U.S. Agriculture Drone Market Size, Share & Trends Analysis Report By Type (Fixed Wing, Rotary Wing), By Component (Hardware, Software, Services), By Farming Environment, By Application, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-103-6

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry:Technology

Report Overview

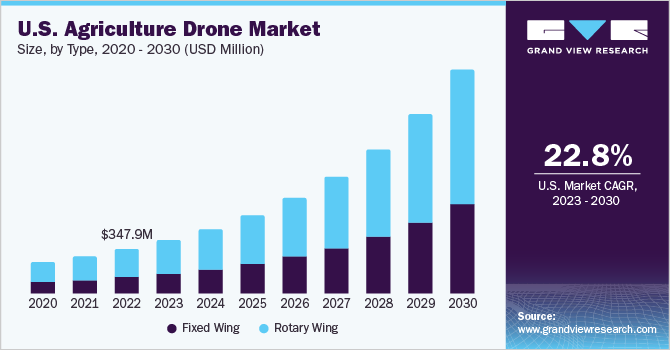

TheU.S. agriculture drone market sizewas estimated atUSD 347.9 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 22.8% from 2023 to 2030. The adoption of agriculture drones in the U.S. has witnessed significant growth, driven by their potential benefits and the need for efficient farm management. With vast farmland areas in the country, traditional crop monitoring and management methods can require considerable time and effort. Agriculture drones offer comprehensive monitoring capabilities, providing an aerial perspective that enables farmers to identify issues and allocate resources effectively. By covering large areas efficiently, drones save time and effort, enhancing productivity in the agricultural sector.

Government initiatives have played a crucial role in fostering the growth of the agricultural drone market in the U.S. The U.S. Department of Agriculture (USDA) and the National Institute of Food and Agriculture (NIFA) offer grants and funding opportunities to advance the use of drones in farming practices. This support encourages innovation, helps farmers access necessary resources, and facilitates the integration of UAVs into agricultural operations.

Technological advancements in hardware, sensors, and data analysis have significantly influenced the adoption of agriculture drones in the U.S. These advancements have made drones more capable and valuable for farmers, empowering them with precise and timely information to optimize farming practices, improve efficiency, and increase productivity. Integrating drones with farm management systems further enhances their value, enabling seamlessdata integrationand analysis for informed decision-making.

COVID-19 Impact

The agriculture drone market players faced significant challenges due to the COVID-19 pandemic and subsequent disruptions in the global supply chains. Lockdowns and restrictions on movement hindered the production and distribution of agriculture drones, leading to delays in sourcing components, assembling drones, and delivering them to customers.

This resulted in shortages and increased prices, making drones less accessible to farmers. Investments in the agriculture drone industry were also affected as businesses and investors became cautious amidst economic uncertainties. Market volatility and financial instability prompted a decline in funding for new projects, including agriculture drones. Consequently, the pace of innovation, research, and development in the industry slowed, hindering overall growth.

Field testing and demonstrations, crucial for showcasing the benefits of agriculture drones, faced challenges due to social distancing measures and gathering restrictions. Large-scale demonstrations and close interactions with farmers were difficult to organize, leading to a slowdown in adoption and market penetration. The pandemic adversely impacted farm incomes, causing farmers to delay investment plans in new technologies like agriculture drones.

Disruptions in global trade, labor shortages, and fluctuating consumer demand resulted in income declines, making it difficult for many farmers to prioritize drone adoption. Furthermore, the COVID-19 pandemic disrupted agricultural events, conferences, and trade shows where companies usually showcase their latest drone technologies. The cancellation or postponement of these events deprived incumbents in the agricultural drone market of valuable opportunities to engage with potential customers, build trust, establish trade relationships, and educate farmers about the benefits of their solutions.

