U.S. & Europe Extractable And Leachable Testing Services Market Size, Share & Trends Analysis Report By Application (OINDP, Parenteral Drug Products), By Product (Single-use, Drug Delivery Systems), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-108-3

- Number of Pages: 236

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

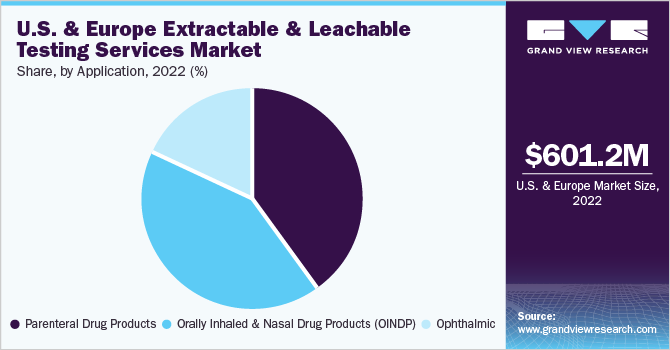

TheU.S. & Europe extractable and leachable testing services market sizewas estimated atUSD 601.2 million in 2022and is expected to grow at a compound annual growth rate (CAGR) of 15.20% from 2023 to 2030. Increasing regulatory scrutiny on the quality of healthcare products and rising emphasis on product safety are key drivers fueling market growth. Moreover, flourishing pharmaceutical andbiotechnologysectors across the U.S. & Europe and supportive government legislation are further projected to support market expansion. The COVID-19 pandemic positively impacted market growth owing to the high demand for novel therapeutics and healthcare products.

The pandemic created a higher demand for pharmaceuticals, comprising treatments,vaccines, and medical devices. As companies scaled up manufacturing these products, the demand for extractable and leachable testing services increased to ensure product safety and compliance with regulatory requirements. In addition, with the introduction of new drugs and medical devices during the pandemic, regulatory bodies increased their emphasis on product safety and quality. As a result, companies had to perform exhaustive leachable testing as a part of their new product development process. Extractable and leachable testing is the analysis of harmful foreign materials that could enter a patient’s body with devices or medicines.

Various pharmaceutical and biotechnology companies use different extractable testing services to safeguard their products from regulatory scrutiny. The regulatory framework for extractable and leachable testing has become more stringent as it is directly concerned with patient safety. In March 2022, the UK government with its Medicines and Healthcare Products Regulatory Agency announced a change in the UK clinical trial regulations. Thereby increasing the demand for extractable and leachable testing services over the forecast period. In addition, rising government support and increasing investment opportunities in thebiopharmaceuticaldomain are anticipated to boost industry growth & positively affect the market.

For instance, in April 2021, venture capital firms invested over USD 36.6 billion in biopharmaceutical companies in the U.S., the UK, and countries in the European Union, accounting for an increase of around 281% from 2017. Thereby increasing the market demand over the forecast period. Furthermore, the growing demand for innovations in bioprocess engineering has led to considerable developments in single-use systems. Advancements in this domain are also fueled by the high usage rate of biopharmaceuticals in recent times.

Furthermore, the increasing number of studies conducted to evaluate the efficiency of single-use bioprocesses is also aiding the rise in awareness about these technologies. Single-use technologies also offer a wide range of benefits, such as a lower risk of cross-contamination, shorter turnaround times, cost-effectiveness, and higher flexibility for altering production volumes. Thus, the rising adoption of single-use technology raised several issues regarding leachable and extractable, as single-use systems can easily come in contact with products and affect their safety and quality. Thus, augmenting the demand for extractable and leachable testing services.

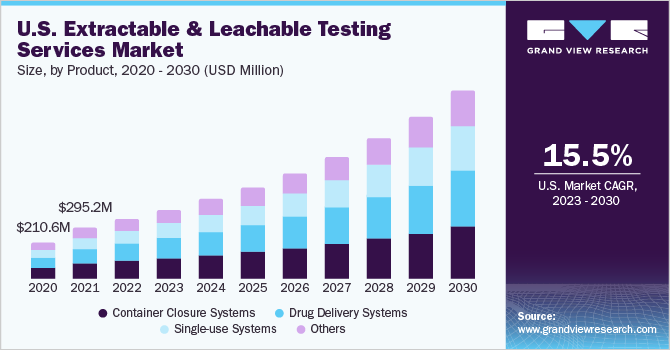

Product Insights

On the basis of products, the container closure systems segment held the largest revenue share of 30.68% in 2022. The rising use of container closure systems in formulations because of their ability to provide long-term stability is boosting the revenue share of this segment. The container closure systems also consist of several package/delivery systems and can leach over time, making E & L testing extremely essential for CCS. Adequate container closure systems are important to maintain the drugs' safety, sterility, and quality. Various cases have been observed involving the loss of safety or formation of harmful contaminants due to the transfer of impurities from container closure systems to pharmaceutical products. For instance, Apotex Corp. recalled the Brimonidine Tartrate Ophthalmic Solution, 0.15%, in March 2023.

Thus, increasing demand for container closure systems in the market is anticipated to drive the segment growth over the forecast period. The single-use systems segment is expected to grow at a significant growth rate of 16.91% from 2023 to 2030. Single-use components and systems usage has increased significantly in commercial & clinical biopharmaceutical manufacturing. These components are generally made up of polymers orplastics. The single-use systems & components provide several advantages, such as speed, flexibility, and operation efficiency, over reusable components. However, the major concern with these SUS is that compounds can leach from the polymeric component, impacting the pharmaceutical product quality or process performance. Thus, extractable & leachable testing has become crucial for single-use systems.

