Insights

The conferencing software segment is expected to witness the fastest growth rate of over 10.0% from 2022 to 2030. This can be attributed to the increasing usage of web conferencing as the primary means of communication across organizations. Several platforms, such as Microsoft Teams and Google Workspace, have gained massive traction as the go-to tools for conducting virtual meetings in the past few years. These solutions have enabled the digital transformation of workplaces by facilitating enterprise-wide, real-time, and online communication.

采用的软件即服务(SaaS) model enables enterprises to conveniently deploy conferencing solutions, promoting continuous innovation and enhancing collaborative capabilities. The SaaS delivery model has significantly transformed team collaboration software into independent applications, mitigating slower response times and leading to lesser system failures.

Application Insights

The healthcare segment is expected to expand at a CAGR of nearly 14% from 2022 to 2030. Clinicians are increasingly utilizing innovative communication and collaboration tools for real-time data sharing between departments and securely managing workflows from remote locations. Several government initiatives in this area are supporting the growth of the segment. For instance, in February 2022, the Department of Health and Human Services (HHS) announced that it would allocate nearly USD 55 million to provide healthcare to the underserved population through virtual care technologies such as remote patient monitoring,telehealth, and digital patient tools and health information tools.

The retail segment is estimated to record a valuation of over USD 13.0 billion by 2030, owing to the increasing demand for comprehensive collaboration software for real-time data sharing, employee engagement, and the exchange of news, feedback, and ideas. Team collaboration software can help retailers with multiple locations or channels improve communication through voice communication, Instant Messaging (IM), and contact center channels.

This ensures easy communication between employees, stores, and back offices at other locations. Moreover, team collaboration solutions can help retail stores integrate mobile applications and enhance customer service. As a result, the retail segment is expected to witness promising growth avenues in the team collaboration software market during the forecast period.

Regional Insights

The North American market accounted for a sizeable revenue share of over 33% in 2021, thanks to the rapid adoption of web conferencing solutions and collaboration portals by enterprises in the region. Moreover, easy access to high-speed internet necessary for operating remote work models is expected to support the growth prospects of the regional market. The strong presence of several leading market players, such as Microsoft, Cisco Systems, Inc., and Asana, is also expected to create lucrative growth prospects for the market.

The Asia Pacific market accounted for a considerable revenue share of close to 22.0% in 2021, owing to the ongoing digitization of businesses and the development of high-speed internet infrastructure in the region. Such developments are encouraging organizations to incorporate team collaboration software to optimize their workforce and facilitate effective interaction among employees. In December 2021, Microsoft released Teams Essentials in India. This solution has been designed to offer an affordable and professional collaborative solution, especially for small businesses.

Key Companies and Market Share Insights

The major players in the market are focusing on developing innovative collaboration software to attract a larger customer base and gain a competitive edge in the market. For instance, in February 2022, work management platform provider Asana released Asana Flow, a complete range of solutions that businesses can use to build, run, and enhance their workflows. The increasing number of such new offerings is expected to favor the growth of the market during the forecast period. Some prominent players in the global team collaboration software market include:

Adobe

Asana, Inc.

Avaya Inc.

AT&T, Inc.

Blackboard, Inc.

Cisco Systems, Inc.

Citrix Systems, Inc.

Google LLC

IBM Corporation

Microsoft

OpenText Corporation

Oracle

Slack Technologies, LLC

Zoom Video Communications, Inc.

Team Collaboration Software Market Report Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 27.40 billion |

Revenue forecast in 2030 |

USD 56.67 billion |

Growth rate |

CAGR of 9.5% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

部署、软件类型application, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico |

Key companies profiled |

Asana; Avaya Inc.; Cisco Systems, Inc.; Citrix Systems, Inc.; IBM Corporation; Microsoft; Slack Technologies, Inc. |

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global team collaboration software market report based on deployment, software type, application, and region:

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

Cloud

On-premise

Software Type Outlook (Revenue, USD Billion, 2018 - 2030)

Conferencing Software

Communication & Coordination Software

Application Outlook (Revenue, USD Billion, 2018 - 2030)

Manufacturing

BFSI

IT & Telecom

Retail

Healthcare

Logistics & Transportation

Education

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

Asia Pacific

China

India

Japan

拉丁美洲

Brazil

Mexico

MEA

Frequently Asked Questions About This Report

b.The global team collaboration software market size was estimated at USD 21.69 billion in 2021 and is expected to reach USD 27.41 billion in 2022.

b.The global team collaboration software market is expected to grow at a compound annual growth rate of 9.5% from 2022 to 2030 to reach USD 56.67 billion by 2030.

b.Some key players operating in the global team collaboration software market include Cisco Systems, Inc.; Microsoft Corporation; Zoom Video Communications, Inc.; and Slack Technologies, Inc.

b.On-premise was the largest deployment segment in 2021 and accounted for a revenue share of more than 55.74% in the team collaboration software market.

b.The communication & coordination software accounted for the highest revenue share of over 57.2% in 2021 in the team collaboration software market.