U.S. Medical Weight Loss Clinics Market Size, Share & Trends Analysis Report By Ownership (Hospital-based, Standalone), By Region (Northeast, Southeast, Southwest, West, Midwest), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-081-7

- Number of Pages: 78

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry:Healthcare

Report Overview

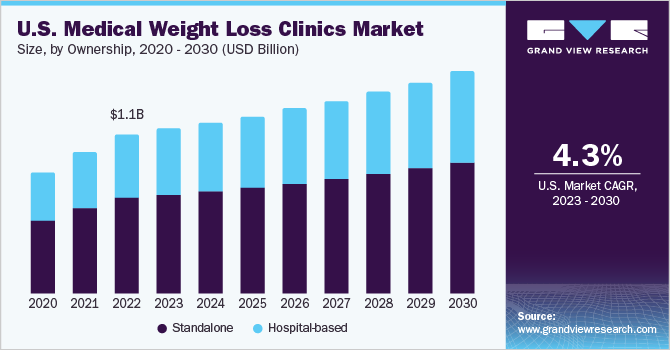

TheU.S. medical weight loss clinics market sizewas valued atUSD 1.09 billion in 2022and is expected to grow at a compound annual growth rate (CAGR) of 4.29% from 2023 to 2030. The increasing prevalence of obesity in the adult U.S. population is expected to drive the growth of the market. According to the CDC statistics of 2022, around 20.7% of people aged 18 to 24 years have reported suffering from obesity, and around 39.3% of adults aged 45 to 54 years of age reported suffering from obesity in the U.S. Obesity is the second leading cause of mortality in the U.S. Obese people have higher risks for heart conditions, diabetes, high blood pressures, and others major health conditions.

Furthermore, patients are shifting from surgical weight loss methods towards non-surgical weight loss methods, owing to similar efficiency and results of the procedures. According to the American Society for Metabolic and Bariatric Surgery, estimated 198,651 bariatric surgeries were performed in 2020 in the U.S., a decline from 256,000 surgeries performed in 2019. The shift of patients can be attributed to the higher cost associated with bariatric surgeries and the risk associated with surgical procedures. According to the American Society for Metabolic and Bariatric Surgery, the average cost of bariatric surgery in the U.S. is around USD 17,000 to USD 26,000. This is much higher compared to medical weight loss programs.

Moreover, with several weight loss medications launched in the U.S., the demand for medical weight loss treatments is constantly rising. For instance, in June 2021, the U.S. FDA approved Wegovy (semaglutide) for chronic weight management in adults. The drug is intended to be used in combination with exercise and a healthy diet and reported 15% to 18% weight loss findings during the clinical trials of the product. Moreover , in May 2023, the Eli Lilly Company announced to seek U.S. FDA approval for Trizepatide for weight loss in the U.S. The drug is approved for type-2 diabetes and has reported positive weight loss effects in clinical trials.

美国行业negativel减肥诊所y impacted by the COVID-19 pandemic in the early phase due to the closure of the programs to maintain social distancing to curb the spread of the virus. According to the study published in the MedScape on VHA MOVE Weight Management Program during and before the pandemic, the monthly participation in the program in April and May 2020 was around 50% to 60% lower compared to the same period in 2019. However, participation started to increase in the latter months of 2020 and reached pre-pandemic levels in 2021. This can be attributed to the shift of patients from in-person programs to telehealth programs.

Ownership Insights

Based on the ownership, the market is categorized into hospital-based and standalone clinics. The standalone segment dominated with a revenue share of 60.61% in 2022. This can be attributed to the presence of a large number of clinics at different locations and the presence of specialized staff in the centers. Moreover, the increased patient burden on hospitals during the pandemic has shifted patients from hospital-based settings toward standalone facilities.

These clinics offer personalized programs at a discounted rate and are available at many locations. For instance, Medi IP, LLC has a presence in more than 103 locations in the U.S. and serves more than 300,000 patients in the U.S. Market players are opening new clinics at different locations to increase their market presence. For instance, in August 2022, Modern Medical Weight Loss opened a new medical weight loss clinic in Kentucky offering advanced medical weight loss solutions.

The hospital-based segment is expected to witness the fastest growth over the forecast period. This can be attributed to the availability of advanced technologies and well-established physician networks across the U.S. Many major hospitals are offering medical weight loss programs in the U.S., including Cleveland Clinic, John Hopkins Health System, Cedar-Sinai, and many others.

