Transcutaneous Electrical Nerve Stimulation Market Size, Share & Trends Analysis By Product Type (Portable, Table Top), By Application (Chronic Pain, Acute Pain), By End-use (Hospitals, Physiotherapy Clinics), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-920-2

- Number of Pages: 110

- Format: Electronic (PDF)

- 历史范围:2017 - 2020

- Industry:Healthcare

Report Overview

The global transcutaneous electrical nerve stimulation market size was valued at USD 300 million in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 3.84% from 2022 to 2030. The demand for transcutaneous electrical nerve stimulation devices is increasing owing to the rising cases of chronic pain and musculoskeletal injuries, especially among older citizens. Transcutaneous Electrical Nerve Stimulation (TENS) devices are primarily used to treat sports injuries, muscle atrophy, nerve pain, arthritis, labor pain, and back & neck pain. In addition, muscle injuries are becoming common among younger adults owing to increased involvement in sports and other physical activities. Therefore, a large number of sports enthusiasts are these days espousing muscle stimulation 2therapies such as TENS therapy to assist in warm-ups and rehabilitation in case of an injury. Also, sports participation has increased in 2020-21, as the COVID-19 pandemic has led to people having more free time.

Moreover, ongoing technological advances and product innovations such as wearable TENS will provide significant growth opportunities to the market players over the forecast period. All these aforementioned factors will augment the overall transcutaneous electrical nerve stimulation market growth shortly.

The COVID-19 outbreak has affected millions of people around the world. The pandemic has compelled the healthcare industry to take action, in a race to develop both therapeutic and preventive interventions. This has negatively impacted the healthcare businesses as well as consumer spending. Chronic & acute pain management services were considered non-urgent during the pandemic. Due to this, all outpatient, as well as elective interventional procedures, were reduced or interrupted during the pandemic for reducing the risk.

Specialty centers for pain management were also shut down during the pandemic, which further negatively impacted the market. Moreover, the pandemic led to the adoption of pain management medications instead of pain management devices, which negatively impacted its market growth.

However, many COVID-19 patients have been facing physiological disabilities affecting respiratory, cardiovascular, and musculoskeletal function due to long-term ICU admission. Palsy of the skeletal system and respiratory muscles has also been observed in some cases. As a result, rehabilitation of such patients is emerging as a major challenge worldwide. Therefore, demand for different muscle stimulation devices including TENS is expected to positively impact the market growth in upcoming years.

In addition, numerous muscle stimulation devices have gained regulatory approval during this phase. For instance, in April 2020, Synapse Biomedical has received had received the U.S. FDA Emergency Use Authorization (EUA) for its TransAeris- a diaphragm stimulator that assists Covid-19 patients to get off mechanical ventilation. Thus, a large number of COVID-19 patients recovering worldwide is expected to spur the demand for TENS in homecare settings. This will certainly fuel the market growth during the forecast period.

Moreover, many studies such as NCBI, and IJAM have suggested that TENS is effective in the treatment of muscle weakness and able to restore muscle strength in admitted patients, especially in ICU. Therefore, many companies such as NeuroMetrix, Inc., and others have started clinical trials of TENS for Post-Acute COVID-19 Syndrome (PACS). Thereby, supporting the market growth during the study period.

Furthermore, the ineffectiveness of oral drugs is prompting patients to look for alternative treatment options, such as electrotherapy devices. Several people are addicted to pain killers; however, these medicines can not only lead to adverse effects but may also be ineffective. According to a study published in Practical Pain Management, 14.0% of patients that were administered codeine experienced less discomfort.

In addition, scientists revealed that there was no single drug that provided pain relief to patients. Also, low preference for surgeries is one of the factors boosting the demand for TENS devices. Several patients tend to avoid surgery if alternative treatments are available. Thus, supporting the market growth during the forecast period.

