U.S. Academic Medical Centers Market Size, Share & Trends Analysis Report By Region (Northeast, Southeast, Southwest, West, Midwest), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-124-3

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

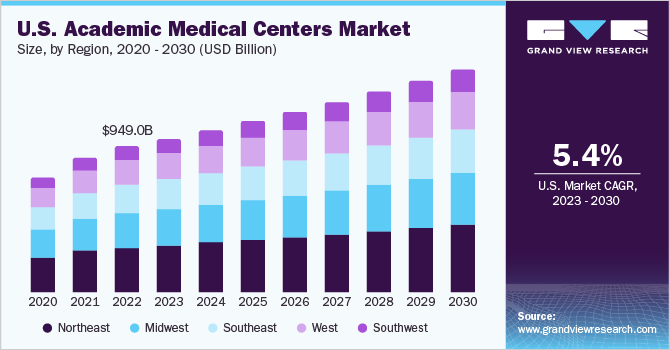

TheU.S. academic medical centers market sizewas valued atUSD 949.0 billion in 2022and is anticipated to witness a compound annual growth rate (CAGR) of 5.37% from 2023 to 2030. AMCs are widely recognized for delivering comprehensive patient care, conducting extensive research initiatives, and playing a pivotal role in educating upcoming healthcare professionals. These institutions consist of medical schools and affiliated major teaching hospitals. The market is majorly driven by the rising funding for academic & research programs, a growing shortage of physicians across the U.S., and an increasing number of AMCs.

医生在初级和日益缺乏specialty care settings is expected to drive the market's growth over the forecast period. The physician shortage could have compounding effects on patient care, specifically the aging population. Medical schools have increased the class sizes to address the country's physician shortage. According to the Association of American Medical Colleges, 26 new medical schools opened in the last ten years in the U.S. Moreover, these institutions expanded the enrollment for the courses to ease the shortage of physicians. According to the same source, the number of first-time applicants in medical schools across the U.S. increased by around 21.2%.

AMCs rely on publicly funded programs to sustain their research efforts and cover a substantial portion of their services. The U.S. federal government is the primary source of research funding, constituting a noteworthy segment of the average AMC's income. For instance, in August 2023, USA Health received USD 1.5 million in funding from the U.S. federal government for thepediatric imagingequipment for the USA Health Children’s & Women’s Hospital. Furthermore, Medicare contributes billions annually towards graduate medical education.

The COVID-19 pandemic negatively impacted the market in the early phase on multiple levels, including the impact on medical students, recruitment & physician shortage, and the financial impacts, among others. Moreover, the pandemic halted the research operations at these centers & adversely affected the research infrastructure and pipelines in many AMCs across the country. For instance, according to an article published in the National Library of Medicine, the AMCs lost around 24% of their research productivity during the pandemic. Moreover, the researchers incurred losses of around USD 2,000 to USD 100,000 per research program.

Regional Insights

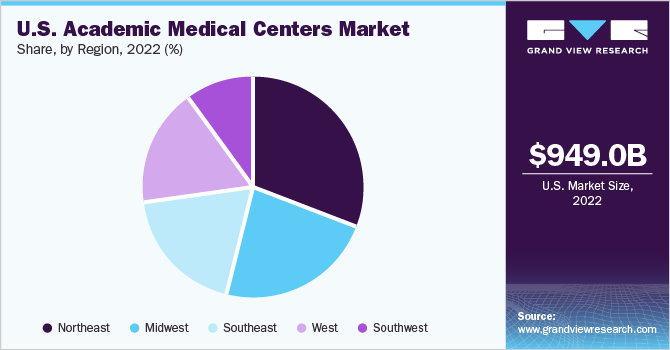

基于该地区,美国学术医疗岑ters Market (AMC) market is divided into Southeast, West, Midwest, Southwest, and Northeast. The Northeast region held the largest market share of 31.2% in 2022. This can be attributed to the presence of major AMCs in the region and continuous innovations in the market. The regional organizations are tapping into new opportunities in the market, including advancement in research and operations and expansion of teaching capacity on the campuses. For instance, in 2021, Massachusetts General Hospital operated as the largest independent hospital in terms of annual funding received with an annual budget of USD 1.2 billion.

The Southwest region is expected to witness the fastest growth over the forecast period. This high growth can be attributed to the opening of several AMCs in the region and increased funding for research and education in this region. For instance, in September 2022, UT Southwestern opened UT Southwestern Medical Center at RedBird, the first-ever AMC campus in Southern Dallas County, Texas. It is the sixth outpatient medical center of UT Southwestern, offering various services.

Key Companies & Market Share Insights

The market is shifting towards consolidation, and players are broadening their relationships with physicians, hospital networks, and care providers in the community to gain maximum market share. These players are adopting strategies including mergers, partnerships, collaborations, affiliations, joint ventures, and other agreements. For instance, in March 2023, Valleywise Health opened a new AMC in Arizona and replaced the 50-year-old facility. Valleywise Health is the public teaching health system & only academic burn center across Arizona. Some prominent players in the U.S. academic medical centers market include:

Weill Cornell Medicine

Cleveland Clinic

Vanderbilt University Medical Center

University Hospitals

The General Hospital Corporation (Massachusetts General Hospital)

Stanford Health Care

UAB Health System

Mayo Foundation for Medical Education and Research (Mayo Clinic)

Cedars-Sinai

The Johns Hopkins University

UC San Diego Health

Icahn School of Medicine at Mount Sinai

U.S. Academic Medical Centers MarketReport Scope

Report Attribute |

Details |

Revenue forecast in 2030 |

USD 1.44 trillion |

Growth rate |

CAGR of 5.37% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Region |

Country scope |

U.S. |

Key companies profiled |

Weill Cornell Medicine; Cleveland Clinic; Vanderbilt University Medical Center; University Hospitals; The General Hospital Corporation (Massachusetts General Hospital); Stanford Health Care; UAB Health System; Mayo Foundation for Medical Education and Research (Mayo Clinic); Cedars-Sinai; The Johns Hopkins University; UC San Diego Health; Icahn School of Medicine at Mount Sinai |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Academic Medical Centers Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. academic medical centers market report on the basis of region:

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

Southeast

Southwest

Northeast

Midwest

West

Frequently Asked Questions About This Report

b.The U.S. academic medical centers market size was estimated at USD 949.0 billion in 2022 and is expected to reach USD 1.05 trillion in 2023.

b.The U.S. academic medical centers market is expected to grow at a compound annual growth rate of 5.37% from 2023 to 2030 to reach USD 1.44 trillion by 2030.

b.Northeast region dominated the U.S. academic medical centers market with a share of 31.2% in 2022, owing to the presence of major AMCs in the region and continuous innovations in the market.

b.Some key players operating in the U.S. academic medical centers market include Weill Cornell Medicine, Cleveland Clinic, Vanderbilt University Medical Center, University Hospitals, The General Hospital Corporation (Massachusetts General Hospital), Stanford Health Care, UAB Health System, Mayo Foundation for Medical Education and Research (Mayo Clinic), Cedars-Sinai, The Johns Hopkins University, UC San Diego Health, Icahn School of Medicine at Mount Sinai.

b.Key factors that are driving the U.S. academic medical centers market growth include rising funding for academic & research programs, a growing shortage of physicians across the U.S., and an increasing number of AMCs.