U.S. Donor Egg IVF Services Market Size, Share & Trends Analysis Report By Type (Fresh, Frozen), By End Use (Fertility Clinics, Hospitals), Competitive Insights, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-3-68038-952-4

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry:Healthcare

Industry Insights

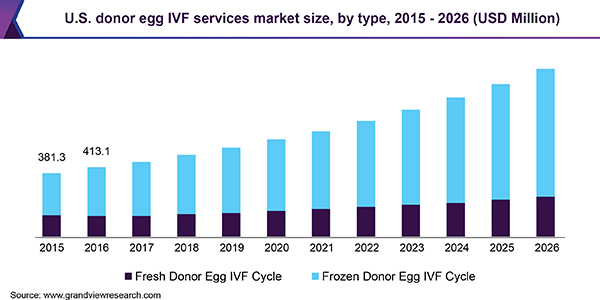

The U.S. donor egg IVF services market size was valued at USD 487.0 million in 2018 and is estimated to exhibit a CAGR of 9.5% over the forecast period. The growing practice of delaying pregnancy among the younger generation, rising infertility due to unhealthy habits, and high success rate of the procedure are some of the crucial factors driving the market. In the U.S., egg donors are not only compensated for the donation but can also negotiate their compensation amount based on the desirability of their eggs.

According to a study published in 2017 by the Society for Assisted Reproductive Technology (SART), banking and freezing of eggs increased from 8,825 in 2016 to 10,936 in 2017. Younger women prefer their own eggs forIVFprocedures. However, women above 40 years of age generally opt for donor eggs as quality and quantity of eggs decline after 40. Delay in pregnancy is a key factor responsible for the declining quality and quantity of one’s eggs. According to the National Center for Health Statistics, the average age to have a baby in the U.S. rose to 26.3 years in 2016 compared to 22.7 years in 1980. Furthermore, this age increased to 30.3 years for women with a college degree.

在美国使用捐赠的卵子增加due to the high success rate of IVF and the availability of significant donors and advanced services in the country. According to the Journal of the American Medical Association, the number of women donating their eggs increased from 10,801 in 2000 to 18,306 in 2010, amounting to a 70% rise. An increase in donation was attributed to technological advancements in assisted reproductive technology and more acceptance of such procedures.

In June 2018, Columbia University Irving Medical Center started seeing patients at the new Columbia University Fertility Center, which is a major step in the field of reproductive endocrinology and infertility. In October 2018, the Columbia University Fertility Center announced that in response to the cryogenic tank failure at two fertility clinics/centers, it has built the first weight-based scale safety system to protect stored embryos and eggs.

Type Insights

The market has been segmented on the basis of type into fresh and frozen donor eggs for IVF. In 2018, frozen donor eggs accounted for the largest share in the market and this trend is likely to continue over the course of the forecast period. These eggs are ready to be transported, thawed, and used for the procedure as they have already been retrieved from screened donors. Moreover, the procedure is a lot more cost-effective in nature as the recipient does not have to foot the travel expenses of the donor. These factors will ensure the segment’s steady growth. The availability of donors, significant compensation, and increasing awareness about these services are some of the other high impact rendering drivers.

End-use Insights

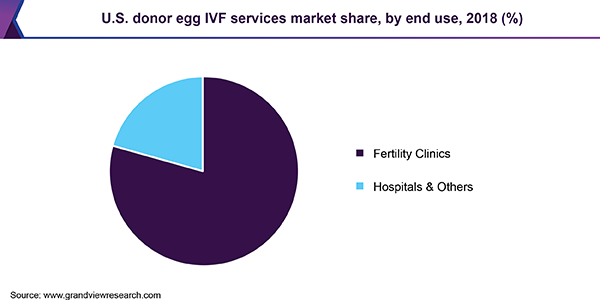

The fertility clinic segment held the largest revenue share in the U.S. donor egg IVF services market in 2018 and is likely to retain its lead throughout the forecast period. With the rise in demand forassisted reproductive technologytreatments, the number of fertility clinics and ART centers is increasing considerably. Licensed fertility clinics offer counseling services to individuals and couples having problems in conceiving. Based on the severity of their problems, doctors and specialists plan out IVF treatments. Fertility clinics offer state-of-the-art equipment such as micromanipulation and non-invasive Radio Frequency Identification (RFID) tags. This factor is further expected to propel segment growth over the forecast period.

Hospitals formed the second-largest end-use segment in 2018 and will report moderate growth over the course of the forecast period. Owing to the scale of services provided by hospitals, the equipment used in assisted reproduction is sophisticated, advanced, and high-tech. This increases customer preference for hospital settings. In numerous developing countries, gynecological consultations and procedures are often done in hospital settings itself. Therefore, increasing incidence of fertility issues in such countries will give this segment a boost.

U.S. Donor Egg IVF ServicesMarket Share Insights

Major players identified in the market include Beverly Hills Egg Donation, Donor Egg Bank USA, Egg Donor America, MyEggBank, Extraordinary Conceptions LLC, Premier Egg Donors, California Fertility Partner, Extend Fertility, Boston IVF, and Fairfax EggBank.

In August 2018, GI Partners announced the acquisition and merger of California Cryobank (CCB) and Cord Blood Registry (CBR) and its plans to operate under the name California Cryobank Life Sciences. The move was aimed at helping around 700,000 families in more than 30 countries. The organization’s portfolio includes fertility preservation storage services, frozen donor egg, and frozen donor sperm services, and cord blood and cord tissue collection and storage services.

Earlier, in December 2016, California Cryobank (CCB) announced the acquisition of Donor Egg Bank USA (DEB). The transaction was majorly financed through California Cryobank investors NovaQuest Pharma Opportunities Fund III, L.P. (“NovaQuest”), Longitude Venture Partners II, L.P, and bank funding. The combination of leading donor egg and donor sperm banks is expected to add to the company’s value and growth potential.

U.S. Donor Egg IVF ServicesReport Scope

Attribute |

Details |

Base year for estimation |

2018 |

Actual estimates/Historical data |

2015 - 2017 |

Forecast period |

2019 - 2026 |

Market representation |

Revenue in USD Million & CAGR from 2019 to 2026 |

Country scope |

U.S. |

Report coverage |

Revenue size & forecast, competitive landscape, growth factors & trends |

15% free customization scope (equivalent to 5 analysts working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

赛格ments Covered in the Report

这份报告预测国家勒的收入增长vel and provides an analysis on latest industry trends in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented the U.S. donor egg IVF services market report based on type and end-use:

Type Outlook (Revenue, USD Million, 2015 - 2026)

Fresh Donor Eggs

Frozen Donor Eggs

End-use Outlook (Revenue, USD Million, 2015 - 2026)

Fertility Clinics

Hospitals & Others