U.S. Craniomaxillofacial Devices Market Size, Share & Trends Analysis Report By Product (CMF Plate & Screw Fixation, Temporomandibular Joint Replacement), By Material, By Application, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-712-4

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Healthcare

Report Overview

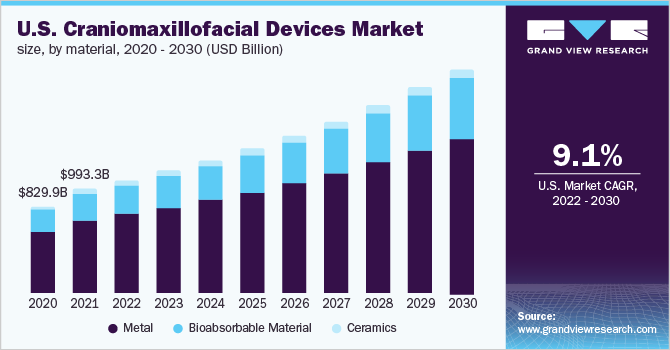

美国craniomaxillofacial设备市场规模w乐鱼体育手机网站入口as valued at USD 993.3 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2022 to 2030. The rising incidence of road accidents due to urbanization and industrialization drives the growth in demand for these devices. Drunk driving, not following safety rules, drowsy driving, speeding, and distracted driving are some of the major reasons for road accidents. The growing demand for minimally invasive surgeries and the rising incidence of facial fractures are also expected to fuel the growth. According to the U.S. National Highway Traffic Safety Transport Administration, “Every day, about 32 people in the United States die in drunk-driving crashes, that is one person every 45 minutes. In 2020, 11,654 people died in alcohol-impaired driving traffic deaths-a 14% increase from 2019. These deaths were all preventable”.

Factors such as the growing demand for minimally invasive surgeries and the rising incidence of facial fractures due to high-impact accidents, sports injuries, and falls, are estimated to fuel the demand for craniomaxillofacial (CMF) devices in the coming years. According to John Hopkins Medicine, about 21% of all traumatic brain injuries among American youngsters are caused by sports and recreational activities.

The market has benefited from young people's growing concerns about their physical and aesthetic attractiveness. The industry is also expected to increase as a result of advantages related to these devices, such as shorter hospital stays, painless procedures, reduced recovery times, safety, and efficacy.

The demand for craniomaxillofacial implants is also being driven by an increase in the frequency of facial abnormalities brought on by genetic diseases and trauma that require aesthetic operations. Increasing disposable income is also supporting people to opt for such surgeries. The American Society of Plastic Surgeons reported that 13,281,235 minimally invasive cosmetic operations were performed overall in 2020.

The demand for craniomaxillofacial products is anticipated to witness a rise in the upcoming years due to the general increase in CMF surgeries. Medicare and other helpful insurance programs that facilitate CMF surgeries are also projected to promote the expansion of the industry.

The COVID-19 pandemic negatively impacted the CMF devices market as the manufacturers of products for elective surgeries experienced a considerable decrease in sales, due to stoppage in production, reduced working hours, and layoffs. The neurological product line was most impacted by the pandemic. Orders were delayed and consumable sales were reduced due to non-essential surgeries being put on hold. Plastic surgeons were made to serve at COVID Care Centers and plastic surgeries were performed only in the case of emergencies.

However, many people opted for surgeries in this period because of working flexibilities but there was a decrease in the number of surgeries performed as compared to previous years. The sales revenue of many manufacturers was also affected, for instance, the annual report of Johnson and Johnson showed an 11.6% decrease in the sales revenue.

Material Insights

Metallic CMF implants held the largest share of about 70% of the U.S. craniomaxillofacial devices market in 2021, owing to their advantages over bioabsorbable and ceramic materials, such as their hard characteristics and minimal corrosiveness. The internal stiff fixation of the face skeleton frequently uses metals such asstainless steel, titanium, Vitallium,chromium, brass silver, and copper. In the surgery, stainless steel alloys made of nickel, chromium, copper, cobalt, aluminum, and molybdenum are still employed.

Bioabsorbable materials are easily absorbed by the human body and they eliminate the need for additional surgery. Hence, the segment is predicted to grow profitably. The growth is also greatly influenced by technological improvements. The growing acceptance of SR technology and its benefits, including ease of handling, biocompatibility, biodegradability, and reliability, have had a beneficial impact on the expansion of the segment. Technological advancements in the clinical use of bioabsorbable materials include copolymeric SR devices like PLGA, biosorb FX, and biosorb PDX.

The main benefit of these bioabsorbable implants is that after biologic fixation has been established, there is initial stability sufficient for healing followed by progressive resorption. These materials also reduce the amount of stress that shields bone, gradually apply load as they deteriorate, eliminate the need for hardware removal operations, and make postoperative radiologic imaging easier.

Application Insights

Craniomaxillofacial devicessaw the most use in Orthognathic and Dental Surgery in 2021 as a result of an increase in the use of CMF devices for procedures for facial reconstruction, and increasing awareness of aesthetic consciousness. Applications for CMF devices are also in neurosurgery including otolaryngology and skull surgery. These tools aid in the management of CSF and the treatment of neuro-oncology, spinal illnesses, neurovascular diseases, nasal skull-based surgery, dura mater repair, deep brain stimulation, and cranial trauma.

Plastic surgery is likely to witness a growth rate of 9.5% in the U.S. during the forecast period. The surgery is used to treat aesthetic skull issues like a sloping forehead, frontal bossing/forehead horns, residual fontanelle depressions, a flat back of the head, an occipital knob or protuberance, excessive temporal fullness (a head that is too wide), excessive temporal depressions (a head that is too narrow), prominent temporal lines, and occipital asymmetries. According to the American Society of Plastic Surgeons, a total of 15.5 million cosmetic surgeries were performed in the U.S. in 2020.

