U.S. External Counterpulsation Devices Market Size, Share & Trends Analysis Report By Product (Pneumatic ECP Devices, Electrocardiogram (ECG)-Synchronized), By End-use (Hospitals, Cardiac Centers), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-109-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

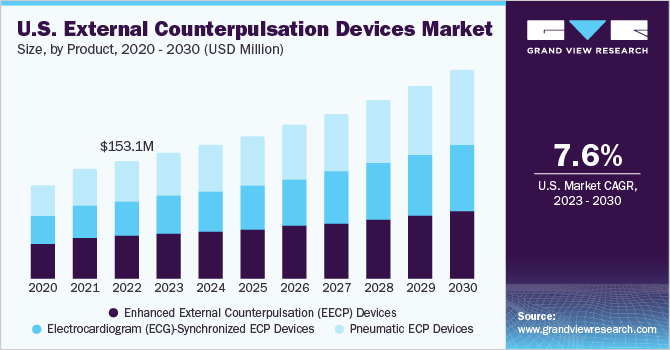

TheU.S. external counterpulsation devices market sizewas estimated atUSD 153.1 million in 2022,预计年复合增长的恶性肿瘤h rate (CAGR) of 7.6% from 2023 to 2030. The escalating prevalence of cardiovascular diseases, including angina, heart failure, and coronary artery disease, fuels the demand for non-invasive solutions like external counterpulsation (ECP) devices. These devices employ external pressure on the lower extremities through inflatable cuffs around the calves, thighs, and buttocks. By carefully inflating and deflating these cuffs, blood vessels experience increased resistance, promoting enhanced blood flow and circulation. The efficacy of this non-invasive method has garnered significant attention in effectively addressing various cardiovascular conditions.

According to data provided by the British Heart Foundation, approximately 620 million individuals worldwide are affected by heart and circulatory diseases. In the U.S. alone, an estimated 6.4 million patients endure coronary artery disease, with around 40,000 new cases annually.

The increasing awareness of the benefits of ECP therapy is propelling market growth in the medical devices sector. ECP therapy's non-invasiveness and potential to improve patient's well-being make it a highly appealing treatment option for cardiovascular conditions. Moreover, favorable reimbursement policies in certain regions positively influence the market outlook, prompting both healthcare professionals and patients to consider ECP therapy a viable choice.

然而,COVID-19流行明显妊娠和分娩综合管理ted the ECP device market, causing disruptions in production, supply chains, and distribution networks. The focus on managing COVID-19 patients led to a temporary decline in ECP therapy adoption and the postponement of non-urgent treatments. Nevertheless, as healthcare systems stabilize, there is an expected resurgence in demand for ECP devices.

Furthermore, the continuous need for non-invasive cardiovascular treatment options is projected to drive this increase in demand. For instance, the American College of Cardiology recognizes Enhanced External Counterpulsation (EECP) as a potential treatment for long COVID. This endorsement provides hope to individuals experiencing prolonged symptoms and underscores the ongoing relevance of ECP therapy in addressing cardiovascular health.

Product Insights

In 2022, the pneumatic ECP devices segment held a dominant the market with a share of 35.68%. These devices utilize air pressure to enhance blood flow to the heart. They have gained traction due to their proven effectiveness in reducing symptoms in angina and refractory angina pectoris patients. Their non-invasive nature and cost-effectiveness make them appealing to patients and healthcare providers, driving increased demand. The rising prevalence of cardiovascular diseases fuels the growth of the pneumatic ECP devices segment. In addition, ongoing technological advancements further contribute to its market expansion, making it a promising therapeutic option for cardiac patients.

The Enhanced External Counterpulsation (EECP) devices segment is expected to exhibit the highest CAGR during the forecast period. The growth is attributed to its demonstrated effectiveness in improving cardiac function and coronary circulation, making it a preferred choice for treating cardiovascular conditions. The non-invasive and safe nature of EECP therapy attracts patients seeking alternative treatments.

Moreover, continuous technological advancements and increasing clinical evidence position EECP Devices to meet the growing demand for effective non-invasive cardiovascular treatments. According to a study by the American College of Cardiology Foundation (published on February 14, 2022), long-term COVID-19 patients with and without coronary artery disease experienced significant improvement in symptoms after receiving 15–35 hours of EECP therapy.

