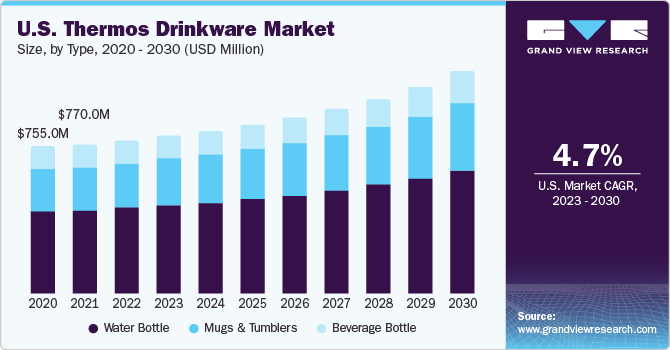

Thermos Drinkware Market Size, Share & Trends Analysis Report By Type (Mugs and Tumblers, Water Bottle), By Application (Outdoor Enthusiasts, Specialized), By Size, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- 报告ID: gvr - 4 - 68040 - 146 - 0

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Consumer Goods

Thermos Drinkware Market Size & Trends

The globalthermos drinkware market size was estimated at USD 2.84 billion in 2022和复合年gro expecyed扩大wth rate (CAGR) of 5.9% from 2023 to 2030. As people increasingly prioritize environmental consciousness, thermos bottles are favored for reducing the use of single-use plastic or paper cups, aligning with sustainability efforts. Simultaneously, the market caters to diverse preferences by offering stylish and customizable thermos bottle designs, appealing to consumers who value aesthetics and personalization.

Rising awareness of plastic pollution levels globally is influencing consumers to disregardbottled waterthereby enhancing market growth for stainless steel water bottles. In addition, the adoption of a healthier lifestyle among consumers to keep themselves hydrated is also expected to boost the sales of the product in the forecast period. In addition, the product helps cut greenhouse gas emissions by reducing plastic production. U.S. Census data for 2023 indicates that 60% of U.S. adults have embraced reusable bottles, aligning with these eco-conscious trends.

Reusable water bottleshave a favorable financial impact. Despite an initial cost, they yield long-term savings as daily bottled water expenses accumulate. For instance, a 2023 blog post by TheRoundup notes that Americans purchase about 50 billion water bottles each year, equivalent to 13 bottles per person per month. Transitioning to reusable bottles could spare an average of 156 plastic bottles annually per person. This contributes to the rising global demand for thermos drinkware.

The strong inclination toward picnics and outdoor activities in city parks, local green areas, and public trails presents a favorable outlook for thermos bottles. For example, a survey conducted by Maru Voice Canada in 2021 revealed that 52% of Canadians express an increased interest in engaging in outdoor leisure activities more frequently.

各国政府正在采取initiatives to ban single-use plastic water bottles and instead promote reusable water bottles made of glass, metals, and other materials that are environment-friendly and safe to use. For instance, Australia, Canada, the U.S., and some states in India have banned single-use plastic water bottles, thereby opening up new growth opportunities for stainless-steel water bottle manufacturers.

Type Insights

Thermos water bottles dominated the global market in 2022 with a revenue share of 56.40%. These water bottles have become trendy accessories among outdoor enthusiasts, contributing to their popularity. According to a survey by Winnebago Industries, Inc., a leading outdoor lifestyle product manufacturer. In 2022, 82% of Americans indicated that they participated in outdoor activities such as camping and hiking at a location away from their home, boating, or visiting a state or national park. This is an increase from 60% in 2020 to 79% in 2021.

The thermos mugs and tumblers segment is anticipated to register the fastest CAGR of 6.6% over the forecast period from 2023 to 2030. Thesedrinkwaresare known for their remarkable ability to preserve the temperature of beverages, ensuring that drinks remain either hot or cold for an extended duration. This feature is especially favored in office settings. In addition, their compact, spill-resistant design enhances their portability, making them ideal for daily commutes and outdoor activities alike.