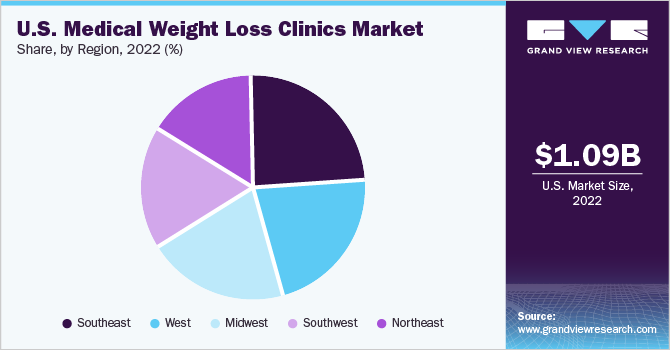

Regional Insights

Based on region, the market is divided into Southeast, West, Midwest, Southwest, and Northeast. The Southeast region dominated with the largest revenue share of 23.95% in 2022. This can be attributed to the higher prevalence of the obese population in the region, majorly in the Kentucky and West Virginia states, and higher physician services expenditures compared to other states. According to the CDC 2021 Adult Obesity Prevalence Maps, more than 40% of the adults in the Kentucky and West Virginia suffered from obesity.

Southwest region is expected to witness the fastest growth over the forecast period owing to the growing number of obese people and the rising number of medical weight loss clinics in the region. For instance, in November 2022, Texas Health Medical Group opened its new medical weight loss clinic in Dallas and the surrounding area in Texas. The clinic is offering a medical weight loss program with the use of a GLP-1 drug.

Moreover, the Northeast segment is expected to witness significant growth over the forecast period. This growth can be attributed to the growing prevalence of obesity in the region. According to the CDC 2021 Adult Obesity Prevalence Maps, the prevalence of obesity in the Northeast in 2021 was 29.9%, higher compared to 29.0% in 2019.

Key Companies & Market Share Insights

The market is highly fragmented, with the presence of standalone clinics holding the majority of the market share. Key players are adopting various strategies to stay competitive, including launching new clinics and franchising their businesses. For instance, in April 2023, Ideal Weight Center opened a new medical weight loss clinic in Rock Hill, South Carolina. The clinic offers specialized GLP-1 therapy, and first of its kind in the area. Some prominent players in the U.S. medical weight loss clinics market include:

Cleveland Clinic

Medical Weight Loss Clinic

Rivas Weight Loss

Medi IP, LLC (Medi-Weightloss)

NYU Langone Hospitals

Stanford Health Care

UCLA Health

Long Island Weight Loss Institute

Cedars-Sinai

Allegheny Health Network

Options Medical Weight Loss

Med-Fit Medical Weight Loss

U.S. Medical Weight Loss Clinics Market Report Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 1.09 billion |

Revenue forecast in 2030 |

USD 1.51 billion |

Growth rate |

CAGR of 4.29% from 2023 to 2030 |

Base year for estimation |

2022 |

Historical data |

2018 - 2021 |

Forecast period |

2023 - 2030 |

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Ownership, region |

Country scope |

U.S. |

Key companies profiled |

Cleveland Clinic (Obesity and Medical Weight Loss Center); Medical Weight Loss Clinic; Rivas Weight Loss; Medi IP, LLC (Medi-Weightloss); NYU Langone Hospitals; Stanford Health Care; UCLA Health; Long Island Weight Loss Institute; Cedars-Sinai; Allegheny Health Network; Options Medical Weight Loss; Med-Fit Medical Weight Loss |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

U.S. Medical Weight Loss Clinics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030.For this study, Grand View Research has segmented the U.S. medical weight loss clinics market report based on ownership and region:

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

Hospital-based

Standalone

Regional Outlook (Revenue, USD Million, 2018 - 2030)

Southeast

Southwest

Northeast

Midwest

West

Frequently Asked Questions About This Report

b.The U.S. medical weight loss clinics market size was estimated at USD 1.09 billion in 2022 and is expected to reach USD 1.12 billion in 2023.

b.The U.S. medical weight loss clinics market is expected to grow at a compound annual growth rate of 4.29% from 2023 to 2030 to reach USD 1.51 billion by 2030.

b.Standalone segment dominated the U.S. medical weight loss clinics market with a share of 60.6% in 2022 owing to the growing presence of these clinics and personalized programs available at these locations.

b.Some key players operating in the U.S. medical weight loss clinics market include Cleveland Clinic (Obesity and Medical Weight Loss Center); Medical Weight Loss Clinic; Rivas Weight Loss; Medi IP, LLC (Medi-Weightloss); NYU Langone Hospitals; Stanford Health Care; UCLA Health; Long Island Weight Loss Institute; Cedars-Sinai; Allegheny Health Network; Options Medical Weight Loss; Med-Fit Medical Weight Loss.

b.Key factors driving the U.S. medical weight loss clinics market growth include the rising prevalence of obesity in the U.S. and the shift of patients from surgical weight loss treatment to non-surgical treatment.