U.S. Commercial HVAC Rooftop Units Market Size, Share & Trends Analysis Report By Capacity (5-7 Ton, 7-10 Ton), By SEER (Less than 14 SEER, 14-19 SEER), By Product Type, By Application, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-104-1

- Number of Pages: 169

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Advanced Materials

Report Overview

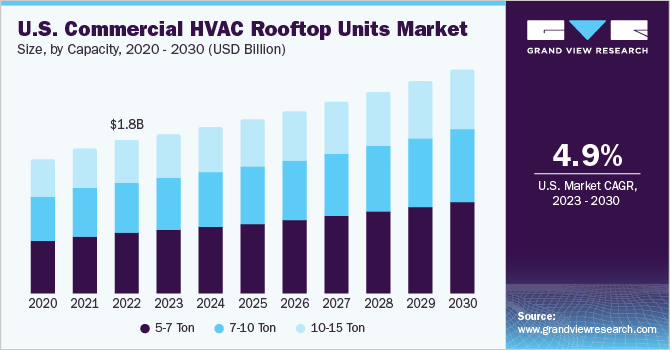

TheU.S. commercial HVAC rooftop units marketsizewas estimated atUSD 1.76 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030. The growth of the market can be attributed to the rising demand for cost-effective and energy-efficient space cooling and heating systems in commercial applications in the U.S. Moreover, the surging demand for heating equipment with a high seasonal coefficient of performance (SCOP) that can work efficiently in both, winter and summer seasons, is expected to fuel the growth of the U.S. market for HVAC rooftop units over the forecast period.

According to the ASHRAE 2021 report, the U.S. is the fourth-largest market for variable refrigerant flow (VRF) systems, followed by Japan, China, and South Korea. The energy efficiency of VRF systems, and their adaptability in zonal control, provision of simultaneous heat recovery, heating & cooling, and ease of installation with no ductwork required can be attributed to their widespread success. From single-family homes to workplaces, data centers, hotels, and hospitals, the spectrum of applications varies significantly for VRF systems.

Commercial HVAC rooftop units come in various capacities between 3 and 162 tons. The size of the space to be maintained and controlled decides the capacity of the HVAC rooftop units. For small businesses such as retail spaces, restaurants, and cafes, the 3 to 7-ton rooftop units can fulfill the basic HVAC requirements. This range of rooftop units is ideal for the small capacity and uneven requirement for cooling and heating.

餐厅的发展,小型企业和retail spaces is likely to drive the growth of the 5-7 ton segment over the forecast period. Moreover, continuous technological innovation and product launches in this capacity range are also expected to facilitate the segment’s growth over the forecast period. For instance, in December 2021, Daikin introduced a 5-ton gas/electric and AC rooftop unit. The new product includes the DF series and meets the Department of Energy (DOE) minimum efficiency standards.

According to the United Nations (UN), more than half of the global population lives in urban areas; the number of urban areas in the U.S. is expected to reach 53 by 2030 compared to 41 in 2010. The positive perception of people about the cities and changing standard of living encourage migration from rural to urban areas. This is expected to boost the development of new metro cities and urban areas and create the need for supermarkets and hypermarkets, thereby driving the U.S. commercial HVAC rooftop unit demand and market over the forecast period.

The increasing number of medium-sized buildings such as restaurants, retail stores, healthcare, educational institutes, and lodging/hospitality primarily drives the growth of the 7-10 ton segment. These buildings require the HVAC rooftop units to have a capacity between 7 to 10 tons. The growth of the 7 to 10-ton rooftop units is attributed to their higher space heating & cooling efficiency, ease of serviceability, and weather-resistant cabinet. Moreover, it offers various advantages over other space heating & cooling equipment, such as compact design, lower installation cost, and lower maintenance.

Capacity Insights

The 5-7 ton segment is expected to witness the fastest CAGR of 5.3% over the forecast period. For small businesses such as retail spaces, restaurants, and cafes, the 3 to 7-ton rooftop units can fulfill the basic HVAC requirements. This range of rooftop units is ideal for the small capacity and uneven requirement for cooling and heating.

The 10-15 ton HVAC rooftop units are ideally used for high-end medium-sized buildings, which include small office buildings, hotels, educational institutes, and shopping malls, among others. This system offers higher capacity for heating, cooling, and ventilation with easy installation and efficient energy usage. The growth in the hotel, restaurant, and shopping mall construction projects in the U.S. is expected to drive the segment’s growth over the forecast period.

