UAE Fire Protection System Market Size, Share & Trends Analysis Report By Product (Detection, Suppression, Response ), By Service, By Application, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-119-5

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Semiconductors & Electronics

Report Overview

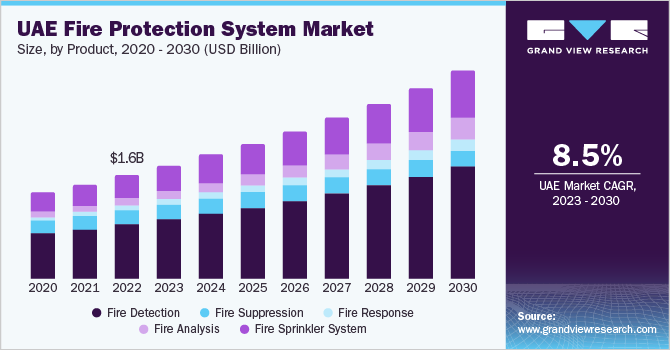

TheUAE fire protection system market sizewas valued atUSD 1.65 billion in 2022and is anticipated to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. The UAE has been renowned for its rapid urbanization and development in recent years. The construction of high-rise buildings, extravagant hotels, massive shopping malls, and state-of-the-art entertainment centers has characterized this growth. The country's commitment to infrastructure development has contributed significantly to its economic prosperity and global status as a leading business and tourist destination. As the UAE continuously invests in building impressive structures, the need for robustfire protection systemshas intensified. These systems are designed to prevent, detect, control, and suppress fires effectively, ensuring the safety of occupants and protecting valuable assets within these buildings.

The growing trend of integrating fire alarm systems into Building Automation Systems (BAS) offers vast growth opportunities to the fire protection systems market. Moreover, connectivity with building automation systems is increasingly becoming a major feature of fire protection systems in commercial, industrial, and residential applications. This can be attributed to the fact that such integration allows the development of systems capable of sharing and gathering data, which can help alert individuals about fire safety issues on the premises. In addition, a notable rise in investment in smart building automation technologies across several regions is expected to offer new opportunities for BASs in the industrial and commercial sectors.

However, periods of economic uncertainty, such as recessions or downturns, can significantly affect various industries, including fire protection systems and related investments. During economic downturns, businesses often face financial challenges and uncertainties. In an effort to maintain profitability and weather the economic storm, many companies tend to prioritize cost-cutting measures. Hence, expenditures across different departments, including safety and infrastructure, might be scrutinized. As a result, such factors can significantly impact the growth of the market.

The UAE has experienced remarkable economic growth over the years, transforming itself into a major business and tourism hub in the Middle East. This growth has been driven by various factors, including its strategic location, robust infrastructure development, and extensive investments in numerous sectors. One of the significant catalysts for the increasing demand for fire safety solutions in the UAE is hosting events such as Expo 2020 Dubai. Such mega-events draw millions of visitors and participants, necessitating stringent fire safety measures in commercial buildings, exhibition halls, pavilions, and other venues. These gatherings require advanced fire protection systems capable of handling large crowds and ensuring their safety in the event of an emergency. As a result, such economic growth provides lucrative opportunities for the growth of the market.

The fire protection industry in the UAE has undergone significant transformations due to rapid technological advancements. These innovations have led to the development of more efficient and intelligent fire safety solutions, revolutionizing how fire protection is approached and managed in the region. Furthermore, automation and robotics are making inroads in firefighting operations in the UAE. The use of drones equipped with thermal imaging cameras allows firefighters to gain a real-time view of fire incidents from above, aiding in situational assessment and strategy development. In addition, AI-powered firefighting robots can navigate hazardous environments and assist human responders, improving overall safety and efficiency during fire emergencies.

Product Insights

Amongst the product segment, fire detection accounted for the largest market share of nearly 52.0% in 2022. The segment's growth is attributed to factors prioritizing safety and compliance with fire safety regulations in the UAE. The UAE's rapid urbanization and construction activities have led to an increase in residential, commercial, and industrial buildings. This surge in construction creates a higher demand for advanced fire detection systems to ensure early detection and prevention of fire incidents. Moreover, rising awareness about the importance of fire safety and the need for modern and efficient fire detection technologies among businesses and homeowners contribute to expanding the UAE fire detection market. As companies and individuals seek cutting-edge fire detection solutions that integrate with smart building technologies, the segment is poised to grow.

The fire response segment is expected to grow considerably over the forecast period. The UAE's rapid urbanization and infrastructural expansion have increased demand for advanced fire safety solutions across residential, commercial, and industrial sectors. As the country continues to witness substantial construction activities, there is a heightened emphasis on adopting state-of-the-art fire response technologies to mitigate potential fire hazards. Moreover, the rising adoption of smart technologies, Internet of Things (IoT) applications, andartificial intelligencein fire response systems has revolutionized the industry, making it more efficient and effective. The integration of these technologies enables real-time monitoring, early detection, and rapid response to fire emergencies, contributing to the segment’s growth.

Service Insights

Amongst the service, installation and design services segment accounted for the largest market share of over 50.0% in 2022. The segment has been proactive in capitalizing on the booming construction industry in the UAE, which has led to an increased demand for fire protection systems in residential, commercial, and industrial projects. The demand for expert fire protection services has increased significantly in the UAE due to rapid urbanization and infrastructure development. Professional fire protection companies such as Fireman Safety Services offer end-to-end installation services, ensuring the seamless integration of fire safety systems into buildings. This is driving the demand for installation and design services in the market.