Application Insights

The orally inhaled and nasal drug products segment was the largest in 2022 andaccounted for the largest revenue share of 41.70%. Orally inhaled and nasal drug products include nasal sprays, metered dose inhalers, dry powder inhalers,nebulizers, and inhalers. These products are widely used for systemic delivery of various therapeutics. These products represent the highest-risk drug products concerning the possible introduction of contaminants via container closure contact. Moreover, these products are used indiseases like asthma and Chronic Obstructive Pulmonary Disease (COPD). Therefore, extractable and leachable testing is vital for orally inhaled and nasal drug products.

Thus, increasing the demand for extractable and leachable testing services over the forecast period. The parenteral drug products segment is projected to witness the fastest CAGR of 17.32% over the forecast period. The segment growth is driven by the rising adoption of parenteral preparations across end-users and the increasing burden of chronic conditions requiring parenteral products. Moreover, parenteral products usually have high concentrations of additives like solubilizing agents, plasticizers, etc., which may leach over time, thus, growing the demand for extractable and leachable testing services market.

Regional Insights

美国举行最大的56.92%的市场份额n 2022. The large share of the country can be attributed to the presence of advanced healthcare infrastructure, the flourishing pharmaceutical & biotechnology sector, and the presence of a large number of market participants. Some of the key players offering E&L testing services are Eurofins Scientific; Sartorius AG; Pacific Biolabs; and Element Material Technology. Stringent government regulations for the safety and quality of healthcare products are encouraging these companies to develop precise analytical solutions for healthcare products. For instance, Eurofins Scientific developed its Good Manufacturing Products (GMP)-compliant protocols for direct E&L testing.

Europe is expected to witness a significant CAGR of 14.86% from 2023 to 2030. The growth can be attributed to the presence of developed economies like the UK, Germany, Spain, France, and Italy. These countries have an established infrastructure, which is anticipated to significantly boost the demand for healthcare products in the region. Moreover, the market growth can be attributed to a growing biotechnology & pharmaceutical industry and rising investments by the key players. Furthermore, supportive government regulations and the presence of numerous testing service providers are augmenting market growth; thus, boosting the demand for extractable and leachable testing services in this region.

Key Companies & Market Share Insights

Market leaders are involved in extensive R&D for manufacturing cost-efficient and technologically advanced testing products. Several strategies, such as mergers & acquisitions, undertaken by these organizations to expand their market presence are anticipated to create significant growth opportunities over the forecast period. For instance, in March 2023, Nelson Labs Europe collaborated with Nemera, a drug delivery device solutions provider, to offer integrated services to customers. This partnership was anticipated to benefit biotech & pharmaceutical customers by supplying drug compatibility lab testing, analytical chemistry, and expert advice.Some of the key players in the U.S. & Europe extractable and leachable testing services market include:

Eurofins Scientific

Intertek Group plc

SGS Société Générale de Surveillance SA

WuXi AppTec

Merck KGaA

West Pharmaceutical Services, Inc

Wickham Micro Ltd. (Medical Engineering Technologies Ltd.)

Pacific Biolabs

Boston Analytical

Sotera Health (Nelson Laboratories, LLC)

U.S. & Europe ExtractableAndLeachable Testing Services Market Report Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 690.6 million |

Revenue forecast in 2030 |

USD 1,859.7 million |

Growthrate |

CAGR of 15.2% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million, and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, application, region |

Regional scope |

U.S.; Europe |

Country scope |

U.S.; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark |

Eurofins Scientific; Intertek Group plc; SGS Société Générale de Surveillance SA; WuXi AppTec; Merck KGaA; West Pharmaceutical Services, Inc.; Wickham Micro Ltd. (Medical Engineering Technologies Ltd.); Pacific Biolabs; Boston Analytical; Sotera Health (Nelson Laboratories, LLC) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. & Europe ExtractableAndLeachable Testing Services Market ReportSegmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. & Europe extractable and leachable testing services market report based on product, application, and region:

Product Outlook (Revenue,USD Million,2018 - 2030)

Container Closure Systems

Single-use Systems

Drug Delivery Systems

Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

Parenteral Drug Products

Orally Inhaled and Nasal Drug Products (OINDP)

Ophthalmic

Regional Outlook (Revenue, USD Million, 2018 - 2030)

U.S.

Europe

UK

Germany

France

Italy

Spain

Denmark

Sweden

Norway

Frequently Asked Questions About This Report

b.美国和欧洲可榨出的,可滤取的testing services market size was estimated at USD 601.2 million in 2022 and is expected to reach USD 690.6 million in 2023.

b.美国和欧洲可榨出的,可滤取的testing services market is expected to grow at a compound annual growth rate of 15.20% from 2023 to 2030 to reach USD 1,859.7 million by 2030.

b.On the basis of product, the container closure systems segment held the largest revenue share of 30.68% of the market. The rising use of container closure systems in formulations because of their ability to provide long-term stability is boosting the revenue share of this segment.

b.Some of the key players operating in the U.S. & Europe extractable and leachable testing services include Eurofins Scientific, Intertek Group plc, SGS Société Générale de Surveillance SA, WuXi AppTec, Merck KGaA, West Pharmaceutical Services, Inc, Wickham Micro Limited (Medical Engineering Technologies Ltd.), Pacific Biolabs, Boston Analytical, and Sotera Health (Nelson Laboratories, LLC).

b.Increasing regulatory scrutiny on the quality of healthcare products and rising emphasis on product safety are key drivers fueling market growth. Moreover, flourishing pharmaceutical and biotechnology sectors across the U.S. & Europe and supportive government legislation are further projected to support market expansion.

我们承诺对客户满意度d quality service.

"The quality of research they have done for us has been excellent."