Type Insights

Based on type, the market is divided into fixed-wing and rotary-wing. The rotary wing segment dominated the overall market, gaining a revenue share of 62.9% in 2022. It is expected to grow at a CAGR of 22.0% throughout the forecast period. The unique features of rotary wing drones such as their ability to hover, climb, descend, and maneuver in any direction, have increased their market share. Unlike fixed-wing drones, which require a forward motion for lift, rotary-blade drones may move quickly and precisely by altering the speed and rotation of their propellers. Because of their maneuverability, they are well-suited for activities that require close control and agility.

The fixed-wing segment is anticipated to grow at the fastest CAGR of 24.0% throughout the forecast period. Because of their aerodynamic shape, fixed-wing drones can fly for longer durations and cover larger areas in a single flight. This flight efficiency allows them to preserve power and stay in the air for longer, resulting in enhanced output and cost-effectiveness.

Component Insights

Based on component, the market is divided into hardware, software, and services. The hardware segment dominated the U.S. agriculture drone market in 2022, with a revenue share of 50.6%. It is expected to grow at a CAGR of 22.2% throughout the forecast period. Hardware for the agriculture drone industry includes frames, flight control systems, navigation systems, propulsion systems, cameras, sensors, and others.

The functionality of agriculture drones and their performance capabilities are directly influenced by their hardware components, including the airframe design, propulsion system, and payload capacity. These components ensure a stable flight, maneuverability, and efficient data collection, ultimately enhancing the drone's effectiveness in crop health monitoring and early pest or disease identification.

The services segment is expected to grow at the fastest CAGR of 23.8% during the forecast period. This is due to the increased need for data analysis and interpretation, improved mapping and surveying services, and crop monitoring and management services. These specialized services assist farmers in making informed decisions, increasing productivity, and optimizing resource utilization, boosting market growth in the services segment.

Farming Environment Insights

基于农业环境中,市场是抚慰心灵fied into indoor farming and outdoor farming. The outdoor farming segment dominated the overall market with a revenue share of 82.5% in 2022. It is expected to grow at the fastest CAGR of 22.6% throughout the forecast period. Agriculture UAVs with high-resolution cameras and remote sensing technologies provide valuable monitoring capabilities for large farmland areas in outdoor farming practices.

它们使作物压力,早期发现疾病e outbreaks, and nutrient deficiencies, empowering farmers to take proactive measures and optimize crop health. Additionally, UAVs with spraying mechanisms offer a more efficient and accurate alternative to traditional pesticide and fertilizer application methods, enhancing worker safety and improving pest and disease control.

室内农业部门预计将增长a significant CAGR of 23.8% during the forecast period. Agricultural drones play a significant role in inventory management for indoor farming operations by scanning and tracking plant growth, providing accurate counts, and generating reports on crop yields. This enables farmers to make informed decisions about space utilization, optimize resource allocation, and plan for future crop rotations, ultimately maximizing productivity and profitability in indoor farming.

Application Insights

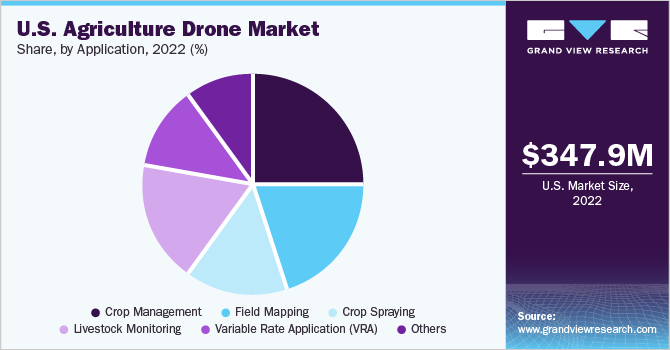

Based on application, the market is divided into crop management, field mapping, crop spraying,livestock monitoring, variable rate application (VRA), and others. The crop management segment held the maximum share of 24.7% in 2022. Crop management holds the highest market share due to its ability to optimize crop production by using agriculture UAVs. By utilizing advanced drone technology, farmers can monitor crop health, detect issues early on, and implement targeted management strategies, resulting in improved yields, reduced waste, and increased productivity.