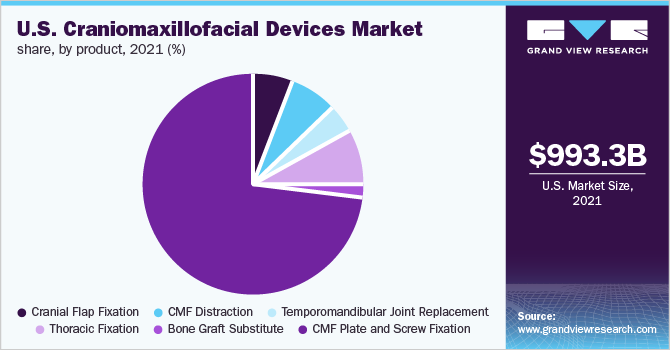

Product Insights

MF plate and screw fixation held the largest revenue share of around 73% in 2021owing to its extensive use in numerous procedures, including orthognathic, tumor removal, deformity correction, and cranial fixation. The Craniomaxillofacial (CMF) devices market is segmented based on product into cranial flap fixation, CMF distraction, temporomandibular joint replacement, bone graft substitute, and Maxillofacial (MF) plate & screw fixation. Cranial flaps are used in skull replacement surgery and they include connecting rods and inferior & superior disks.

CMF distraction system is used for post-trauma reconstruction, orthognathic surgeries, and oncology. Temporomandibular joints are used in jaw replacement surgery. Bone graft substitutes are used for the reconstruction of the bone cavity and spine fusion, while MF plates & screws are used for treating facial trauma and deformities. In 2020, there were roughly 256,085 maxillofacial surgeries conducted in the US, according to a report from the American Society of Plastic Surgeons (ASPS).

Due to an uptick in sports injuries, cranial fractures, and rising demand for face augmentation, the temporomandibular joint (TMJ) replacement market is anticipated to develop at the fastest rate throughout the projection period. It can be used for a variety of things, including fractures, deformities, degenerative joints, and arthritic disorders. Additionally, the utility of the device is in decreasing jaw discomfort, obstructing normal eating, and enhancing mouth opening ability.

Key Companies & Market Share Insights

The key players are focusing on growth strategies, such as enhancements in the existing technologies, geographical expansion, product launches, and product approvals. For instance, in August 2021, Stryker announced its plan for a USD 14 million expansion in Portage Road, Auckland. Since the company had granted the tax abatement for the expansion of its manufacturing facility in 2018. As a result of continual growth, the company needed to expand its warehouse as well. Also, in April 2022, Medtronic and GE Healthcare announced their collaboration to meet the growing needs of outpatient care services. Some of the prominent players in the U.S. craniomaxillofacial devices market include:

Stryker Corporation

Medtronic Plc

格kl马丁公司

Medartis AG

Johnson & Johnson

W. L. Gore & Associates, Inc

TMJ Concepts; Integra LifeSciences

OsteoMed L.P.

Aesculap Implant Systems, Inc

Zimmer-Biomet Inc.

U.S. Craniomaxillofacial Devices MarketReport Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 0.9 billion |

Revenue forecast in 2030 |

USD 2.1 billion |

Growth rate |

CAGR of 9.1% from 2022 to 2030 |

Base year for estimation |

2021 |

Historic data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

Segments covered |

Product, material, application |

Country scope |

U.S. |

Key companies profiled |

Stryker Corporation; Medtronic Plc; KLS Martin L.P; Medartis AG; Johnson & Johnson; W. L. Gore & Associates, Inc; TMJ Concepts; Integra LifeSciences; OsteoMed L.P.; Aesculap Implant Systems, Inc; Zimmer-Biomet Inc. |

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Pricing and purchase options |

Avail of customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Craniomaxillofacial Devices Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. craniomaxillofacial devices market report based on product, material, and application:

ProductOutlook (Revenue, USD Million; 2018-2030)

Cranial Flap Fixation

CMF Distraction

Temporomandibular Joint Replacement

Thoracic Fixation

Bone Graft Substitute

CMF Plate and Screw Fixation

MaterialOutlook (Revenue, USD Million; 2018-2030)

Metal

Bioabsorbable material

Ceramics

ApplicationOutlook (Revenue, USD Million; 2018-2030)

Neurosurgery

Orthognathic and Dental Surgery

Plastic surgery

Frequently Asked Questions About This Report

b.美国craniomaxillofacial设备市场规模w乐鱼体育手机网站入口as estimated at USD 993.3 million in 2021 and is expected to reach USD 0.9 billion in 2022.

b.The U.S. craniomaxillofacial devices market is expected to grow at a compound annual growth rate of 9.1% from 2022 to 2030 to reach USD 2.1 billion by 2030.

b.MF plate and screw fixation dominated the U.S. craniomaxillofacial devices market with a share of 73.0% in 2021. This is attributable to high adoption in different surgeries such as orthognathic, tumor removal, deformity correction, and cranial fixation.

b.Some key players operating in the U.S. craniomaxillofacial devices market include DePuy Synthes; Zimmer-Biomet Inc.; and Medtronic Inc, Medartis AG, Stryker Corporation.

b.Key factors that are driving the U.S. craniomaxillofacial devices market growth include increasing incidence of sports and facial fractures, rising demand for minimally invasive surgeries, and technological advancements in the management of craniomaxillofacial injuries.