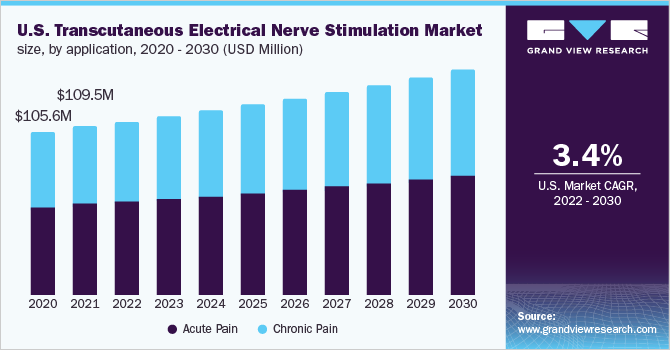

The U.S. dominated the overall market with market revenue shares of 83.10% in 2021. The growing adoption of a sedentary lifestyle is leading to a rise in the prevalence of chronic pain disorders, such as osteoarthritis, back pain, and fibromyalgia are contributing to the growth of the market in the country. For instance, according to the National Fibromyalgia Association, as of August 2019, fibromyalgia affected 10 million people in the U.S. This has fueled the demand for TENS devices to help manage chronic pain.

In addition, according to CDC, as of July 2019, osteoarthritis affects 32.5 million adults in the U.S. Moreover, insurance coverages available for TENS devices by Medicare along with the presence of key players in the market are further expected to drive the market growth in the U.S.

Furthermore, technological advancements in electrotherapy devices are anticipated to drive the market. Electrotherapeutics are evolving and incorporating new functions, including neuromodulation or communication, with the central nervous system. Scientists, researchers, & healthcare providers have begun to tap into advanced circuitry and electrical signaling to modulate nerve function.

Recent technological advancements in this field include products such as automatic, wearable, transcutaneous, and electrode-based electrical nerve stimulators. These devices provide pain relief within minutes. In January 2018, Omron Healthcare introduced an over-the-counter electrotherapy device for safe and effective drug-free pain relief named- Avail. It is a TENS unit with wireless and dual-channel capability that provides relief from chronic and acute pain. Such advancements are expected to foster market growth in the region during the forecast period.

Product Type Insights

Based on product type, the portable TENS segment dominated the market with a market revenue share of 71.70% in 2021. The growth is attributed to the factors such as growing demand for at-home use devices and the growing base of the geriatric population widening the base of immobile patients. The market is segmented into portable, and tabletop TENS units Portable TENS units are also suitable because they are small, and relatively distinct, therefore one can keep a TENS unit in their pocket or clip it onto a belt to ensure that they have immediate access to pain relief either at home or away. Thus, all these aforementioned factors are contributing to the segment growth.

In addition, the portable TENS segment is anticipated to grow at the fastest CAGR of 4.0% during the forecast period owing to benefits such as decreased number of doctor visits for patients. Portable TENS are used extensively for preventing muscle atrophy, relaxation of muscle spasms, managing chronic pain due to arthritis, and increasing blood circulation.

Moreover, many key players in the market are offering various innovative stimulators in this segment. For instance, the company NeuroMetrix, Inc. offers a portable pain relief kit, which is a TENS unit that fits like a brace on patients and provides stimulation for pain relief. The company Zynex, Inc., is offering JetStream, a portable system that can be used at home for treatment. OMRON Corporation is currently providing a small-sized portable electrotherapy TENS device that can be used for providing relief from sore and aching muscles. These factors are anticipated to drive the global transcutaneous electrical nerve stimulation market growth over the forecast period.

Application Insights

基于应用程序中,急性疼痛段举行the largest share of 53.42% in 2021. The market has been segmented into chronic pain and acute pain. Acute pain is further sub-segmented into sports injuries, postoperative pain, labor pain, and menstrual pain. This type of pain may be primarily caused by surgery, trauma, sports-related injuries, or other medical illnesses. As more people are participating in sports and recreational activities, the risk of injuries is increasing.

For instance, according to Stanford Children’s Health, over 3.5 million injuries are reported annually among children and teens in the U.S. Additionally, the rising number of surgical procedures along with the increase in healthcare expenditures will improve the overall market shortly. Opioids have been extensively used in the perioperative pain setting. However, the side effects associated with these medications have raised emphasis on devices-based pain management therapies including TENS, thereby, contributing to the market growth during the forecast period.