The field mapping segment is anticipated to grow at the fastest CAGR of 24.1% throughout the forecast period. Providing farmers with detailed and accurate information about their fields enables them to make informed decisions regarding crop management, resource allocation, and overall field planning. The use of aerial imaging techniques, such as high-resolution aerial photographs andremote sensing technologies, allows farmers to obtain valuable insights into crop health, identify areas of concern, and develop targeted strategies for addressing challenges.

Key Companies & Market Share Insights

The market is fragmented indicating the presence of multiple players and diverse offerings within the market. These players are adopting product development and acquisition strategies to gain a competitive edge. For instance, in January 2021, AgEagle Aerial Systems Inc acquired MicaSense, Inc, a pioneer in drone sensor manufacturing, for USD 23 million. The company was looking forward to leveraging the acquisition to develop and bring MicaSense, Inc’s legacy sensor products to customers, primarily in agriculture, plant research, land management, and forestry management. Some prominent players in the U.S. agriculture drone market include:

AeroVironment, Inc.

AgEagle Aerial Systems Inc

DJI (SZ DJI Technology Co., Ltd)

Parrot Drone SAS

PrecisionHawk

Trimble Inc.

DroneDeploy

Sentera

Sky Drones Technologies LTD

Draganfly Inc.

Pix4D SA

Autel Robotics.

U.S. Agriculture Drone Market Report Scope

Report Attribute |

Details |

Revenue forecast in 2030 |

USD 1,758.4 million |

Growth Rate |

从2023年到2030年的复合年增长率22.8% |

Base year for estimation |

2022 |

Historical Data |

2017 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million, CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

Segments covered |

Type, component, farming environment, application |

Country Scope |

U.S. |

Key companies profiled |

AeroVironment, Inc.; AgEagle Aerial Systems Inc; DJI (SZ DJI Technology Co., Ltd); Parrot Drone SAS; PrecisionHawk; Trimble Inc.; DroneDeploy; Sentera; Sky Drones Technologies LTD; Draganfly Inc.; Pix4D SA; Autel Robotics |

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Agriculture Drone Market Report Segmentation

This report forecasts revenue growth and offers a qualitative and quantitative analysis of the market trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. agriculture drone market report based on type, component, farming environment, and application:

Type Outlook (Revenue, USD Million, 2017 - 2030)

Fixed Wing

Rotary Wing

Component Outlook (Revenue, USD Million, 2017 - 2030)

Hardware

Frames

Flight Control Systems

Navigation Systems

Propulsion Systems

Cameras

Sensors

Others

Software

Services

Professional Services

Managed Services

Environment Outlook (Revenue, USD Million, 2017 - 2030)

Indoor Farming

Outdoor Farming

Application Outlook (Revenue, USD Million, 2017 - 2030)

Crop Management

Field Mapping

Crop Spraying

Livestock Monitoring

Variable Rate Application (VRA)

Others

Frequently Asked Questions About This Report

b.The U.S. agriculture drone market size was estimated at USD 347.9 million in 2022 and is expected to reach USD 418.1 million in 2023.

b.The U.S. agriculture drone market is expected to grow at a compound annual growth rate of 22.8% from 2023 to 2030 to reach USD 1,758.4 million by 2030.

b.The crop management sub-segment accounted for the highest market share of 24.7% in 2022 in the U.S. agriculture drone market.

b.Major players operating in the target market include AeroVironment, Inc.; AgEagle Aerial Systems Inc; DJI (SZ DJI Technology Co., Ltd); Parrot Drone SAS; PrecisionHawk; Trimble Inc.; DroneDeploy; Sentera; Sky Drones Technologies LTD; Draganfly Inc.; Pix4D SA; and Autel Robotics.

b.The major factors attributing to the growth of the market are increasing awareness of benefits associated with agriculture drones; and the growing popularity of precision farming. In addition, the aspects such as the favorable government initiatives to encourage agriculture drones adoption is further bolstering the growth of the market.