Upper Extremity Implants Market Size, Share & Trends Analysis Report By Type (Shoulder, Elbow, Hand & Wrist), By Biomaterial (Natural Biomaterials, Metallic Biomaterials), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-069-8

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- 工业:Healthcare

Report Overview

The globalupper extremity implants market sizewas valued atUSD 1.7 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The rising incidence of sports-associated injuries coupled with a higher preference for implants owing to their numerous advantages is driving the growth. In addition, the rising number of upper limb surgeries is facilitating the demand for artificial limbs and implants. For instance, according to recent data from the American Academy of Orthopaedic Surgeons, over 53,000 shoulder replacement surgeries are performed in the U.S. every year, and shoulder & elbow replacement surgeries are among the top 10 most common orthopedic surgeries.

The increasing burden of musculoskeletal disorders, sport associated injuries is expected to fuel market expansion throughout the forecast period. Some of the marketed implants for upper limb arthritis are HemiCAP Systems from Anika Therapeutics, Inc., and Zimmer Biomet shoulder replacement solutions among others. In addition, according to an article published by Johns Hopkins Medicine, approximately 30 million people take part in some organized sports, accounting for more than 3.5 million sports injuries each year in the U.S.

Moreover, the development of customized implants, rising demand forbiocompatible implantswith less toxic effects, and robust demand for technologically advanced prosthetics from end-users are pushing manufacturers to introduce novel products. For instance, in October 2022 Integrum announced that its revolutionary OPRA Implant System received patent approval from US Patent and Trade Organization. This system is a novel bone-anchored prostheses system in which prostheses are directly attached to the bone. The OPRA system is suitable for both upper as well as lower limbs.

The COVID-19 pandemic had a negative impact on the global upper extremity implants market owing to cancellations of surgical treatments, a reduction in fracture cases, and fewer hospital and clinic visits owing to restrictions and safety purposes. The industry players saw a decline in their revenue from implant sales due to the pandemic. But, after the pandemic, the market has started gaining momentum due to streamlining of elective surgeries. Thus, owing to the high number of fractures and bone diseases the market is likely to witness significant growth opportunities in the coming years.

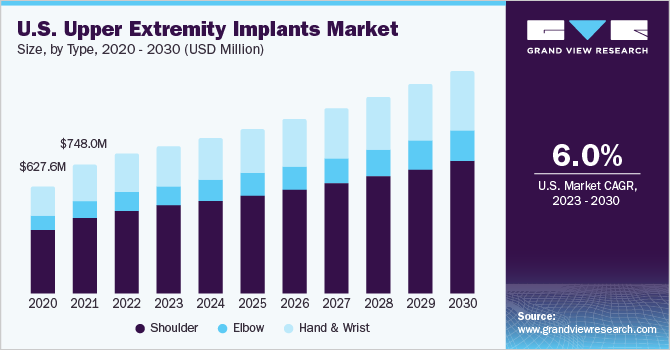

Type Insights

肩膀部分占据了全球市场n 2022 and accounted for a maximum revenue share of more than 59.5%. The segment’s growth is driven by the rising number of sports injuries, shoulder dislocation, rising geriatric population, increasing incidence of osteoarthritis, fracture of the shoulder, accidents, and traumas that have led to the increasing need for upper extremities implant products. Besides, shoulder replacements account for the largest number oforthopedic extremityprocedures and represent one of the profitable segments in orthopedics.

With increasing expectations of patient satisfaction, several surgeons are looking for treatment options to improve clinical outcomes. Hence, shoulder replacement or arthroplasty implant products are majorly driven by trends such as the revision of failed previous shoulder replacements in older patients, the requirement for various biomaterial implants, bone-preserving solutions, and next-generation joint arthroplasty systems.

The elbow segment is expected to grow at the fastest rate over the forecast period. The elbow segment is driven by continuous innovation in new elbow implant systems. In addition, the requirement for implant in elbow replacement for primary and revision surgery has uplifted the growth. Alternatively, hand & Wrist is expected to have lucrative growth over the forecast period with new product launches.