However, the chronic pain segment is expected to grow at the fastest CAGR of 4.07% during the forecast period. An increase in the incidence of chronic pain has created clinical urgency for incorporating long-term solutions. For instance, as per the Versus Arthritis organization, around 15.5 million people in England (34%) have chronic pain and around 5.5 million people (12%) have high-impact chronic pain. In addition, high impact chronic pain has become more common among young adults accounting for a rise from 21% to 32% between 2011 and 2017.

十是主要用于慢性颈部或事件back pain has not been relieved despite surgery or medications. With increasing chronic pain due to conditions such as failed back surgery, lumbar & cervical radiculitis, and neuropathy, the demand for TENS units is rising. This, in turn, is anticipated to fuel the market growth during the forecast period.

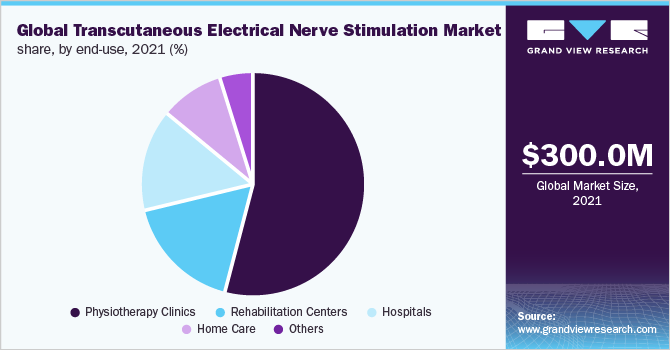

End-use Insights

Based on end-use, the physiotherapy clinics segment held the largest share of 54.16% in 2021. The market is segmented into hospitals, physiotherapy clinics, rehabilitation centers, home care, and others. The growing preference of physiotherapists toward electrotherapies as compared to manual techniques is a major factor driving the growth of this segment. Moreover, increasing patient visits for seeking stimulation therapies and the availability of these therapies at an affordable cost at physiotherapy clinics are the major factors anticipated to fuel the segment growth. Also, medical reimbursement provided to patients seeking these therapies is further anticipated to drive the segment growth during the forecast period.

However, the home care segment is expected to grow at the fastest CAGR of 4.93% during the forecast period. The patient-friendly, inexpensive, and safe nature of these devices is contributing to their growing popularity at home. In addition, rising hospital costs and chronic pain make homecare a better option, especially for the elderly population. For instance, according to a 2018 report by WHO, the global population aged 60 years and older is expected to reach 2 billion by 2050, up from 900 million in 2015.

由于老年人与跌倒有关的伤害是major health and social concern globally, this is expected to present a significant growth opportunity for the market during the forecast period. The advancements and availability of TENS units to use at home have made it a preferred choice of pain relief therapy device. Its cost-effective nature also makes it feasible for patients in developed and developing economies.

Regional Insights

North America dominated the market with a market revenue share of 43.91% in 2021and is likely to maintain its position over the forecast period. The presence of key participants, huge investments by governments for the development of innovative medical devices, and the early introduction of novel TENS devices are supplementing the growth of the market in the region. Moreover, the high purchasing power of consumers and increased adoption of advanced technologies and innovative medical devices are further expected to drive market growth.

Also, the presence of extensive public & private funding initiatives, especially in the U.S., to create awareness regarding advanced devices. These initiatives, including the U.S. Affordable Care Act (ACA), focus on reducing the cost of medical devices. Furthermore, acute pain is the most common cause of emergency room visits in this region. Over 45 million Americans undergo inpatient surgery each year and experience acute surgical pain. This is expected to drive the market growth in the region during the forecast period.

However, the Asia Pacific region is estimated to witness the highest growth of CAGR of 5.24% in the market during the forecast period. Growing awareness related to health and fitness, increasing adoption of pain management therapies, and growing usage of smart devices for maintaining health are the key growth drivers in this region. Moreover, increasing cases of sports injuries in this region are poised to stir up the demand for TENS units during the forecast period.