The managed service segment is expected to register the second highest CAGR over the forecast period. The increasing focus on safety and regulatory compliance has prompted businesses and organizations to seek professionally managed services for their fire protection needs. Outsourcing fire protection management allows companies to concentrate on their core operations while ensuring their fire safety systems are expertly monitored and maintained.

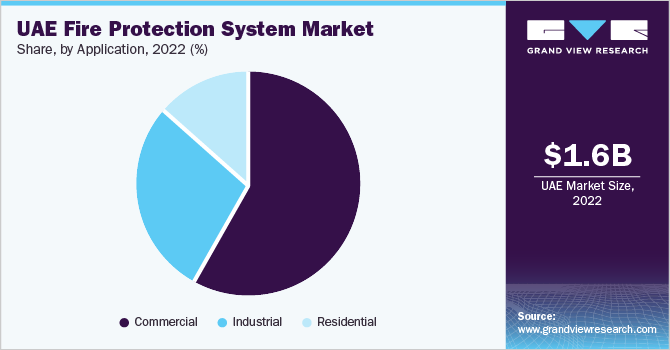

Application Insights

Amongst the application segment, the commercial sector accounted for the largest market share of over 57% in 2022. The rapid growth of commercial infrastructure, including skyscrapers, shopping malls, and business centers, necessitates robust fire safety measures. Furthermore, stringent government regulations and safety standards in the UAE push businesses to invest in comprehensive fire protection systems to ensure compliance and safeguard their assets and employees. Additionally, rising awareness among business owners about the potentially catastrophic consequences of fire incidents on their reputation and operations has led to a proactive approach to adopting modern fire protection solutions. Hence, the market is witnessing a substantial upswing with increased demand for fire detection, suppression, and prevention systems tailored to meet the fire safety requirements of the commercial sector.

The industrial sector is expected to register the highest CAGR over the forecast period. The industrial sector is witnessing a rise in the adoption of specialized fire suppression systems tailored to address specific hazards. These may include foam-based systems for flammable liquid fires, deluge systems for high-risk areas, and dry chemical systems for combustible dust hazards. Furthermore, water mist fire suppression systems are gaining popularity in industrial settings due to their effectiveness in suppressing fires while minimizing water wastage. These systems atomize water into fine droplets, creating a cooling effect and suppressing the fire by reducing oxygen availability. All these factors are expected to drive the demand for fire protection systems in the industrial sector.

Key Companies & Market Share Insights

市场参与者的市场整合operating in the region, including Bristol Fire Engineering LLC; Honeywell International Inc.; Johnson Controls; MMJ; NAFFCO; Robert Bosch Middle East FZE; and SFFECO. Companies are engaging in several growth strategies, including partnerships, mergers & acquisitions, and geographical expansion, to stay afloat in the competitive market scenario. For instance, in May 2023, Johnson Controls announced the launch of the Johnson Controls Ducted Systems (DS) Solutions application. For commercial Rooftop Units (RTUs) and residential equipment, the free application acts as a centralized resource for finding equipment information and contacting technical help.Some prominent players in the UAE fire protection system market include:

Bristol Fire Engineering LLC

Honeywell International Inc.

Johnson Controls

MMJ

NAFFCO

Robert Bosch Middle East FZE

SFFECO

UAE Fire Protection System Market Report Scope

Report Attribute |

Details |

Revenue forecast in 2030 |

USD 3.17 billion |

Growth rate |

CAGR of 8.5% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, service, application |

Country scope |

U.A.E. |

Key companies profiled |

Bristol Fire Engineering LLC; Honeywell International Inc.; Johnson Controls; MMJ; NAFFCO; Robert Bosch Middle East FZE; and SFFECO. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

UAE Fire Protection System Market Report Segmentation

The report forecasts revenue growth at country level and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE fire protection system market report based on product, service, and application.

Product Outlook (Revenue, USD Million, 2018 - 2030)

Fire Detection

Fire Suppression

Fire Response

Fire Analysis

Fire Sprinkler System

Service Outlook (Revenue, USD Million, 2018 - 2030)

Managed Services

Installation And Design Services

Maintenance Services

Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

Commercial

Industrial

Residential

Frequently Asked Questions About This Report

b.The UAE fire protection system market size was estimated at USD 1.65 billion in 2022 and is expected to reach USD 1.79 billion in 2023.

b.阿联酋市场预计消防系统to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 3.17 billion by 2030.

b.Fire Detection segment dominated the telehandler market with a market share of more than 52.0% in 2022. Fire detection growth is anticipated due to increasing safety and compliance with fire safety regulations in the country.

b.Some key players operating in the UAE fire protection system market include Bristol Fire Engineering LLC; Honeywell International Inc.; Johnson Controls; MMJ; NAFFCO; Robert Bosch Middle East FZE; and SFFECO.

b.Major factor expected to drive the UAE fire protection system market is increasing demand for the fire alarms alarms and detectors in residential sector, and rising safety concerns amongst several industries.

We are committed towards customer satisfaction, and quality service.