For instance, in March 2020, Extremity Medical announced that it has received FDA 510(k) clearance for KinematX Total Wrist Implant. This product is developed to emulate the natural wrist range of motion in people with wrist arthritis & other degenerative wrist diseases. Thus, the recent product approvals from regulatory authorities to serve evolving demand is likely to contribute to market expansion.

Biomaterial Insights

The metallicbiomaterialssegment held the majority of the revenue share of 40.8% in 2022. This can be attributed to advanced properties such as proper strength, fracture toughness, ductility, hardness, corrosion resistance, and biocompatibility.

Furthermore, demand for metallic materials such as stainless steels, titanium (Ti)-based alloys, Co-based alloys, and biodegradable alloys such as Mg-based alloys in the shoulder, and elbow replacement surgery has lifted the segment growth. Additionally, these materials have been approved by the U.S. FDA and are routinely used inorthopedic implants. Furthermore, new designs and conceptions of metallic biomaterials are expected to create the potential for biomedical applications in the upper extremities.

Natural biomaterials are expected to have lucrative growth at the fastest CAGR over the estimated period. Natural biomaterials have emerged as a trend in surgical procedures because of their ability for integrating and remodeling, along with bio-compatibility within the patient’s own tissue. This biomaterial offers a scaffolding or support structure that allows cells to start forming new tissue.

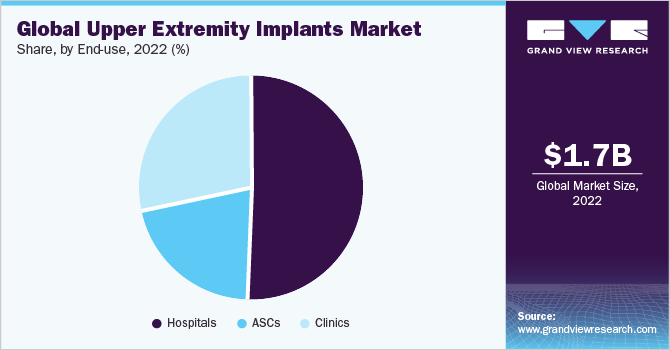

End-use Insights

The hospital segment held the largest share of 50.7% in 2022. The dominance of the segment is attributed to the rising injury percentage of the different upper extremities and the requirement for operative treatment of fractures. Moreover, the rising concerns to treat upper extremities caused due to sports injuries is a factor for the overall growth. The market products offer comprehensive services to restore function and eliminate injury which has increased demand for the products in hospitals over the estimated period.

The ASCs segment is expected to show the fastest growth over the forecast period which can be attributed to increased preference for ASCs in upper extremities procedures, the rising number of new product innovations, and FDA clearance has led to the rise in market growth. The ASCs segment provides added advantages to the patient with adequate postoperative pain control, rapid patient discharge, minimal side effects, and overall cost containment.

For instance, in August 2021, the Orthopaedic Implant Company announced the launch and FDA clearance of the DRPx System. The device is the only distal radius plating system with an improved ergonomic design that meets orthopedic surgeons while saving costs with the improved financial viability of hospitals andambulatory surgery centers(ASCs). The product is available in the United States.

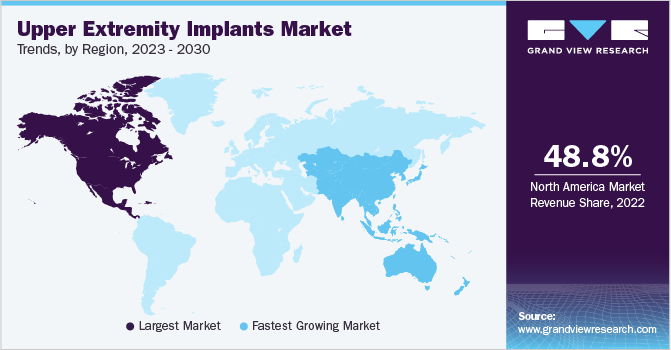

Regional Insights

North America led the overall upper extremity implants industry with a share of 48.8% in 2022 and is anticipated to continue dominating throughout the forecast period. Factors such as rising common shoulder injuries such as included dislocations/separations, sprains/strains, contusions, and fractures. The rise in the geriatric population, increasing number of sports injuries, and presence of key participants in North America are driving regional growth. Alternatively, the presence of established healthcare facilities treating a range of conditions such as fractures, dislocations, tendonitis, and arthritis has flourished the requirement of products to a major extent.