Furthermore, the growing geriatric population in Asian countries such as Japan and China-with major untapped opportunities-is expected to drive market growth during the forecast period. A 2018 study from World Bank estimated that more than 20% of the population in Japan was over the age of 65 years, making it one of the top countries with the largest geriatric population. Its large geriatric patient pool is expected to be a critical factor supporting the market in the region during the forecast period.

Key Companies & Market Share Insights

The market leaders operating in the market are focusing on introducing innovative devices and solutions to offer increased comfort to patients with musculoskeletal pain and improve their quality of life. For instance, in September 2020, a leading provider of neurostimulation-based medical devices- NeuroMetrix Inc., has launched the Quell App for Apple Watch users. It is a wearable, TENS device for knee, foot, and leg pain that is available over the counter (OTC).

Similarly, mergers, acquisitions, partnerships, and strengthening of the distribution network are the key strategies adopted by the market players to fuel their growth and expansion goals. For instance, in April 2021, DJO (Colfax Corporation) completed the acquisition of MedShape, Inc a leading provider of medical devices for fracture fixation, joint fusion, and soft tissue injury repair.Some prominent players in the transcutaneous electrical nerve stimulation market include:

OMRON Corporation

Zynex Medical

NeuroMetrix, Inc.

EMS Physio Ltd.

BioMedical Life Systems

DJO Global, Inc.

Globus

经皮电神经刺激(十)Market Report Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 310.24 million |

Revenue forecast in 2030 |

USD 419.48 million |

Growth rate |

CAGR of 3.84% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2017 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, Application, End-use, Region |

Regional scope |

North America Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

Country scope |

美国.; Canada; U.K.; Germany; France; Italy; The Netherlands; Spain; Sweden; Japan; China; India; South Korea; Taiwan; Australia; Vietnam; Brazil; Mexico; South Africa; and Saudi Arabia |

Key companies profiled |

OMRON Corporation; Zynex Medical; NeuroMetrix; Inc.; EMS Physio Ltd.; BioMedical Life Systems; DJO Global, Inc.; Globus other players |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global transcutaneous electrical nerve stimulation market report based on product type, application, end-use, and region:

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

Portable TENS

Table Top TENS

Application Outlook (Revenue, USD Million, 2017 - 2030)

Chronic Pain

Arthritis

Back & Neck Pain

Fibromyalgia

Neuropathic Pain

Others

Acute Pain

Sports Injuries

Postoperative Pain

Labor Pain

- Menstrual Pain

End-use Outlook (Revenue, USD Million, 2017 - 2030)

Hospitals

Physiotherapy Clinics

Rehabilitation Centers

Home care

Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

美国.

Canada

Europe

U.K.

Germany

France

Italy

Spain

Asia Pacific

Japan

China

India

South Korea

Australia

Latin America

Brazil

Mexico

Argentina

Colombia

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global transcutaneous electrical nerve stimulation market size was estimated at USD 300.00 million in 2021 and is expected to reach USD 310.24 million in 2022.

b.The global transcutaneous electrical nerve stimulation market is expected to grow at a compound annual growth rate of 3.84% from 2022 to 2030 to reach USD 419.48 million by 2030.

b.North America dominated the TENS market with a share of 43.91% in 2021. This is attributable to the rising cases of chronic & acute pain, the presence of key participants, and huge investments by governments in the development of innovative medical devices in the region.

b.Some of the key players operating in the transcutaneous electrical nerve stimulation market include OMRON Corporation, Zynex Medical, NeuroMetrix, Inc., EMS Physio Ltd., BioMedical Life Systems, DJO Global, Inc., Globus, and other players.

b.Key factors that are driving the transcutaneous electrical nerve stimulation market growth include the rising cases of chronic pain and musculoskeletal injuries, especially among older citizens as well as the ineffectiveness of oral drugs prompting patients to look for alternative treatment options.