Size Insights

Based on size, the 500-1000ml segment dominated the market in 2022 with the largest revenue share of 55.92%. This size segment is highly favored by students and outdoor enthusiasts who prefer to have a water bottle with them at all times due to its compact and convenient size. They easily fit into any bag without taking up much space. These bottles come in a range of colors, patterns, and designs, enhancing their visual appeal, practicality, and usefulness.

The less than 500ml segment is anticipated to register the fastest CAGR of 6.6% over the forecast period. Water bottles with a capacity of less than 500 ml are commonly chosen for their refillable nature, aiding individuals in tracking their daily hydration goals. The smaller size encourages frequent refills and serves as a visual reminder to stay hydrated throughout the day, making them a practical choice for those mindful of their water intake and overall well-being.

Distribution Channel Insights

The online retailers segment is anticipated to register the fastest CAGR of 6.5% over the forecast period. The rising popularity of this channel for shopping among consumers owing to a large variety of product availability under one roof and influential layout motivates consumers to purchase products from these stores.

The supermarkets and hypermarkets segment dominated the market in 2022, with the largest revenue share of 39.5%. A notable surge in consumer preference for shopping at supermarkets and hypermarkets has emerged. These large-scale retail stores offer an extensive range of products, including groceries, household items, and more, all under one roof. This one-stop shopping approach provides convenience and variety, making it increasingly popular among consumers seeking efficiency and diverse product choices for their daily needs.

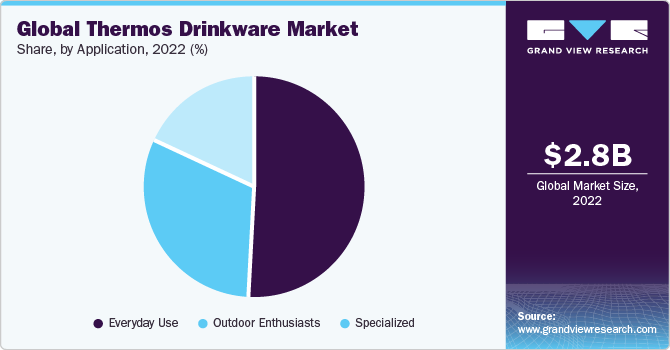

Application Insights

In terms of application, the everyday use segment led the market in 2022 with a revenue share of 50.9%. This segment's versatility extends to accommodating a diverse array of beverages, from coffee and tea to water, smoothies, and soups. This adaptability caters to a broad spectrum of dietary preferences, contributing to their widespread use across various applications where different beverages can be enjoyed daily like office settings.

The outdoor enthusiast segment is anticipated to register the fastest CAGR of 6.5% from 2023 to 2030. The increased focus on health and well-being motivates people to engage in outdoor activities, providing physical exercise, stress relief, and mental rejuvenation. In addition, the growing need for digital nomads to disconnect from screens promotes outdoor adventures that allow individuals to embrace the physical world, contributing to the demand for thermos water bottles. Given the rugged nature of outdoor activities, the durability of these bottles ensures they can withstand the rigors of hiking, camping, and other outdoor pursuits.

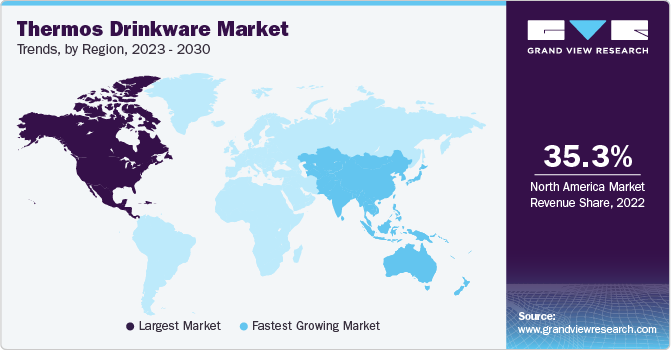

Regional Insights

The North America market held the largest revenue share of 35.3% in 2022. In this region, outdoor activities have surged, with a 2023 survey from Winnebago Industries, Inc., a leading outdoor product manufacturer, indicating that 97% of Americans plan to engage in outdoor activities in the upcoming year, up from 95% the previous year. This growth is particularly pronounced among younger generations, with Gen Z showing a stronger inclination for increased outdoor activity in 2023 compared to Gen X and Baby Boomers.