Furthermore, the growing emphasis by manufacturers of HVAC rooftop units on technological advancements and the incorporation of value-added features in rooftop units is expected to drive the segment's growth. The inclusion of technological advancements and new product launches is likely to increase revenue generation from new as well as existing customers. In April 2023, Trane launched Precedent Hybrid Dual Fuel Rooftop Units with Symbio, consolidating a 3-10 ton solution with Voyager 2 12.5-25 ton solution. The new product offered by the company includes a hybrid heat pump solution that offers the option to switch to gas in colder conditions.

SEER Insights

The above 19 seasonal energy efficiency ratio (SEER) segment is expected to witness a CAGR of 4.7% over the forecast period owing to the rising importance of energy efficiency and a favorable regulatory environment. In the above-19 SEER HVAC systems, having best-in-class energy efficiency also leads to savings in energy bills. The adoption of above-19 SEER HVAC units is limited; however, over the forecast period, the adoption of these units is anticipated to increase.

The manufacturers of the U.S. HVAC rooftop units are continuously investing in technological improvements. For instance, in December 2021, Daikin launched a comfort product featuring R-32. Compared to its R410A predecessor line, the Daikin ATMOSPHERA system uses R-32 refrigerant. It is a ductless, single-zone system with up to 16.3 EER ratings, 13.8 HSPF, and 27.4 SEER. It also provides ultra-efficient heating and cooling. Such product launches along with the technological developments in the HVAC rooftop units are likely to fuel the market’s growth over the forecast period.

According to the new standard by the U.S. DOE, since January 2023, the minimum efficiency (SEER2) for most of the packaged units was increased. For the southern region of the U.S., the minimum efficiency for AC units was increased from 14.0 to 15.0 SEER. The units which fail to meet this requirement cannot be installed on the rooftops. In addition, the national heat pump minimum efficiency was increased from 14.0 to 15.0 nationwide. Such developments and the increasing need for energy-efficient heating and cooling systems will positively impact the growth of the 14-19 SEER segment over the forecast period.

Product Type Insights

The VRF HVAC rooftop units segment is expected to witness the fastest CAGR of 10.1% over the forecast period. The rising popularity of the VRF HVAC rooftop units is attributed to the characteristics and advantages offered by these units, which include energy efficiency, flexible zonal control capabilities, and easy installation. In addition, these units can simultaneously deliver heating and cooling without requiring ductwork. Such advantages are expected to drive the demand for VRF HVAC rooftop units over the forecast period.

此外,连续的技术gical advancements and the availability of energy-efficient systems in the market are likely to fuel the segment’s growth in the future. In July 2022, Toshiba launched a new VRF flagship system for commercial buildings. This system offers customers high-quality cooling and heating, ultra-efficient operation, and enables commercial buildings to achieve the best sustainability rating.

传统空调屋顶单元段的恶性肿瘤h is primarily driven by their continued usage and demand for packaged AC and packaged terminal heating units in the U.S. Conventional HVAC rooftop units are installed on the rooftop of commercial buildings such as hotels, office buildings, and shopping malls. The growing construction industry and several buildings in the U.S. are likely to propel the demand for conventional HVAC rooftop units. According to the U.S. Census Bureau, the total value of construction is increasing continuously. In May 2023, the total construction spending in the U.S. was USD 1,925.6 billion, up from USD 1,909.0 billion in April 2023.

Moreover, technological advancements by key players in traditional HVAC rooftop units are expected to drive the market. The major HVAC companies in the U.S. offer high-performance units, which meet RTU specifications. Conventional RTUs are comparatively cheaper, with less capital investments than the VRF systems.

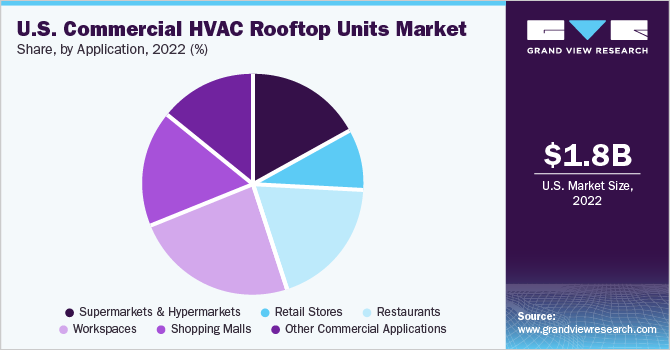

Application Insights

The workspaces application segment led the market and held 23.7% of the revenue share in 2022. The workspaces segment growth is substantially driven by the growth of the commercial sector, primarily office buildings. The HVAC RTU plays a vital role in maintaining the indoor air quality, proper heating, cooling, and ventilation of buildings. Education, mercantile, offices, and warehouse buildings account for 50% of the total buildings and 61% of the total floor space.