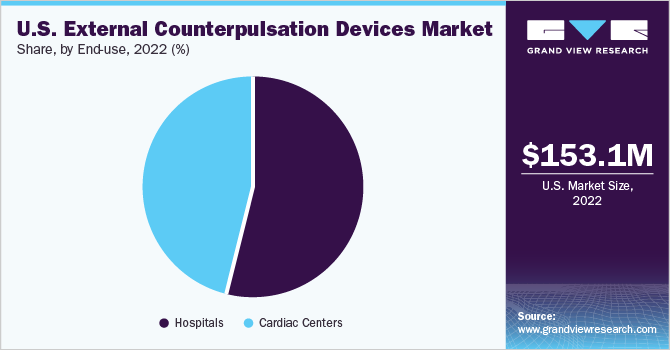

End-use Insights

Based on end-use, the U.S. ECP devices market is classified into hospitals and cardiac centers & clinics. The hospital segment dominated the market with a share of 35.68% in 2022 Hospitals dominate the ECP devices market due to their larger patient volumes, specialized care for cardiovascular diseases, and access to advanced resources and technologies.

Moreover, with comprehensive treatment options provided by experienced medical professionals, hospitals are the preferred choice for patients seeking ECP therapy. The adoption of ECP therapy, particularly for managing congestive heart failure, exemplifies hospitals' dominance, supported by dedicated cardiology departments and intensive care units. As cardiovascular diseases continue to rise, the demand for ECP devices in hospitals is expected to reinforce their market dominance.

The cardiac center segment is anticipated to witness the highest CAGR of 8.5% during the forecast period. Cardiac centers are specialized healthcare facilities dedicated to the diagnosis and treatment of cardiovascular conditions. They often have advanced medical equipment, specialized staff, and expertise in managing cardiac diseases, including the implementation of ECP therapy.Additionally, as the awareness and recognition of ECP therapy's benefits continue to grow, cardiac centers are increasingly incorporating ECP devices into their treatment protocols. This trend is driven by the effectiveness of ECP therapy in managing various cardiovascular conditions, such as angina and heart failure.

Key Companies & Market Share Insights

Market players are introducing advanced products at affordable prices to increase their market share. Key players are implementing strategic initiatives, such as mergers, acquisitions, and collaborations, to maximize their market dominance. For instance, in 2020, Omay (Guangzhou) Med Technologies received FDA 510k Clearance for their Enhanced External Counter Pulsation Device, known as Omay-A. This regulatory approval signifies the device's compliance with FDA standards and allows Omay to market and distribute their advanced ECP device. Some prominent players in the U.S. External Counterpulsation (ECP) devices market include:

血管o Corporation

ACS Diagnostics

Scottcare Corporation

Cardiomedics Inc

U.S. External Counterpulsation Devices MarketReport Scope

Report Attribute |

Details |

Market size value in 2023 |

USD 163.0 million |

Revenue forecast in 2030 |

USD 272.5 million |

Growth rate |

CAGR of 7.6% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, end-use |

Country scope |

U.S. |

Key companies profiled |

血管o Corporation; ACS Diagnostics; Scottcare Corporation; Cardiomedics Inc |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to Country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. External Counterpulsation Devices Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented theU.S. External Counterpulsation (ECP) devices marketreport based on product and end-use:

Product Outlook (Revenue, USD Million, 2018 - 2030)

Pneumatic ECP Devices

Electrocardiogram (ECG)-Synchronized ECP Devices

Enhanced External Counterpulsation (EECP) Devices

End-use Outlook (Revenue, USD Million, 2018 - 2030)

Hospitals

Cardiac Centers

Frequently Asked Questions About This Report

b.The U.S. external counterpulsation (ECP) devices market size was estimated at USD 153.1 million in 2022 and is expected to reach USD 163.0 million by 2023.

b.The U.S. external counterpulsation devices market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 272.5 million by 2030.

b.In 2022, hospitals dominated the ECP device market with a share of 35.68%. Their larger patient volumes, specialized care for cardiovascular diseases, access to advanced resources and technologies, and comprehensive treatment options make hospitals the preferred choice for ECP therapy. As cardiovascular diseases continue to rise, the demand for hospital ECP devices is expected to reinforce their market dominance.

b.Some key market players are Vaso Corporation, ACS Diagnostics, Scottcare Corporation, and Cardiomedics Inc.

b.The global market for external counterpulsation (ECP) devices is growing due to the increasing prevalence of cardiovascular diseases and the demand for effective treatments.