Asia Pacific is anticipated to witness a lucrative CAGR throughout the forecast period. The increasing aging population, rising demand for orthopedics surgeries and therapies, improving access to healthcare with quality care, and reduced costs have presented new growth opportunities for companies in the APAC region with the presence of countries such as Japan, China, and India. Moreover, the rising burden of sports injuries, fractures, and a significant increase in demand for products in the region is likely to support regional expansion.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product development, merger & acquisition, and partnership to increase their market share. Players such as Stryker,DePuy, Smith & Nephew, Zimmer Biomet, and others are actively involved in the development of upper extremity implants. For instance, in August 2021, DePuy Synthes introduces the INHANCE shoulder system, a fully integrated shoulder arthroplasty system. Some prominent players in the global upper extremity implants market include:

Stryker

DePuy

Zimmer Biomet

Smith & Nephew

Medtronic

Aesculap

BioTek Instruments

Conmed

Arthrex, Inc.

Ossur

DJO Global

Acumed LLC

Upper Extremity Implants MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 1.8 billion |

Revenue forecast in 2030 |

USD 2.8 billion |

Growth rate |

CAGR of 6.8% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, biomaterial, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

Key companies profiled |

Stryker; DePuy; Zimmer Biomet; Smith & Nephew; Medtronic; Aesculap; BioTek Instruments; Conmed; Arthrex, Inc.; Ossur; DJO Global; Acumed LLC |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

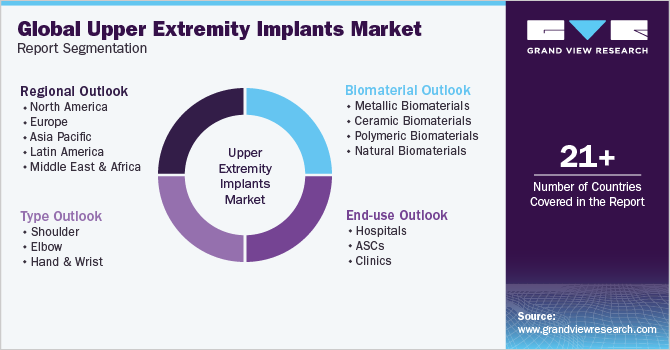

Global Upper Extremity Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global upper extremity implants market report based on type, biomaterial, end-use, and region:

Type Outlook (Revenue, USD Billion, 2018 - 2030)

Shoulder

Elbow

Hand & Wrist

Biomaterial Outlook (Revenue, USD Billion, 2018 - 2030)

Metallic Biomaterials

Ceramic Biomaterials

Polymeric Biomaterials

Natural Biomaterials

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

Hospitals

ASCs

Clinics

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Europe

UK

Germany

France

Italy

Spain

Sweden

Norway

Denmark

Asia Pacific

Japan

China

India

Australia

Thailand

South Korea

拉丁美洲

Brazil

Mexico

Argentina

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Frequently Asked Questions About This Report

b.The global upper extremity implants market size was estimated at USD 1.7 billion in 2022 and is expected to reach USD 1.8 billion in 2023.

b.The global upper extremity implants market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 2.8 billion by 2030.

b.The shoulder segment held the largest share of 59.5% in 2022 owing to constant product demand for shoulder replacement developments and increased implant demand in the treatment of fractures

b.Some of the key players oerating the market include Stryker Corporation, DePuy Synthes, Zimmer Biomet, Smith & Nephew, and Medtronic among others.

b.The increasing prevalence of musculoskeletal disorders such as osteoarthritis and osteoporosis coupled with the rising geriatric population across the world are the major factors driving the global upper extremity implants market.