Asia Pacific is expected to witness the fastest CAGR of 7.0% over the forecast period. The demand for portable drinkware, such as thermos bottles, has surged with the rise of urban living, addressing the needs of busy city dwellers. These bottles provide a convenient solution for staying hydrated on the go, aligning with the active and fast-paced lifestyles of many. Furthermore, in certain Asian cultures, the customary practice of consuming hot water throughout the day is believed to offer health benefits.

Key Companies & Market Share Insights

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retails, to enhance their portfolio offering in the market. For example:

In February 2023, Thermos L.L.C. announced the introduction of the all-new Icon™ Series. The new product line comprises hot beverage and food storage solutions, with an expanded range now emphasizing cold beverage and hydration products. These offerings prioritize consumer convenience, featuring a Griptec™ Non-Slip Base and a True-Coat™ Finish across all items, ensuring a user-friendly design.

In January 2023, Xiaomi introduced a new product named MIJIS Thermos Flask. This thermos has a large 1.8l capacity and is priced at USD 19. The new product launch is designed for long-term cold storage and heat preservation.

Key Thermos Drinkware Companies:

- Sigg Switzerland AG

- Thermos L.L.C.

- TIGER CORPORATION

- Camelbak

- Zojirushi America Corporation.

- Stanley PMI

- Klean Kanteen

- Hydro Flask.

- KINTO Co., Ltd.

- Contigo Brands.

Thermos Drinkware MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 2.95 billion |

Revenue forecast in 2030 |

USD 4.49 billion |

Growth rate |

CAGR of 5.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, size, application, distribution channel, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Canada; Mexico: France; Germany; UK; Spain: Italy; China; Japan; India; Australia; Brazil; South Africa; UAE |

Key companies profiled |

Sigg Switzerland AG; Thermos LLC; TIGER CORPORATION; Camelbak; Zojirushi America Corporation; Stanley PMI; Klean Kanteen; Hydro Flask; KINTO Co. Ltd.; Contigo Brands |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Thermos Drinkware Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global thermos drinkware market report based on type, size, application, distribution channel, and region:

Type Outlook(Revenue, USD Million, 2017 - 2030)

Mugs and Tumblers

Water Bottle

Beverage Bottle

Application Outlook(Revenue, USD Million, 2017 - 2030)

Outdoor Enthusiasts

Everyday Use

Specialized

Size Outlook(Revenue, USD Million, 2017 - 2030)

Less than 500 ml

500 ml to 1000 ml

1000 ml and above

Distribution Channel Outlook(Revenue, USD Million, 2017 - 2030)

Supermarkets/Hypermarkets

Convenience Stores

Specialty Stores

Online

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Spain

Italy

Asia Pacific

China

India

Japan

Australia

Central & South America

Brazil

Middle East & Africa

南非

UAE

Frequently Asked Questions About This Report

b.The global thermos drinkware market was estimated at USD 2.84 billion in 2022 and is expected to reach USD 2.95 billion in 2023.

b.The global thermos drinkware is expected to grow at a compound annual growth rate of 5.9% from 2022 to 2030 to reach USD 4.49 billion by 2030.

b.North America dominated the market with a share of around 35.2% in 2022. This can be attributed to the increasing popularity of colorful offerings from prominent market players, as well as the increased participation in outdoor activities.

b.Some of the key players operating in the thermos drinkware market include Sigg Switzerland AG, Thermos L.L.C., TIGER CORPORATION, Camelbak, Zojirushi America Corporation., Stanley PMI, Klean Kanteen, Hydro Flask., KINTO Co., Ltd., Contigo Brands.

b.Key factors that are driving the thermos drinkware market growth include the awareness among the people for overall well-being by focusing on hydration and elimination of the use of plastic bottles in daily life.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."