The growing population, customer preference for outdoor dining, and increasing demand for unique restaurants are likely to augment the restaurant industry’s growth. This will positively impact the overall demand for HVAC RTUs over the forecast period. Moreover, the new strategic initiatives are expected to support the growth of the market. In March 2023, Carrier Global Corporation announced a distribution strategy, in partnership with Budderfly, for energy-efficient HVAC systems designed for restaurants.

The growing urbanization across the U.S. significantly drives the supermarket and hypermarket segment’s growth. The population in the country is witnessing enormous growth and a subsequent change in the landscape of human settlement. Furthermore, the positive perception of people about cities and changing standard of living fuel the migration from rural to urban areas. This is expected to boost the development of new metro cities and urban areas and create the need for supermarkets and hypermarkets, thereby driving the U.S. HVAC rooftop unit demand and market over the forecast period.

The growing number of retail stores is projected to drive the demand for HVAC rooftop units over the forecast period. The growth in retail stores is driven by the growing population, increasing disposable incomes, and high expenditure on consumer goods and commodities. According to the National Retail Federation, in 2022, annual retail sales grew by 7% in the U.S. compared to 2021 and are expected to attain a growth rate of 4-6% in 2023.

Key Companies & Market Share Insights

Manufacturers of commercial HVAC rooftop units use diverse strategies, such as product launches, expansions, and investments, to increase their market share and meet the shifting technological demands from various end-use sectors. For instance, in April 2023, LG Electronics opened its factory to produce heat pumps in the U.S. The factory will make 100% electrical units, with future intentions to produce outdoor heat pumps. Further, in January 2023, the new AirfinityS rooftop air-to-air heat pump systems from Trane were launched with variable speed compressors, Adaptive Frequency Drive, and low GWP R-454B refrigerant.

Moreover, Lennox International launched packaged rooftop units with the introduction of Xion and Enlight product lines. This new product reduces environmental impact by offering exceptional efficiency, sustainable design, and efficient service. Some prominent players in the U.S. commercial HVAC rooftop units market include:

Carrier Global Corporation

DAIKIN INDUSTRIES, Ltd.

Johnson Controls, Inc.

LG Electronics, Inc.

Danfoss

Lennox International

STULZ Air Technology Systems, Inc.

Rheem Manufacturing Company

Trane

Samsung

Mitsubishi Electric Corporation

Fujitsu

Gree Commercial

AAON

U.S. Commercial HVAC Rooftop Units Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 1.83 billion |

Revenue forecast in 2030 |

USD 2.56 billion |

Growth Rate |

CAGR of 4.9% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

Segments covered |

Capacity, SEER, product type, application |

Country scope |

U.S. |

Key companies profiled |

Carrier Global Corporation; DAIKIN INDUSTRIES Ltd.; Johnson Controls, Inc.; LG Electronics, Inc.; Danfoss; Lennox International; STULZ Air Technology Systems, Inc.; Rheem Manufacturing Company; Trane; Samsung; Mitsubishi Electric Corporation; Fujitsu; Gree Commercial; AAON |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Commercial HVAC Rooftop Units Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. commercial HVAC rooftop units market report based on capacity, SEER, product type, and application:

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

5-7 Ton

7-10 Ton

10-15 Ton

SEER Outlook (Revenue, USD Million, 2018 - 2030)

Less than 14 SEER

14-19 SEER

Above 19 SEER

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

Conventional HVAC Rooftop Units

VRF HVAC Rooftop Units

Application Outlook (Revenue, USD Million, 2018 - 2030)

Supermarkets & Hypermarkets

Retail Stores

Restaurants

Workspaces

Shopping Malls

Other Commercial Applications

Frequently Asked Questions About This Report

b.U.S. commercial HVAC rooftop units market size was estimated at USD 1.76 billion in 2022 and is expected to reach USD 1.83 billion in 2023.

b.U.S. commercial HVAC rooftop units market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 2.56 billion by 2030.

b.VRF HVAC rooftop units are expected to witness a CAGR of 10.1% over the forecast period. The rising popularity of the VRF HVAC rooftop units is attributed to the characteristics and advantages offered by these units, which include energy efficiency, flexible zonal control capabilities, and easy installation.

b.在美国的一些关键球员操作通讯ercial HVAC rooftop units market include Carrier Global Corporation, DAIKIN INDUSTRIES, Ltd., Johnson Controls, Inc., LG Electronics, Inc., Danfoss, Lennox International, STULZ Air Technology Systems, Inc., Rheem Manufacturin g Company, Trane, Samsung, Mitsubishi Electric Corporation, Fujitsu, Gree Commercial, AAON.

b.The key factors that are driving U.S. commercial HVAC rooftop units market include the rising demand for cost-effective and energy-efficient space cooling & heating systems in commercial applications in the U.S.